Rapid North American shale gas development pushes up global capacities

Shale gas development in North America last year pushed up regional and global processing and fractionation capacities more rapidly in 2012 than in 2011, as reflected in Oil & Gas Journal's latest plant-by-plant survey of global gas processing as of Jan. 1, 2013.

With drilling and production targeting wetter shale plays, midstream processors and transporters have responded by seeking opportunities to extract high-value liquids and to move both gas and liquids to downstream markets as soon as possible. Part of that response also sees growing export capacity, especially along the US Gulf Coast.

OGJ data show US gas processing capacity advanced in 2012 by nearly 4 bcfd, pushing up total global capacity by nearly 5.5 bcfd.

Overall, global natural gas production in 2012 gained over production in 2011 (OGJ, Mar. 11, 2013, p. 31), up by nearly 6.5 tcf and led by the US, Africa, and the Middle East countries.

For 2012, the US produced nearly 22% of global natural gas, up slightly from its 21% for 2011 and 20% for 2010. Also last year, US production grew by 6.2% over 2011 after growing by more than 7% in 2011 compared with 2010.

Growth in US gas processing capacity accelerated in 2012, growing by 5%, compared with growth in 2011 of 3.4% and in 2010 of 1.5% (Table 1). For the entire world, OGJ's data show global capacity grew 2.1%, well ahead of 1.2% growth in 2011 and 0.5% in 2010.

US gas processing capacity growth in 2012 pushed the US and Canada back toward the share of global capacity they had held until 2005, when regions outside the US and Canada took over the majority of global capacity.

In 2012, the two countries' share of global gas processing capacity increased to just shy of 50%, from 49.3% for 2011 and below 49% for 2010. As noted in this space last year, capacity in the US is accelerating with more on tap through 2014-15.

Strong natural gas production growth, especially in the Middle East and Asia-Pacific, will likely continue in the near term to about 2015, requiring even more processing capacity there.

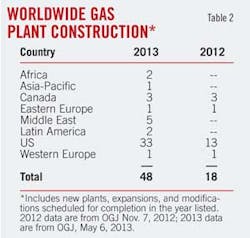

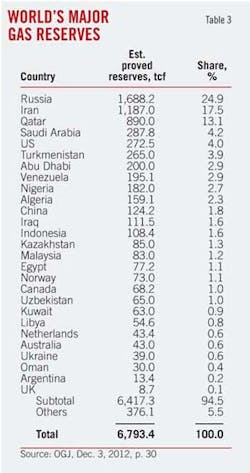

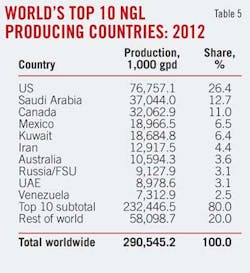

Table 2 presents a snapshot of global gas plant construction; Table 3, a review of global natural gas reserves; Table 4, a list of the world's leading gas producing countries; and Table 5, the leading NGL-producing countries.

OGJ subscribers can download, free of charge, the 2013 Worldwide Gas Processing Survey tables at www.ogjonline.com: Scroll to "Surveys and Statistics." Click on OGJ Subscriber Surveys, then Worldwide Gas Processing, and choose from the list below June 3, 2013. To purchase spreadsheets of the survey data, please go to http://www.ogj.com/resourcecenter/orc_survey.cfm or email [email protected].

Sources

Oil & Gas Journal's exclusive, plant-by-plant, worldwide gas processing survey and its international survey of petroleum-derived sulfur recovery provide industry activity figures.

Canadian data are based on information from Alberta's Energy and Utilities Board that reflect actual figures for gas that moved through the province's plants and are reported monthly to the EUB. For 2000 for the first time, OGJ took these data for all of Alberta and compiled annual figures and thereby created a new baseline for data comparisons thenceforth.

(Effective Jan. 1, 2008, the province realigned the EUB into two separate regulatory bodies: the Energy Resources Conservation Board to regulate the oil and gas industry and the Alberta Utilities Commission to regulate utilities.)

