DEEPWATER GULF DECOMMISSIONING—2: Structure inventory runs gamut of deepwater technologies

Mingming Liu Zhen Wang

China University of Petroleum

Beijing

Mark J. Kaiser

Louisiana State University

Baton Rouge

The deepwater Gulf of Mexico (GOM) is the largest source of domestic oil production in the US and a laboratory for deployment of advanced drilling and development technologies. In 2013, the deepwater GOM contributed more than 80% of the oil produced in the GOM from 95 fixed and floating structures.

To work in the deepwater arena requires companies with deep pockets and the ability to manage complex projects with large technical risk and long development cycles. If projects are successfully executed, investors will be rewarded with some of the industry's highest rates of return and strong cash flows for years to come.

The purpose of this four-part series is to examine end-of-life production in the GOM and forecast the expected removal times for the fixed and floating structures that reside in waters deeper than 400 ft. Although still in its nascent stage, the deepwater decommissioning market will become increasingly important over the next decade.

Previously, we summarized deepwater installation and removal trends (OGJ, Feb. 3, 2014, p. 60). This second part of the series describes the well and structure inventories that serve as input data into our forecast models. Parts 3 and 4 will describe short and long-term removal forecasts.

Well inventory

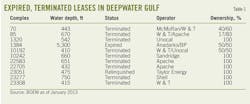

In January 2013, 95 structures in waters deeper than 400 ft were producing from 997 dry-tree wells and 191 subsea wells, according to data from the US Bureau of Ocean Energy Management (BOEM; Table 1).1 Almost all deepwater wells are sidetracked, and more than half of the deepwater fields developed to date are producing via subsea tiebacks.

Most floating structures are supported by a large number of dry-tree wells producing from anchor fields, but in some cases (e.g., NaKika, Independence Hub) several smaller fields were aggregated via tiebacks to produce in commercial quantities.

Subsea technology forms part of area-wide or integrated field development, in which several fields are grouped together and developed as a single project, as well as being used to produce remote and smaller fields.

Structures with the largest number of tiebacks include Mars, Bullwinkle, Auger, Nansen, Phoenix, Ursa, Pompano, and Morpeth. Mensa is the longest offset subsea development in the GOM at 68 miles from the host structure.

Hub platforms may be designed to serve multiple off-lease fields from start-up or may function as a hub structure after production capacity becomes available. The useful life of a hub platform depends upon its location and the number of subsea wells tied back to it.

Platform wells are usually owned in the same proportion as the structure's working interest. Subsea wells drilled off the platform lease frequently involve different ownership. When well and structure ownership positions are different, companies arrange a production-handling agreement to process at the host platform and pay for these services separately.

Structure type

Deepwater fixed platforms are large, robust structures with multiple decks to support the drilling rig and its equipment and crew quarters, as well as the buildings, treatment facilities, compressors, pumps, and storage tanks for production.

In total, 62 fixed platforms have been installed in the GOM in waters 400-1,360 ft deep, according to BOEM data.2 3 Bullwinkle is the deepest conventional fixed platform in the world in Green Canyon Block 65 at 1,360 ft water depth (OGJ, June 4, 1990, p. 64).

Compliant towers are attached to the seabed but differ from jacket structures in that they are configured to respond flexibly to waves. Unlike fixed platforms, which require a stiff structure with a wide base, compliant towers maintain a constant cross section similar to a radio tower and are held in place by guy lines and buoyancy tanks.

In 1983, Exxon Co. USA installed Lena, the first compliant tower, in 1,000 ft of water (OGJ, July 4, 1983, p. 56). Amerada Hess installed Baldpate in 1998 in 1,650 ft (OGJ, May 11, 1998, p. 49) and ChevronTexaco installed Petronius in 2000 in 1,754 ft water depth (OGJ Online, May 5, 2000). Petronius is the tallest free-standing platform in the world.

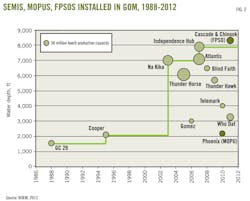

There are four major categories of floating platform used in deepwater development (Fig. 1). Semisubmersibles and floating production storage and offloading (FPSO) vessels are by far the most popular worldwide and normally converted from old drilling rigs and oil tankers.

