OGJ Newsletter

GENERAL INTEREST — Quick Takes

Kerry expects other agencies' Keystone XL reports soon

US Sec. of State John F. Kerry said he expects to receive other federal agencies and departments' reports soon on the proposed Keystone XL crude oil pipeline so the US Department of State can determine if it is in the national interest.

"I think by this Monday, all the relevant agencies, per the president's executive order, have to report in, and then we will analyze and address that information as appropriate," he said on Jan. 31. "That's what I intend to do."

Kerry said DOS's review of TransCanada Corp.'s application for a presidential crossborder permit is undergoing a rigorous and transparent review that is part of an established procedure. "The process needs to be honored, not circumvented, and that means that there has to be the thorough sort of process of determination," he said.

His remarks came 2 days after the US Senate passed a bill approving Keystone XL that is generally similar to one the House adopted on Jan. 12 (OGJ Online, Jan. 30, 2015). US President Barack Obama has said he would veto such a measure if it reached his desk.

"All the agencies have to report back to us," the secretary said during a press conference in Boston with Canadian Foreign Minister John Baird and Mexican Foreign Secretary Jose Antonio Meade. "At that point, it's in our hands for me to make a recommendation to send to the president."

Obama should move quickly and approve the Keystone XL project himself once Kerry submits his recommendation, American Petroleum Institute Pres. Jack N. Gerard said on Feb. 2. "Congress is getting ready to send the president a bill to approve this pipeline," Gerard noted. "Instead of prepping his veto, he can now take sole possession of this decision and finally approve KXL on his own terms."

Shell cuts $15 billion in spending for 2015-17

Royal Dutch Shell PLC has curtailed more than $15 billion in potential spending over the next 3 years, but is not "not overreacting to current low oil prices," and is keeping its "best opportunities on the table," the company says.

"Our strategy is delivering, but we're not complacent," explained Ben van Beurden, Shell chief executive officer. "The agenda we set out in early 2014 to balance growth and returns has positioned us well for the current oil market downturn. However, lower oil prices and the impact of our 2014 divestments will likely reduce this year's cash flow."

Shell says this year should see further ramp-up from the new fields brought on line in 2014. The company continues to invest in several new oil and gas fields and LNG, with the next wave of significant start-ups in the 2016-18 timeframe. Shell, however, says it's canceling its Arrow LNG project in Australia (OGJ Online, Jan. 30, 2015).

Last year's results include $25 billion of free cash flow, encompassing $15 billion in asset sales completed before markets weakened across the end of the year (OGJ Online, June 17, 2014; Aug. 14, 2014).

Petrobras CEO, five other senior executives resign

Maria das Gracas Foster, chief executive officer of Petroleo Brasileiro SA (Petrobras) since 2012, has resigned along with five other senior executives.

The Petrobras board will meet on Feb. 6 to elect new senior executives, according to Reuters news agency, which cited a filing with Brazil's securities regulator. The filing did not identify the five other senior executives.

New senior management will come from within Petrobras and elsewhere in the private sector.

Authorities in the past year have alleged a huge corruption scandal involving price-fixing, bribes, and kickbacks. Some 86 people have been implicated for criminal wrong-doing, according to The Wall Street Journal. Prosecutors have not implicated Foster in any indictments of former Petrobras executives.

Foster met on Feb. 3 at the presidential palace in Brasilia with Brazilian President Dilma Rousseff, former chairwoman of Petrobras's board.

Chevron unit farms into Mauritania offshore blocks

Chevron Mauritania Exploration Ltd., a wholly owned subsidiary of Chevron Corp., has agreed to acquire 30% nonoperated working interest in Blocks C8, C12, and C13 offshore Mauritania from Kosmos Energy Ltd., Dallas.

The three blocks cover a contiguous area of 27,200 sq km and lie in 1,600-3,000 m of water.

In exchange for the blocks, Chevron will pay a disproportionate share of the costs of one exploration well and a second contingent exploration well, subject to maximum expenditure caps. Chevron will also pay its proportionate share of previously incurred exploration costs.

Chevron will not initially fund drilling of the Tortue prospect, but retains the option to participate in this prospect after the transaction is completed. The deal is subject to the approval of Mauritania's government.

Kosmos Energy will retain 60% interest and remain operator. Societe Mauritanienne des Hydrocarbures et de Patrimoine Minier (SMHPM), Mauritania's national oil company, will maintain 10% interest. Following any commercial discovery after the exploration phase, Chevron will become the operator and maintain 30% interest.

Kosmos' 2015 exploration work program in Mauritania currently includes two wells to be drilled by the Atwood Achiever drillship (OGJ Online, June 11, 2013). The first exploration well will test Tortue, with estimated resources of 2 billion boe recoverable across both Mauritania and Senegal.