In addition to EUB figures for Alberta and to operators' responses to its annual survey, OGJ has supplemented its Canadian data with information from the British Columbia Ministry of Energy, Mines and Petroleum Resources and the Saskatchewan Ministry of Energy & Resources.

Activity

As upstream activity in US shale gas plays began to hit stride in 2012 and early 2013, some midstream companies began taking advantage of opportunities either to expand their processing and transportation assets through acquisition or merger…or to leave the plays altogether.

As second-quarter 2013 began, liquids prices seemed to have plateaued while vapor prices secured some footing north of $4/MMcfd.

US mergers, acquisitions

In April last year, Kinder Morgan Energy Partners LP agreed to acquire Kohlberg Kravis Roberts & Co. LP's 50% interest in a joint venture that owned midstream assets in Utah and Texas. The acquisition included Altamont natural gas gathering, processing, and treating in the Uinta basin in Utah and the Camino Real gathering system in Texas's Eagle Ford shale play.

El Paso Corp., the purchase of which Kinder Morgan has since concluded, owned the other 50% of the joint venture (OGJ Online, Oct. 17, 2011).

Later in 2012, Kinder Morgan agreed to sell some midstream assets to Tallgrass Energy Partners LP for about $3.3 billion. Included in the deal were Kinder Morgan Interstate Gas Transmission, Trailblazer Pipeline Co., the Casper-Douglas natural gas processing plant, and West Frenchie Draw treating in Wyoming, and Kinder Morgan's 50% interest in the Rockies Express Pipeline.

The deal was part of a divestiture required by the US Federal Trade Commission to complete Kinder Morgan's acquisition of El Paso.

In May last year, MarkWest Energy Partners LP agreed to buy Keystone Midstream Services LLC for $512 million to boost processing operations in the Marcellus. Keystone, owned by Rex Energy Corp., Sumitomo Corp., and Stonehenge Energy Resources LP, operated two cryogenic gas plants in Butler County, Pa.

At the time of the announcement, MarkWest said it expected gas volumes from Keystone to grow to 170 MMcfd at yearend 2013 and to about 350 MMcfd by 2016, from 40 MMcfd in 2012.

In August, Eagle Rock Energy Partners LP, Houston, announced it would pay $227.5 million in cash for two BP America Production Co. processing plants and associated gathering operating in the Texas Panhandle.

Upon closing on Oct. 1, Eagle Rock and BP entered into a 20-year, fixed-fee gas gathering and processing agreement under which Eagle Rock gathers and processes BP's production from existing connected wells.

BP's Panhandle system encompasses about 350,000 acres and more than 500 drilling sites. It consists of two cryo plants—the 190-MMcfd Sunray and the 50-MMcfd Hemphill, according to OGJ's 2012 Gas Processing Report (OGJ, May 7, 2012, p. 88)—and about 2,500 miles of gathering pipelines.

In September, Summit Midstream Partners LLC, Dallas, agreed to buy Canyon Pipeline LLC for $207 million from La Grange Acquisitions LP, a wholly owned subsidiary of Energy Transfer Partners LP. Canyon gathered and processed natural gas in the Piceance and Uinta basins in Colorado and Utah.

The gathering and processing systems consist of more than 1,600 miles of pipe, 440,000 hp of compression, processing assets totaling 97 MMcfd in capacity, and two NGL injection stations.

In December, Dominion, Richmond, Va., and Caiman Energy II LLC, Dallas, formed a $1.5-billion joint venture to provide midstream services to gas producers in the Utica shale in Ohio and Pennsylvania.

Blue Racer Midstream LLC is a 50:50 partnership between Dominion and Caiman, with Dominion contributing midstream assets and Caiman contributing private equity capital.

Included are Dominion's Natrium extraction plant, which came online in April of this year in Marshall County, W.Va., and a Dominion Transmission pipeline connecting Natrium to Dominion East Ohio's gathering system (photo).

Dominion told OGJ another 200 MMcfd would be added this summer, after which ownership of the plant will move to Blue Racer Midstream.

