OGJ Newsletter

GENERAL INTEREST — Quick Takes

BP could be fined up to $13.7 billion for Macondo spill

The US District Court for the Eastern District of Louisiana ruled under Phase 2 of the MDL 2179 civil trial that 3.19 million bbl of oil were discharged into the Gulf of Mexico during the Macondo deepwater well incident in 2010. BP PLC previously was found negligent in the spill (OGJ Online, Sept. 4, 2014).

That sets the stage for Phase 3, slated to begin Jan. 20, in which the court will determine the company's Clean Water Act (CWA) penalty.

Based on the ruling, BP PLC faces a possible fine of up to $13.7 billion under the CWA, taking into account the maximum penalty of $4,300/bbl. BP claimed 2.45 million bbl were spilled, differing from the government's claim of 4.2 million bbl. The government was seeking a maximum penalty of $17.9 billion.

During the penalty proceedings, the court will consider eight statutory factors:

• The violator's efforts to minimize or mitigate the effects of the spill.

• The seriousness of the violation or violations.

• The nature, extent, and degree of success of any efforts of the violator to minimize or mitigate the effects of the discharge.

• The economic impact of the penalty on the violator.

• The economic benefit to the violator, if any, resulting from the violation.

• The degree of culpability involved; any other penalty for the same incident.

• Any history of certain types of prior violations.

• Any other matters as justice may require.

In a statement released following the Phase 2 ruling, BP said it "believes that considering all the statutory penalty factors together weighs in favor of a penalty at the lower end of the statutory range."

Tullow Oil reports $2.7 billion pretax writeoff

Reviewing assets in a declining oil-price environment, Tullow Oil PLC reported pretax write-offs totaling $2.7 billion.

An exploration write-off of $400 million is primarily related to 2014 activities in Norway, Mauritania, and Ethiopia. An additional $1.2 billion in noncash exploration write-offs are related to drilling and license costs from prior years and include previously reported unsuccessful offshore efforts in French Guiana, Mauritania, and Norway.

The assessment also includes $600 million in various impairment charges and $500 million in disposal charges.

Tullow expects to report 2014 revenue of $2.2 billion and gross profit of $600 million.

Tullow's 2015 capital expenditures are projected to be $1.9 billion. Included are exploration expenditures of $200 million, down from November's projection of about $300 million (OGJ Online, Nov. 13, 2014). Exploration will target "high-impact, low-cost" opportunities in East Africa.

Capital is being reallocated toward production assets and commercialization of existing discoveries, and will focus on "delivering high-margin oil production" in West Africa. That area is expected to grow to 100,000 b/d net to Tullow by the end of 2016.

Tullow noted that operating costs for Jubilee field in Ghana averaged $10/bbl in 2014 while gross production averaged 102,000 b/d.

In East Africa, the South Lokichar basin exploration and appraisal program continues with drilling recently completed at the Ngamia-5 and Ngamia-6 wells. Beyond South Lokichar, results from the Epir-1 well are expected later this month.

The company said it is entering discussions with partners and suppliers regarding potential savings as industry costs decline.

Harvest seeks arbitration against Venezuela

Harvest Natural Resources Inc., Houston, is seeking international arbitration against Venezuela, alleging the country's government has thwarted efforts to sell its interest there.

Through subsidiaries, Harvest owns 32% of Petrodelta SA, which produces oil in eastern Venezuela.

The US company tried to sell the interest to state-owned PT Pertamina (Persero) of Indonesia and later to Pluspetrol Venezuela SA (OGJ Online, Nov. 20, 2013).

Harvest Pres. and Chief Executive Officer James A. Edmiston blamed the government for failure of those efforts.

"Over the past decade, the Venezuelan government has violated Harvest's rights as an investor by systematically thwarting the development of Harvest's investment in Venezuela as well as the company's ability to sell its interest there," he said. Harvest has had interests in the Latin American country for 22 years.

Affiliates HNR Finance BV and Harvest Vinccler SCA submitted a request for arbitration before the International Center for Settlement of Investment Disputes.

Exploration & Development — Quick Takes

Eni gets extension for Block 15/06 offshore Angola

Angolan authorities have given Italy's Eni SPA a 3-year extension to the exploration period for offshore Block 15/06, 350 km northwest of the city of Luanda and 130 km east of Soyo town.

The original exploration period expired in November 2014, and Eni requested an extension to complete planned activities, including the drilling of three wells and 1,000 sq km of 3D seismic. Eni says that possible new discoveries could be developed quickly using existing production facilities.

The extension also includes an area adjacent to the Block 15/06 covering the Reco-Reco discovery, estimated to hold 100 million bbl OOIP. Synergies with existing infrastructure will enable production in this area to begin quickly, Eni says.

