Paula Dittrick

Senior Staff Writer

Oil and natural gas executives along with various economists laud the resource and the economic potential of the Marcellus shale play, and a recent Pennsylvania State University study concluded Marcellus production could supply 25% of US natural gas needs by 2020.

The Marcellus gas play is Devonian black shale extending from southern New York across Pennsylvania, and into western Maryland, Virginia, West Virginia, and eastern Ohio. The play covers an estimated 95,000 sq miles.

Researchers from Advanced Resources International Inc. of Arlington, Va., named the Marcellus in late 2009 as having likely recoverable resource of 200 tcf, largest of the top five US shale plays, from an overall Marcellus resource estimate of 2,100 tcf.

Although operators in the Appalachian basin have known the Marcellus formation to be a reservoir rock for more than 75 years, the shale became an important gas play in recent years given energy prices along with advances in horizontal drilling and completion technology, including hydraulic fracturing—which has attracted much attention regarding chemicals used in the fracturing fluid and whether the practice can affect groundwater supplies.

Pennsylvania figures among seven case studies the US Environmental Protection Agency is examining from across US unconventional oil and gas plays regarding potential impact of fracing on drinking water resources. A final report from the EPA's congressionally mandated study is scheduled for 2014.

Fracing questioned

Meanwhile on a regional level, lawmakers and citizens in the Marcellus shale states also have expressed concerns about the large volumes of water required for shale drilling and completions. Water must be recovered and disposed before the gas flows. Public planners and others question the availability of water supplies needed for production and seek details about wastewater disposal logistics.

Kathryn Klaber, president and executive director of the Marcellus Shale Coalition (MSC), said industry has committed to recycling as much water as possible rather than disposing of it through wastewater facilities.

MSC members include 40 oil and gas companies representing 95% of the rigs running in Pennsylvania.

Geologists report the most prospective areas are where the shale is at least 5,000 ft below ground and where the shale is 50-250 ft thick.

Most Marcellus development and production has focused on Pennsylvania and, to a lesser extent, West Virginia. New York state lawmakers and regulators are reviewing environmental assessment procedures and regulations, preventing all horizontal drilling activities in New York at this time.

The pace of Marcellus development in West Virginia is accelerating. A study done by All Consulting LLC for the US Department of Energy forecast 900 Marcellus wells/year will be drilled in West Virginia by 2020 compared with 299 wells drilled in 2008.

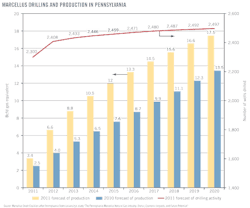

The recent Penn State study, commissioned by the MSC, estimates Marcellus shale production in Pennsylvania will average 3.5 bcfd of gas equivalent in 2011 compared with an average 1.3 bcfed in 2010. This includes dry gas and petroleum liquids.

Production at yearend 2010 in Pennsylvania was nearly 2 bcfd, the report said. The study, taken in tandem with DOE projections released earlier this year, said the shale in Pennsylvania has the potential to produce 17.5 bcfd by 2020, which would be about 25% of US gas (see figure).

The MSC study estimates that by 2020, Marcellus development could support 256,420 jobs and generate $20 billion in added value to Pennsylvania's economy.

The Pennsylvania Department of Environmental Protection reports 1,405 Marcellus wells were spudded during 2010 of which 1,213 were horizontal.

Operators are producing dry gas in the northeastern Pennsylvania counties of Susquehanna, Bradford, and Tioga and wet gas in the southwestern Pennsylvania counties of Greene, Washington, and Butler.

A Marcellus shale advisory commission to Pennsylvania Gov. Tom Corbett said geologists anticipate the number of sweet spots will grow across the central portion of the Appalachian Plateau through Centre, Clearfield, Indiana, and Westmoreland counties.

The Penn State study was the third in a series of reports documenting Marcellus shale development. The latest report said 2010 Marcellus production in Pennsylvania averaged 1.3 bcfd equivalent of gas.

Marcellus producers operating in Pennsylvania told researchers they plan to spend more than $12.7 billion during 2011 compared with $3.2 billion in 2008. Estimates suggest 2011 spending could support 160,000 jobs. Royalty payments are expected to rise to $1.86 billion during 2012 from $346 million during 2010, Penn State researchers said.

Operators upbeat

Range Resources of Fort Worth estimates ultimate recovery of a Marcellus horizontal well averaged 5.7 bcf equivalent based upon the production performance of 103 horizontal wells that came on stream during 2009-10. The 5.7 bcfe EUR averaged 4 bcf of gas and 281,000 bbl of natural gas liquids and crude oil although the gas:liquids ratio varied depending upon well location.

