OGJ Newsletter

GENERAL INTEREST — Quick Takes

House bill aims to expedite pipeline construction

US Rep. Mike Pompeo (R-Kan.) introduced a bill on May 9 that aims to expedite construction of US natural gas pipelines by streamlining the permitting process and expediting approvals.

Several parts of the country don't have the necessary pipeline capacity as more gas is used to generate electricity, the House Energy and Commerce Committee member noted. Dramatic gas production growth also is occurring in areas of the US without pipeline access to markets, he added.

HR 1900 would amend Sect. 7 of the Natural Gas Act by requiring US Federal Energy Regulatory Commission approval of a new gas pipeline within 12 months of its application's public notice. An agency responsible for issuing a siting, construction, capacity expansion, or operating permit or license could request a 30-day extension.

"This bipartisan piece of legislation makes common sense reforms to the natural gas pipeline permitting process," Pompeo said. Energy and Commerce Committee members Jim Matheson (D-Utah), Pete Olson (R-Tex.), Cory Gardner (R-Colo.), and Bill Johnson (R-Ohio) are cosponsors. US Reps. Fred Upton (R-Ohio), the committee's chairman, and Ed Whitfield (R-Ky.), who chairs its Energy and Power Subcommittee, also support the measure.

Interstate Natural Gas Association Pres. Donald F. Santa immediately expressed support for the bill, which he said reflects the principal recommendation from a December 2012 INGAA Foundation report on permitting.

The report found that, while FERC does an effective job of reviewing applications for authority to build pipelines, it lacks the authority to enforce permitting deadlines for other federal and state agencies, Santa said.

"The lack of enforceable permitting deadlines increasingly is causing pipeline project delays," Santa said. "Providing clear permitting deadline authority will add certainty to the process and encourage timely decision-making."

Rosneft, Petrovietnam ink cooperation MOU

Rosneft and Petrovietnam have signed a memorandum of understanding to strengthen cooperation in upstream and downstream oil and gas operations in Russia, Vietnam, and third world countries.

Rosneft has Vietnamese interests through TNK Vietnam, a 100% indirect subsidiary it absorbed when it acquired TNK-BP in March (OGJ Online, Mar. 21, 2013).

TNK Vietnam holds a 35% interest in and operates offshore Block 06-1 and a 32.67% share of the Nam Con Son pipeline, which carries natural gas and condensate from offshore fields to the Dinh Co Terminal and to the Phy My Power Complex.

Statoil, Total swap Barents Sea interests

Statoil AS and Total SA have agreed to swap 10% interests in two petroleum licenses in the Barents Sea offshore Norway.

Statoil receives 10% equity in PL535. Total receives 10% equity in PL395.

Statoil has made a discovery called Ververis on PL395, which it operates, and Total Norge E&P has a discovery called Norvarg on PL535, which it operates (OGJ Online, Aug. 10, 2011). A Norvarg appraisal well is in progress.

The blocks are on the Bjarmeland platform.

San Leon Energy to buy share of shale gas JV

San Leon Energy PLC agreed to buy Talisman Energy Inc.'s share of a shale gas joint venture in Poland. Talisman is the second international major oil company to withdraw from Poland, following a decision last year by ExxonMobil Corp. to exit Poland after early results failed to produce commercial wells.

San Leon said it is taking 100% ownership of the Gdansk W and Braniewo S licenses and increased its interest to 50% in the Szczawno license in Poland's Baltic basin (see map, OGJ, Nov. 7, 2011, p. 36).

Talisman has said it wants to focus on production in two core areas: the Americas and Asia-Pacific.

Previously, Talisman carried San Leon on drilling expenses for three wells in the Baltic basin.

Now, San Leon will now use Talisman Polska's cash to fund the planned fracture of its Lewino-1G2 well in the Gdansk W Baltic basin.

The vertical fracture is intended to prove the unconventional gas potential of the Lower Silurian and Ordovician shales, San Leon said. Operations will begin as soon as permitting and regulatory approval is granted.

