OGJ Newsletter

GENERAL INTEREST — Quick Takes

Global action urged on Nigerian oil theft

Oil theft in Nigeria, a large but murky problem, needs a nuanced, international response, argues a new report by Chatham House, London (OGJ Online, July 9, 2013).

"Nigerian crude oil is being stolen on an industrial scale," write Christina Katsouris of Chatham House and Aaron Sayne of 104 Consulting.

Amounts are uncertain. According to what the authors describe as best available data, an average 100,000 b/d "vanished from facilities on land, in swamps, and in shallow water in the first quarter of 2013." More oil might leave the country illicitly from export points.

The theft creates problems outside Nigeria by polluting markets and financial institutions and by creating reputational, political, and legal hazards. It has destabilized the Niger Delta but otherwise hasn't been a large security risk for Nigeria or West Africa.

In general, Katsouris and Sayne write, "Oil theft is a species of organized crime that is almost totally off the international community's radar."

The authors recommend collaboration by Nigeria and other countries to gather intelligence about trade in stolen oil and to improve information about volumes, movements of stolen oil, money patterns, and security risks.

They also recommend that Nigeria consider other steps to build the confidence of partners and that other states address parts of the trade in stolen Nigerian oil they know are playing out inside their borders.

And they call on Nigeria to "articulate its own multipoint, multipartner strategy for addressing oil theft."

Katsouris and Sayne point out that distinctions between legal and illegal oil supplies in Nigeria can be unclear.

"The government's system for selling its own oil attracts many shadowy middlemen, creating a confusing, high-risk marketplace," they write. "Nigeria's oil industry is also one of the world's least transparent in terms of hydrocarbon flows, sales, and associated revenues."

Obama includes energy in US-MENA interests

The free flow of energy is one of the United States' core interests in the Middle East and North Africa (MENA), US President Barack Obama said in a Sept. 24 address to the United Nations General Assembly in New York.

"We will ensure the free flow of energy from the region to the world," he declared. "Although America is steadily reducing [its] own dependence on imported oil, the world still depends on the region's energy supply, and a severe disruption could destabilize the entire global economy."

Obama said the US is prepared to use all elements of its power, including military force, to secure those core interests, which also include confronting external aggression against its allies and partners, dismantling terrorist networks, and not tolerating development or use of weapons of mass destruction.

America's core interests are not its only interests in the region, Obama emphasized. "We deeply believe it is in our interests to see a Middle East and North Africa that is peaceful and prosperous, and will continue to promote democracy and human rights and open markets, because we believe these practices achieve peace and prosperity," he said.

"But I also believe that we can rarely achieve these objectives through unilateral American action, particularly through military action," Obama continued. "Iraq shows us that democracy cannot simply be imposed by force. Rather, these objectives are best achieved when we partner with the international community and with the countries and peoples of the region."

API: US oil production reaches 25-year August high

US crude oil production reached a 25-year high for August of nearly 7.6 million b/d, according to the American Petroleum Institute's monthly statistics for August.

Total US petroleum deliveries, a measure of demand, slipped 0.7% from August 2012 to 19.1 million b/d last month, recording the highest deliveries for the year and the lowest August level in 4 years, API reported.

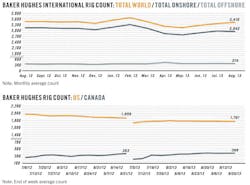

The number of oil and gas rigs in the US in August, according to Baker Hughes Inc., was 1,781, up from 1,766 last month, API said.

"August saw a continuation of trends that have been building for quite some time," said John Felmy, API chief economist. "The incredible rise in American energy production, helped in part by softening demand, has allowed the US to dramatically increase energy exports and reduce its energy imports."

Demand for gasoline was up 0.4% from the previous month to 9.1 million b/d, marking a high point for the year but the third-lowest August level in 13 years, API said. The distillate delivery increased by 2.3% from a year ago, while demand for "other oils" trended downward 1.4% over the same period, including a 3.8% decline of residual fuel and a 0.3% decline of jet fuel.

Refinery gross inputs increased 4.2% from last year to 16.3 million b/d, reaching a 9-year August high. Exports of refined petroleum products averaged 3.5 million b/d, up 2.6% from July and 16.1% from a year ago.

Gasoline production in August was 9.2 million b/d, down 0.8% from July but up 1.6% from last August. Production of distillate fuel rose 9.6% from a year earlier to an August record of 5.04 million b/d.

Crude oil stocks ended the month at 361.6 million bbl, the second-highest August level in 23 years, according to API. Motor gasoline stocks ended at 218.1 million bbl and distillate fuel oil stocks ended at 129.5 million bbl.

Total US imports averaged just over 9.8 million b/d, hitting an 18-year August low on a 10% drop from the previous year. Imports of crude oil and refined products both decreased from year-ago levels.

