Conglin Xu

Senior Editor-Economics

Oil prices relate to a combination of factors, including fundamental supply and demand, and market sentiment. The major challenge in empirically assessing which factor provides a better explanation for the dynamics in crude oil prices consists in isolating the different forces in its effect on the price.

Using a SVAR (structural vector autoregressive) model described in the box below, shocks to crude oil prices are decomposed into four groups: shocks to non-OPEC oil supply, shocks to OPEC oil supply, shocks to global oil demand, and residual shocks. A positive supply shock has a negative impact on prices, while a positive demand shock has a positive impact on prices. Residual shocks represent a premium resulting from forward-looking market speculations or sentiment fluctuations, which could also be deemed as shocks aimed directly at prices.

The chart in this sidebar displays the four types of shocks since 2008. The results show that real Brent prices are largely driven by flow demand and speculative shocks. During turbulent times or periods of structural change, speculative forward-looking elements tend to play a more dominant role in oil price swings, which happened, for example, in the 2008 global financial crisis.

As illustrated in the chart below, the oil market in 2014 was characterized by a contraction in demand growth and an acceleration in supply. However, the price plunge since mid-June is more a market reaction to possible future imbalances than a sudden change in supply-demand fundamentals.

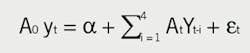

The structural vector autoregressive (SVAR) model is based on monthly data for yt=(Δprodt, econactt, pricet), where

Δprodt is the percentage change of global oil production from a year ago, econactt refers to real global GDP index, and pricet is the real Brent price, deflated by US consumer price index (CPI). The latter two are expressed in logarithmic terms. The model representation is

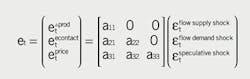

where A0 has a recursive structure. So the reduced form errors et can be decomposed according to et=A0-1εt with the following restrictions on A0-1:

The model above was extended here by distinguishing between changes of OPEC supply and non-OPEC supply, assuming that OPEC supply adjusts in response to non-OPEC supply, but not vice versa.

For more details about the model and its estimation, contact Conglin Xu at [email protected].

Reference: Kilian, L. (2009), "Not All Oil Price Shocks Are Alike: Disentangling Demand and Supply Shocks in the Crude Oil Market," American Economic Review, 99, 1053-1069.

About the Author

Conglin Xu

Managing Editor-Economics

Conglin Xu, Managing Editor-Economics, covers worldwide oil and gas market developments and macroeconomic factors, conducts analytical economic and financial research, generates estimates and forecasts, and compiles production and reserves statistics for Oil & Gas Journal. She joined OGJ in 2012 as Senior Economics Editor.

Xu holds a PhD in International Economics from the University of California at Santa Cruz. She was a Short-term Consultant at the World Bank and Summer Intern at the International Monetary Fund.