Exploration & Development — Quick Takes

East Java Sea Lengo-2 well DSTs at 21.2 MMscfd

Gas flowed at a maximum rate of 21.2 MMscfd at the Lengo-2 appraisal well in the East Java Sea offshore Indonesia and had the same composition as the gas from the 2008 Lengo-1 discovery well, said AWE Ltd., Sydney.

KrisEnergy Satria Ltd., Singapore, operates the well on the western segment of the two-part Bulu PSC. The gas flow came on a drillstem test of the Kujung I carbonate reservoir at 2,415-2,571 ft.

Final gas composition results from this and an earlier DST are expected within weeks, but preliminary analysis of the latest test indicated 66% methane, 10% carbon dioxide, 21% nitrogen, and 3% other hydrocarbon gases, AWE said. KrisEnergy also recovered 79 ft of core at 2,485-2,571 ft and ran wireline logs.

A previous DST of Kujung at 2,415-85 ft at Lengo-2 flowed at a maximum rate of 4.6 MMscfd (OGJ Online, May 7, 2013). Maximum flow rate from Kujung at Lengo-1 was 12.8 MMscfd. KrisEnergy will deepen Lengo-2 to 2,717 ft to tag basement.

Statoil farms into Great Australian Bight

Statoil has farmed into BP PLC's four permits in the South Australian sector of the Great Australian Bight to earn a 30% interest overall.

Commercial terms for the deal were not disclosed, but BP has already committed to spending $1.4 billion (Aus.) on its exploration program in EPs 37, 38, 39 and 40 in the Ceduna Sub Basin offshore South Australia.

The permits cover an 24,000 sq km area. Statoil has already shot 3D seismic over a 12,000 sq km area. Processing the data is being finalized to identify drillable prospects. Work also continues on the region's environmental studies.

The company's forward work program comprises as many as four wells beginning in the Southern Hemisphere summer of 2015-16. The program could take 18-30 months.

BP will remain operator. The overall objective is to explore a giant buried delta believed to be similar in size to the Niger Delta offshore West Africa.

Statoil's move adds to its earlier move in Australia to farm into acreage held by PetroFrontier Corp. in the southern Georgina basin onshore Northern Territory.

Karoon sees wider extent at Santos basin oil find

Karoon Gas Australia Ltd. said recovery of additional samples indicates that the extent of its Bilby-1 indicated discovery in the Santos basin offshore Brazil is larger than previously thought.

The company recovered seven oil samples to surface, one of which it opened for early oil quality assessment that showed 33° gravity oil.

The net oil-bearing reservoir is estimated to be 70 m. Reservoir porosity values up to 23% have been interpreted from wireline logs, and further testing is under way, including coring. Once wireline testing is complete, the well on the S-M-1166 block will drill ahead to 4,573 m, where Karoon hopes to find more hydrocarbon-bearing reservoirs down to the Santonian level.

The confirmed stratigraphic extent of the oil bearing reservoirs now includes interbedded sands in rocks of Eocene, Paleocene, and Late Cretaceous age, said Pacific Rubiales Energy Corp., Toronto, which has a 35% participating interest subject to ANP approval.

The Bilby-1 well is positioned 150 m downdip from the trap crest as indicated on seismic data, creating potential for additional prospectivity higher in the structure.

Eni group gauges Pakistan onshore gas discovery

Eni Pakistan Ltd. said the Lundali-1 new field wildcat is a gas discovery on the Sukhpur block in the Kirthar fold belt 270 km north of Karachi, Pakistan.

The discovery in Sindh Province flowed at rates as high as 33 MMscfd from sands of Paleocene age and will be produced to the Bhit gas processing facility 30 km west of the block. Total depth is 2,660 m.

The discovery will go on line less than 3 years after award of the block in February 2010, Eni said. The joint venture of Eni 45%, Pakistan Petroleum Ltd. 30%, and Kuwait Foreign Petroleum Exploration Co. 25% will drill another exploratory well on the block within 12 months.