The refinery capacity utilization rate averaged 91.3% in August. API's latest refinery operable capacity was 17.8 million b/d, up 3.6% from last year's capacity of 17.2 million b/d.

Indian minister requests oil supply from Venezuela

Citing the "increasing appetite" for crude at Indian refineries, India's minister for petroleum and natural gas has requested long-term supplies from Venezuela.

M. Veerappa Moily met with Rafael Ramirez, Venezuela's minister of energy and mines, who led a delegation to India for a review of cooperation in the hydrocarbons sector.

Indian representatives on Sept. 24 cited difficulties related to pricing and signing of term contracts for importation of crude from Venezuela. And, for Indian companies working in the Venezuelan exploration and production sector, delayed dividend payments to joint venture partners were noted.

Ramirez encouraged Indian companies to increase participation and invited them to attend a meeting in Venezuela Oct. 7-9. Ramirez assured his audience that all issues would be discussed in detail to arrive at mutually acceptable solutions.

Both agreed to completing a comprehensive package that would also include participation by Indian companies in providing expertise for infrastructure and technology, and for boosting trade in goods and services.

Halliburton pleads guilty to Macondo evidence charge

Halliburton Energy Services Inc. pleaded guilty to destroying evidence in connection with the 2010 Macondo deepwater well blowout, and was sentenced to pay the maximum $200,000 fine, the US Department of Justice said on Sept. 19.

DOJ also filed a criminal information charging a former Halliburton manager, Anthony Badalamenti, of Katy, Tex., with one count of evidence destruction. An information is merely a charge, and a defendant is presumed innocent unless proven guilty, it noted.

US District Court Judge Jane Triche Milazzo of Louisiana's Eastern District accepted Halliburton's plea and imposed the sentence, which also included 3 years' probation, according to DOJ.

During the guilty plea and sentencing proceeding, she cited Halliburton's self-reporting of the misconduct, substantial and valuable cooperation in the government's investigation, and substantial efforts to recover the deleted data, it said.

In its own announcement, the Houston oil field service and supply company said DOJ has closed its investigation of the matter following this resolution under a previously announced cooperation plea agreement.

"DOJ's investigating taskforce characterized the company's cooperation in the case as 'exceptional' as well as 'forthright, extensive, and ongoing since the outset of the investigation,'" it said.

Exploration & Development — Quick Takes

Statoil makes gas find at Iskrystall off Norway

A group led by Statoil ASA has made a gas discovery at the Iskrystall prospect on PL 608 in the Barents Sea offshore Norway.

Well 7219/8-2 proved a 200-m gas column in the Sto and Nordmela formations. Statoil estimated volumes at 6-25 million boe.

The Norwegian Petroleum Directorate said the reservoir quality in both formations was "poorer" than expected.

"Our main goal was to find oil in Iskrystall, but unfortunately it did not materialize," said Statoil's Gro Haatvedt, senior vice-president, exploration, Norway.

Statoil has 50%, Eni Norge 30%, and Petoro 20%.

The well, which was drilled using Seadrill Ltd.'s West Hercules semisubmersible rig, is about 30 km southwest of 7220/8-1 Johan Castberg and about 240 km north of Hammerfest. The rig will be moved back to PL 532 to drill the Skavl prospect.

Total to develop Bolivia's Incahuasi field

Total E&P Bolivia will develop Incahuasi gas-condensate field in Bolivia's Subandean region, with output expected to start in 2016, and will drill several more exploratory and appraisal wells on the Ipati and Aquio blocks to prove further potential of that field (OGJ Online, May 12, 2011).

The Total subsidiary took the final investment decision after drilling the ICS-2 exploratory well with a successful outcome.

A Total-led group will drill three wells, one on Aquio and two in Ipati, 250 km southwest of Santa Cruz. The development also involves a 230 MMcfd gas treatment plant and connecting pipelines. A large share of produced gas will be exported, the company said.

ICS-2 went to a total depth of 5,636 m and proved a hydrocarbon column 1,100 m thick in fractured Devonian Huamampampa sandstones. It is the second successful exploratory well on the Ipati block.

Total said it will also begin exploring the adjacent Azero block following the recent signature of agreements with state Yacimientos Petroliferos Fiscales Bolivianos (YPFB) and Russia's OAO Gazprom.

Total E&P Bolivia operates Aquio and Ipati with 60% participating interest, Tecpetrol de Bolivia has 20%, and Gazprom has 20% pending final administrative approvals.

SOCO tests high Oligocene oil rate off Vietnam

SOCO International PLC said it gauged oil at one of the best rates from the Oligocene in Vietnam at the TGT-10XST1 exploratory well on the H5 fault block of Te Giac Trang field, exceeding all pretest expectations.