Dominion is also building a 60-mile, 8-in., liquids pipeline north from Natrium to Brooke County, W.Va., connecting to the Enterprise Products Partners LP's Atex Express pipeline (OGJ Online, Jan. 4, 2012; Aug. 31, 2012) with about 27,000 b/d of capacity.

And recently in 2013, Williams Partners LP, Tulsa, and Shell PLC formed Three Rivers Midstream to provide gas gathering and gas processing for production in northwest Pennsylvania. The venture will invest in both wet-gas and dry-gas infrastructure serving Marcellus and Utica shale wells.

Three Rivers Midstream signed a long-term gathering and processing agreement for Shell's production in the area, which includes about 275,000 dedicated acres, said the company announcement. The JV also plans to pursue gathering and processing agreements with other producers in the liquids-rich areas of northeast Ohio in addition to northwest Pennsylvania.

Three Rivers will build a 200-MMcfd cryo gas plant at a location to be determined; it is to be in service by second-quarter 2015.

Williams Partners will initially own most of Three Rivers Midstream and operate the assets. Shell retains the right to invest capital and increase its ownership before mid-2015 (OGJ Online, Apr. 16, 2013).

In February of this year, Regency Energy Partners LP, Dallas, announced it would buy Southern Union Gathering Co. LLC, owner of Southern Union Gas Services Ltd., from Southern Union Co., a jointly owned affiliate of Energy Transfer Equity LP and Energy Transfer Partners.

The $1.5-billion deal will expand Regency's presence in the Permian basin and is to close by mid-year.

Included will be the purchase of a 5,600-mile gathering system and about 500 MMcfd of processing and treating in West Texas and New Mexico for natural gas and NGLs. In addition, Southern Union Gas this month will start up the 200-MMcfd Red Bluff processing plant with associated treating. An additional 200-MMcfd cryo plant with associated treating is being planned and could be in service in second-half 2014.

Finally, in late April, shareholders at Copano Energy LLC, Houston, approved a merger, announced earlier this year, among Copano, Kinder Morgan Energy Partners, Kinder Morgan GP Inc., and Javelina Merger Sub LLC, a wholly owned unit of Kinder Morgan Energy Partners.

Copano conducts midstream operations in Oklahoma, Texas, and the US Rocky Mountains, including gathering, intrastate transmission, processing, fractionation, conditioning, and treating natural gas.

With its partially owned affiliates, its services handle about 2.2 MMbtu of natural gas through about 6,900 miles of gas pipelines, 2.7 bcfd of gas throughput capacity, nine processing plants and more than 1 bcfd processing capacity, and 315 MMcfd treating capacity.

New US capacity

Two accompanying boxes (on this and the previous page) list US gas plants and fractionators planned, under construction, or completed in response to US shale gas development. What follows are some highlights of US construction over the past year.

In June 2012, Eagle Rock Energy started up a 60-MMcfd cryogenic processing plant in Hemphill County, Tex.

With completion of the Woodall plant and resumption of processing at the company's Phoenix-Arrington Ranch plant, Eagle Rock was operating about 190 MMcfd of processing capacity in the Granite Wash play.

Also in June, Southcross Energy LLC, Dallas, began expanding capacity at its Bonnie View fractionator in Refugio County in South Texas. The fractionator's initial capacity of 11,500 b/d of NGLs increased to 22,500 b/d and was started up in February this year (OGJ Online, Feb. 7, 2012).

The Bonnie View fractionator is directly connected to the Seadrift ethane and propane product pipelines. Completion of the expansion brings Southcross Energy's total fractionation capacity in the Corpus Christi area to 27,300 b/d.

In August last year, Regency Energy said it began expanding processing capacity near Dubach in Lincoln Parish, La., to 210 MMcfd by adding 70 MMcfd of cryogenic capacity and 20 MMcfd of Joule-Thomson capacity (OGJ, May 7, 2012, p. 88 and p. 104).

The $75-million Dubach expansion also includes construction of high-pressure gathering to bring production to the plant. The project will come online in July.

