Hydrocarbon potential, reservoir development estimated for western Iraq's Akkas gas field

Muhammed Mazeel

RWE Dea AG

Hamburg

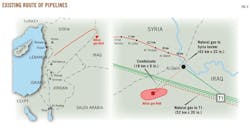

Akkas is in northwestern Iraq near the border with Syria.

It is 52 km from the T1 pump station and 285 km from the K3 pump station. The distance between this field and Baji town, where the entire Iraqi gas grid passes, is around 300 km. The nearest industrial complex to the field is the Al-Qaim Industrial Complex that consists of a fertilizer plant and cement plant and is less than 40 km away.

The first exploration well in Akkas region took place in August 1992. The drilling program target was to reach a depth of 5,000 m, but this did not succeed due to technical difficulties. The drilling reached a depth of 4,238 m, and the well test confirmed the presence of natural gas with a flow rate of 6-8 MMscfd.

Akkas is one of the largest gas fields in Iraq. It contains 5.68 tscf of initial gas in place, of which 4.55 tscf is estimated to be recoverable. There is also the potential of condensate and other prospects in deeper formations.

In 2001, the development of Akkas-Saladin gas field was referred to the Syrian Petroleum Co. The commitment was to drill five horizontal wells and redrill the SA-1 (Akkas-1) discovery well horizontally. An average well test for another five wells is demonstrating more than 9 MMscfd on the largest choke.

Geology and petrophysics

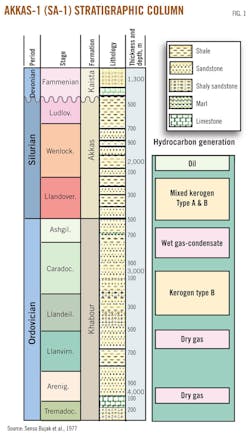

The formations with hydrocarbon potential in Akkas field are as follows:

• The Ora Kaista Pirispiki formation at 1,365-1,424 m is a sequence of sandstone, a compact shale layer of low and medium porosity, followed by dolomite and limestone.

• The Akkas formation at 1,993-2,002 m is sandstone with compact shale layers of low porosity.

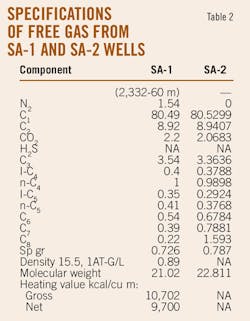

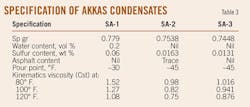

• The Khabour formation, at 2,332-60 m in Akkas-1 (SA-1), 2,365-75.5 m in Akkas-2 (SA-2), and 2,341-55 m in Akkas-3 (SA-3), is sandstone and compact shale layers of low porosity. The specific gravity of the tested gas was 0.726-0.6953 and of the condensate was 0.7792.

In Akkas-1 (SA-1) are indications of light oil (density 0.8326 gm/cu cm). An Akkas-4 (SA-4) test showed gas, and the author believes condensate may also be present in this well.

The gas fields of the Widyan basin-Interior platform in western Iraq are mainly Lower Paleozoic petroleum systems such as gas in the Lower Silurian Akkas and Ordovician Khabour formations. Their main source could be the Khabour formation and the oil shale of the Akkas formation. Structural framework of folding and faulting as well as stratigraphic facies changes could form the main traps in these regions.

Samples of cores and cuttings were collected from the Khabour, Akkas, and Upper Devonian Kaista formations in wells Akkas 1-6, Khleisya-1, KH 5-6, and KH 5-1. Their diagnostic organic matters are abundant and a few spores and chitinozoa as well as scolecodonts, graptolite siculae, cuticles, and amorphous organic matter.

Hydrocarbon generation potential is assessed by plotting organic matter up to 16% TOC, especially the hot shale of the Akkas formation, which is very low asphaltene and sulfur. The saturated and aromatic hydrocarbons of more than 96% and high peaks of C2-C20 gas chromatography could indicate predominant gas generation with some light oils.