Combined maximum rate from two of the three zones tested exceeds 16,500 b/d of oil. A third drillstem test in the well, which encountered some 250 m of gross pay section (119 m of net pay) in Miocene and Oligocene reservoirs, is under way.

The first test, over a net 93-m section in the Oligocene C, produced at a maximum 9,488 b/d of 41.1° gravity oil and 1.16 MMscfd of gas. The second test, over the Miocene Lower 5.2L sequence, tested a net 47.3-m interval. The maximum flow achieved over this interval was 7,100 b/d and 1.76 MMscfd.

The final test is of the Lower Miocene Intra Lower Bach Ho 5.2 Upper and Lower sequence, testing an additional net 88.6 m. This test has just commenced and should be completed in 5-7 days.

The TGT-10XST1 well is 6 km south of the H4 wellhead platform, which is in the southern part of TGT field on Block 16-1 in the Cuu Long basin off southern Vietnam.

Drilling & Production — Quick Takes

Efficiency seen lifting US frac capacity

Operational efficiency is increasing overall capacity to hydraulically fracture wells in the US without a corresponding increase in equipment, report analysts at UBS Securities LLC.

The efficiency gains, say Angie Sedita, analyst, and associate analysts Sasha Sanwal and Paul Choi, come from faster frac crews, better frac design, engineering improvements, and growth in 24-hr operations.

The pressure-pumping industry began 2013 with 20-25% excess capacity while the well count was expected to increase 8-10%. But as much if not more pressure-pumping equipment is idle now as then.

Compared with less than a year ago, "the industry is able to do more with less," the analysts say.

"It can complete twice as many frac stages as only 6-9 months ago, perform the job more quickly and efficiently, better design a frac job, and still manage to use even less and less horsepower than before," they write in a Sept. 23 report.

They estimate efficiency gains such as those have increased "virtual" pressure-pumping capacity by 10-15% and expect the trend to continue.

While growth in the number of frac stages eventually will diminish, they add, improvements can continue in frac design, engineering capability, fracing efficiency, zipper fracs, pad drilling, crew speed, and technology.

BLM outlines strategy to clean up Alaska legacy wells

Half of the 136 wells the US government drilled in the National Petroleum Reserve-Alaska from 1944 to 1982 require no further action, the US Bureau of Land Management said as it issued its final plan to address these "legacy" wells.

The 68 wells were either remediated or pose no threat to the public or environment, it explained. Another 18 are being used by the US Geological Survey to monitor climate change in the Arctic, and the remaining 50 will require various levels of additional cleanup work, BLM said on Sept. 23.

Bud Crilby, BLM's Alaska state director, said the US Department of the Interior agency appreciated input from Alaska's state government, North Slope borough officials, and other stakeholders in preparing the plan.

"While this final plan lays out an aggressive strategy to address 16 of our highest priority wells, we continue to work with our partners to determine the next steps on the remaining wells requiring remediation," he said.

The 16 high-priority wells include some that pose high risks to the surface, including three sites on the Simpson Peninsula where the US Navy left solid waste behind, according to BLM. Work there could happen as early as next year's field season, it said.

The Navy and USGS initially drilled the exploratory wells to gather geologic data or to identify petroleum reserves, BLM said. It inherited the responsibility to assess, and if necessary, plug and clean up wells and surface sites in 1982, when administration of the NPR-A was transferred from the Navy to DOI.

Crilby said full remediation of the wells will require tremendous resources in the coming years, but BLM is committed to getting the job done.

BHP starts up Macedon gas project in W. Australia

BHP Billiton reported the start up of the $1.5 billion Macedon natural gas project, which will supply 20% of Western Australia's domestic gas for the next 20 years.

Gas flow started last month from Macedon gas field on production lease WA-42-L in the Exmouth subbasin, about 100 km west of Onslow, offshore Western Australia. BHP, which operates Macedon, will develop an estimated 400-750 bcf of gas in Western Australia's Pilbara region (OGJ Online, Dec. 9, 2010).

Macedon will initially have four subsea completed wells producing wet gas to the pipeline that will transport the gas to the onshore gas plant, which has a production capacity of as much as 200 TJ/day of gas.

In July 2011 the partners let a contract to the Australian subsidiary of McDermott International Inc. for the subsea installation of umbilicals, risers, and flowlines (OGJ Online, July 8, 2011). BHP holds 71.43% interest in Macedon; Apache Corp. holds the remainder.

PROCESSING — Quick Takes

Shell picks Louisiana site for world-scale GTL plant

Royal Dutch Shell PLC, in a joint press statement with the state of Louisiana, reported the selection of Ascension Parish as a potential location for a $12.5 billion gas-to-liquids (GTL) facility. If built, the plant, to be located near Sorrento, La., would be one of the first commercial-scale plants of its kind in the US.

