Alkylation provides option to monetize butane surplus

Eric Ye

DuPont Sustainable Solutions

Wilmington, Del.

Daniel Lippe

Petral Consulting

Houston

| Based on a presentation to the 2013 AFPM Annual Meeting, Mar. 17-19, 2013, San Antonio. |

The rapid growth of hydraulic fracturing and horizontal drilling in shale and tight rock formations has not only created a surge in North American natural gas and light oil production, but also has boosted NGL production. While lighter NGL fractions such as ethane and propane will likely be snatched up by light-olefin producers or export markets, the supply of heavier components such as normal butane will outpace demand.

This article presents how refiners, using alkylation, can improve profitability by converting this highly discounted butane feedstock into commercially more attractive products.

Butane outlook

The unprecedented discount between North American natural gas prices and oil prices has increasingly pushed oil and gas producers to shift their focus onto liquids-rich plays to improve profitability. This increased wet-play production, however, brings with it larger volumes of associated natural gas, thus adding to the existing surplus and further driving down natural gas prices.

While most analysts believe that natural gas prices will rise over the next several years, many project they will level out at $3.50-4/MMbtu ($20–25/bbl crude oil equivalent), while crude will continue to trade around $100/bbl.

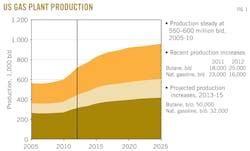

While butanes and natural gasoline comprise a small fraction of the overall expected increase in NGL production, they will profoundly affect supply and demand balances. Fig. 1 shows the production of butanes and natural gasoline will increase in the next 3 years by 50,000 b/d for butane and 32,000 b/d for natural gasoline.1 This growth in supply is coupled with a relatively limited market for these products.

Butanes are primarily used as a motor gasoline blendstock, driven by their high octane values. They also possess, however, relatively high blending Reid vapor pressures, which restrict the amount that can be blended into gasoline, particularly in summer months.

Furthermore, the forecast decline in domestic gasoline demand, a result of increasing vehicle fuel efficiency standards and changing demographics, will likely further lower demand for butane as a gasoline blendstock.

Other applications can accept some of this butane surplus but not without demand limitations of their own. For example, while natural gasoline produced from natural gas wells is used as a diluent to move the heavy bitumen from Canada's oil sands to markets in the US, butane's high vapor pressure restricts its use in this application. And while some butane is used as a feedstock for ethylene production, its high cost relative to lighter feedstocks such as ethane and propane will likely cause further declines in butane use.1

In light of this dwindling domestic demand, North American producers are looking to export this increased butane production to feed the growing global market. The necessary export infrastructure, however, is insufficient for the future expected volumes of butane. While efforts are under way to increase NGL export capacity,2 the cost to handle and transport the incremental volumes will contribute to a large butane discount compared with heavier products such as gasoline.

These factors have contributed to butane selling at an increasingly wide discount to gasoline in the past 2 years, a trend that will likely continue. For US refiners, alkylation represents an attractive opportunity to capitalize on this discounted butane supply and improve overall refinery profitability.

Basics

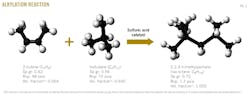

The alkylation reaction combines light olefins such as propylene (C3=), butylene (C4=), and amylene (C5=) with isobutane (iC4) in the presence of a strong acid catalyst, typically sulfuric or hydrofluoric acid, to form an alkylate—a mixed paraffin, high-octane, low-vapor-pressure gasoline blend component. Fig. 2 shows an idealized alkylation reaction for isobutane and 2-butene.

Actual alkylation reactions are complex, and the final quality of the alkylate depends on such variables as the type of olefins contained in the feedstock and the operating conditions. Alkylation, however, is one of the few NGL processing technologies that convert a paraffin to a heavier hydrocarbon molecule without first converting the paraffin to a more reactive compound such as an olefin or alcohol.

Due to its low vapor pressure, the alkylate product allows for the direct blending of additional butanes (or other high-vapor-pressure, low-octane compounds) into the gasoline pool. Alkylates possess high octane values and near ideal T50 and T90 boiling ranges. In addition, they consist of almost entirely paraffin compounds and contain no toxics such as sulfur, aromatics and olefins—all compounds that are restricted in current clean-burning transportation fuels.

These properties have earned alkylate the industry nickname "liquid gold" for its ability to help refiners upgrade less desirable gasoline blendstocks into on-spec or premium-grade gasoline.