In September 2012, Enterprise Products started up the second 300-MMcfd train at the partnership's Yoakum cryogenic gas plant in Lavaca County, Tex. With the additional train, nameplate capacity increased to 600 MMcfd and the plant can extract about 74,000 b/d of NGLs. In February 2013, Enterprise started up Train 3 at Yoakum, increasing capacity to 900 MMcfd and 111,000 b/d of NGLs.

Including the 900-MMcfd of capacity at Yoakum, Enterprise said it expected ultimately to have about 2.4 bcfd of capacity available to the region.

Construction of a 173-mile extension of the company's NGL pipeline system from Yoakum to LaSalle County, Tex., is linking Enterprise's NGL pipeline system that delivers Eagle Ford Shale production from Yoakum to its expanding fractionation at Mont Belvieu.

(For more on expanding NGL infrastructure related to US shale production, see the box this page.)

In November, Enterprise Products started up its sixth NGL fractionator at Mont Belvieu, an 85,000-b/d unit that increases Enterprise's total fractionation there to 485,000 b/d (OGJ, Apr. 7, 2011, p. 88).

The fractionator addresses increasing NGL production from US shale plays, the company said, including the Eagle Ford and other basins in the Rocky Mountains and Midcontinent (OGJ Online, May 4, 2012; Sept. 11, 2012).

The company said Fractionators 7 and 8 are under construction at Mont Belvieu and will increase total capacity there to about 650,000 b/d when completed in fourth-quarter 2013. At that time, Enterprise's system-wide fractionation capacity will exceed 1 million b/d.

Also in November, MarkWest Energy Partners and Antero Resources LLC, Denver, began operations at the Sherwood processing plant and on the first phase of a high-pressure gas gathering system in Harrison and Doddridge counties, W.Va.

The 200-MMcfd Sherwood 1 plant is the first phase of planned processing; MarkWest has built a 200-MMcfd second phase there (Sherwood 2), which began operating last month.

MarkWest and Antero reached agreements for a potential third processing plant at the same site to support additional rich-gas production and bring total processing capacity at Sherwood to 600 MMcfd. The companies have estimated future capacity at Sherwood could exceed 1 bcfd with continued development by Antero of its rich-gas acreage.

As of late 2012, MarkWest's total announced NGL fractionation capacity for the Marcellus and Utica was about 275,000 b/d. This capacity included nearly 155,000 b/d of purity ethane and 120,000 b/d of propane and heavier NGL fractionation.

MarkWest said that by yearend 2014, it will operate more than 2.5 bcfd of processing capacity in Pennsylvania and West Virginia.

At yearend 2012, DCP Midstream LLC and DCP Midstream Partners LP announced plans for a cryogenic plant to provide gas processing for producers in the Eagle Ford shale. The new Goliad plant is being built by the DCP Eagle Ford joint venture, which is owned two-thirds by DCP Midstream and one-third by DCP Midstream Partners.

The 200-MMcfd Goliad plant, expected to be completed by first-quarter 2014, will be the joint venture's seventh plant in South Texas.

Also in December, MarkWest began operations at the first of three planned Mobley gas processing plants in Wetzel County, W.Va. The 200-MMcfd plant processes rich-gas production from the Marcellus shale by EQT Corp., Pittsburgh, Magnum Hunter Resources Corp., Houston, and other producers.

MarkWest began operating in February its second, 120-MMcfd Mobley plant (Mobley 2). By fourth-quarter 2013, it will bring online the 200-MMcfd Mobley 3 plant.

When all plants are operating, the Mobley complex will be able to process about 520 MMcfd in the wet-gas area of northern West Virginia. NGLs recovered at Mobley move by MarkWest's NGL gathering network to the 60,000-b/d Houston fractionator in Washington County, Pa. (OGJ Online, Dec. 14, 2012).

In February, announcements from other companies made clear major cryogenic processing and NGL fractionation will come on stream in eastern Ohio in late second quarter or early third quarter to handle Utica shale natural gas and liquids, with another plant planned for 2014.

