Barnett at DFW provides lessons on shale gas projects at US airports

Ruud Weijermars

Alboran Energy Strategy Consultants

Delft, Netherlands

US airfield owners are lured by attractive signing bonuses to lease their shale acreage. But shale operators cannot always fulfill their promises to drill, and the Dallas-Fort Worth Barnett shale field development project shows some winners and losers. The author has analyzed the technical challenges and financial fundamentals.

The Pittsburgh airport authority is clearly inspired by a major shale gas field development project at the Dallas Fort Worth Airport (DWFA) that has earned the Texas airport over $300 million net profit in just half a decade.

Pittsburgh International and Allegheny County Airports want to reap a similar financial windfall from their shale resources and signed a deal with Consol Energy in February 2013. Key components of the agreement are a signing bonus of $50 million and royalties on future gas sales at 18% of gross gas sale revenues. The airport hopes to make $450 million on future royalty payments.

What can Pittsburgh learn from the DFWA project?

The DFWA shale project provides an excellent case study with very instructive technical and financial lessons to be learned for shale field development projects at other major airports and elsewhere. Several US airports possess appealing shale acreage. There are additional safety regulations to observe (FAA, EPA, fire prevention standards),1 2 but the projects can usually move ahead once the commercial agreement is in place and signed.

The bidders need to negotiate with only a single party, normally the airport authority, mainly to settle on an agreeable signing bonus and the royalty percentage on future hydrocarbon sales.

First we draw the major lessons learned from the DFWA shale project, and next we highlight the need for better field development strategy options for the future.

DFW Airport case study

For DFWA, the leasehold agreed with Chesapeake Energy (CHK) in October 2006 indeed has been a sweet spot deal: it has earned the airport well over $300 million as of September 2012.

The majority of the sum was paid up front as a signing bonus in two installments of $92.6 million each in 2007 and 2008, followed by 25% royalty on gross revenues from gas sales. The airport netted a further $108 million in royalties over the past 5 years of production and $13.6 million for the gas operator's use of airport structures.

Meanwhile further field development at the DFWA has stalled.

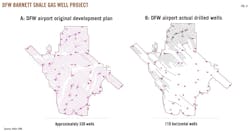

More than half of the leased acreage remains undeveloped after field operator CHK incurred substantial losses on the DFWA shale project. CHK originally planned to drill 330 wells but has drilled only 110. The company is now dragging its feet and announced it will only drill 3 or 4 further wells in 2014 and 2015 to meet leasehold obligations.

Technology challenges

A detailed project timeline of the DFWA shale development project lease signed in October 2006 is reconstructed in Fig. 1.

A range of technical challenges were faced of which some notable examples are outlined here. The first major operations were the night-time seismic surveys that required the Vibroseis trucks and recording equipment at the runways and platforms of the airport between December 2006 and March 2007 (Fig. 2 a-c).

That period of surface activity was followed by the rapid deployment of a 24-in. pipeline around the perimeter of the airport and lateral gas gathering lines of 8 to 24-in. that serve to collect the production from the gas wells. The gas gathering lines flow toward a major compressor station located in the north of the airport that is connected to the regional distribution network for delivery to the market.

There were also installed more than 100 miles of 10 to 12-in. polyethylene pipes to carry fresh water used for fracking the wells and to evacuate salt water separated from the production fluid back to two injection wells. Many of these service pipelines had to pass underneath runways and other structures, so advanced horizontal drilling technology was used to meet all requirements for safe construction in close coordination with DFW departments.3

The injection of the brine fluid was started in September 2008 and continued until August 2009, when the first 110 wells were all fracked and placed on production.

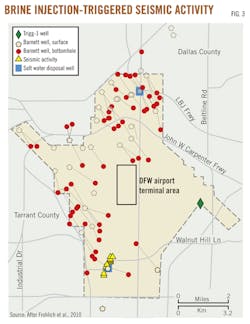

The brine injection triggered 9 quakes that occurred at the southernmost disposal well on Oct. 31, 2008 (Fig. 3). Injection of salty produced water had started there into the Ordovician Ellenburger formation at rates of about 8,000-11,000 b/d about 7 weeks prior to the quakes.

An analysis of the epicenters linked the quakes to slip on a SW-NE trending normal fault in the vicinity of the disposal well and with a known vertical throw of about 80 m down SE.4

The drilling of the production wells required a major refurbishment of the drilling rigs to meet environmental emission standards. The diesel engines where refitted with electrically powered 650 and 1,500-hp engines running at 600 volts that needed to draw power from the 25,000-volt electricity grid at the DFW airport.5

Five drilling rigs (Nomac and Mountain Riggs) were electrified and their operational use of kilowatts required very close cooperation with the local electricity utility company to prevent grid surges and overloading.

