Dallas Parker

Jose Valera

Pablo Ferrante

Gabriel Salinas

Mayer Brown

Houston

The Mexican National Hydrocarbons Commission (CNH) on Mar. 13 will publish a revised draft of the production-sharing contract (PSC) it proposed last Dec. 11 for exploration and production rights covering 14 shallow-water areas to be offered in the first phase of Round One bidding. The round, part of energy reform begun in 2013, will be the first allowing participation by companies from outside Mexico.

Non-Mexican companies may validly participate in all phases of the bidding round pursuant to the terms described here. However, upon selection of a winning bidder, the CNH may execute exploration and production contracts only with Mexican-incorporated commercial entities. State-owned Petroleos Mexicanos (Pemex) will be able to bid by itself or in partnership with other bidders under equivalent terms.

The PSC adopted for the first phase will provide important insights into the legal and administrative framework for other phases in Round One. According to the latest official timeline, which is subject to change, those phases will cover shallow-water production, onshore, the Chicontepec basin and unconventional resources, and deep water.

The CNH will publish the final PSC on June 15. This article highlights some of the important features of the model PSC published in December. It is presented for informational purposes only, summarizes heavily, and omits many details. It therefore should not be used for legal decisions.

General terms

In a clarification important to international bidders, the model PSC stipulates that title to hydrocarbons in place remains with the state but allows contractors to "report for accounting and financial purposes the contract and its expected benefits pursuant to applicable law." In effect, this means oil and gas reserves established in the contract area may be booked in accordance with applicable disclosure guidelines by securities regulators.

PSC terms are 25 years. CNH may grant two 5-year extensions to accommodate enhanced recovery. Contractors may relinquish contracts in whole or in part at any time but must meet work obligations, including payment of related penalties and abandonment.

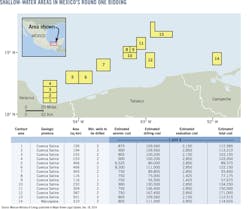

The draft PSC requires completion of minimum work programs within initial exploration periods of up to 3 years, based on exploration plans that contractors must submit to CNH for approval within 45 days of contract effective dates. All 14 of the contracts to be offered will require seismic data acquisition. Two of the contracts will require the drilling of at least one exploratory well, and the rest will require two wells (see figure, p. 29).

A contractor that has met the minimum work obligations will be able to seek CNH approval for a 1 year extension of the exploration period. During the extension period, the contractor will have to drill another well with the same characteristics as the well or wells included in the minimum work program. A second exploration-period extension is available with the same drilling requirement.

The draft PSC requires relinquishment of acreage not progressing through the exploration, evaluation, and development stages during extensions. It also requires a performance guarantee by the contractor covering the minimum work program and the payment of penalties for failure to meet work obligations.

During any of the exploration periods, the contractor may request approval from CNH of a work program and budget to evaluate a discovery. Each evaluation program will have a 12-month term, extendable for a further 12 months with CNH approval. Production during an evaluation period will be delivered to CNH's marketing agent, with proceeds shared according to profit and cost splits provided in the contract.

Within 60 days of the end of any evaluation period, the contractor must advise CNH whether the discovery is commercial. For discoveries declared commercial, the contractor must submit a development plan for CNH approval within 90 days. CNH may require modifications to development plans if it determines that:

• Gas flaring is excessive.

• Reserves would be developed at excessive or insufficient rates.

• There would be an excessive loss of pressure of the reservoir, or there would not be optimal separation between wells.

• The development plan is inconsistent with best industry practices, including industrial security and health.

• The development plan would be contrary to the contract or applicable law.

• The environmental risk assumed would not be acceptable under applicable law.

• The risk administration program is inadequate or does not conform to applicable regulations.

• The program would create an adverse effect on the environment.

The contractor, while required to develop a commercial discovery pursuant to the approved development plan, may modify the development plan with CNH approval. At the end of an evaluation period, the contractor must relinquish all the evaluation area if, within time limits established in the contract, it hasn't declared a commercial discovery or, if it has declared a commercial discovery, it hasn't submitted a development plan or received CNH approval for a submitted plan.