The associated gases are mainly methane and ethane of CH4, C4H6, and C3H8. Accordingly, source potential for wet gas and condensate could be assessed at a depth of 2,750-3,000 m and dry gas at a depth of 3,570-3,650 m in Akkas-1 only from the Khabour formation. Little oil might be generated from the Akkas formation in Akkas-1 and KH 5-6 (Fig. 1).

These potential source rocks are extended toward neighbor countries. Accumulation sites of these generated gases and a little oil could be within the sandstone porosities of 10-17% and permeability of 500 md sealed by the nonpermeable shale along closures of the structured anticline fold and fault of this field as well as along the unconformity of the boundary of the Akkas formation with the Kaista formation.

Accordingly, Lower Paleozoic Total Petroleum System of generation, migration, and accumulation could be assessed for a basin includes West Iraq and extensions in the neighboring regions.

Formation evaluation

In Akkas-1, the borehole generated condensates and wet and dry gas of mainly 85% methane and ethane. Little oil could have been generated from the upper part of the Lower Silurian rocks.

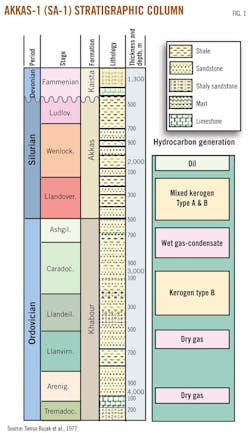

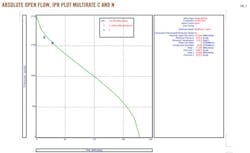

Increasing thermal alteration (>170° C., TAI = 3.8) applied to rocks containing more than 0.5% TOC would be a reason for generating gas from Ordovician rocks. Trapped gas and oil could be accumulated along anticline and fault structural traps within Ordovician and Silurian sandstone's interlayers in West Iraq. Table 1 shows summarized characteristics of the Khabour formation obtained from the tests made in the Akkas-1 (SA-1) well:

Wet gas and condensate generation

The Akkas-1 borehole has total organic carbon of 0.71-1.42 wt % at 2,750-3,000 m.

The biodegradation and thermal alteration of the organic matter resulted in abundant amorphous organic matter (70-75%).

The Khabour B rock unit started the generation of wet gas and condensates hydrocarbons during the Mississippian (Mesopotamian) time and continued till now with the expulsion quantity of 65% of its proven reserve.

Dry gas generation

The Akkas-1 borehole has TOC of 0.5-1.0% at 3,570-3,650 m.

The biodegradation and thermal alteration of the organic matter led to abundant amorphous organic matter. The analyses for this shale unit (Khabour D) is giving results of starting dry gas generation during Silurian time and ended generation during late Triassic.

Oil generation

Potential source rocks for oil have been encountered from the Akkas formation depths of 2,280-2,330 m in Akkas-1. The analyses for this lithostratigraphic unit of Akkas hot shale have resulted in no hydrocarbon generation although it has very high organic content.

Subsurface condition

Low sulfur content of the generated hydrocarbons in Akkas field could be explained by the presence of iron in these clastic marine rocks that combines with sulfur and precipitates as iron pyrites (which is found in abundance with the organic kerogen).

The free sulfur content is reduced in the organic matter and in the released hydrocarbons. In addition, an increase in the geothermal gradient due to the presence of radioactive shales has caused the breakdown of long chain hydrocarbon compounds into simpler compounds forming very light oil, condensate, and gas with low sulfur contents.

This was proven by the test results from Akkas-1, which has 42° gravity light oil in sandstone units at the base of Silurian and free sweet gas in the upper part of the Khabour formation. The results of bitumen analysis from the shale source rock unit, at the base of Silurian, indicated that saturated hydrocarbons and aromatics make up 96 wt % and asphalt compounds 3.89 wt % of the extract.

The saturated compounds are of low molecular weight (C2-C20) by gas chromatography and hence could indicate predominant gas generation with some light oils.

Reservoir and seal

This principal reservoir (Khabour formation) is the oldest known sedimentary rock unit in Iraq. It consists entirely of siliciclastic sequences, comprising thin-bedded, fine-grained sandstone, quartzite graywackes, and silty micaceous shale with some intercalation of dolomite and limestone.