Block 15/06 was acquired in 2006 following a bid round. Eni has drilled 24 exploration and appraisal wells, discovering 3 billion bbl of oil in place and 850 million bbl of reserves.

At yearend 2014, Eni started production from the West Hub development project, near Block 15/06, 4 years after the declaration of commercial discovery (OGJ Online, Dec. 8, 2014). Block 15/06 also includes the East Hub development project, which is under development and is expected to start production in 2017.

Eni last year also discovered the Ochigufu exploration prospect offshore Angola, estimated to hold 300 million bbl of oil in place (OGJ Online, Sept. 17, 2014). It will be connected to West Hub by 2017.

Eni operates Block 15/06 with 35% interest, with Sonangol EP as concessionaire.

Noble drills dry hole with Madison well in deepwater gulf

Noble Energy Inc., Houston, reached the targeted upper and middle Miocene objectives but did not encounter commercial hydrocarbons in the Madison exploration well in the Gulf of Mexico, the company said.

The well, spud in late October, was drilled to a total depth of 16,859 ft on Mississippi Canyon Block 479. The drilling rig has since been released.

Noble previously reported that Madison contains unrisked gross resources of 45-120 million boe. Noble operated the well with 60% working interest alongside Stone Energy Offshore LLC with 40% (OGJ Online, Dec. 4, 2014).

Lundin spuds Zulu exploration well in North Sea

Lundin Norway AS, a wholly owned subsidiary of Lundin Petroleum AB, spud exploration well 26/10-1 in PL674BS to test the reservoir properties and hydrocarbon potential of Miocene aged sandstones of the Utsira formation in the Patch Bank Ridge.

The Island Innovator semisubmersible drilling unit is expected to reach a planned total depth of 1,020 m below mean sea level over a period of 25 days.

Lundin estimates the Zulu prospect, which lies 100 km west of Stavanger on the Norwegian west coast and 30 km northeast of the Johan Sverdrup discovery, to have the potential to contain unrisked, gross prospective resources of 153 million boe.

Lundin Norway is operator of PL674BS with 35% working interest. Partners are Petrolia Norway and E.On E&P Norge AS with 35% and 30% interest, respectively.

Drilling & Production — Quick Takes

Wintershall: Shale gas debate blocking conventional

Wintershall Holding GMBH says natural gas production in Germany fell by about 6% in the past year, and controversy over shale gas and hydraulic fracturing is blocking conventional gas production.

For more than 3 years, the ongoing discussion on shale gas has prevented projects from being approved that require the use of hydraulic fracturing even for conventional gas production, the company said.

"More than a third of the conventional natural gas produced in Germany has been safely recovered in an environmentally friendly manner with the use of hydraulic fracturing," said Andreas Scheck, head of Wintershall's activities in Germany. Scheck spoke at the Handelsblatt Annual Energy Industry Conference in Berlin.

Scheck said strengthening of Germany's supply security depends not just on the possible future production of shale gas reserves but above all on established, conventional production.

Today only 11% of Germany's natural gas requirement is met by domestic sources; 15 years ago it was 22%.

"The project backlog is not only threatening domestic supply security but is also meanwhile putting jobs at risk, especially in Lower Saxony," Scheck said. About 95% of Germany's natural gas is produced in Lower Saxony.

"We need a reliable legal framework, time frames, and planning security for the future use of fracking technology in Germany, of course taking into account Germany's highest safety and environmental standards," he said.

Scheck said hydraulic fracturing has for decades been safely and successfully deployed in Germany with so-called tight gas.

"It's already safe to use today," he said. "Over 300 fracs in Germany alone have proved this during the last 50 years."

BHP to reduce US onshore rigs by 40% by July

Australia's BHP Billiton will reduce its US onshore rig presence from 26 to 16 by July in response to lower oil prices.

Andrew Mackenzie, BHP's chief executive officer, explained in the company's operational review for the half-year ended Dec. 31 that it will instead focus on improvements in drilling and completions efficiency.

"Our ongoing shale investment program will remain focused on our liquids-rich Black Hawk acreage [in the Eagle Ford shale]," Mackenzie said. "However, we will keep this activity under review and make further changes if we believe deferring development will create more value than near-term production."

The company in 2011 entered the Eagle Ford-where a majority of the company's US onshore rigs currently reside-in its $12.1-billion merger with Petrohawk Energy. The move was part of a $20-billion investment in US shale by a firm whose expertise at the time was primarily in deepwater drilling.

Rod Skaufel, BHP's president of North American shale, during a visit to Houston last summer attributed productivity increases in the Eagle Ford to a continuous performance benchmarking system called the pacesetter program, which involves breaking down a well into sections of a hole and then looking across the company's rig fleet to see which rig drilled each section the fastest (OGJ Online, June 3, 2014).