A second exploration well will test the Marsouin prospect with estimated resources of 300 million boe recoverable, replacing the previously announced Orca prospect in the 2015 drilling program.

Kosmos has held rights to conduct exploration in the C8, C12, and C13 contract areas since 2012 under production sharing contracts with Mauritania's government (OGJ Online, Apr. 10, 2012).

Exploration & Development — Quick Takes

Antero trimming, delaying Marcellus drilling

Antero Resources Corp., Denver, has reported a $1.8 billion budget for 2015, down 41% from 2014. The independent said it plans to defer completions in the Marcellus during the second and third quarters to limit natural gas volumes sold into low-price markets.

Paul Rady, Antero chairman and chief executive officer, still expects the company will increase production 40% despite the drilling and completion reductions. He attributed that to operating efficiencies.

"Based on our projections for 2015, we will not have access to favorable markets for Marcellus gas in excess of the volumes included in our guidance until the previously disclosed regional pipeline project is placed into service, which is currently projected to be in the fourth quarter," he said.

"Consequently, we have adjusted our Marcellus plan so that we can sell the vast majority of our gas into more favorable markets. We will continue to monitor commodity prices throughout the year and may revise the capital budget lower if conditions warrant."

The $1.6-billion drilling and completion budget represents a 33% reduction in drilling and completion capital compared with the 2014 budget. The budget decrease is driven by a reduced rig count and the deferral of 50 Marcellus well completions from this year's second half until 2016.

About 60% of the drilling and completion budget is allocated to the Marcellus and the remaining 40% is allocated to the Utica.

During 2015, Antero plans to operate an average of 9 drilling rigs in the Marcellus in West Virginia and 5 drilling rigs in the Utica in Ohio. Antero expects to complete about 80 horizontal wells in the Marcellus and 50 horizontal wells in the Utica.

Also this year, Antero plans to continue consolidating acreage in the core of the southwestern Marcellus rich-gas play and the core of the Utica rich-gas play in southern Ohio. But given current low commodity prices, Antero has reduced its 2015 land budget by $300 million, or 67%, to $150 million for 2015. The budget does not include acquisitions.

Petrobras confirms extent of Farfan area discovery

The drilling of a third extension well in the Farfan area in the ultradeepwater Sergipe basin confirmed the extent of the 2013 light oil and gas discovery, Petroleo Brasileiro SA (Petrobras) reported on Feb. 2. The presence of a shallower, 68-m reservoir holding light oil was found as well.

Well 3-SES-186 was drilled 103 km from the city of Aracaju, Brazil, and 10 km from the discovery well in 2,467 m of water. The well will be drilled to 6,060 m.

This accumulation is part of the exploratory project in the deepwater Sergipe-Alagoas basin.

Petrobras operates the consortium with 60% interest in partnership with IBV-Brazil, which holds the remaining 40%.

Santos acquires interest in block offshore Malaysia

Santos Ltd. has acquired 20% interest in a deepwater permit offshore Sabah, Malaysia. The company will take 10% from each of Japan's Inpex and operator JX Nippon Oil & Gas Exploration for Block R.

The block, which covers 673 sq km and lies in 100-1,400 m of water, is close to Murphy Oil's existing Kikeh oil field and Shell's Gumusut-Kakap oil field.

Three wildcat wells are planned for the permit early this year.

JX Nippon and Inpex now have 27.5% each, with Petronas 25% and Santos 20%.

Drilling & Production — Quick Takes

IHS sees second-half end of US output surge

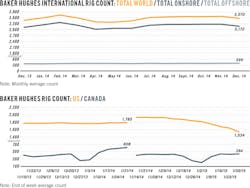

Expectations are moderating about growth of oil production in the US this year.

A report by IHS says the US production surge may end by midyear as low oil prices crimp output from tight formations.

"Growth is still expected in the early months of 2015, but that momentum will level off in the latter half of the year amidst prices at lows not seen since the 2008-09 Great Recession," IHS said in a press statement.

A study of 39,000 wells indicated month-to-month growth will cease in the latter half of 2015 if the price of West Texas Intermediate crude remains below $60/bbl.

About one fourth of new wells in 2014 had break-even WTI prices below $40/bbl, according to the study. Slightly less than half the new wells had break-even prices below $60/bbl. Nearly 30% of new wells had break-even prices above $81/bbl.

The study defined "break-even" as the WTI price needed to cover capital and operating costs and yield a 10% return.

Sustaining drilling this year are hedging programs, work to finish uncompleted wells, contractual obligations, and drilling of the most economic tight oil plays, the study said. "But adverse economics and lower spending will lead to fewer wells drilled than in 2014."

The study projected monthly average US production at the end of 2015 about 500,000 b/d above the January 2015 level. Nearly all the growth will have come in the year's first half.