The base of the formation, which may be more than 1,000 m thick, has not been reached in wells. It was deposited in shallow marine inner to outer neritic environments that prevailed over the entire eastern part of the Arabian Plate.

In Akkas field, the Khabour formation is found at depths below 2,310 m and exhibits good reservoir properties. It comprises sandstone with silty shales and has a gross thickness of approximately 38 m and an average thickness of 25 m.

Core analysis of the reservoir intervals generally indicated an average porosity of 10% and permeability of 500 md. Its depth in Akkas-1 is at 2,040 m below sea level. Formation temperature is 146° C. at 3,300 m. The high temperature is caused by the Silurian shales' radioactivity and decreases downward in the Khabour formation to normal gradients. The gross hydrocarbon reservoir column is about 80 m.

A secondary reservoir is provided by the Akkas formation found above the Khabour formation at a drilled depth of 1,465-2,326 m. It is comprised of a sandstone unit inter-bedded within the basal hot shale unit, with a gross thickness of 10 m and net thickness of 1.5 m. Core analysis of the reservoir intervals indicated porosity of 17% and a permeability of 500 md. The Akkas formation was found to contain 42° gravity light oil only from the thin sandstone horizon sandwiched between the hot shales at the base; it is therefore considered a minor reservoir. The overlying Silurian shale of the Akkas formation is an effective local regional seal.

Reservoir engineering

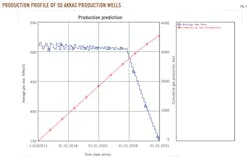

The author's MBAL material balance model indicates that cumulative recoverable gas at Akkas would be 3.553 tscf.

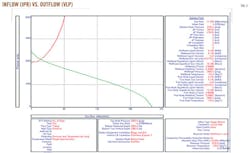

A possible production profile plateau is 500 MMscfd from 50 wells and for contract reason can be 55 wells. Published data show many uncertainties in the reservoir like bottomhole pressure, wellhead pressure, density, and downhole equipment. From published information it is impossible to calculate the vertical lift performance (VLP) and the inflow performance relationship (IPR). The author estimated the wellhead pressure according to the given reservoir pressure of 3,720 psi.

The author used available data and estimated the well data, which are not available or available but inconsistent with reservoir data.

In order to design and allow for the building of reliable and consistent well models with the ability to address each aspect of wellbore modeling, PVT (fluid characterization), vertical lift performance (VLP) correlations (for calculation of flow line and tubing pressure loss) and IPR (reservoir inflow), the author used Prosper.

According to the available data from Akkas-1, the Prosper model shows the absolute open flow of 214 MMscfd (Fig. 2). It shows VLP and inflow performance relationship (IPR) with production rates of 17.4 MMscfd (Fig. 3).

Efficient reservoir development requires a good understanding of reservoir and production systems. The author used MBAL to define reservoir drive mechanisms and hydrocarbon volumes and finally the reliable reservoir models quickly.

Fig. 4 shows the rough MBAL model for the tank Akkas-1 (SA-1) and extrapolated rates of the 50 wells including the five existing wells. According to the well test rates from the exploration wells, I take a conservative average production of 10 MMscfd/well.

Field development plan

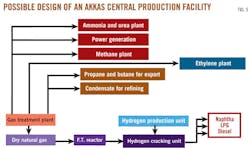

Iraq proposed a strategy plan and wished to use the methane to satisfy domestic power/water demand, C1, C2, C3 based petrochemicals for export. Ethane and propane are used for olefins production. Butane and condensates are for domestic use, export, and petrochemical production.

The proposed development plan can be divided in two phases: The first phase is 250 MMscfd gas rate. Power generation and methanol use natural gas. Propane, butane, and condensate are for export. The second phase is an additional 250 MMscfd gas processed including ethane recovery for olefin production.

Furthermore, power generation and ammonia use the incremented gas. Ethane is to be used for ethylene production, with the option to use some propane and butane. Polyethylene production is the main ethylene derivative.

Gas and condensate specs

The samples are taken from the separator (Tables 2 and 3).

Central plant facility

The proposed central plant facility is according to the possible development scenarios of the field and the use of the hydrocarbon and their derivates (Fig. 5).