Drilling & Production — Quick Takes

Statoil orders newbuild jack up for Mariner

Statoil and its partners placed an order with Noble Corp. for a newbuild, high-specification jack up drilling rig to be used in the Mariner heavy oil development in the UK North Sea.

Noble said it is negotiating construction of the jack up, and the drilling contractor expects delivered costs will be $690 million.

The rig will be capable of drilling in about 500 ft of water in harsh conditions, and it will be designed with a maximum total drilling depth capacity of 33,000 ft.

An initial 4-year contract is expected to commence during third-quarter 2016, Noble said. Total estimated value of the 4-year contract is $655 million, including mobilization.

Mariner project lies on the East Shetland Platform 93 miles east of the Shetland Islands.

Statoil previously said it anticipates production will average 55,000 b/d during the plateau period of 2017-20. The field was discovered in 1981 and is expected to produce for 30 years (OGJ Online, Dec. 21, 2012).

Statoil entered the license as operator in 2007 and holds 65.11% interest. Partners are JX Nippon Exploration and Production (UK) Ltd. with 28.89% and Alba Resources Ltd. with 6%.

Large gain seen in Alberta oil production

Bitumen will claim an increased share of sharply higher oil production in Alberta over the next 10 years, according to the provincial Energy Resources Conservation Board.

In an annual outlook, ERCB projects an increase in supply of crude oil and equivalent to 4.2 million b/d in 2022 from 2.5 million b/d in 2012. The amounts include nonupgraded bitumen, upgraded bitumen, pentanes-plus, heavy oil, and light and medium crude oil.

The bitumen share of total supply will increase to 87% in 2022 from about 73% in 2012, ERCB forecasts. The agency slightly lowered its estimate of Alberta's in situ and mineable crude bitumen to 167.9 billion bbl to account for production. It estimates reserves of conventional crude oil at 1.7 billion bbl.

In 2012, bitumen production from in situ projects exceeded that from mines for the first time. The trend is expected to continue.

The ERCB expects bitumen production to increase from 1.9 million b/d in 2012—52% in situ—to 3.8 million b/d in 2022—58% in situ. It expects shipments outside of Alberta to slip to 76% from 81% of total production in the forecast period because of declines expected in light-medium and heavy oil.

Natural gas production, according to the report, will fall to about 210 million cu m/day (MMcmd) in 2022 from 304.7 MMcmd in 2012, which was down 5.6% from the 2011 rate.

The ERCB estimates Alberta's conventional gas reserves as of yearend 2012 at 916 billion cu m, down slightly from the 2011 estimate. It estimates remaining established reserves of coalbed methane at 56.7 billion cu m, also down slightly, out of initial established reserves of 101.3 billion cu m.

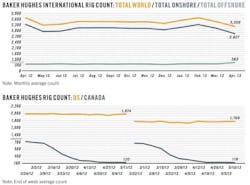

US drilling rig count up 5 units to 1,769

The US drilling rig count gained 5 units during the week ended May 10 to a total of 1,769 rotary rigs working, Baker Hughes Inc. reported. That compared with 1,974 rigs working in the comparable week last year.

All of the gains were seen in land-based drilling activity, which increased 6 units from a week ago to 1,696 rigs working. The offshore count fell by 1 unit to reach 50, while inland water drilling remained unchanged at 23. Of the rigs drilling offshore, 47 were in the Gulf of Mexico, down 1 unit from a week ago.

Oil-targeted rigs climbed by 9 units to 1,412, while those drilling for gas decreased by 4 to 350. Seven rigs were considered unclassified, unchanged from a week ago.

Rigs drilling horizontally were reported at 1,099, up 7 units from a week ago, but 30 fewer than the comparable week last year. Rigs drilling directionally gained 1 unit to 198. This compared with 228 rigs working horizontally in the comparable week a year ago.

