Novel upgrading technology cuts diluent use, capital costs

View Image Gallery>>

Max I. Fomitchev-Zamilov

Superior Upgrading Technologies

Bellefonte, Pa.

A novel bitumen upgrading process that decreases the amount of diluent required for pipeline transportation and reduces overall operating costs has been proven in a 100-b/d demonstration plant in Pennsylvania.

Deployable at wellheads or suitable for a facility from 100-100,000 b/d, Superior Upgrading Technologies' (SUT) Hammer Technology (HT) relies on the combination of fluid hammer effect, hydrodynamic cavitation, and extreme shear to create macroscopic fluid flows. These set molecules on a collision course with kinetic energies large enough to break bitumen's molecular hydrocarbon bonds at nearly ambient temperature and pressure (cold cracking) in lieu of the more energy-intensive processes associated with conventional delayed coking or catalytic cracking technology.

Pipeline, diluent problems

It is no secret that the Canadian oil sands industry effectively operates at about half of its actual capacity, with a large capacity consumed by diluent. Like plasma in the vascular system, diluent is the blood necessary to carry bitumen and heavy crude through a pipeline. Exported bitumen contains 30- 40% diluent, which while facilitating transportation creates additional load on the already strained infrastructure by consuming valuable pipeline capacity as well as requiring extra trucks and railroad cars.

The situation with the pipelines has been particularly severe in recent years: Increased production from oil sands has resulted in nearly full-utilization of all available pipelines and created strong demand for rail transportation to deliver production from Canada to US markets.

Fig. 1 shows the network of existing and proposed Canadian-US pipeline networks.

The situation with bitumen production from Alberta's tar sands, in fact, is paradoxical. While Alberta's bitumen production is abundant, only a limited quantity reaches the US economically.

Bitumen, or rather its transportable variant, dilbit in the form of Western Canadian Select (WCS) benchmark blend, sells at a steep 20% discount (~$24/bbl at the moment of writing) to WTI at Edmonton on a FOB basis, with the discount all but evaporating when the commodity reaches US Gulf Coast refineries because of increased dilbit transportation costs due to constrained capacities along North American pipelines.

The essence of the paradox is that by exporting more bitumen to US refiners, Canadian oil sands producers will be able to command higher prices for their product alongside higher transportation costs, thus eliminating the WCS/WTI discount.

The WCS/WTI discount, then, additionally lowers oil sands producer netbacks that already suffer from high diluent costs (up to $13/bbl) and extraordinary transportation costs (up to $18/bbl).

Conventional solutions

While the need for heavy crude oil upgrading has existed for decades, the technological solutions were not pursued vigorously until recently when rising oil prices spurred sharp increases in Canadian oil sands production, which currently exceeds 2.5 million b/d. The increase in Alberta exploration and production was rapid by oil industry standards.

Because the initial focus was on production technology, such as steam-assisted gravity drainage, the upgrading problem did not surface until much later. As a result, cost-effective upgrading technology had no time to mature.

View Image Gallery>>

The need for increased investment in new upgrading technology has been exacerbated within the past 10 years by enhanced environmental protections, which have made historical solutions for conventional upgrading (such as building additional refineries and pipelines) impossible, impractical, or prohibitively expensive.

That is why the conventional solution to the diluent and transportation problem is getting no traction. While US and Canadian industries would like to expand the network and capacities of current transnational pipeline systems, environmental concerns have sparked fierce public and political opposition to these proposed projects, such as the Keystone XL, in both countries, leading to indefinite delays in permitting, construction, and commissioning projects.

Another proposed solution to the upgrading problem has been construction of additional upgrading in Canada to convert heavy, sour, and highly viscous bitumen into light, sweet synthetic crude oil (SCO).

Canadian producers like Syncrude and Suncor, which built upgraders and refineries in tandem with rising oil sands production, already produce substantial quantities of SCO, which sells at near parity with Brent benchmark oil. New construction of traditional refineries and upgraders, however, is nearly impossible today. These massive plants are economical only on a large scale, requiring billions of dollars and years, if not decades, to erect and ramp up to full capacity. A typical upgrader carries a capital cost of about $10 billion, or roughly $40,000/b/d.

Environmental permitting, market volatility, and a slow rate of return also have complicated the prospects of undertaking projects to construct mega-upgraders. For example, despite years of planning and preparation, Suncor decided to scrap its Voyageur upgrader, taking a $1.68-billion writedown instead (OGJ Online, Mar. 27, 2013).