BHP's onshore US liquids volumes rose 71% in the December 2014 half-year to a record 24.4 million boe, underpinned by the Black Hawk and Permian plays, where liquids production increased 81% and 107%, respectively. The company's drilling and development expenditure totaled $1.9 billion.

Activity in the Permian and Hawkville in the near future, however, will be limited to the retention of core acreage, the company says. BHP's dry gas development program will be trimmed to one rig in the Haynesville, with a focus on continued drilling and completions optimization ahead of full-field development.

BHP says the reduction in drilling activity will not affect its 2015 financial year production guidance, and the company remains confident that its shale liquids volumes will rise 50% during that period.

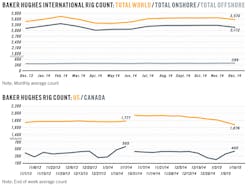

US rig count falls 74 units to lowest total since 4Q10

The US drilling rig count plunged 74 units-all on land-to settle at 1,676 rigs working during the week ended Jan. 16, Baker Hughes Inc. reported. That's the lowest total since the Oct. 29, 2010, rig count, which totaled 1,672.

The count has now fallen in 7 consecutive weeks, losing 244 units during that time (OGJ Online, Dec. 5, 2014). The US has 101 fewer rigs compared with this week a year ago.

Land rigs have plummeted 134 units in the last 2 weeks to settle at a total of 1,610. Unchanged from a week ago were offshore rigs at 54 and rigs drilling in inland waters at 12.

Oils rigs this week dropped 55 units to 1,366. Gas rigs dropped 19 units to 310.

Horizontal drilling rigs plunged 48 units to 1,253. Directional drilling rigs dropped 8 units to 153.

The bulk of the losses in the major oil- and gas-producing states came in Texas, where its count fell 44 units to 766, reflected by a 15-unit loss in the Permian to 487 and a 12-unit loss in the Eagle Ford to 185. The state's total is the lowest since the Mar. 25, 2011, rig count.

North Dakota reported the second-most losses, giving up 6 units to 156. The Williston also lost 6 units and now totals 165. Oklahoma dropped 5 units to 201. Wyoming and California each dropped 4 units to 47 and 18, respectively. New Mexico dropped 3 units to 92. West Virginia, Kansas, and Arkansas each dropped 2 units to 26, 24, and 11. Louisiana, Colorado, and Utah each edged down 1 unit to 107, 64, and 17, respectively. Unchanged from a week ago were Pennsylvania at 51 and Alaska at 11. Ohio was the only state to report a gain, edging up 1 unit for the second consecutive week. It now totals 48.

PROCESSING — Quick Takes

EPA okays California's refinery emission regs

The US Environmental Protection Agency has issued a final rule approving revisions to portions of California's state implementation plan (SIP) that govern emissions of certain air pollutants from the state's refineries.

The approval covers revisions to California's SIP by South Coast Air Quality Management District (SCAQMD) and Ventura County Air Pollution Control District (VCAPCD) that concern volatile organic compound (VOC) emissions from petroleum coking operations, as well as primary emissions of sulfur dioxide from stationary combustion sources in the regions, EPA said in a Jan. 20 Federal Register notice.

The revision to SCAQMD Rule 1114, which is designed to minimize VOC emissions generated during the delayed coking process at a refinery, will now require that coke drums be depressurized to less than 2 psig before it can be allowed to vent into the atmosphere.

A revised VCAPCD Rule 54, which aims to limit emissions of sulfur compounds from fossil fuel combustion at stationary sources in Ventura, will now include a 1-hr average National Ambient Air Quality Standard sulfur dioxide concentration limit of 75 ppb, or 0.075 ppm, at the property line of the emitting source.

While the agency said it has finalized the rule without prior notice amid its beliefs that the revisions fully satisfy all relevant requirements under the Clean Air Act and that their approval unlikely would receive any objections, EPA will accept any adverse comments on the action by Feb. 19.

If no adverse comments on the final rule are received by the February deadline, the direct final approval of revisions will become effective and incorporated into California's SIP without further notice from EPA as of Mar. 23, the agency said.

Versalis plans cracker restart at Venice plant

Versalis SPA, the wholly owned chemicals subsidiary of Eni SPA, is planning to temporarily restart the 490,000-tonne/year ethylene steam cracker at its Porto Marghera petrochemicals plant in Venice, Italy.

The planned restart, which is scheduled during the first half of February, results from an agreement Versails reached with Royal Dutch Shell PLC to provide temporary ethylene supply support to the Dutch producer, Eni said.