The production wells descended vertically into the Barnett which occurs at 8,300 ft below the airport, and the horizontal sections of the wells were aligned with the major runways (Fig. 4a & b). The horizontal wellbore sections are aligned with the general direction of the least principal horizontal stress to facilitate the placement of transverse fracs along the wellbores. The horizontal length of the wells extends to more than 3,700 ft.

Financial performance

US wholesale gas prices were soaring back in 2006 when CHK took the final investment decision to commit a $750 million capital expenditure (CAPEX) to the DFWA shale development project.

At the time, the 18,543 acres of the airport were estimated to hold 470 bcf of technically recoverable gas resources (TRR), and the ratio of the CAPEX and the TRR suggested an all-in development cost of $1.98/Mcf.6

In hindsight such calculations were neither hedged against uncertainty in the well productivity nor against the volatility of future gas prices. Both factors started to work heavily against the profitability of the DFWA project and resulted in hefty losses for CHK.

The realized cumulative production from the 100+ wells completed over the past 5 years amounted to 104 bcf.7 This means that the undiscounted all-in cost to develop DFWA was not $1.98/Mcf but rather $7.21/Mcf.

Setting off that cost per thousand cubic feet against the reported and realized sales price of $4.32/Mcf (time-averaged over the first 5 years of gas sales) explains the $316 million undiscounted loss made by the operator. Table 1 provides a detailed annualized profit-loss account for the operator.

When properly discounted for the time value of money, the losses incurred by CHK on the DFWA project would increase to well over half a billion dollars.

The project valuation of Table 1 does not include the cost of capital nor any tax payments. This exclusion is common practice when appraising the intrinsic value of any oil and gas project. The NPV and IRR of the project based on EUR estimates can be concluded to remain negative over the lifecycle of the wells even when undiscounted.

Table 2 shows the profit made by the DFW Airport Authority, which did not share any risk in the project and took a lucrative upfront signing bonus of about $10,000/acre. The total proceeds of $305 million as of September 2012 have been used to improve the terminal buildings and to keep landing fees as low as possible to encourage further growth of the airport, which already ranks among the world's 14 busiest superhubs. DFWA also is the third mostly trafficked US airport.

Lessons learned

The DFWA shale field development project has been profitable to the lease provider ($305 million cumulative profit; Fig. 5a) and very unprofitable for the lessee that developed and operated the shale gas field ($316 million cumulative losses; Fig. 5b).

All the project risk resided with CHK, and the company has been overly optimistic about its projected returns on investment. The worst downside materialized in two ways: (1) the realized wells so far produced only a fraction of the estimated TRR, and (2) US gas wellhead prices declined steeply after the project started and did not recover to render the wells profitable.

The previously completed wells must be considered as sunk cost, and for CHK the DFWA project has in fact become a going concern. Drilling and completion of any further wells to develop the remaining gas resources will only ever become profitable again if the gas price were to rise above $10/Mcf to account for the time-value of money and applying a 15% discount rate on the capital invested to ensure investors a fare return on the money at risk.

As long as the gas price is unlikely to recover above the threshold cost, CHK is unlikely to fulfill the leasehold obligation that requires it to drill additional wells at a certain rate. The company already is negotiating a postponement of 14 wells due for drilling in 2013 and 2014 under current leasehold provisions.

The project loss clearly demonstrates that the signing bonus at $10,000/acre paid by CHK at the start of the project was unrealistically high. In this perspective, the $50 million paid by Consol Energy to the Pittsburgh International and Allegheny County Airports for its 9,263 acres or $5,400/acre seem also too high for making the shale field profitable for the field development company.

Although the Marcellus shale may have higher TRR than the Barnett shale, it remains to be seen if investors in Consol Energy will be rewarded for the investment risk taken.

The project performance of the DFWA shale gas development project is exemplary for the lagging returns on investment from US shale fields.8 The average EUR for Barnett wells is estimated at 1.4 bcf.9

The 100+ DFWA wells drilled in the Barnett core region have produced on average 1.04 bcf/well during the first 5 years of operation. These wells certainly will not produce more than the quoted 1.4 bcf/well as decline has greatly reduced gas production.

This tends to confirm doubts about some of these projections for certain shale plays by analysts such as Berman.10 11

Options forward

The lease granted by the DFW Airport Authority to CHK will expire if the company fails to fulfill its drilling obligations.

Should DFWA agree with CHK that it is wise to decide on further development investments only when a gas price recovery renders the shale acreage profitable?

