A total high bonus of $1.2 billion at Central Gulf of Mexico Lease Sale 227 masked the fact that oil and gas companies made only 407 bids on 320 of the 7,299 blocks offered.

Only 58 blocks drew more than a single bid, the US Bureau of Ocean Energy Management revealed in sale statistics. The 52 participating companies lodged 131 bids for blocks in greater than 1,600 m of water, 78 bids for tracts in 800-1,600 m of water, and 85 bids for blocks in less than 200 m of water.

Blocks totaling 1.7 million acres off Louisiana, Mississippi, and Alabama drew bids even though the government offered 38.6 million acres. No block drew more than six bids.

Apparent high bidders

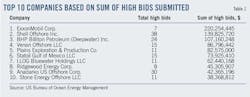

Shell Offshore Inc. bid high for 38 blocks, Anadarko US Offshore Corp. and ConocoPhillips, 30 blocks each, and BHP Billiton Petroleum (Deepwater) Inc., 24 blocks. Statoil Gulf of Mexico LLC and Venari Offshore LLC submitted the high bids on 15 blocks each.

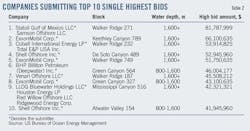

Statoil and Samson Offshore LLC put up the sale's highest bid of $81.8 million for Walker Ridge Block 271. The block drew only one other bid. ExxonMobil Corp. made the sale's second-highest apparent high bid, offering $66.1 million for Keathley Canyon Block 789.

Cobalt Energy International LP and Total E&P USA Inc. joined for the third-highest bid, $53.9 million for Walker Ridge Block 232, Shell was fourth high at $52.9 million for De Soto Canyon Block 489, and ExxonMobil bid $51.8 million for Walker Ridge Block 749. All five blocks are in more than 1,600 m of water.

On Walker Ridge Block 187, which lies in water deeper than 1,600 m, drew six bids, with Venari Offshore making the top offer of $45.5 million.

In the 800-1,600 m of water category, BHP Billiton put up the sale's sixth-highest high bid at $46 million for Green Canyon Block 564. ExxonMobil made the sale's eighth-highest apparent high bid of $43.1 million for Green Canyon Block 327.

Only 26 tracts in the 200-800 m of water category drew bids.

Other active bidders included Talos Energy Offshore LLC, Maersk Oil Gulf of Mexico Two LLC, Plains Exploration & Production Co., LLOG Bluewater Holdings LLC, Stone Energy Offshore LLC, and Ridgewood Energy Corp.

No bids from BP

BP PLC did not submit bids even though the Department of the Interior had said that BP could submit bids. Currently, BP is suspended from receiving new government contracts because of the April 2010 Macondo oil spill. DOI recently said BP could bid, and the government then would determine the status of the BP's suspension when the leases are finalized in about 90 days.

BOEM noted that the sale terms included an increased minimum bid for deepwater tracts, escalating rental rates, and tiered durational terms with relatively short base periods followed by additional time under the same lease if the operator drills a well during the initial period.

BOEM increased the deepwater minimum bid requirement to $100/acre, up from $37.50/acre in previous central gulf lease sales. Rigorous analysis showed that leases that received high bids of less than $100/acre experienced virtually no exploration and development, the agency said.

Each high bid on a tract will go through a strict evaluation process within BOEM to ensure the public receives fair market value before a lease is awarded.