Government fiscal policies diverting interest to Norway from UK North Sea

David Valente

Deloitte LLP

London

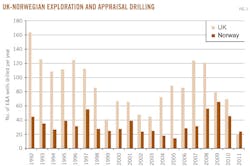

In 2010, a total of 70 exploration and appraisal wells was spudded on the United Kingdom Continental Shelf, 11% fewer than in 2009, and the lowest total since 2003.

While a year-on-year decrease of this size is too small a fluctuation to suggest that levels of drilling activity on the UKCS are in serious decline, this level is below the average for the first decade of the 21st century.

Levels of activity in the first 6 months of 2011 have also been lower than during the same period in recent years. By June 30, 2011, 43% fewer E&A wells had been spudded compared with the same period in 2010. This is lowest midyear total since 2002.

Across the North Sea on the Norwegian Continental Shelf (NCS), the trends in drilling activity are very different.

In 2010, a total of 46 E&A wells was spudded, 20 fewer than during 2009. However, despite this year-on-year decrease of 30%, 2010's total was 28% higher than the average for the last 10 years and towards the end of the last decade levels of drilling activity in Norway reached record highs. In 2009, 66 E&A wells were spudded, the highest number on the NCS to date and, in 2008, a total of 56 wells of this kind was spudded, the third highest level ever recorded.

The declining trend in drilling activity in the UK and increasing trend in Norway can be attributed to a number of factors including the differing maturity of the sectors, the opening up of new areas for exploration in both countries, differing licensing processes, and contrasting government fiscal policies. Herein, we discuss some of these factors and consider the future of oil and gas exploration in both areas with particular focus on the North Sea.

In both the UK and Norway, the majority of E&A activity has been focused on the North Sea. Between July 1, 2010, and June 30, 2011, 78% of E&A wells drilled on the UKCS were drilled in the North Sea and in Norway, 71% of wells of this kind were spudded in the North Sea. As the historic focus of E&A activity, how do the UK and Norwegian sectors of the North Sea compare and what does the future hold for both of these areas?

Sector maturity

Exploration for oil and gas in the North Sea began in the 1960s and since then the UK sector has been the focus of E&A activity.

By June 30, 2011, a total of 3,366 E&A wells had been drilled in the UK sector, an area that covers 130,000 sq km. In the Norwegian sector, however, there has been much less E&A activity. By June 30, 2011, a total of 1,101 wells has been drilled in an area of 150,000 sq km. The UK sector of the North Sea is roughly 10% smaller than the Norwegian sector, but more than three times as many E&A wells have been drilled in the UK.

As well as the large contrast in the number of E&A wells drilled, the two areas currently exhibit vastly different exploration success ratios.

In the period from July 1, 2010, to June 30, 2011, 20 exploration wells were completed in the Norwegian sector and 13 of these successfully discovered hydrocarbons, representing a well success ratio of 65%. A total of 13 exploration wells were spudded during the same period in the UK sector, but only three of these were successful, representing a well success ratio of 23%. While it is important to note that a number of UK wells operated confidential, the well success ratio in Norway is almost three times as high as in the UK.

The North Sea can broadly be described as one geological basin that is divided down its center by the UK-Norwegian median line. Both the UK and Norwegian sectors share similar play types, with exploration potential in the pre-Cretaceous and Tertiary. However, that three times more E&A wells were spudded in the UK sector suggests that the UK is a much more mature area.

The exploration success ratio in the Norwegian sector over the last 12 months was almost three times higher than in the UK sector, which is also representative of the greater level of maturity of the UK. As a less mature province, it could be suggested that a greater amount of exploration potential remains on the Norwegian side of the maritime boundary. This may, in part, be driving the current trends observed in E&A drilling with a decrease in activity in the UK and an increase in activity in Norway.

Government fiscal policies

There is a significant difference in the types of wells drilled in the UK and Norwegian sectors of the North Sea.

In the period between July 1, 2010, and June 30, 2011, only 24% of the wells drilled in the Norwegian sector had appraisal targets. In the UK sector, the proportion of appraisal wells drilled was more than twice as large.

One of the reasons for the large proportion of exploration wells in Norway is a tax rebate system introduced in 2005 whereby companies are able to claim 78% of their exploration costs in a dry hole case. This system aims to increase investment in the NCS and slow the rate of decline in production. This system considerably reduces the risk associated with exploratory drilling and acts as an incentive for companies looking to invest.

