Study: 2015 will be pivotal for Asia-Pacific LNG

For LNG in Asia-Pacific countries, 2015 will be a pivotal year, according to a study released earlier this year by London-based GlobalData. Much of the supply from new regional producers and much of the demand from newer regional markets will culminate in 2015, the company's analysis has found.

This will happen after the region has, in the last decade, witnessed an increase in both LNG regasification capacity and LNG imports. Such traditional LNG buyers as Japan, South Korea, and Taiwan dominated regas capacity and trade during 2000-10. By 2015, China and India will have emerged as new LNG buyers in Asia-Pacific and will considerably increase their LNG regas capacity.

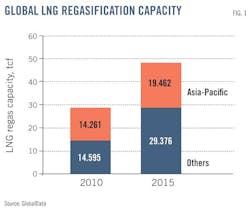

Total regas capacity of Asia-Pacific increased to 28.56 tcf in 2010 from 12.88 tcf in 2000, says GlobalData, an average growth of 10%/year. During 2010-15, LNG regas capacity of Asia-Pacific will increase at 10.5%/year.

Major regional LNG suppliers Indonesia and Malaysia have been seeing an upsurge in domestic demand and modest increase in natural gas reserves during recent years, said the study. These countries will strive to increase the share of gas consumption in their domestic markets that may, by 2015, affect their LNG supply commitments.

Also by 2015, Australia will strengthen its presence as the key supplier of LNG with start-up of multiple LNG projects. The country's total gas liquefaction capacity will increase to 92.1 million tonnes/year (tpy) in 2015 from 20 million tpy in 2010. Papua New Guinea will commence LNG exports by 2015 with start-up of four LNG liquefaction projects.

Total LNG liquefaction capacity of Asia-Pacific during 2010-15 will increase to 179.5 million tpy in 2015 from 86.3 million tpy in 2010, growing at 14.6%/year.

The region's LNG market is dominated by the gas and power companies of Japan and South Korea with large LNG regas capacities, according to the study. Such national oil companies as Malaysia's Petronas have made considerable contribution to total liquefaction capacity. By 2015 international oil companies will increase their share in gas liquefaction.

In 2015, Asia-Pacific's contribution to global regas capacity will decrease to 39.8% from 49.4% in 2010 (Fig. 1). Despite mature LNG markets, such as Japan, South Korea, and Taiwan, accounting for a small increase in regional LNG regas capacity by 2015, large capacity additions during 2011-15 in France, Mexico, Italy, and the US will increase the share of regas capacity of regions other than Asia-Pacific by 2015.

Australia to surpass Indonesia

With several planned liquefaction plants in Australia set to open, that country by 2015 will surpass Indonesia as having the most capacity in the region. In Australia, 12 planned LNG plants will come on line during 2011-15, increasing by 2015 the country's LNG production capacity by 72.1 million tpy.

Chevron Corp.'s Gorgon will be the largest liquefaction plant among those planned with a capacity of 15 million tpy. Planned LNG plants in Queensland in eastern Australia, such as Gladstone LNG, Queensland Curtis LNG, and Asia-Pacific LNG, would use unconventional coalseam gas to produce LNG. These projects have already completed their final investment decisions.

Also by 2015, Asia-Pacific will account for 26% of global LNG regas capacity added. The region will add a capacity of 5.2 tcf during 2011-15 through planned additions and expansions of existing LNG regas terminals. India and China together will contribute about 55% to total planned capacity additions in Asia-Pacific and 13.5% to the global capacity added by 2015.

In India, growing demand for gas from the power and industrial sectors, a constrained domestic supply, and absence of cross-country pipeline import options have mandated LNG imports. In China, to meet rapidly growing electricity demand and reduce high acid-pollution levels, the government has adopted time-bound, goal-oriented policies to increase the share of gas in China's primary energy mix. To achieve that, China since 2006 has been increasing LNG imports, which are likely to continue through 2015.

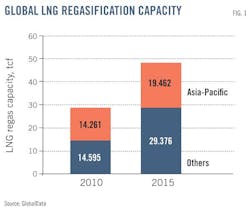

New LNG importing countries will by 2015 make a large contribution to the total capacity addition in Asia-Pacific's LNG regas market, said the study.

The Asian LNG market will witness the entry of new LNG buyers and suppliers by 2015. The growing demand for gas and a limited domestic supply have prompted many southern Asian countries to build LNG regas terminals, which are likely to come on line by 2015. New LNG terminals will commence operations in Pakistan, Bangladesh, Thailand, Vietnam, Singapore, Philippines, Indonesia, and Malaysia. These countries will contribute 33% to the total planned capacity additions in Asia-Pacific's LNG regas market by 2015 (Fig. 2).

Among new Asia-Pacific LNG suppliers, Papua New Guinea will emerge by 2015. It plans to begin building four LNG plants during 2011-15 that will add another 13.1 million tpy to the total gas liquefaction capacity of Asia-Pacific by 2015.

Changes in trade contracts

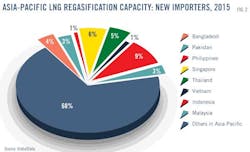

Finally, the study noted that new entrants into the liquefaction market, seasonal demand, and fluctuating energy prices have worked in favor of short-term LNG agreements with more flexible contractual terms. These factors, along with certain opportunities such as surplus LNG capacity from liquefaction plants, the availability of tankers, spare capacity in LNG receiving terminals, and attractive market pricing have made uncontracted supply trade more favorable for the demand side of LNG trade.

Recent developments in global energy markets such as increasing shale gas production in the US and continuing global economic slowdown, have increased LNG supply to Asian markets. It has also bestowed greater bargaining power on Asian buyers looking to increase their spot LNG purchases. It is estimated that the uncontracted capacity in Asia-Pacific will increase to 60.2 million tpy in 2015 from 13.2 million tpy in 2010, reflecting a strong shift towards spot trade (Fig. 3).

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com