Semisubmersibles are designated as "column stabilized units" because the center of gravity is above the center of buoyancy and stability is determined by the restoring moment. Eleven semisubmersibles have been installed in the GOM (Fig. 2). Anadarko Petroleum Corp.'s Independence Hub is the deepest semisubmersible, on Mississippi Canyon Block 920 in 8,000 ft of water (OGJ Online, July 20, 2007).

FPSOs are used primarily in isolated areas where there is no market for oil and gas within pipeline range, but in the GOM, the primary advantage of the FPSO—its oil storage capacity—has not been needed historically because of the extensive pipeline infrastructure in the region. In 2011, Petrobras installed the first FPSO in the GOM to develop the Cascade and Chinook fields (OGJ Online, Mar. 2 and Sept. 14, 2012).

Mobile offshore production units (MOPUs) are ship-shape vessels without oil storage capacity. The first MOPU installed in the GOM was a converted cargo ship employed by Helix Energy Solutions Group Inc. in the Phoenix redevelopment in 2010 (OGJ Online, June 15, 2010).

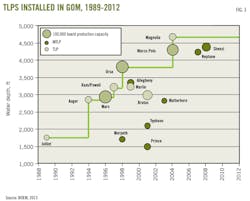

A tension leg platform (TLP) consists of columns and pontoons similar to semisubmersibles, but the mooring system consists of vertical tendons that constrain the heave (vertical) and rotational (pitch and roll) motion. The steel tendon requirements for mooring have constrained commercial application of TLPs to about 5,000 ft of water (Fig. 3).

Conventional TLPs have four buoyant hulls with hollow columns in which ballast water is injected and withdrawn to adjust the tension in the vertical legs. Mini TLPs (MTLPs) employ a single column with three radial pontoons anchored to the seabed and are deployed with smaller reservoirs and well counts. TLPs support drilling rigs and permit the use of dry trees.

A total of 9 TLPs and 7 MTLPs have been installed in the Gulf of Mexico. The first TLP was for ConocoPhillips's Jolliet field in 1989 (OGJ, Nov. 11, 1991, p. 60), and the deepest is ConocoPhillips's Magnolia on Garden Banks Block 783 in 4,760 ft of water (OGJ, Nov. 22, 2004, p. 50).

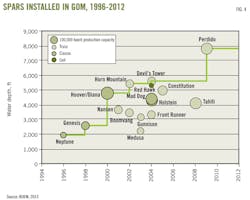

A surface-piercing articulated riser (spar) consists basically of a long cylinder, the upper part of which provides buoyancy while ballast in the bottom portion provides stability. Spars have been employed in a variety of applications, including both wet-tree host and dry-tree wellhead, with or without platform drilling in water depths of 2,000-8,000 ft (Fig. 4). Station keeping is provided by catenary anchor lines.

The first generation of spars, referred to as the "classic," was made of one cylindrical hull that extended to the bottom of the structure. Later spar designs replaced the midsection with a space frame truss structure ("truss"), which resulted in a lighter, less expensive hull structure.

The third generation of spar design is the cell spar, made up of several identically sized cylinders surrounding a center cylinder. Cell spars are the easiest and cheapest of the three designs to fabricate, but because they have no center opening for wellheads, only subsea production is possible.

The first spar installation was on Oryx Energy Co.'s Neptune field in 1996 in 1,935 ft of water (OGJ, Sept. 23, 1996, p. 35), and the first truss spar was Kerr-McGee Oil & Gas Corp.'s Nansen in 3,680 ft in 2001 (OGJ Online, Oct. 4, 2001). The latest and deepest truss spar is Shell Exploration & Production Co.'s Perdido in 7,835 ft of water (OGJ, Sept. 8, 2008, p. 35). Perdido gathers, processes, and exports production within a 20-mile radius with peak production designed for 100,000 boe/d.

Anadarko's Red Hawk is the only cell spar installed in the GOM (OGJ, July 26, 2004, Newsletter) and last produced in 2008.

