OGJ Newsletter

GENERAL INTEREST — Quick Takes

Chu: Decision to build Keystone XL a political one

The decision on whether to permit the construction of the Keystone XL crude oil pipeline is a political one and not one that is scientific in nature, according to former US Energy Sec. Steven Chu.

Speaking at a news conference in Port of Spain Chu said, "I don't have a position on whether the Keystone Pipeline should be built. That is for the secretary of State and the president. But I will say that the decision on whether the construction should happen was a political one and not a scientific one."

Chu then told OGJ that he wanted to expand his statement to say that the studies commissioned by the administration were, in fact, scientific. Late last month, the US State Department said in its long-awaited final supplemental environmental impact statement that the 1,700-mile proposed construction and operations of the Keystone XL line would not have significant environmental impacts (OGJ Online, Feb. 1, 2014).

Chu said, "The entire statement should include that the studies looking into what are the long-term effects are in fact scientific and that is the only scientific part of the decision."

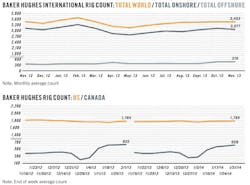

Chu, who is a speaker at Trinidad and Tobago's Energy Chamber's annual conference and trade show, said he expected US crude production to increase by another 1 million b/d of oil by yearend. Chu said this increase in production was a direct result of tight oil, which has added millions of barrels of crude in the last few years.

BPC releases first three commissioned papers on RFS

The Bipartisan Policy Center released the first three of five papers it commissioned on the federal Renewable Fuels Standard. The papers are part of its effort to foster discussions on ways to reform the RFS, which was established by the 2005 Energy Policy Act and expanded by the 2007 Energy Independence and Security Act, BPC said.

Oil industry groups have said RFS quotas assumed that US crude oil production would continue to decline and demand continue to rise when, in fact, the opposite has happened, creating significant compliance problems for refiners and other obligated parties.

The three papers—"Technical Barriers to the Consumption of Higher Blends of Ethanol" by The International Council on Clean Transportation, "Petroleum and Renewable Fuels Supply Chain" by Stillwater Associates LLC, and "Inventory of Federal Regulations Affecting Biofuels other than the Renewable Fuel Standard" by Van Ness Feldman—express the opinions of their authors, and not the RFS advisory group BPC assembled to discuss opportunities for reform, host public workshops, and develop viable policy options.

Two remaining papers, which will present separate law firms' perspectives on the US Environmental Protection Agency's authority to amend the RFS, will be released at the end of February, BPC said.

Range Resources selects chief executive officer

Range Resources Ltd. has named Rory Scott Russell as its chief executive officer.

Russell most recently served as finance manager, exploration in Europe and Russia for Shell, where he gained more than 10 years of international experience in upstream positions.

In that role he oversaw all financial aspects of the business, corporate governance and control, treasury management, and sat on regional investment committees covering the North Sea, onshore Netherlands and Germany, Italy, Russia, and Kazakhstan, Range said.

Russell previously worked in The Hague- and Moscow-based role of finance and commercial manager, exploration, in Russia as well as in the strategic planning unit for Shell's global upstream business.

Exploration & Development — Quick Takes

ExxonMobil expands acreage, enters Utica agreement

XTO Energy Inc., a subsidiary of ExxonMobil Corp., has agreed to fund development to gain operating equity in 34,000 gross acres in the liquids-rich Wolfcamp in Texas's Midland and Upton counties, increasing the company's holdings in the Permian basin to just more than 1.5 million net acres.

XTO also has signed an agreement with American Energy–Utica LLC (AEU) that will enable AEU to earn 30,000 net acres of XTO's Utica basin leasehold in Ohio's Harrison, Jefferson, and Belmont counties.

In the Wolfcamp, Endeavor will continue to operate shallow production while XTO will drill and operate horizontal wells in the deeper intervals.

"The Wolfcamp shale is a vast, tight oil resource with tremendous potential," said XTO Pres. Randy Cleveland. "The presence of multiple, stacked pay zones creates the potential for capital-efficient horizontal development, and the proximity to XTO's ongoing Wolfcamp operations will offer operating cost efficiencies."

In the Utica, XTO will continue to operate in a core area of 55,000 net acres, optimizing development by using proceeds from the transaction to fund 100% near-term development costs.

"We just initiated development in the Utica and are encouraged by results from our initial well that is producing at a peak 30-day rate of about 15 MMcfd of dry gas," said Cleveland.

XTO in 2013 expanded production in the Appalachia region by almost 30%, maintaining 645,000 acres in the Marcellus and Utica.

Total sells interest offshore Angola for $750 million

Total SA will sell 15% participating interest in offshore Angola Block 15/06 to Sonangol E&P for $750 million.

