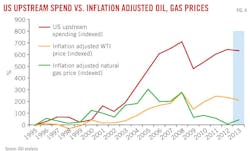

Movement in prices and US upstream spending

In the Short-Term Energy Outlook report released in February, the US Energy Information Administration projected that the average West Texas Intermediate crude oil price will fall to $93/bbl in 2013 and to $92/bbl in 2014 from $94/bbl in 2012.

The correlation between historical US upstream spending and inflation-adjusted oil prices is strong. The modestly reduced WTI oil price in the coming year and unfolding operational and logistical challenges in many new oil plays are dampening upstream spending growth in the US. Cramped cash flow due to low natural gas prices is also a constraint, especially for many US-based independents.

With natural gas prices still depressed, oil and liquids-rich shale plays continue to be heavily weighted in spending.