Structure inventory

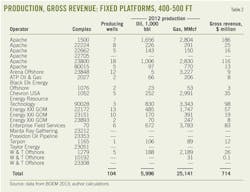

Through 2012, 30 fixed platforms have been installed in 400-500 ft of water and 8 platforms have been removed (Table 2). Half of the structures installed are primarily oil producers, while 7 of the 8 removals were gas producers. About 20% of the inventory consists of hub platforms processing off-lease production.

Chevron, EP Energy, and W&T Offshore each removed one deepwater fixed platform in 2011, and W&T Offshore removed a deepwater platform in 2012.

To date, the collection of fixed platforms in 400-500 ft of water has produced 346 million bbl oil and 3.6 tcf of natural gas, or on average, about 12 million bbl oil and 120 bcf of natural gas per structure. In 2012, fixed platforms in 400-500 ft of water generated roughly $714 million in gross revenue and contributed about 1% of the oil and natural gas production in the Gulf of Mexico.

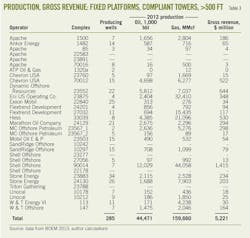

In waters deeper than 500 ft, 32 fixed platforms have been installed since 2009 and 4 platforms have been removed (Table 3). More than half of the fixed platforms in waters deeper than 500 ft are primarily oil producers, and all 4 structures removed were gas producers.

BP PLC removed Cinnamon in 2009, and Chevron removed Pimento and Kilauea in 2010 and 2011. Sojitz Energy Ventures also removed a deepwater fixed platform in 2010.

Fixed platforms in waters deeper than 500 ft sit at the edge of the continental shelf, and more than half serve as hubs and pipeline junctions.

In 2012, fixed platforms in waters deeper than 500 ft contributed about 8% of the oil and natural gas production in the Gulf of Mexico and generated $4.1 billion in gross revenue. To date, the facilities have produced on average 43 million bbl of oil and 186 bcf of natural gas per structure.

All three compliant towers in the GOM are oil producers and Baldpate is the only compliant tower that hosts subsea tiebacks. In 2012, Lena, Baldpate, and Petronius generated $1.1 billion in gross revenue and had cumulative production of 314 million bbl oil and 819 bcf natural gas.

Operators have installed 45 floating structures and removed 3 over the last 25 years (Table 4). Most floating structures process subsea production with 8 of every 10 hosting wet wells. In 2012, there were 16 spars, 9 TLPs, 9 semisubmersibles, 6 MTLPs, 1 MOPU, and 1 FPSO active in the gulf.

To date, floating structures have produced on average 92 million bbl of oil and 216 bcf of natural gas per structure, and these volumes will increase in the years ahead because the majority of installations sit atop large fields and reserves are likely to grow.

All floating structures except Anadarko's Independence Hub are primarily oil producers. In 2012, floating structures contributed about 70% of the oil and 34% of the natural gas production in the Gulf of Mexico and generated about $36 billion in gross revenue.

References

1. Wellbore Database, 2013, US Bureau of Ocean Energy Management; www.data.boem.gov/homepg/data_center/well/well.asp.

2. Platform Master Database, 2013, US Bureau of Ocean Energy Management; www.data.boem.gov/homepg/data_center/platform/platform/master.asp.

3. Structure Database, 2013, US Bureau of Ocean Energy Management; www.data.boem.gov/homepg/pubinfo/freeasci/platform/PlatformStructuresFixeddfn.asp.

The authors

Biographical sketches of Mingming Liu and Mark J. Kaiser appear with Part 1 of this series, OGJ, Feb. 3, 2014, p. 60.

Zhen Wang ([email protected]) is professor and executive dean of the Academy of Chinese Energy Strategy, China University of Petroleum, Beijing. He was a Fulbright Visiting Research Scholar at the Darden Graduate School of Business at the University of Virginia, Charlottesville, Va. Wang holds a PhD in finance from Peking University and his areas of interests include mergers and acquisitions and energy finance.