Block 15/06, which covers 2,984 sq km, lies in 220-1,700 m of water 350 km northwest of Luanda off Angolam.

The northwestern hub of the block, currently under construction, is expected to produce in 2015. Total said a final investment decision for a northeast project is expected to be made this year.

Eni SPA is the block's operator with 35% interest. Partners are Sinopec's and Sonangol's joint affiliate SSI 25%, Total 15%, Sonangol 15%, Statoil 5%, and Falcon Oil Angola Investimentos 5%.

"The sale of our interest in Block 15/06 is in line with Total's global strategy to actively manage its portfolio and focus its investment capability on core assets in which it has more material interests, such as Block 17 with the CLOV project currently under development and the future development of Kaombo on Block 32 in Angola," said Jacques Marraud des Grottes, senior vice-president, exploration and production for Africa.

The company's primary Angola asset is Block 17, which it operates with 40% interest (OGJ Online, Oct. 17, 2006). The block's four major hubs are Girassol-Rosa, Dalia, Pazflor, and CLOV's pooling of discoveries Cravo, Lirio, Orquidea, and Violeta. Total said Girassol-Rosa, Dalia, and Pazflor are currently producing while CLOV's development, launched in 2010, is expected to start-up in 2014 (OGJ Online, Aug. 11, 2010).

Pacific Rubiales makes oil discovery in Peru

Pacific Rubiales Energy Corp., Toronto, has made an oil discovery in the Los Angeles-1X exploration well on Block 131 of Peru's onshore Ucayali basin.

The Los Angeles-1X well was spud in September and reached a total depth of 12,409 ft in November. Petrophysical evaluation indicated the presence of 62 ft of net pay in the Cretaceous-aged Cushabatay formation.

Pacific Rubiales conducted three separate tests across different net pay intervals in the Cushabatay formation under swabbing and natural flow conditions and through variable choke sizes over 22-60-hr test periods. Final flow rates from the three test intervals were 135 b/d, 936 b/d, and 2,351 b/d, respectively, of 44-45° API gravity sweet oil, the company said. Water cuts ranged from 10% in the lowest interval to 0.3% to nil in upper intervals.

The produced oil was trucked and sold to the nearby 3,250-b/d Pulcallpa refinery. The operator has applied for a 30-day initial production test to further understand the reservoir drive mechanism to be followed by an extended production test, subject to government approvals, beginning in the middle of this year. Both companies are currently evaluating development and oil marketing strategies for the block.

Pacific Rubiales's wholly owned subsidiary Pan Andean Resources PLC (Peru), Sucursal del Peru, holds 30% working interest in Block 131. The operator carried 100% of the well costs and will retain the remaining 70% working interest.

"The company is very encouraged by the test results in the Los Angeles-1X well in Block 131 and is looking forward to progressing this discovery and the earlier Sheshea-1X oil discovery in Block 126 through an evaluation phase and future development and production," said Ronald Pantin, Pacific Rubiales chief executive officer. "These light-oil discoveries support our confidence in the potential of the underexplored onshore basins in Peru."

The Sheshea-1X exploration well on Block 126 was drilled to a total depth of 8,925 ft in late 2012 and tested 1,430 b/d of 53° API gravity sweet oil with no water from a 10-ft perforated zone in the cretaceous aged Chonta formation. The Cretaceous aged Agua Caliente formation tested 80 b/d of 42° API gravity with a 97% water cut suggesting a potential accumulation updip from the well, Pacific Rubiales said.

The company, which holds 100% operated working interest in Block 126, has recently applied for environmental impact assessments for early production facilities along with 23 drilling pads comprised of 8 wells each plus a 2D and 3D seismic program. Pacific Rubiales expects to receive approval by yearend.

Drilling & Production — Quick Takes

Shell starts production from second Mars platform

Shell Oil Co. has started production from its Mars B development through Olympus, a tension-leg platform in 3,100 ft of water 130 miles south of New Orleans in the Gulf of Mexico (OGJ Online, Oct. 5, 2010). Shell expects the added production from Olympus to extend the life of the greater Mars basin to 2050 and deliver a resource base of an estimated 1 billion boe.

Shell discovered Mars field in 1989 and production began in 1996 (OGJ, Oct 11, 1993, p. 28). The Mars B development, a joint venture with BP PLC, includes subsea wells at West Boreas and South Deimos fields, export pipelines, and a shallow-water platform near the Louisiana coast. Using the Olympus platform and a floating drill rig, the company claims it will ramp up to a peak of 100,000 boe/d by 2016. The field produced about 60,000 boe/d in 2013.

Olympus is Shell's seventh deepwater platform in the gulf and the first deepwater project +in the gulf to expand an existing oil and gas field with new infrastructure, according to the company.