The project also would create 740 direct jobs, according to an incentive agreement with the state.

A decision on whether to begin construction of the facility is pending the completion of site evaluation and preliminary engineering studies, which would take several years, Shell said.

"Selecting a site is an important step that allows us to conduct more detailed planning, technical analysis, and begin the permitting process," said Executive Vice-Pres. Jorge Santos Silva, who directs integrated gas activities for Shell Upstream Americas. "Should we move forward with the project, we expect project costs to be well in excess of the minimum spend that was agreed upon with the state of Louisiana," he added.

Shell would invest an estimated $32 million in road improvements to alleviate traffic accompanying the construction and operation of the facility, the joint press statement said. Construction is slated to start this year and finish in 2016. The state of Louisiana would reimburse Shell for costs related to necessary public road improvements, land acquisition, and other infrastructure costs with a performance-based grant of $112 million as part of an incentive package.

Shell built the first commercial GTL facility in Bintulu, Malaysia, in 1993. Then in 2011, Shell, in a joint venture with Qatar Petroleum, began production from the Pearl GTL facility in Ras Laffan, Qatar, which is capable of producing 140,000 b/d of GTL products and remains the world's largest commercial GTL plant (OGJ Online, June 11, 2011).

Pemex awards refinery expansion contract

Fluor Corp. unit ICA Fluor's industrial engineering-construction joint venture with Empresas ICA SAB de CV has received a $95 million contract from Petroleos Mexicanos to develop the first phase of the project to reconfigure the Miguel Hidalgo refinery in Tula, Hidalgo. ICA Fluor will be responsible for basic and detailed engineering for the process plants, auxiliary services, and integration required to increase the refinery's distillate production capacity to 80% from 63%.

The announcement said this is the first phase of a megaproject announced by Pemex to increase national production of higher value distillates through reprocessing of such products as gas oil (diesel). Pemex expects total investment to be about $3.5 billion.

TRANSPORTATION — Quick Takes

Plains, EPP to expand Eagle Ford crude pipeline

Plains All American Pipeline LP and Enterprise Products Partners LP have agreed to expand their 50-50 Eagle Ford joint venture crude oil pipeline. The expansion will increase the pipeline's capacity to 470,000 b/d of light and medium crude oil from 350,000 b/d to accommodate additional volumes expected from Plains' Cactus pipeline, currently under construction. It also will add a total 2.3 million bbl of storage in Gardendale, Tilden, and Corpus Christi, Tex.

The companies expect the expansion to enter service second-quarter 2015. Expansion will occur in stages, by adding pumping capacity and looping certain segments of the existing system, at a total cost of $120 million.

The Eagle Ford JV pipeline system—most of which is currently in service, with the rest expected to be completed by Sept. 30—delivers crude to both the Three Rivers and Corpus Christi refineries and a marine transport terminal at Corpus Christi. The pipeline supplies the Houston-area through a connection to the EPP Crude Pipeline terminal and EPP's South Texas Crude Oil Pipeline at Lyssy in Wilson County, Tex.

Plains is building the Cactus Pipeline from McCamey, Tex., in the Permian basin to Gardendale. The pipeline will have an initial capacity of 200,000 b/d; it also is expected to enter service second-quarter 2015.

EPP to further expand HSC LPG-export capacity

Enterprise Products Partners LP will further expand its LPG export terminal on the Houston Ship Channel, increasing its ability to load fully refrigerated, low-ethane propane by 1.5-million bbl/month. EPP will enhance the terminal's refrigeration to increase total design capacity to about 9 million bbl/month upon first-quarter 2015 project completion.

EPP completed an expansion of its LPG export terminal in March that increased its propane loading capacity to 7.5 million bbl/month from 4 million bbl/month. At the time, EPP also expanded the scope of its long-term terminal service agreement with terminal owner Oiltanking Partners LP to increase the number of docks available to load LPG export vessels and support further expansion of EPP's export capacity.

The terminal currently loads more than 8 million bbl/month. EPP expects it to continue to perform at this level citing increased production of NGLs from shale plays and growing demand for propane as a feedstock for global ethylene crackers. The firm started operations at its seventh NGL fractionator at Mont Belvieu, Tex., earlier this month as part of a joint venture with Western Gas Partners LP (OGJ Online, Sept. 18, 2013).

EPP also is developing two refined products export terminals on the US Gulf Coast, one in Beaumont, Tex., and one on the HSC. The reactivated Beaumont terminal is set to enter service first-quarter 2014 handling Panamax-size vessels, followed in mid-2014 by HSC terminal expansions to handle Aframax-size ships (OGJ Online, May 30, 2013).