Work programs

A contractor will have to submit for CNH approval annual work programs covering all operations contemplated under the contract. CNH must approve annual work programs that comply with:

• The minimum work program, exploration plan, and development plan.

• The accounting procedure attached to the contract and other contract terms.

• Best industry practices.

• The administration system related to security.

• Applicable law.

In any year during which production is expected to start, the contractor must include in its work programs a production forecast for each well and reservoir. Drilling is subject to requirements for permits and progress reports.

Contractors also must provide quarterly reports to CNH regarding the progress of the oil and gas operations conducted under the contract.

For each annual work program, the contractor must submit for CNH approval a budget, modifications to which require CNH approval.

Cost recovery

Costs incurred in relation to the oil and gas operations under the contract will be considered eligible for recovery only if they are indispensable and meet requirements established by the contract and the rules issued by the Finance Ministry.

Not recoverable are (i) costs, expenses, or investments that are unrelated to the contract and those incurred before the effective date of the contract or after its termination; (ii) costs, expenses, or investments that do not have supporting documentation, those that have not been registered in the operating account, or those that have not been included in the budgets and work programs approved by CNH; (iii) costs, expenses, or investments that elevate the total budget over 5% of the original budgeted amount or over 10% of the original budgeted amount for a specific item; (iv) financial costs; (v) costs of rights-of-way, easements, temporary or permanent occupations, leasing, land acquisition, indemnifications, and any other similar rights; and (vi) legal and consulting fees, except for those related to geological studies for the exploration and extraction of hydrocarbons that have been approved in the work programs and their respective budgets.

Up to 60% of the value of production in any month may be allocated to cost recovery. Unrecovered costs are carried forward until fully recovered.

The state owns production until it reaches a metering point within the contract area, beyond which the contractor takes ownership of its share, which it may market by itself, subject to registration requirements, or through a marketing firm.

CNH will supervise the installation, operation, maintenance, and calibration of metering systems, which are responsibilities of the contractor, and may request metering at the wellhead.

During the term of the contract, the contractor maintains title to materials, equipment, pipes, drilling or production platforms, infrastructure, and facilities generated or purchased for the operations covered by the contract and charged to the operating account. Title to the property will pass to the state at no charge if the contract is terminated for any reason.

Payments, production split

After commercial production begins, monthly payments under the model PSC are to be handled by the Mexican Oil Fund, which will receive proceeds from the sale of the state share of production by a marketing agent. The fund will determine and make production allocations.

Payments to the state include:

• For the part of the contract area not covered by an approved development plan, a cash payment by the contractor, representing the exploratory phase contract fee, of 1,150 pesos/sq km during the first 60 months of the contract and 2,750 pesos/sq km thereafter. The fee will be adjusted annually for inflation.

• The volume of hydrocarbons that corresponds to the royalties determined for each type of hydrocarbon through the application of a royalty rate established in a contract annex, adjusted for inflation.

• The volume of hydrocarbons that corresponds to the state's share of operating profits, determined initially by the contractor's bid and increased as the internal rate of return meets thresholds established in the contract. The total operating profits will be determined monthly by subtracting from the contract value of measured production the value of recoverable costs and royalties.

Payments to the contractor will include the volume of hydrocarbons allocated for recovery of eligible costs and the volume of hydrocarbons remaining after payment of the state's share of operating profits.

Volume allocations between the state and contractor will be calculated monthly on the basis of hydrocarbon valuations.

The value of oil and condensates will be determined by reference to crude oil price benchmarks specified in the contract, with volume allocations made on that basis. In the month following the month in which the production is sold, the volume allocations will be adjusted by reference to actual sales prices under market terms and conditions.

For natural gas, the value will be defined by the determination used by the Energy Regulatory Commission (CRE) to set the price where gas produced under the contract enters the integrated national transportation and storage systems. If a natural gas sale contract exists, the contract price will be the greater of the price determined by CRE and the price agreed under the sale contract.