M3 Midstream LLC (Momentum), Houston, is building the two plants at an estimated cost of $900 million and will operate both.

Under construction near Kensington in southern Columbiana County, Ohio, is a 600-MMcfd cryogenic plant. Near Scio, south of Kensington in northern Harrison County, Momentum is building a 90,000-b/d fractionator (OGJ, May 7, 2012, p. 88). The plants will be connected with 60 miles of 12-in. gas pipeline and 24-in. NGL pipeline.

Momentum Executive Vice-Pres. George Francisco told OGJ the Kensington plant will operate three trains of 200 MMcfd each. The 5.5-gal/Mcf (GPM) feed gas will have limited CO2, and he expects 90% ethane recovery and 96+% of the heavier NGLs once the plant is fully operating.

Kensington's NGL output will match the 90,000-b/d fractionator being installed in two 45,000-b/d units. Production for these plants will come from Chesapeake Energy Corp., Total E&P USA, and EV Energy Partners LP.

Francisco confirmed that Momentum plans a third, 200-MMcfd cryogenic gas plant near Leesville in southwestern Carroll Country but declined to provide OGJ an estimated cost. Liquids from the Leesville plant will flow via a 24-in. line to the new fractionator in Harrison County, to which will be added a third 45,000-b/d unit.

The company will begin construction there in this year's third quarter and aim for start-up in second-quarter 2014 (OGJ Online, Feb. 18, 2013).

Earlier this year, MarkWest Utica EMG LLC, a joint venture of MarkWest Energy and Energy & Minerals Group, said that in slightly more than 9 months, it had announced agreements with four major producers in the southern Utica shale, including Gulfport Energy Corp., Antero Resources, Rex Energy, and PDC Energy Inc., Denver.

MarkWest Utica EMG is building a gathering system, two large-scale processing complexes, and a C2+ fractionation and marketing complex to be in service early next year.

Fractionation also will be connected by an NGL pipeline to MarkWest's Marcellus shale NGL infrastructure, including its Houston, Pa., complex.

In February, MarkWest Utica said it would provide Rex Energy with gas gathering, processing, fractionation, and marketing services in the Utica shale beginning in April.

The joint venture late last year began operations at its 60-MMcfd Cadiz refrigeration plant in Harrison County, Ohio, serving Gulfport Energy Corp.'s Utica production (OGJ Online, Dec. 3, 2012). During second-quarter 2013, MarkWest Utica began operating its 125-MMcfd Cadiz I cryogenic processing plant.

In March, it reached agreements with PDC to provide gathering, processing, fractionation, and marketing in the Utica Shale. MarkWest Utica said it expected to begin gathering and processing PDC's liquids-rich gas production from Guernsey County, Ohio, by mid-2013. Initial production from Utica operations will be processed at Cadiz.

In second-half 2013, PDC's gas will move via MarkWest Utica's high-pressure rich-gas header system to the Seneca complex in Noble County, Ohio, for processing. The company expects to complete the first 200-MMcfd Seneca plant by October and the second 200-MMcfd Seneca plant by yearend, bringing the JV's total processing capacity in the Utica shale to 585 MMcfd.

In addition to developing gathering and processing for PDC, during first-quarter 2014 MarkWest Utica and MarkWest expect to complete installation of 100,000 b/d of C2+ fractionation capacity in Harrison County that will include marketing access by truck, rail, and pipeline. When completed, the fractionation plant will be connected by NGL pipeline to MarkWest's NGL infrastructure in the Marcellus shale and to its Houston, Pa., complex.

Also in the area, NiSource Midstream Services LLC plans to spend $150 million to build a 200-MMcfd cryo gas plant in Mahoning Country, Ohio, as part of the $300 million Hickory Bend project that will include a gathering system for production from eastern Ohio and western Pennsylvania.

Also in February 2013, Howard Midstream Energy Partners LLC, San Antonio, announced plans to build a 200-MMcfd cryogenic gas processing plant in Webb County, Tex., and said it had begun building an import and export railroad hub for oil field services and products, including condensate and NGLs.