IHS Energy Vice-Pres. Jim Burkhard said US production next year might flatten or decline if oil prices stay low and confidence in future prices remains shaken.

"But there is plenty that could happen-a recovery in oil prices, lower upstream costs, and improved well productivity-that would quickly change the calculus of drilling new wells and reinvigorate US production growth," he said.

Gazprom Neft starts shale oil production in Siberian field

JSC Gazprom Neft reported start of shale oil production from the Bazhenov formation during tests of two wells in southern Priobskoye field in central western Siberia. Tests are planned for two other wells.

Gazpromneft Khantos obtained a license for exploring the Bazhenov and Tyumen formations in March 2014. The formations lie at 2-3,000 m.

In addition, the company has been analyzing 3D seismic data and well-core data from the Bazhenov-Abalak formation in southern Priobskoye, with four directional wells planned in the first stage (OGJ Online, Oct. 2, 2014). The Abalak formation lies beneath the Bazhenov and, in some instances, abuts it.

Another shale project involves the Palyanovsky reserves in the Krasnoleninsky field, also in the Khanty-Mansiysk Autonomous Region. Drilling of the first well has been completed, with multistage hydraulic fracturing expected to begin soon.

Inpex starts development drilling at Ichthys field

Inpex Corp. has started development drilling in Ichthys gas-condensate field in the Browse basin, about 200 km offshore Western Australia.

The development campaign will target the Brewster reservoir with 20 production wells more than 4,000 m beneath the seabed.

The well was spudded Feb. 3 by Ensco PLC's ENSCO 5006 semisubmersible drilling rig, which recently arrived at the field after undergoing major upgrades in Singapore.

Inpex, operator of the Ichthys LNG project, said gas from Ichthys field will be initially processed offshore and then sent to onshore LNG facilities in Darwin via an 889-km pipeline (OGJ Online, July 8, 2014). Condensate will be stored on a floating production, storage, and offloading vessel and then loaded onto tankers for export.

Detailed engineering, procurement, and construction of the Ichthys LNG project continues with production scheduled to begin by yearend 2016. At peak, the project is expected to produce 8.4 million tonnes/year of LNG and 1.6 million tpy of LPG, along with 100,000 b/d of condensate.

PROCESSING — Quick Takes

CNOOC subsidiary inks deal for grassroots refinery

Hebei Zhongjie Petrochemical Group Co. Ltd., a subsidiary of China National Offshore Oil Corp. (CNOOC), has entered into a $700 million agreement with Genoil Inc., Calgary, to establish a joint venture for the construction of a heavy oil refinery at Zhongie Industrial Park, Hebei Province, China.

The planned 1 million-tonne/year refinery will use Genoil's heavy upgrading process to convert low-grade atmospheric and vacuum-distillation bottoms from heavy oil into lighter distillates and finished transportation fuels, such as C5, C6, naphtha, and light diesel fuel for distribution to Chinese and international markets, Genoil said.

The refinery also would produce heavy diesel fuel, vacuum gas oil, sulfur, and ammonia, Genoil said.

Genoil will hold 70% interest in the new joint venture, along with 60% share in profits earned from refining activities, while HZPGC will retain a 30% ownership interest with 40% stake in profit sharing, Genoil said.

Lending discussions with parties interested in the proposed refinery are now under way, the company said.

A firm timeframe for the project, however, has not been disclosed.

This latest contract for the refinery revises an initial agreement signed late last year by Genoil and HZPGC.

The grassroots refinery, which is based on engineering and feasibility studies previously completed for the project by China Petroleum Engineering Co. Ltd., a division of China National Petroleum Corp. (Sinopec), initially was to have a planned processing capacity of 1.2 million tpy, according to an October 2014 statement from Genoil.

Williams reports another delay for Geismar ethylene sales

An unexpected maintenance setback in the final stages of start-up at Williams Partners LP's newly rebuilt Geismar, La., olefins plant has led to another month-long delay for sales of ethylene production from the site (OGJ Online, June 12, 2013).

The company halted final ramp-up procedures at the plant after discovering that a brazed-aluminum heat exchanger had become plugged and required cleaning and maintenance, Williams Partners said.

With the unplanned maintenance work now completed, the plant is scheduled to resume commissioning activities as of Feb. 3, the company said.

As a result of the interruption, however, the start of ethylene sales from the plant has been pushed back to February from the company's previously announced target of January (OGJ Online, Dec. 31, 2014).

While Williams Partners provided no specific date on which sales might begin this month, the partnership did confirm it would provide an update on the status of plant operations on or before its Feb. 19 scheduled conference call with investors.

The revamped and rebuilt Geismar plant has faced a series of delays related to the implementation of about $20 million in additional safety and maintenance upgrades included in the project as the company redoubled its efforts to safeguard operations after a 2013 explosion at the site (OGJ Online, Dec. 2, 2014).