The short-term restart of the cracking plant, which halted operations in February 2014, does not affect plans by Versalis to convert the Porto Marghera site into a production center for bio-based products as a means to ensure the manufacturing location's long-term competitiveness and viability based on environmental sustainability, Eni said.

In November 2014, Claudio Descalzi, Eni's chief executive officer, said the Porto Marghera project would involve the creation of a "green chemistry" center that includes two new production plants equipped with technology to produce lubricants and detergents from vegetable oil feedstock, according to a Nov. 14, 2014, release from the company.

Once Versalis has completed the conversion of its Porto Marghera operations into an integrated "green chemical" hub, the site's steam cracking plant will remain closed permanently, according to information posted to Eni's web site.

Eni previously completed the conversion of its 80,000-b/d Venice refinery at Porto Marghera into a biorefinery base for the production of biodiesel (OGJ Online, Feb. 18, 2014).

The temporary supply agreement with Shell follows interruptions to ethylene production after a June 2014 explosion at Shell subsidiary Shell Nederland Chemie BV's Moerdijk petrochemical plant in the Netherlands (OGJ Online, June 5, 2014).

Work to repair and rebuild the Moerdijk production site began in September of last year, according to a Sept. 17, 2014, release from Shell Nederland.

Contract let for Aramco's Jazan refinery, terminal

Saudi Aramco, through a contractor, has let a contract to Alderley FZE, Dubai, a division of Alderley PLC, Wickwar, UK, to provide metering systems at the 400,000-b/d Jazan refinery and associated marine terminal project currently under construction in the southwest of Saudi Arabia, along the Red Sea (OGJ Online, Oct. 22, 2012).

Alderley will supply the Jazan project with nine metering systems equipped with turbine metering technology that will enable each system to measure a specific petroleum product, including high-sulfur diesel, vacuum gas oil, naphtha, methyl tertiary butyl ether, fuel oil, gasoline, ultralow-sulfur diesel, benzene, and paraxylene, Alderley said.

Each of the metering systems also will include a fast-loop system, auto-sampling system, small-volume prover, as well as associated control systems, the company said.

The metering systems are due for delivery at Jazan in September 2015, Alderley said.

A value of the contract was not disclosed.

Scheduled for completion in late 2016, the Jazan refinery and terminal project also will be coordinated with a large integrated gasification combined-cycle plant, which is to be operational in 2017 (OGJ Online, May 8, 2014).

TRANSPORTATION — Quick Takes

Third PNG LNG train planned to boost power

The ExxonMobil Corp.-led Papua New Guinea-LNG (PNG-LNG) joint venture has signed a memorandum of understanding with the Papua New Guinea government to supply gas for electric power plants in return for enabling the project to develop a new gas field and expand to a third LNG train.

It is likely the development of the P'nyang gas field in the western highlands in licence PRL3 would be the supply source for the LNG plant expansion.

PNG-LNG has pledged to supply 20 MMcfd of gas for 20 years to help Papua New Guinea improve its electricity generation capacity and reliability of power supply in the country.

Up to 25 Mw of power will be provided to Port Moresby through the PNG-LNG facilities for an interim period. At the same time the government will look at long-term power generation options.

The remainder of the promised gas will be used to supply a state-owned power station near the LNG plant.

A new appraisal well will be drilled at P'nyang within 2 years of being awarded a development licence for the field. A pipeline license also will be awarded.

Final investment decision for a third LNG train will be no later than yearend 2017.

Magnolia LNG signs MOU for fourth train

Magnolia LNG LLC (MLNG) signed a memorandum of understanding with Kellogg Brown & Root LLC, a wholly owned subsidiary of KBR Inc. (KBR), and SKE&C USA Inc. (SKEC) whereby KBR and SKEC, forming a 70-30 joint venture to deliver the 8-million tonne/year four train Magnolia LNG project.

The MOU follows last year's letting of an engineering, procurement, and construction contract to SKEC (OGJ Online, Dec. 3, 2014) and a subsequent technical services agreement with KBR announced earlier this month. KBR and SKEC will complete all due diligence in relation to technical, commercial, and contractual matters to execute a lump sum EPC contract on the project, as well as commissioning, start-up, and performance testing of the LNG plant.

MLNG expects the JV agreement to be finalized next month, paving the way for an EPC contract signing in April. The company does not expect any material changes to the EPC contract on the way to first LNG fourth-quarter 2018.

The project comprises development on an established LNG shipping channel in Lake Charles, La., using MLNG's wholly owned optimized single-mixed refrigerant (OSMR) process technology and the completed LNG-plant front end engineering and design from parent-company Liquefied Natural Gas Ltd.'s Gladstone Fisherman's Landing LNG project in Queensland, Australia.