Estimating the value

While the economic incentive to alkylate butanes varies with a refiner's particular configuration and market, it is clear that refiners need to consider these sources of highly discounted butanes as an additional cost-advantaged feedstock in future operations.

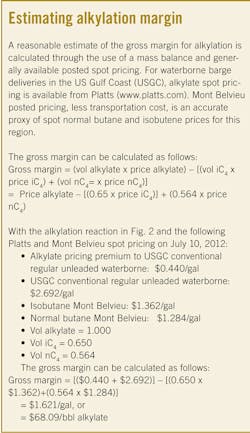

Refiners can ascertain whether alkylation is the most appropriate means of monetizing their butane supply with a number of basic calculations outlined in the sidebar (above). With this methodology, one can calculate the gross margin for a US Gulf Coast refiner processing isobutane and mixed butylenes (priced at spot Mont Belvieu pricing) to producing alkylate at Platts's minimum specifications.

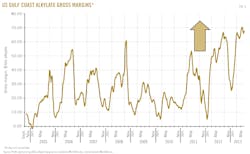

Fig. 3 illustrates the 30-day running average of the alkylate margin upgrade calculated with this method. As shown, alkylate margins exhibit a consistent seasonal variation, with maximum values realized during the summer gasoline season and minimum levels during the winter gasoline season (when gasoline Reid vapor pressure specifications do not restrict direct butane blending into gasoline).

This figure shows an upward step change in alkylate margins in the last 2 years, a reflection of the increasing butane discount to gasoline that results from the current increasing surplus of butanes in the US.

It should be noted that isobutane, due to its higher octane and potential use as an alkylation feedstock, usually sells at a premium to normal butane. Therefore, if a refiner has a butane isomerization unit, normal butanes can be upgraded to isobutane for an additional gross margin upgrade.

A look ahead

Before making additional capital investments to upgrade butane feedstocks via alkylation, refiners must ask themselves if the current market trend is temporary or sustainable in the long term. History has consistently shown that large market arbitrages do not exist forever, and therefore natural gas cannot remain at its current large discount to oil prices forever.

As demand picks up with economic recovery and as markets such as LNG exports look to leverage natural gas's discounted price, natural gas prices will invariably increase.

Continued fracing technology advancements, however, coupled with development of new shale fields, will likely prevent natural gas prices from reaching parity with oil prices in the near future. Producers will continue to focus on wet plays, even as natural gas demand and prices increase.

Even the most pessimistic analyses suggest that the surge in North American production of NGLs will likely continue. The expected ongoing decline in domestic demand, coupled with limited new domestic markets for butane, will keep the supply of butanes high and ensure that it sells at a large discount to heavier hydrocarbon products.

While motor gasoline consumption in North America will likely remain flat and eventually decline due to new corporate average fuel economy (CAFE) standards and the increasing use of biofuels, overall gasoline demand in the Western Hemisphere should increase, as rapidly growing demand in Latin America more than offsets the decline in the North American markets.

In addition, fuel specifications in these same growing export markets are evolving towards cleaner burning fuels. With its superior blending properties, alkylate derived from butanes will continue to be a key component in clean burning fuels and will likely displace less desirable or less economic gasoline blendstocks.

References

1. Lippe, Daniel, NGL Heavy End Markets "Change is Knocking at the Door," Platts Natural Gas Forum, Sept. 24, 2013.

2. Stauft, Tim, "Accessing Value for NGLs in Western Canada," DUG Conference, Calgary, June 20, 2012.

The authors

Eric Ye ([email protected]) is clean technologies technical development manager for DuPont Sustainable Solutions in Wilmington, Del. He has worked in the petroleum refining and petrochemical industry for the past 22 years and held positions in engineering, operations, construction management and financial analysis for Chevron, Hess, and Sunoco. Ye holds a BS in chemical engineering from the University of Michigan and an MBA from Drexel University. He is a licensed professional engineer in New Jersey and a member of the American Chemical Society.

Daniel L. Lippe ([email protected]) is president of Petral Consulting Co., which he founded in 1988. He has expertise in economic analysis of crude oil, refined products, natural gas, NGLs, other ethylene feedstocks, and primary petrochemicals. Lippe began his professional career in 1974 with Diamond Shamrock Chemical Co., moved into professional consulting in 1979, and has served petroleum, midstream, and petrochemical industry clients since that time. Lippe holds a BS (1974) in chemical engineering from Texas A&M University and an MBA (1981) from Houston Baptist University. He is an active member of the Gas Processors Suppliers Association and serves on GPA's NGL Market Information Committee.