The UK government also has tax incentives in place, such as the Field Allowance, which is designed to promote exploration and development of marginal fields in the mature UK sector. In order to encourage their development, fields which hold relatively small reserves, contain heavy oil, have reservoirs that are under high pressure and high temperature (HP/HT), or are in deep water qualify for tax breaks.

Towards the end of 2010, the outlook for the UKCS appeared positive, and these tax incentives were beginning to make companies look to develop fields and explore prospects which, prior to their introduction, were noncommercial. However, a number of alterations made to the UK fiscal regime in the first part of 2011 has severely impacted investor confidence.

In March 2011, the UK government announced an increase in Supplementary Corporation Tax (SCT). This increase was met with significant opposition from the industry, especially given that the decision was unexpected, taken without consultation, and raised the tax level on some more mature fields to as much as 81%. Furthermore, this decision represented just one of a number of changes made to the UK fiscal regime over the last 10 years. These changes have led to the UK being viewed as an unstable oil and gas province and, therefore, a less attractive place to invest.

At the end of the second quarter of 2011, the UK government announced another change to the fiscal regime by increasing Ring Fence Expenditure Supplement to 10% from 6% allowing companies to offset a greater proportion of their expenditure against their taxes. This concession is positive for certain specific companies and projects but is unlikely to be material enough to offset the negative effect that the rate increase has had on confidence generally.

In comparison to the UK, the Norwegian government has maintained a stable fiscal regime coupled with strong incentives to invest. These differing government approaches are very likely to impact drilling activity in the two sectors. However, due to the lead time associated with the planning of E&A wells, it is likely that the effects of the recent tax changes in the UK, if any, will be seen over the next 6-18 months.

The licensing process

The differing levels of maturity of the UK and Norwegian sectors of the North Sea and the effects of recent fiscal changes may go some way to account for the different trends seen in drilling activity over the last decade but the way in which the UK and Norwegian governments conduct licensing rounds has also contributed.

Drilling levels in Norway increased significantly towards the end of the last decade. This increase coincided with the completion of drilling commitments resulting from the Awards in Predefined Areas (APA) scheme.

As well as the traditional biennial license rounds, in 2003, the Norwegian government held the first APA round with the aim of encouraging exploration on the NCS by recycling acreage and attracting new and more diverse companies to the area.

Before the APA process began in 2003, there were 28 companies with interests on the NCS. At June 30, 2011, 58 companies held equity in Norwegian licenses. As well as bringing in new players with fresh ideas, the APA has also been successful in driving E&A drilling. Accordingly, 67% of wells drilled in the Norwegian sector of the North Sea in 2010, and 63% of those drilled in 2011, were located in acreage awarded through the APA process.

These figures demonstrate that not only has APA been successful in making mature acreage available to new companies, but also that these companies believe a large amount of potential still remains in the Norwegian North Sea.

The process of turning over acreage in this way began much earlier in the UK, but in the early part of the last decade the UK government also implemented changes to the way it conducts licensing rounds and introduced two new types of licenses, Promote and Frontier.

Promote licenses have reduced rental fees with the aim of attracting small start-up companies, and Frontier licenses have an extended exploration phase with the aim of giving companies more time to evaluate large areas and identify a greater number of prospects.

As with APA in Norway, Promote licenses were available from 2002 and Frontier licenses were available from 2004. However, the UK's latest licensing initiative has not been as successful at driving E&A drilling in the North Sea. Only 13% of wells spudded in the UK sector in 2010, and 33% of those spudded so far in 2011, were located in Promote licenses.

Drilling activity has increased in the Norwegian North Sea since the awarding of mature acreage through APA began in 2002. The recycling of acreage started much earlier in the UK, and the UK government's latest licensing initiatives have not been as successful at driving E&A activity. The success of APA may help to maintain the current trends of high drilling activity and high exploration success ratios in Norway over the coming years.

From the UK to Norway?

The Norwegian sector is a less mature petroleum province, and record levels of E&A activity have been recorded in recent years.

The Norwegian government has also been very supportive of companies looking to explore, and the introduction of the APA scheme 10 years ago provided a further boost to E&A activity in the sector.

Due to a number of interacting factors, trends in drilling activity can change dramatically over short periods, but a continuation of the current trends, against a backdrop of an uncertain investment climate in the UK and the relative stability of the Norwegian fiscal regime, could signal a shift in focus in the North Sea from the UK to Norway.

The authorMore Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com