The new Reveille gas plant and associated pipelines will tie into the Cuervo Creek gathering pipeline that Howard Energy bought in March 2012 (OGJ Online, Mar. 15, 2012). Plant construction began last month with start-up anticipated in January 2014.

Howard Energy said it has signed long-term gathering and processing contracts with Escondido Resources II, Midland, Tex., and Laredo Energy, Laredo, Tex., that support construction of the Reveille plant. These agreements add to Howard Energy's "guaranteed minimum throughput of fee-based commitments" to its system, said the company, bringing the total to more than 350 bcfd.

About the same time, Nuevo Midstream LLC, Houston, completed Phase 2 expansion of its Ramsey gas gathering, processing, and treating in the Delaware basin near Orla, Tex., Reeves County, about 65 miles west of Odessa.

Nuevo's new cryogenic processing plant, Ramsey 2, can process 100 MMcfd, bringing capacity at the Ramsey site to 110 MMcfd.

At the time, Nuevo said it expected to bring Ramsey 3 online in early 2014, raising total cryogenic capacity there to 310 MMcfd.

As producers in the Ramsey area continue to define the extent of each play and as drilling programs evolve, Nuevo said, it will explore a fourth expansion to the Ramsey site, which could add 200 MMcfd in capacity as early as 2015 (OGJ Online, Jan. 18, 2013).

In April, Oneok Partners LP announced it had completed three projects as part of its previously announced growth program through 2015:

• The Bakken NGL Pipeline, transporting unfractionated NGLs from the Bakken formation and Three Forks formations in the Williston basin to the partnership's 50%-owned Overland Pass Pipeline, a 760-mile NGL line extending from southern Wyoming to Conway, Kan.

• The Stateline II gas processing plant in western Williams County, ND.

• An ethane header pipeline creating a new interconnection between the partnership's Mont Belvieu, Tex., NGL fractionation and several petrochemical customers.

The Bakken NGL Pipeline is a $450-550 million, 600-mile system that will transport 60,000 b/d of unfractionated NGLs from Oneok's gas plants and third-party plants to a northern Colorado interconnection with the Overland Pass Pipeline for shipment to both Oneok's Midcontinent NGL fractionation and storage in central Kansas and the Texas Gulf Coast.

Oneok also began operating its $135-150 million, 100-MMcfd natural gas Stateline II gas plant. It is the third new gas processing plant Oneok has completed in the Williston basin since late 2011, joining the 100-MMcfd Garden Creek and 100-MMcfd Stateline I plants, increasing its processing capacity in the region to 390 MMcfd from 90 MMcfd in 2011.

The company had previously announced that it would invest $1.7-1.9 billion for gas gathering and processing in the Williston basin 2011-15, including the Garden Creek II and 100-MMcfd Garden Creek III plants in eastern McKenzie County, ND (OGJ Online, Jan. 18, 2013). These plants are to enter service in third-quarter 2014 and first-quarter 2015, respectively, increasing its gas processing capacity in the region to 590 MMcfd.

Oneok's 12-in. OD ethane header pipeline also entered service, transporting up to 400,000 b/d of purity ethane from the its 80%-owned, 160,000-b/d MB-1 fractionator in Mont Belvieu, underpinned by contracts with area petrochemical companies.

The header moves ethane from Oneok's wholly owned, 75,000-b/d MB-2 and MB-3 fractionators once they are completed in third quarter of this year and fourth-quarter 2014, respectively, and the previously announced 32,000-b/d ethane, 8,000-b/d propane splitter expected to enter service second-quarter 2014 (OGJ Online, Aug. 12, 2012).

The Bakken NGL Pipeline, Stateline II plant, and Mont Belvieu ethane pipeline are part of $4.7-5.3 billion in growth planned by Oneok through 2015 (OGJ, Apr. 15, 2013, p. 28).

Middle East; Asia-Pacific

In June of last year, Abu Dhabi Gas Industries Ltd. said as much as 90% of the work on its Habshan 5 gas processing plant had been completed.