The value of production will be calculated net of processing, storage, and transportation costs that the contractor incurs after the metering point and until the produced hydrocarbons are sold.

Termination

The draft PSC specifies conductions under which CNH may declare administration termination of the contract. It must give the contractor at least 30 days' notice and may end the contract without the need of a judicial resolution if the contractor doesn't cure the event of default within the notice period.

CNH may declare administrative termination of the contract if:

• One hundred eighty consecutive days pass without initiation by the contractor of operations included in the exploration plan or development plan or suspension of operations by the contractor for that period without CNH authorization or justified cause.

• The contractor does not comply with the minimum work program, without justified cause.

• The contractor partially or completely assigns the operations or its interest under the contract without CNH approval.

• A serious accident occurs because of the willful misconduct or fault of the contractor that causes damage to facilities, death, and loss of production.

• The contractor, on more than one occasion, delivers false information willfully or unjustifiably or omits certain information from Ministry of Energy, the Ministry of Finance, the Ministry of Economy, CNH, or the environmental agency regarding production, costs, or any other relevant aspect of the contract.

• The contractor does not comply with a final resolution of federal jurisdictional.

• The contractor omits, without justified cause, any payment to the Mexican state or delivery of hydrocarbons pursuant to the terms of the contract.

Outside the requirements for administration termination, CNH also may terminate the contract if:

• The contractor does not deliver the exploration plan or the work program of the first exploration period to CNH within 45 days of its due date.

• The contractor has a 180-day delay in the performance of any work program or development plan submitted.

• The contractor does not deliver the performance guarantees for the exploration period or the corporate guarantee or does not keep them in effect.

• The contractor withholds relevant information from, or delivers false information to, authorities with respect to the production, costs, or any other issue related to the oil and gas operations.

• The contractor or the guarantor is liquidated or ceases to legally exist.

• The contractor enters insolvency or is unable to pay its debts.

• Any of contractor's representations and guarantees pursuant to the contract, or those made during the bidding round, is demonstrated to be false as of the effective date.

• The contractor violates the contract assignment rules or has a change in control without CNH consent.

• The contractor violates the anticorruption and conflict of interest provisions of the contract.

• There is any other material noncompliance of the contractor with its obligations under the contract.

If CNH declares administrative or contractual termination of the contract, the contractor must pay the state monetary penalties, cease operations in the contract area other than those needed to protect material and equipment, and return the contract area to CNH. The contractor has no compensation rights following termination of the contract and must comply with its obligations regarding return of the contract area, including abandonment.

Other requirements

The draft PSC requires the contractor to provide various performance and financial guarantees to take responsibility for abandonment of the contract area.

It also requires that minimum levels of goods and services used for oil and gas operations be procured in Mexico. The national content requirement covers goods, labor, services, training, technology transfer, and infrastructure. Minimum national-content shares are 13% during the exploration period and 25% during the development period, increasing annually to at least 35% by 2025.

The contractor must submit to CNH, at no cost, all data and information obtained during oil and gas operations. This requirement covers geological, geophysical, geochemical, and engineering information; well logs, progress reports, studies, reports, spreadsheets, and databases; and any other information related to the completion, production, maintenance, or performance of oil and gas operations. The state will own the information as well as any geological, mineral, or other samples obtained by contractor during work conducted under the contract.

The contractor may use the information, without any charge or restriction, for the processing, evaluation, analysis, and other purposes related to the oil and gas operations but not for other uses or sale. Except for the technical information and any intellectual property (defined under the contract), all other information and documentation derived from the contract will be considered public information.

The draft PSC assigns contractors other responsibilities for environmental performance, corruption mitigation, and other matters not covered in detail in this article.

Acknowledgment

This article is adapted from a Mayer Brown report published on Jan. 13, 2015. Related updates and presentations appear at www.mayerbrown.com/Mexico-Energy-Reform/.

The authors