Once fully commissioned, the 600 million-lb/year Geismar expansion project will increase the plant's ethylene production capacity to 1.95 billion lb/year from 1.35 billion lb/year, with Williams Partners' share of the total capacity amounting to about 1.7 billion lb/year.

Sasol lets contract for Louisiana petchem plant

South Africa's Sasol Ltd. has let a contract to GE Oil & Gas, Florence, Italy, to provide the main-compression trains required for a low-density polyethylene (LDPE) plant at its proposed integrated ethane cracker and downstream derivatives complex to be located adjacent to the company's existing operations near Lake Charles in Westlake, La. (OGJ Online, Dec. 3, 2012).

GE will supply main-compression and power-generation trains consisting of primary-purge and hyper-compression services for a 20-cyclinder, two-stage, LDPE hyper-compressor that will have discharge pressures of 45,000 psi and be situated in the center of the new plant, GE said in a Feb. 2 release.

The project equipment, which GE will design and build in Florence, is scheduled for shipment to the Lake Charles site during first-half 2016, according to the service provider.

A value of the contract was not disclosed.

In December 2014, Sasol let a contract to Toyo Engineering Korea Ltd. (TEK), a subsidiary of Toyo Engineering Corp., to provide detailed engineering, procurement, module fabrication, and construction support services for the planned 450,000-tonne/year (tpy) linear LDPE plant to be included at Westlake complex (OGJ Online, Dec. 4, 2014).

In addition to the LDPE plant, the $8.9 billion petrochemical complex will include a grassroots ethane cracker capable of producing 1.5 million tpy of ethylene, as well as several other chemical manufacturing plants (OGJ Online, Dec. 23, 2014).

With site preparation now under way, the new complex currently is on schedule to be commissioned in 2018.

While construction of the planned ethane cracker and derivatives complex remains ongoing, Sasol recently delayed final investment decision on a proposed large-scale, gas-to-liquids plant that would be located adjacent to the Westlake complex as part of a company-wide plan to conserve cash in response to lower international oil prices (OGJ Online, Jan. 28, 2015).

TRANSPORTATION — Quick Takes

Woodside gets NEB approval for BC LNG exports

Woodside Energy Holdings Pty. Ltd. has received approval from Canada's National Energy Board on its application for a 25-year natural gas export license with a maximum term quantity of 807 billion cu m, plus or minus 15%. Exports would leave a proposed LNG liquefaction plant near Grassy Point, north of Prince Rupert, BC.

Woodside would implement Grassy Point LNG in two phases. Phase 1 would produce 6-15 million tonnes/year (tpy) with Phase 2 increasing overall capacity to 20 million tpy. Woodside plans to begin construction in 2017 for a 2021 in-service date.

The board determined that the quantity of gas proposed to be exported by Woodside Energy is surplus to Canadian needs. NEB was also satisfied that the gas resource base in Canada, as well as North America overall, is large and can accommodate reasonably foreseeable Canadian demand, the natural gas exports proposed in Woodside's application, and a plausible potential increase in demand.

NEB acknowledged that, when taken together, LNG export license applications submitted to it to date represent a significant volume natural gas exports from Canada, but noted that all of the applicants are competing for a limited global market and face numerous development and construction challenges. NEB believes that not all LNG export licenses issued by it will be used or used to their full allowance and therefore evaluates each application on its own merit.

The board last year granted Aurora Liquefied Natural Gas Ltd. approval to export a maximum of 24 million tpy of from a proposed liquefaction plant at Grassy Point (OGJ Online, May 1, 2014).

Live Oak LNG to build Calcasieu Ship Channel export site

Live Oak LNG LLC, a subsidiary of Parallax Energy LLC, Houston, will invest $2 billion to develop a 5-million tonne/year liquefaction plant and LNG export terminal on the Calcasieu Ship Channel near Lake Charles, La. The terminal will include two 130,000-cu m storage tanks and will be able to accommodate what the company described as standard-sized LNG carriers. The project will lie on the west bank of the Calcasieu Ship Channel, southwest of Lake Charles, on a roughly 350-acre tract.

Live Oak said it will begin the US Federal Energy Regulatory Commission permitting process within the next few weeks, targeting a late-2016 construction start and a late-2019 in-service date.

Magnolia LNG LLC, a wholly owned subsidiary of Liquefied Natural Gas Ltd., Perth, last year filed an application with FERC seeking authorization for an LNG liquefaction and export plant on the Calcasieu River (OGJ Online, May 1, 2014). The company last month signed a gas pipeline interconnect agreement with Kinder Morgan Louisiana Pipeline LLC and expects to receive all regulatory approvals this year and begin LNG exports second-half 2018.

Magnolia LNG will use four 2-million tpy trains for a total 8-million tpy liquefaction capacity.