Emerging technologies

Relatively high oil prices in recent years have encouraged investments in more cost-effective upgrading. The goal has been a solution that would yield processed bitumen to meet pipeline specifications of API gravity of 18-20° and viscosity of 350 cst at the pipeline reference temperature.

As a result such companies as Ivanhoe Energy Inc., MEG Energy Corp., Western Research Institute (WRI), Value Creation Inc., Fractal Systems Inc., Field Upgrading Ltd., Petrosonic Energy Inc., and others offer a variety of upgrading technologies that largely can be classified into two categories: coking-thermal cracking (Ivanhoe HTL, MEG Hi-Q, WRI WRITE) and solvent deasphalting (Petrosonic).

The outliers are the molten sodium upgrading technology by Field Upgrading, cavitation-based JetShear technology by Fractal, and SUT's HT, of which the latter two can be broadly described as "cavitation technologies." A detailed review of these and other technologies can be found elsewhere.1-2

All these technologies can be characterized by the following:

• Capital costs of $10,000-30,000 b/d.

• Operating costs of $2-6/bbl.

• Target plant capacity of 3,000-10,000 b/d.

To date, only MEG and Value Creation have applied for field pilots, with the earliest pilot installation expected to be operational by 2016-17. The rest exist in demonstration plants or limited field tests.

Viscosity reduction

In lieu of "fully" upgrading bitumen into intermediate sour crude (20-24° API), a complicated process that requires coking and hydrotreating, SUP has developed simplified, partial upgrading technology for bitumen that reduces the requisite diluent required for pipeline transportation, expedites the commodity's arrival to market, and lowers both capital and operating costs.

Instead of using a more traditional, energy-intensive process that requires hydrotreating as well as sulfur and coke remediation to increase unprocessed bitumen's API gravity a full 10° to 18-20° API, SUT's HT implements a "gentle" upgrading process that reduces viscosity by 50-85% and is accompanied by an API gravity increase of 1-4°.

With SUT's HT upgrading process, there is no product loss, no incondensable gas formation, and very limited olefin production.

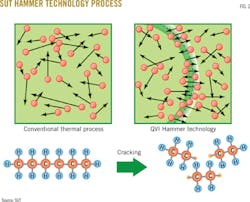

In a typical thermal process, molecules collide randomly in a three-dimensional space. Some molecular collisions are energetic enough to break or form bonds. Thermal energy input, therefore, is the crux of conventional petrochemistry, in which heat is added to large volumes of feedstock to force thermal (or catalytic) cracking of hydrocarbons.

By contrast, SUT's HT operates at ambient temperature and pressure by producing high-velocity fluid streams, in which molecular motion is confined to one dimension and molecules collide head-on in an organized manner.

Fig. 2 illustrates the SUT HT process.

Because the process occurs only in "hot spots" where the fluid streams collide, the depth of upgrading is not as large as in the conventional thermal process. Because the bulk of liquid remains at ambient temperature and pressure, however, the hardware complexity of the process drops several levels of magnitude, as does energy use. As a result of SUT HT's relatively low process temperature, formation of coke, gas, and olefins also is negligible.

Developed after 2 years of research, SUT HT provides bitumen upgrading that, in addition to its capability for deployment at wellheads, can be aggregated into a larger installation of 100-100,000 b/d at a construction cost of less than $2,000 bbl and an operating cost of less than $1-2/bbl.

Comparative economic analysis with a conventional upgrading system and an installation utilizing the new process showed an SUT HT system will pay for itself in 1-2 years.

View Image Gallery>>

Pilot plant testing

To validate the HT process, SUT constructed a 100-b/d demonstration plant in Bellefonte, Pa. (Fig. 3a), and tested it on bitumen and atmospheric residue, which have similar viscosities. Atmospheric residue, however, generally tends to have a lighter API gravity and lower sulfur content.

The demonstration plant has airtight, all-stainless, closed-loop design and was pressure-tested to 80 psi. The SUT HT reactor is powered by a three-phase, 100 hp (75 kw) electric motor-controlled via a variable frequency drive (VFD) with power metering capability (not shown).

To test bitumen at the plant, WCS crude oil (essentially dilbit with 33% diluent) was purchased from United Refinery Group, Warren, Pa. Prior to processing, diluent was removed by vacuum distillation. The crude oil storage tank was heated to 80° C., and diluent vapor was removed by a vacuum pump, keeping the tank under a few inches of mercury.