An alternative course of action would be for DFWA and CHK to agree on a farm-in partner that is prepared to develop the remaining acreage without the burden of past losses and making use of CHK experience and gas gathering facilities. The farm-in options can be inversely modeled to see what percentage of royalty sharing would make this profitable for all parties concerned, assuming a conservative forward price scenario.

All in all, the permissive attitude of regulators and financiers and their neglect of the flagging signs of weak fundamentals are all typical for investment bubble hypes, as seen recently in the dot.com bubble and housing scandal. The shale gas bubble is likely the next one to burst.

All this does not mean web-based information services, housing, and shale gas projects are a sham. These businesses are needed, and both the cyberspace and housing hypes have each gone through their own peak period of investment hyping until a burst brought new reality to such investments.

That time is surely nearing for shale gas asset investments. The emerging new reality for shale gas development projects will mean field development projects must re-consider their signing bonuses and optimize their well-roll-out rates.12

References

1. DFWA, "International Airport Environmental awareness guidance document for natural gas drilling and exploration," 2009 (http://www.dfwairport.com/cs/groups/public/documents/webasset/p1_049875.pdf).

2. DFWA, "Dallas/Ft. Worth International Airport construction and fire prevention standards, resolutions and amendments to the codes," 2011 (http://www.dfwairport.com/cs/groups/public/documents/webasset/p1_007829.pdf).

3. Faughtenberry, J., Fissel, B., and Hutson, A.C., "Directional drilling at the world's third largest airport," White paper, 2008, 11 pages.

4. Frohlich, C., Potter, E., Hayward, C., and Stump, B., "Dallas-Fort Worth earthquakes coincident with activity associated with natural gas production," The Leading Edge, March 2010, pp. 270-275.

5. Shipley, K.A., "Chesapeake Energy drilling rig electricity project at Dallas/Fort Worth Airport," American Association of Drilling Engineers, AADE 2009NTCE-01-01, technical paper, 2009, pp. 1-3.

6. DFWA, "Dallas/Ft. Worth International Airport and Chesapeake Energy Corporation Celebrate Completion of Record-Setting $185 Million Lease," 2006 (http://www.dfwairport.com/pressroom/Chesapeake_Celebrate_Completion_Natural_Gas_Lease.pdf).

7. DFWA, "Fiscal Year 2012 comprehensive financial report, 2013 (https://www.dfwairport.com/cs/groups/public/documents/webasset/p2_097009.pdf).

8. Weijermars, R., and Watson, S., "Unconventional Natural Gas Business: TSR Benchmark and Recommendations for Prudent Management of Shareholder Value," SPE 154056, SPE Economics & Management, Vol. 3, No. 4, 2011, pp. 247-261.

9. Weijermars, R., and Van der Linden, J., "Assessing the Economic Margins of Sweet Spots in Shale Gas Plays," First Break, Vol. 30, No. 12, December 2012, pp. 99-106.

10. Berman, A.E., "Lessons from the Barnett Shale imply caution in other shale plays," World Oil, Vol. 230, No. 8, 2009, p. 17.

11. Berman, A.E., "ExxonMobil's Acquisition of XTO Energy: The Fallacy of the Manufacturing Model in Shale Plays," The Oil Drum, 2010 (http://www.theoildrum.com/node/6229).

12. Weijermars, R., "Global Shale Gas Development Risk: Conditional on shale profits beating the time-value of money," First Break, Vol. 31, No. 1, January 2013, pp. 39-48.

Bibliography

Gentry, J., "Natural gas wells: assessing the risk," (http://www.usfa.fema.gov/pdf/efop/efo45492.pdf).

Weijermars, R., "Credit Ratings and Cash Flow Analysis of Oil & Gas companies: Competitive disadvantage in financing costs for smaller companies in tight capital markets," SPE 144489-PA, SPE Economics & Management, Vol. 3, No. 2, pp. 54-67, 2011 (http://dx.doi.org/10.2118/144489-PA).

Weijermars, R., "Jumps in proved unconventional gas reserves present challenges to reserves auditing," SPE 160927-PA, SPE Economics & Management, Vol. 4, No. 3, 2012, pp. 131-146.

The author

Ruud Weijermars ([email protected])conducts original research in energy strategy, petroleum economics, and geomechanics—integration of these disciplines is required to optimize fossil fuel recovery. He is associate professor at Delft University of Technology, where he heads the Unconventional Gas Research Initiative (UGRI; http://ugri.tudelft.nl/) and a consulting research associate of the Bureau of Economic Geology, University of Texas at Austin. He is principal partner at Alboran Energy Strategy Consultants (http://alboran.com) and editor-in-chief of Energy Strategy Reviews, a scholarly journal published by Elsevier (http://www.journals.elsevier.com/energy-strategy-reviews/).