Iraq's Ahdab oil field development limits contractor profitability

Editor’s note: This article contains material for which attribution is insufficient from Wood Mackenzie’s Ahdab Asset Analysis published by Wood Mackenzie Upstream Service in April 2010.

Muhammed Abed Mazeel

RWE Dea

Hamburg, Germany

An economic analysis for the development of Ahdab field in Iraq under a technical service contract shows that the economic return to the contractor is modest in comparison with other types of contracts used in the oil industry.

But the field has potential for greater returns if uses for the associated gas can be found and oil does not have to be burned to generate electricity.

Ahdab oil field

Ahdab oil field is in a 303 sq km block in Iraq's Wasit province, 180 km (about 112 miles) southeast of Baghdad. The field originally was delineated with 1970s vintage 2D seismic data.

The first well on the structure, Al Ahdab-1, discovered oil in the Zubair formation. This was followed by further appraisal drilling in the early 1980s. Iraq National Oil Co. (INOC) has drilled seven wells on the Ahdab structure.

Currently China National Petroleum Corp. (CNPC) is developing the field in a joint venture with state-owned North Oil Co.-Middle Land Oil Co. under a technical service contract (TSC) concluded in 2008. The contract was the first contract awarded by Iraq's oil ministry to a foreign company.

The equity in the service contract is held 75% by CNPC and 25% by North Oil Co.-Middle Land Oil Co.

The Ahdab development includes not only oil production but also an oil-fired power plant being built by Shanghai Heavy Industries. Plant construction started in 2008 and expectations are that it will be completed in 48 months.

The $940 million plant has a design capacity of 1,320 Mw. An estimate is that the plant at full capacity may need a supply of up to 50,000 b/d of Ahdab crude.

Using crude oil to produce electricity is an expensive alternative and not environmentally friendly. At $80/bbl, the plant would burn $400,000 of oil/day.

Geology

Ahdab field is an elongate anticlinal structure, with two prominent domes oriented along a northwest-southeast axis. The gross structural closure measures 30 km by 5 km.

The proved oil resources are in the Late Cretaceous Khasib and Mishrif formations and the Hauterivian Zubair formation. The possible source for Mauddud formation oil is the Upper Jurassic strata.

The Zubair formation reservoir consists of interbedded quartzitic sands, shales, and siltstones that were deposited in a series of migrating and overlapping delta lobes. This has produced a complex, heterogeneous reservoir, with highly variable net reservoir thicknesses and reservoir quality across the structure.

The Zubair reservoir contains light 34° gravity oil.

The Khasib formation is a chalky limestone. It has moderate and occasionally a good reservoir quality with up to 120-md permeability. This reservoir contains moderately heavy 23° gravity oil.

The Mishrif formation is a limestone with shale of shallow-marine origin. It has an average 14% porosity and up to a 50-md permeability.

The Mishrif formation seal is the Tanuma tight limestone reservoir. Mishrif contains a heavy 14° gravity oil. Sulfur content is 1.9-2.4%; reservoir depth is about 3,500 m.

Mauddud formation is grey colored dolomite and light grey limestone or dolomitic limestone. It has a 10-35% porosity and 10-110 md permeability as reported from various fields. The middle section of the Mauddud formation contains 28.5° gravity oil.

Because these formations produce different crudes, it will be necessary to develop technical scenarios for single and commingled production and for controlling gas coning or water influx as wells as for preventing sand and H2S problems.

To optimize reservoir management in this field, Iraq's Ministry of Oil should decide on the maximum efficiency rate for the wells to ensure efficient and stable production from the reservoirs.

Development plan

Ahdab contains about 1 billion bbl of P50 oil reserves, but my estimate of the recoverable reserves is 670 million bbl based on the 115,000-120,000 b/d contract-term production target starting gradually in 2012 and maintaining a plateau for 20 years.

The 750 bscf of associated gas reserves are considered technical resources because there are no announced plans for their commercial development, in which case the gas likely will be flared or reinjected.

Available gas cap and or associated gas could also fuel a small power plant or find local domestic or industrial uses.

CNPC started its appraisal program in 2009. It completed a 3D seismic survey and has started workover operations and is drilling vertical and horizontal wells.

The use of horizontal wells will reduce the surface impact of the proposed development. This is important because the field lies along the left bank of the Tigris River and is in Iraq's main cereal growing Wasit province.

The Ahdab facilities are about 140 km from Iraq's strategic pipeline. Sources at the oil ministry indicate that the trunkline from the field will tie into Iraq's 42-in strategic pipeline.