A small portion of diluent remained in the blend after distillation, which resulted in the dilbit's slightly higher API gravity of 13° and lower viscosity when compared with raw bitumen (typical gravity of 10°).

Atmospheric residue was obtained from the American Refining Group, Bradford, Pa., and corresponded to "cylinder stock" marketed as Kendex 0842.3 This material contained no diluent and had an initial boiling point of 400° C.

Fig. 3b shows the SUT HT process flow at the demonstration plant.

The same testing method was used for both the bitumen and residue.

Before testing, the plant was flushed with nitrogen to eliminate atmospheric oxygen, and one drum (55 gal) of material was deposited into the plant's 100-gal feed tank for processing.

Before treatment, the oil was preheated to the process temperature of 100° C. by circulating via the feed pump through the Sterling hot oil heater and back into the feed tank using the preheat bypass. The raw sample was obtained from the feed tank. The feed tank's pressure remained at 0 psig throughout preheating.

For treatment the heater was turned off, the preheat bypass was closed, and power was supplied to the SUT HT reactor and water to the cooler. The flow rate was set to 3 gpm, and the pressure within the reactor was measured at 145 psig. The treatment process lasted about 15 min consuming 25 kw-hr of power according to the VFD.

At the end of the treatment, the oil temperature in the feed tank was 200° C., and the pressure in the feed tank was 10-20 psig (due to light hydrocarbons produced during the treatment).

Next, the oil was cooled by cycling it through the reactor and the cooler at 30 gpm by way of the feed pump. (The reactor was powered down and not restricting the flow.) After about 45 min, the oil was cooled to 50° C., and the feed tank pressure returned to 0 psig, indicating that all volatile hydrocarbons condensed back into liquid form and mixed with the oil.

As a result, no incondensable gases remained that could be registered on the pressure gauge. At this point, an upgraded sample of oil was obtained from the feed tank.

View Image Gallery>>

Upgrading results

The samples were analyzed by SGS, a third-party lab, for independent verification.

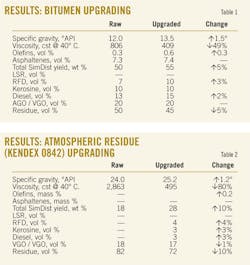

Table 1 summarizes the results for upgraded bitumen; Table 2 summarizes the results for upgraded residue.

Taken together, the results established a typical performance of the SUT HT upgrading process for bitumen and residue:

• A 1-2° increase in API gravity.

• A 50-80% reduction in viscosity.

• An unchanged asphaltenes content.

• A slight increase (0.3%) in olefins.

• A 5-10% increase in distillation yields (mostly due to gasoline and diesel fractions).

It takes about 15 min to process 55 gal (1.3 bbl) of material, and a total 25 kw-hr of power was consumed. This gives the performance of about 100 b/d and the energy use of 70 MJ/bbl, which translates into about $1/bbl assuming the $0.06/kw-hr power cost.

Fig. 4 shows the simulated distillation curves for the atmospheric residue before and after treatment. The characteristic kink in the curve due to light distillate formation is clearly seen.

The ASTM D-7169 SimDist chromatograms from which the curves on Fig. 4 were derived are shown on Fig. 5.

Before processing (Fig. 5a), the residue chromatogram had only one peak that corresponded to heavy hydrocarbons with IBP of about 400° C. After the processing (Fig. 5b), a second peak appears corresponding to lighter hydrocarbons in the gasoline-diesel range.

Field testing

Field-testing is next for SUT HT. Only field-testing on 100-1,000 b/d of bitumen can help build a case for commercial application of the technology as well as reveal any potential problems.

References

1. Castaneda, L., et al., "Current situation of emerging technologies for upgrading of heavy oils," Catalysis Today, 220-222 (2014), pp. 248.

2. Colyar, J., "New upgrading technologies applicable to heavy oil and bitumen, Colyar Consultants, 2013, www.colyarconsult.com/studies.html.

3. www.amref.com/Products/Kendex/0842.aspx.

The author

Max Fomitchev-Zamilov ([email protected]) is chief executive officer of Superior Upgrading Technologies, Bellefonte, Pa. He holds a PhD in ultrasonics and control systems from the Moscow Institute of Electronic Engineering, Moscow, Russia, and served for 7 years as associate professor of engineering at Pennsylvania State University, State College, Pa., during which time he launched Quantum Potential Corp. As CEO of SUT, Fomitchev-Zamilov researches cost-effective upgrading, well-stimulation, and water-treatment technologies to help address global energy and environmental challenges.