Of the major oil and gas producing states, Texas gained 7 units to reach 838. Oklahoma and North Dakota, at respective counts of 190 and 176, were up 2 rigs each. Five states were unchanged this week: Colorado, 63; California, 41; Ohio, 32; Arkansas, 15; and Alaska, 8. Four states were down 1 rig each: New Mexico, 77; Pennsylvania, 59; Wyoming, 40; and West Virginia, 23. Lousiana was down 2 rigs to 106 units working.

PROCESSING — Quick Takes

Crosstex to invest in condensate stabilization

Dallas-based Crosstex Energy companies Crosstex Energy LP and Crosstex Energy Inc. have announced that Crosstex Energy Inc. will invest about $25 million in a third natural gas compression and condensate stabilization plant in the Ohio River Valley.

The company will invest in E2, a company formed in March with the former management of Enerven Compression Services, to provide services for producers in the liquids-rich part of the Utica shale. Initial investment in E2 of about $50 million will fund construction of two similar facilities.

The announcement said the E2 investment "complements" Crosstex Energy LP's assets in the Ohio River Valley, which encompass crude oil, condensate, and logistics operations in the Utica and Marcellus shales.

E2 will build, own, manage, and operate all three compressor stations and condensate stabilization plants in Noble and Monroe counties in the southern portion of the Utica in Ohio. The counties are immediately east of assets in the Ohio River Valley.

The new plant will have compression capacity of 100 MMcfd and condensate stabilization capacity of 5,000 b/d, which brings total expected capacity for the three facilities to 300 MMcfd of compression and 12,000 b/d of condensate stabilization.

The three facilities are supported by long-term, fee-based contracts with Antero Resources, an exploration and production company operating in the region. Commercial start-up of the new station will be in this year's fourth quarter.

Contract let in PDVSA refinery upgrade

The prime contractor for an upgrade of the 180,000-b/d Petroleos de Venezuela SA refinery at Puerto La Cruz, Venezuela, has let a contract for construction of key modularized units to Wison Offshore & Marine Ltd. (OGJ Online, July 29, 2011).

After completion of the project, the refinery, which now runs light and medium crude oil, will be able to process 210,000 b/d of heavy and extra-heavy crude oil from Venezuela's Orinoco region.

The project includes construction of a 50,000-b/d deep-conversion unit based on HDH Plus technology developed by Intevep, PDVSA's research unit. It also includes a three-train sequential hydroprocessing unit, a 130,000-b/d three-train vacuum unit, upgrade of two atmospheric distillation units, auxiliary and service units, interconnections, and tanks.

Wison Offshore received the contract from Hyundai-Wison, a consortium of Hyundai Engineering & Construction Co. Ltd., Hyundai Engineering Co. Ltd., and Wison Engineering Ltd. that holds the engineering, procurement, and construction contract.

Wison Offshore, for which the project represents a first in onshore module fabrication, will provide pipe racks and equipment modules weighing about 26,000 tonnes, handling fabrication design of the steel structures, material procurement, construction, precommissioning, and loadout. Hyundai-Wison will provide the pipeline, equipment, and electric facilities and instrumentation.

BP starts Cherry Point diesel hydrotreater

BP PLC has commissioned a diesel hydrotreater and hydrogen plant at its 234,000-b/d Cherry Point refinery at Blaine, Washington.

The hydrotreater has production capacity of 25,000 b/d. The hydrogen unit's capacity is 44 MMscfd.

TRANSPORTATION — Quick Takes

Double Eagle pipeline begins condensate shipments

Double Eagle Pipeline LLC, a 50-50 joint venture of Magellan Midstream Partners and Kinder Morgan Energy Partners, has started shipping condensate for Eagle Ford shale producers in Karnes and Live Oak counties, Tex. Double Eagle line-fill ended last week, with the system now transporting condensate via KMEP's existing 50-mile, 14-in. and 16-in. OD pipeline from Three Rivers, Tex., to Magellan's Corpus Christi, Tex., terminal.