VAALCO gets IFC loan for work off Gabon

VAALCO Energy Inc., Houston, has received a $65-million reserve-based loan facility from IFC, part of the World Bank Group, to support further oil and gas development on the Etame Marin Block offshore Gabon.

Subsidiary VAALCO Gabon, operator with a 28.1% working interest in the block, plans to install two platforms this year.

One, a 4-pile, 8-slot unit, will be installed in the second half of the year in 85 m of water on the southern edge of Etame field. The cost will be $175 million gross. The operator plans to drill three wells from the platform initially at $25 million/well gross to develop 10 million boe of reserves.

Also in the second half VAALCO Gabon plans to install a similarly configured platform, also in 85 m of water, in what it calls the South East Etame/North Tchibala (SEENT) project (OGJ Online, June 16, 2010). Three initial wells will cost $25 million each. The project is to develop 7 million bbl of oil reserves. Gross investment in the SEENT platform will be $150 million.

Current production from the Etame Marin block recently was 18,000 b/d gross. Flow is from wells completed subsea in Etame field and tied back to a floating production, storage, and offloading vessel and from wells drilled from platforms on Avouma-South Tchibala and Ebouri fields, all tied back to the FPSO.

VAALCO's partners in the Etame Marin permit are Addax, Sasol, Tullow, Sojitz, and PetroEnergy.

Eland starts production from Opuama field

Eland Oil & Gas PLC has started oil production from Opuama field on the OML 40 license onshore Nigeria.

Eland said production has restarted through the successful recommissioning of existing systems and the reopening of two existing wells. Gross output from the two wells is expected to stabilize in aggregate at 2,500 b/d of oil. The crude oil produced will be delivered to the Shell Forcados export terminal through Eland's recently recommissioned flow station and export pipeline, with a capacity to export as much as 30,000 b/d.

Opuama is operated by Nigerian Petroleum Development Corp. The field, which has gross recoverable 2P reserves of 54.2 million bbl, was in production during 1975-2006 before Shell Petroleum Development Co. undertook a controlled shutdown of the facilities.

NPDC holds 55% interest in OML 40, with the remaining 45% interest belonging to Elcrest Exploration & Production Nigeria Ltd., Eland's joint venture company.

PROCESSING — Quick Takes

EPA rule requires new reporting from refiners

The US Environmental Protection Agency has finalized a rule under existing statutory law that establishes reporting requirements for petroleum and petrochemical processors that use or plan to use five chemical substances identified generically as "complex strontium aluminate, rare earth doped" (CSA-RED).

The "significant new use" (SNU) rule, which falls under the Toxic Substances Control Act, will require chemical manufacturing and petroleum refineries that intend to import, manufacture, or process any of these substances for an activity that is designated as a SNU to notify EPA at least 90 days before beginning such activity, according to a notice from EPA in the Feb. 4 Federal Register.

The five chemical substances identified generically as CSA-RED, which were the subject of premanufacture notices (PMN), include P-12-22, P-12-23, P-12-24, P-12-25, and P-12-26, all of which EPA predicts, at certain exposure levels, are agents of potential lung overload and toxicity to workers inhaling the substances. According to PMN, the five substances are intended to be used as dye in the making of imaging and media products.

SNU's rule also requires any chemical manufacturer or refiner that began commercial manufacturing, importing, or processing the designated CSA-RED substances after June 22, 2012, to stop before the final rule takes effect on Apr. 7.

Flint Hills plans Alaska refinery closure

Flint Hills Resources Alaska LLC (FHRA), a wholly owned subsidiary of Koch Industries Inc., Wichita, Kan., plans to cease crude oil processing at its 85,000-b/d North Pole refinery near Fairbanks, Alas., by June.

The refinery's extraction unit will be shut down on May 1, ending gasoline production, while crude unit No. 2 will be shuttered no later than June 1, ending production of jet fuel and all other refined products, the company said.

The refinery's closure stems from the enormous amount of money and resources FHRA has had to spend addressing soil and groundwater contamination that was caused when the plant and the land beneath it was under previous ownership by Williams Cos. Inc., Tulsa, and the state of Alaska, respectively, according to Mike Brose, FHRA vice-president and refinery manager.

"So far, neither Williams nor the state of Alaska have accepted any responsibility for the cleanup," Brose said. "With the already extremely difficult refining market conditions, the added burden of excessive costs and uncertainties over future cleanup responsibilities make continued refining operations impossible."

Despite the refinery's shutdown, FHRA will continue to meet its regulatory commitments to operate the groundwater remediation system to actively remove sulfolane from the onsite aquifer, Brose said.

Regarding petroleum-product supply to the local market, FHRA said it will continue marketing fuels from other suppliers through its terminals in Anchorage and Fairbanks, including the North Pole Terminal and associated tank farm, which has 720,000 bbl, or about 30 million gal, of product storage.

