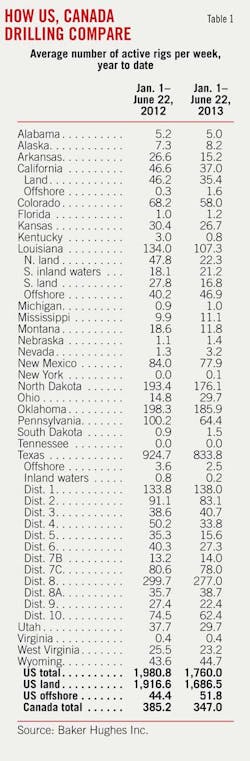

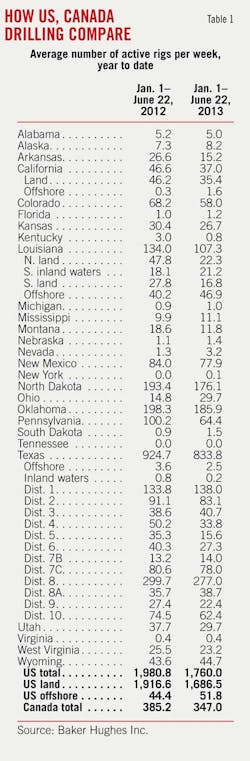

Operators backed away further from gas drilling in Canada and parts of the US in the first half of 2013 compared with the first half of 2012.

An anemic resumption in US Gulf of Mexico activity wasn't nearly enough to offset the drilling declines due to the exodus toward more liquids-prone land plays. Both trends should continue in the second half of 2013.

Areas in which drilling was off the most in the first half included North Louisiana, Arkansas, eastern and western districts of East Texas, and Pennsylvania—all areas in which gas drilling has predominated in recent times. Land drilling also fell in Montana and California.

Posting year to year drilling increases of note were Ohio, Alaska, and offshore Louisiana.

Internationally, Latin America was the only region to experience a drilling decline year to year in January through May, but the drop was enough to offset gains in the Middle East, Africa, and Europe.

OGJ estimates the numbers of wells to have been drilled in given periods, and these estimates differ from those of the American Petroleum Institute, which issues quarterly estimates of the numbers of wells completed in the US.

Here are highlights of OGJ's midyear drilling forecast:

• Operators will drill 38,158 wells in the US in 2013, down from an OGJ-estimated 43,669 wells in 2012.

• US operators will drill 1,809 exploratory wells of all types, down from an estimated 2,118 last year.

• Operators will drill 11,270 wells in western Canada, down from an OGJ-estimated 11,828 wells in 2012.

First half US drilling

The continued reduction in US gas drilling in the first half of 2013 was evident in plays such as the Marcellus shale in Pennsylvania, Haynesville/Bossier in North Louisiana and East Texas, and Fayetteville shale in Arkansas.

Bucking that trend was the Utica shale play in eastern Ohio. Operators averaged running 30 rigs/week in Ohio in the 2013 first half through early June, more than double the count in the same period of 2012, Baker Hughes reported.

OGJ estimates that Ohio operators may have drilled as many as 527 wells in the 2013 period, an unknown share of which were to the Utica and Marcellus shales.

Gulf of Mexico drilling sustained its rebound from the moratorium with an average 47 rigs running off Louisiana, 15% more than in the 2012 first half.

California's first half suffered as operators ran an average of 35 land rigs, down 28% from 2012.

Even the Williston basin Bakken play lost a bit of steam at a first-half average of 176 rigs in North Dakota, down 9% on the year.

Based on E&P company Capex budgets, the US land rig count can be expected to pick up by 25-50 rigs by the end of 2013, according to a June 10 research note from Simmons & Co. International, Houston. The analyst sees 2014 drilling as flat with 2013 fourth quarter activity.

Simmons estimated a fleet of 2,300 US land rigs compared with the 1,700-plus rigs working, 1,089 of them drilling horizontally, and said the estimated 525 US land rigs capable of walking or skidding will see greater demand as operators accelerate pad drilling.

Canadian outlook

OGJ sticks with its January 2013 forecast for the eventual drilling of 11,270 wells in Canada this year (OGJ, Jan. 7, 2013, p. 37).

After stronger than expected drilling in the first quarter, the Canadian Association of Oilwell Drilling Contractors hiked its 2013 western Canada forecast 2.3% to 10,649 wells.

CAODC said industry averaged 496 rigs or 61% utilization in January through March, compared with the 60% utilization anticipated in the November forecast (OGJ Online, May 28, 2013).

International drilling

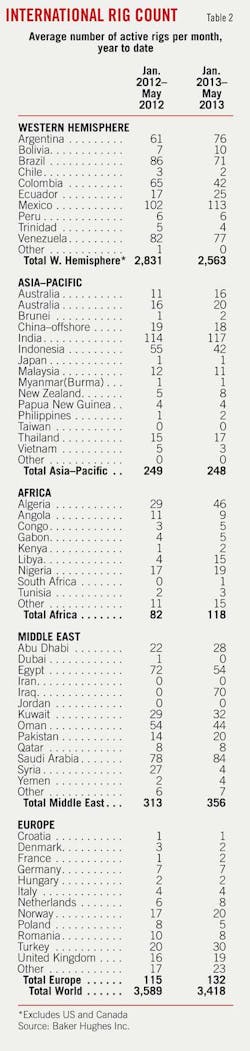

Worldwide outside the US and Canada, operators ran an average of 3,418 rigs/month in January through May 2013, a decline of 4.7% from the first 5 months of 2012, Baker Hughes reported.

Asia-Pacific drilling was steady at 248 rigs, and gains were recorded in the Middle East at 356 rigs, Europe 132 rigs, and Africa 118 rigs.

In Latin America, Brazil fell to 71 rigs from 88, Colombia to 42 from 65, and Venezuela to 77 from 82. Mexico averaged 113 rigs/month this year compared with 102 in 2012. The combined changes dropped the Western Hemisphere rig count outside the US and Canada to 2,563 from 2,831.

India, the world's largest operator of rigs outside North America, had 117 active rigs this year versus 114 in the first 5 months of 2012.