The Habshan 5 plant has a nameplate capacity of 1 bcfd for offshore gas from Umm Shaif and an additional 1 bcfd for onshore gas consisting of a mix of associated gas from the Abu Dhabi Co. for Onshore Operations (ADCO) and non-associated highly sour gas from Habshan fields.

Also in Abu Dhabi in April of this year, Abu Dhabi National Oil Co. selected Royal Dutch Shell as partner to develop sour-gas reservoirs in giant Bab gas-condensate field 93 miles southwest of the city of Abu Dhabi to supply the local market.

ADNOC said the Bab megaproject will include installation of a new processing and treatment plant, including gathering and sulfur recovery, able to process 1 bcfd of sour gas. The complex will yield 520 MMscfd of sales gas for delivery to the domestic distribution network by 2020.

ADNOC will hold a 60% interest in the joint venture, Shell 40% (OGJ Online, Apr. 30, 2013).

In Iran in May last year, media cited a National Iranian Gas Co. official that in the previous 3 years, the country's gas processing capacity had risen by 40 million cu m/day (about 1.4 bcfd)

The official was reported to have said most of the additional volume came from upgrading Bid-Boland, Fajre-Jam, and Hashemi Nejad processing plants and that Iran's gas processing capacity had risen to 520 million cu m/day.

Referring to South Pars gas field, he said that in 2011 the field's gas processing capacity increased by 2 billion cu m over the previous year, bringing it to 156 billion cu m/year.

In June, media reported the first Iran-made gas processing plant with a capacity of 12.5 million cu m/day was to come on stream in Assalouyeh, onshore part of the offshore South Pars gas field by late September.

And in early 2013, regional media reported that Iran inaugurated a $590 million NGL plant on the Persian Gulf island of Siri. The report said the Siri NGL plant will have about $500 million/year in sales. It will produce 1,400 b/d of condensate, 1,500 b/d of pentane, 4,000 b/d of butane, and 8,000 b/d of propane.

In April last year, Saudi Aramco started up its gas processing at Khursaniyah for the Karan gas program (OGJ Online, Apr. 25, 2012).

One gas-treating train and one sulfur-recovery train formed the core of operations at the Khursaniyah gas plant, which is able to process 1 bcfd of nonassociated gas produced from Karan offshore field.

Later in the year, Saudi Aramco said that two additional gas trains began operating, bringing Karan gas processing capabilities at Khursaniyah to 1.8 bcfd.

In Australia last month, Empire Oil and Gas NL, Claremont, WA, began commissioning its Red Gully natural gas and condensate separation plant in Western Australia (photo).

The plant will treat condensate and gas from the Gingin West-1 and Red Gull-1 discovery wells. Initial capacities will be 10 MMcfd and 500 b/d, to be doubled by a likely second train. Cost of the plant and related construction is estimated at $35.8 million.

Gas will be treated to meet specifications for flow, under a 20-year agreement, through the Dampier-to-Bunbury gas pipeline (OGJ Online, Dec. 29, 2006), which will be reached via a new 2-mile, 4-in., 30-MMcfd pipeline that is part of the project. Condensate will be stored and trucked to BP's Kwinana, WA, refinery.

The company statement said that, in addition to treating gas from the Gingin West-1 and Red Gully-1 discovery wells, the plant could be used to treat other nearby conventional and unconventional discoveries.

Elsewhere in the wider Asia-Pacific region, state-owned State Oil Co. of Azerbaijan Republic (SOCAR) said in April 2012 it expected to commission a new oil and gas processing and petrochemical complex near Baku between 2017 and 2020.

Costs estimated at the time ran to $14 billion, according to regional media reports. The gas plant will begin operating in 2017 able to process about 1.4 bcfd.

In January of this year, state media reported that KazMunaiGas had settled on a feasibility study of a gas processing plant in West-Kazakhstan Oblast. The plant will be developed in cooperation with Eni.

The gas plant will have an inlet capacity of about 485 MMcfd and process associated sour gas produced from Karachaganak field.

If all final approvals are obtained, the first stage of construction could begin 2014-19, while the second stage is planned for 2021-23.