Of those 103 horizontal wells, the lateral length averaged 2,802 ft with nine fracturing stages in the southwest liquid-rich gas area of the Marcellus.

Jeffery L. Ventura, Range president and chief operating officer, said a 35-mile stepout well in Washington County in southwest Pennsylvania proved to be one of Range's best wells. The well tested 18.6 MMcfd on a 5-day test.

Range executives believe Marcellus wells have the potential to produce two or three times as much gas as did the company's former properties in the Barnett shale in North Texas. The Fort Worth independent sold its Barnett shale properties in April.

John H. Pinkerton, Range chairman and chief executive officer, said on July 18, "We have already made up roughly half of the production that we sold. By the end of the third quarter, we expect to have fully replaced all of the Barnett production" through Marcellus shale and Midcontinent region production. Range anticipates its Marcellus production will grow to 400 MMcfd net by yearend 2011 and more than 600 MMcfd by yearend 2012 compared with just over 200 MMcfd at yearend 2010.

Speaking with analysts during March, Pinkerton called the Marcellus region "really three plays in one" because of the potential to produce gas and NGLs from the Marcellus shale, the Upper Devonian shale above the Marcellus, and the Utica shale about 1,000-2,000 ft below the Marcellus.

"A very significant advantage we'll have in developing the Upper Devonian and Utica will be that we'll be drilling where we've been drilling Marcellus wells," Pinkerton said.

He estimates the incremental costs to develop the Upper Devonian and Utica will be reduced by one-third compared with developing those zones on a stand-alone basis. Range already will have "incurred the cost for acreage, roads, surface location, water management, gas lines, and compression."

Chesapeake Energy Corp. entered the Marcellus through its 2005 acquisition of Columbia Natural Resources, a West Virginia gas producer active in the Marcellus since the mid-1990s. Chesapeake, the play's largest leasehold owner with 1.7 million net acres, reported 450 Marcellus wells produced more than 100 bcfe during 2010.

For 2011, Chesapeake plans to drill 300 wells, and the Oklahoma City independent had 33 drilling rigs running in the play during the first half of the year.

Regulatory pressures

Chesapeake Appalachia LLC voluntarily suspended completion operations in Pennsylvania shortly after a well-control incident in Bradford County on Apr. 19. Chesapeake resumed its completion operations during May after providing 700 pages of response documentation to the Pennsylvania Department of Environmental Protection (PDEP).

A failure at a valve flange connection to the wellhead resulted in a fluid discharge. Chesapeake said 240 bbl of a mixture of well fluid and rain water flowed over the top of a containment berm onto nearby land with a limited amount of that entering an unnamed tributary of Towanda Creek.

"An equipment failure of this type is extremely rare in industry and is the first valve flange failure of this magnitude in more than 15,000 wells Chesapeake has completed since its founding in 1989," the company said.

Cabot Oil & Gas Corp. faced regulatory pressure for allegedly causing methane seepage that led to a January 2009 explosion at a Susquehanna County residence.

PDEP ordered Cabot to temporarily shut down operations and demanded that it sign a "nonnegotiable" agreement in which Cabot was to admit responsibility for gas leaks. The company commissioned a study showing the presence of methane in area drinking water before gas drilling began.

During 2011, Cabot surpassed 400 MMcfd of production from the Marcellus shale in northeast Pennsylvania after completing upgrades of the Lathrop Compressor Station that included new compression, new dehydration, and adding a second suction line to the station.

Talisman Energy Inc. has Marcellus shale assets in New York and Pennsylvania. The company holds 223,000 net acres in Pennsylvania having 2,000 net drilling locations. In February, Talisman said it plans to drill 100 net wells in the Pennsylvania Marcellus in 2011.

Most of Talisman's Marcellus wells for 2011 have been permitted, and Talisman said it has secured sufficient pipeline capacity, water access, and disposal services. Talisman had Marcellus production of 315 MMcfd at yearend 2010, up from 65 MMcfd at yearend 2009.

Anadarko Petroleum Corp. was averaging gross Marcellus production of more than 500 MMcfd from 125 wells in late July. Its output in the quarter ended June 30 set a weekly high of 456 MMcfd gross, 116 MMcfd net, from 117 wells.

The company spud 29 operated wells in the quarter with eight rigs, participated in 33 wells with about 15 nonoperated rigs, and reduced quarterly cycle time to 19.6 days from 26.8 days.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com