Double Eagle's new truck unloading and storage facility near Three Rivers also entered service.

The joint venture expects to complete construction of Double Eagle's 140-mile, 12-in. OD western leg from Gardendale near Cotulla, Tex., in LaSalle County to Three Rivers early next quarter. Initial capacity of the pipeline is 100,000 b/d, expandable to 150,000 b/d with additional pumps.

Double Eagle was initially proposed by a joint venture consisting of Copano Energy LLC and Magellan (OGJ Online, Feb. 10, 2012). KMEP purchased Copano early this year (OGJ Online, Jan. 13, 2013).

Gazprom starts key compressor station work

Gazprom has started construction of the Kazachya compressor station in Krasnodar Territory, part of its Southern Corridor natural gas transmission system feeding the South Stream export pipeline to Europe (OGJ Online, Apr. 4, 2013).

The 220-Mw station will be able to handle the transmission system's full capacity of 63 billion cu m/year of gas. It will have eight compressor units. From the Kazachya station, gas under pressure of 11.8 MPa will flow to the Russkaya compressor station. There it will enter the South Stream line, which will cross the Black Sea to southern and central Europe. South Stream construction began late last year.

The Southern Corridor system will have two legs, to be built in phases with the western leg first, joining at Russkaya. In addition to feeding the South Stream export line, it will supply markets in central and southern Russia.

The system, due for completion in 2017, will have total length of 2,506 km. Its 10 compressor stations with total capacity of 1,516 Mw.

The Kazachya station is on the western leg of the Southern Corridor system. The northernmost of the western leg's compressor stations will be at Pisarevka in Voronezh Oblast.

The northernmost of the longer eastern leg's compressor stations will be at Pochinki in Nizhny Novgorod Oblast.

BG, CNOOC sign another CSG-LNG contract

BG Group has signed another binding contract with China National Offshore Oil Corp. (CNOOC) for the sale of upstream assets in Queensland for $1.93 billion (Aus.).

CNOOC will acquire 20% interest in coal seam gas (CSG) reserves and resources from permits in the Walloons trend in the Bowen basin as well as an additional 40% equity in Train 1 at the Queensland Curtin Island CSG-LNG plant.

CNOOC also has secured a further 5 million tonne/year supply of LNG production and has taken out an option to participate up to 25% in one of the potential expansion LNG trains at the project.

In return, CNOOC will reimburse BG Group for its share of the project expenditure since January 2012.

CNOOC is a foundation partner in the project. BG Group has now committed 8.6 million tpy of LNG to China, making it the largest LNG supplier in the world market.

First LNG from Train 1 at the Curtin Island plant is slated for 2014.

GDF Suez-Santos lets contract for FLNG project

A joint venture of GDF Suez and Santos has let a contract to the Wood Group Kenny consortium for the pre-front-end-engineering and design of the subsea definition of its proposed Bonaparte floating LNG project in the Timor Sea.

The project involves development of the Petrel, Tern, and Frigate dry-gas fields that straddle the offshore boundary of Western Australian and Northern Territory waters some 250 km west of Darwin.

Operator GDF Suez plans to produce the fields from a total of 22 wells connected to a centrally located FLNG vessel capable of producing 2 million tonnes/year of LNG.

The fields, discovered by ARCO during the late 1960s-early 1970s have been regarded as stranded gas since that time and it is only now with the advent of FLNG technology that a viable development can be considered.

The development proposal was given the government environmental green light last October. The pre-FEED work is in line with the schedule to move to FEED at midyear. A final investment decision is expected in 2014.

Drilling will follow in 2016-17, with first production expected in 2018.

Wood Group Kenny will manage the pre-FEED work from its office in Perth. The company already has extensive experience with offshore projects in northwest Western Australia, including Prelude, Equus, Pluto, Ichthys, and Browse.

GDF Suez has 60% interest in the project; Santos holds the remainder.