Products from other sources will be able to come into the terminal by truck or rail for distribution to regional markets, according to the company. But "FHRA will entertain offers for the assets associated with the refinery as an ongoing enterprise or as a terminal/marketing operation," Brose said.

FHRA acquired the North Pole refinery and its associated terminals in Fairbanks and Anchorage in 2004 (OGJ Online, Dec. 20, 2004).

BP ramps up heavy crude throughputs at Whiting

BP PLC is in the process of boosting heavy crude oil runs at its 413,000-b/d refinery at Whiting, Ind., following the yearend 2013 completion of a modernization project designed to increase the plant's ability to process heavy, sour crude (OGJ Online, Dec. 18, 2013; July 1, 2013).

"At Whiting right now, all of the units are commissioned, and we're ramping up," BP Chief Financial Officer Brian Gilvary said during a quarterly earnings call on Feb. 4.

While the company was running some heavy crude during late-2013, BP Chief Executive Officer Bob Dudley declined to specify the amount of heavy crude throughputs at the refinery, citing it as "trading-sensitive information."

Dudley said, "But we were running some heavy crude at the end of the year there, minimal amounts as we were commissioning [units]. Now we're working through that sort of post-startup testing set of activities."

But a timeframe for when Whiting would reach its full heavy crude processing capacity remained unclear. "We're going to progressively ramp it up," Dudley said. "We can't be specific on the pace because we are going to fine tune it as we go."

The Whiting refinery currently can run up to 380,000 b/d of heavy crude, Gilvary said during the call.

Both Dudley and Gilvary reiterated that the reconfigured Whiting refinery remains on track to deliver an estimated incremental $1 billion of operating cash flow/year, depending on market conditions (OGJ Online, Dec. 18, 2013).

TRANSPORTATION — Quick Takes

Southcross starts construction on Webb pipeline

Southcross Energy Partners LP has begun construction on the $125 million, 300-MMcfd Webb pipeline in the rich gas area of the Eagle Ford shale in South Texas.

The 24-in., 94-mile pipeline will extend from Webb County near Encinal, Tex., to McMullen County near Tilden, Tex. At Tilden, the Webb line will connect to the extension of Southcross' existing McMullen pipeline, on which construction of a 5-mile extension has also begun.

The project's objective is to move rich gas to Southcross' processing and fractionation complex near Corpus Christi, Tex.

Pipeline engineering, procurement, and right-of-way purchasing is under way and the pipeline is expected to be in service in this year's fourth quarter.

Southcross said construction of the pipeline is anchored by a commitment of rich gas volumes onto the Southcross system. Advanced discussions are under way with other producers regarding additional rich gas volumes.

WBI launches Dakota gas pipeline open season

WBI Energy Inc., a subsidiary of MDU Resources Group Inc., has launched an open season for its planned 375-mile Dakota natural gas pipeline running from western North Dakota to northwestern Minnesota.

The pipeline's proposed route will allow interconnection with pipelines operated by Great Lakes Gas Transmission LP, Viking Gas Transmission Co., and potentially TransCanada Pipelines Ltd. The interconnections would occur in northwestern Minnesota.

The Dakota Pipeline would use two compressor stations to transport an initial 400 MMcfd of Bakken shale gas through mostly 24-in. OD pipe. It could be expanded to more than 500 MMcfd if demand warrants. Pending sufficient market demand and regulatory approvals, WBI plans to begin building the pipeline in 2016 for a 2017 in-service date.

Dakota will cost roughly $650 million.

MDU last year announced construction of a 20,000 b/d North Dakota diesel refinery to process Bakken Crude (OGJ Online, Feb. 7, 2013). Construction began in March, with MDU expecting the refinery to come online late this year.

MDU says the state's diesel consumption has increased over the past 4 years to more than 53,000 b/d and is expected to reach 75,000 b/d by 2025. North Dakota's sole current refinery produces 22,000 b/d, according to MDU.

Pipe supply contracts signed for offshore section

OAO Gazprom said contracts have been signed to supply 75,000 12-m pipes for the first gas pipeline of South Stream Transport's offshore section.

German Europipe GMBH will supply half of the volume. The other supplies will come from two Russian sources: United Metallurgical Co., 35%, and Severstal, 15%. Contracts were signed in Amsterdam Jan. 29. Total value is €1 billion.

South Stream's offshore section will extend under the Black Sea between Bulgaria and Russia. It will have four 931-km lines, with a diameter of 813 mm and wall thickness of 39 mm.

Pipe will be stockpiled at temporary bases on the coast of Bulgaria and construction will start this fall. The first offshore line is scheduled to start operations in December 2015 (OGJ Online, Oct. 21, 2013).

Gazprom said the bidding procedure for pipe suppliers was based on "extremely stringent" requirements.