Pipelines and route connection

There are many possibilities to transport the gas and their products. The optimized way is to use the route of T1 to the Baniyas port in Syria (Fig. 6).

Possible contract conditions

Currently the main Iraq has only the service contracts, which still do not have the approval of political actors and public organs.

The term service contracts encompass those various contracts in which the host government has a contract with a service company or an international oil company for the performance of services related to the exploitation of petroleum resources.

The risk service contract appears similar to the production-sharing contract but differs in certain important matters. Its basic distinctive feature is that it reimburses the contractor in cash, not in crude oil or gas, although it may have provisions permitting the contractor to buy back an amount of crude oil at an international selling price equivalent to the amount to be paid to the contractor.

A pure service contract is an agreement between a contractor and a host country that typically covers a defined technical service to be provided or completed during a specific period of time. The service company investment is typically limited to the value of equipment, tools, and personnel used to perform the service.

In most cases, the service contractor's reimbursement is fixed by the terms of the contract with little exposure to either project performance or market factors. Payment for services is normally based on daily or hourly rates, a fixed rate, or some other specified amount. Payments may be made at specified intervals or at the completion of the service. Payments, in some cases, may be tied to the field performance, operating cost reductions, or other important metrics.

These agreements are similar to the production-sharing agreements with the exception of the contractor payment. With a risk service contract, the contractor usually receives a defined share of production (in kind). As in the production-sharing contract, the contractor provides the capital and technical expertise required for exploration and development. If exploration efforts are successful, the contractor can recover those costs from the sale revenues and receive a share of profits through a contract-defined mechanism.

Cost estimation

The approximate cost estimation for Akkas development phases are illustrated in Table 4. The calculations have been made for operating costs, based on the gas price for October 2010.

Workover rig rates will be around $20,000/day.

The annual fixed operating costs for the central processing facility will be in range of $30-40 million/year. In addition, the fixed operating costs for the existing Iraqi pipelines will be $2 million/year. The variable operating costs are 20-30¢/bbl of oil or condensate, and 4.5-7.5¢/Mcf.

Author's assumptions

This article sets out assumptions about Akkas development that the author has derived from poor published data.

The inconsistency between the downhole pressure, reservoir pressure, and the wellhead pressure published numbers is solved by estimation. The possible production rate and plateau is based on a conservative production development scenario. Akkas field shows very high gas rate potential. Further steps should be taken:

• Analyze samples from Akkas wells to evaluate their biomarkers and thereby confirm the oil and gas sources in order to find other oil and gas pays in Akkas and oil and gas fields in the west of Iraq.

• Analysis of local oil seeps has been conducted to find their affinity and the structural relation to Akkas oil and gas fields. It is also possible that they lead to other oil fields that have been charged by oil migration from Mesopotamian basin to structural closures in West Iraq.

• It is important to drill deeper at least in the exploration/appraisal phases to find possible gas accumulations.

It is well known that the Iraq government would like to develop Akkas and is looking for new discoveries in the Western Desert of Iraq. This region has not yet been explored and may hold potential.

The development plan for the use of Akkas gas is more likely to serve the national grid of electricity, future and existing petrochemicals, and other industrial plants. Part of the derivates will be exported. Most likely Iraq will follow the Saudi Aramco plan that uses the gas for development of national industry and demand. Those can multiply the profits from the petrochemicals and other industries of the petroleum resources.

The Iraq government chooses the service contracts for different political and regulatory reasons (like delays or unapproved petroleum law). The long-term service contracts in Iraq are similar to PSAs, the SC is signed without the agreement of the parliaments; it can lead to escalation between IOCs and future governments in Iraq.

In order to have clean and transparent business for all participants, the IOCs should press to have the right regulation and a law to cover legal activities (investment), tax, and environmental issues related to the oil industry in Iraq.

The political turbulence and mismanagement in the country make the development of the oil and gas industry and the country development questionable. There can be no concrete development of oil and gas fields without the parallel development of the infrastructure of the country; without this, turbulence may arise.

The CAPEX for the exploration and development phases and OPEX are simulated with cost simulation taking into account the security factor. Even with high contingencies, still the 4.5-7.5¢/Mcf is low compared with that of other OPEC countries.

The authorMore Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com