Production strategy

The reservoir development plan in the 1997 production sharing contract (PSC) with CNPC, which now has been voided by the Iraqi parliament, set several reservoir targets. These were 25,000 b/d on start-up, 50,000 b/d within 4 years, and peak production of 90,000 b/d within 6 years from the start of production.

If the new 2008 TSC is consistent with the original plan of development, production should be only from the Late Cretaceous Khasib, Mishrif, and Mauddud formations.

The production facilities under the 2008 contract are expected to have a design capacity greater than 100,000 b/d and be built in two phases.

My economic analysis assumes a crude output peak of 120,000 b/d in 10 years from the start of production (Fig. 1).

Costs

In 1997, CNPC estimated a $660 million development cost, which includes $350 million for drilling and completions and about $280 million for processing facilities, piping, and storage.

It also estimated a $280 million operating cost (opex) over the life of the project. This is equal to an average operating cost of $1.30/bbl.

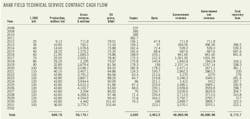

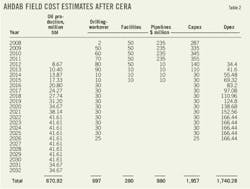

The project costs (Table 1) have increased to a $3 billion capital investment in 2009, which includes the previously mentioned power station, and an additional $1.8 billion in 2010. The power station will be paid out of revenues generated from the sale of Ahdab crude oil.

Total estimated capital expenditures (capex) for developing 120,000 b/d of production is about $3.9 billion or $5.50/bbl. Opex will average about $5.2/bbl.

These values are greater than expect if the calculations were based on CERA international cost estimates.

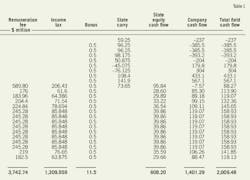

Table 2 shows the cash flow calculations based on CERA cost estimates. The estimates show an average capex at about $2.9/bbl and average opex at about $2.6/bbl. The addition of a conservative 15% for contingencies and a 10% escalation increases the cost estimate for capex to $3.60/bbl and opex to $3.25/bbl.

Economics

My estimates of Ahdab field costs are based on Iraq's 2009 model technical service contract (TSC) as illustrated in Table 1. The key remunerative element of the TSC is a service fee consisting of petroleum costs and remuneration fees.

Cost recovery is on a dollar-for-dollar basis, subject to a service fee cap equal to 50% of petroleum revenues. The remuneration fee is payable to the contractor for the amount of oil produced, on a $/bbl basis.

The maximum remuneration fee decreases according to the ratio of cumulative revenues to cumulative costs (R-factor). The remuneration fees are:

• $6/bbl for R-factor less than 1.

• $5.40/bbl for R-factor of 1-1.5.

• $4.90/bbl for R-factor of 1.5-2.

• $3/bbl for R-factor greater than 2.

The contractor is liable for a corporate income tax at a rate of 35%. The calculation of net taxable profits is the annual aggregate of the remuneration fee actually received.

The calculation of the cash flow assumes the following:

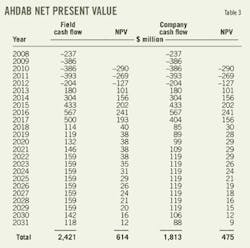

• Nominal 10% discount rate.

• Discount date of Jan. 1, 2010.

• 2% long-term inflation from January 2010.

• An Ahdab crude price of Brent less 2.5%.

• CERA Brent price of $81.28/bbl in 2011, $87.85/bbl in 2012, $91.69/bbl in 2013, $94.94/bbl in 2014, $98.86/bbl in 2015, $102.56/bbl in 2016, and $104.44/bbl in 2017.

• Wood Mackenzie Brent price of $77.63/bbl in 2010, $84.50/bbl in 2011, $80/bbl in 2012, $74.28/bbl in 2013, $75.77/bbl in 2014, $77.29/bbl in 2015, escalating at 2%/year thereafter. This equals a long-term assumed oil price of $70/bb in real terms (2010).

The internal rate of return (IRR) takes into account the timing of cash flows from Ahdab contract period. IRR is the discount rate at which the net present value of a project equals zero.

In 24 years, a compounded 10% annual interest rate will multiply an original investment by a factor of 10 and decrease cash received by a factor of 10.

Table 3 shows the sum of Ahdab net present value (NPV) of the cash flow.

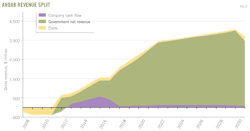

Profit oil is the net revenue/production after the deduction of tax, bonus, etc. Profit oil is divided between the international oil company and host government.

The portion of the profit oil allocated to the company usually is negotiable and stipulated in the agreement. The basis of the split varies in different countries and may differ even within the same country, depending on prospects in an area, fiscal regime, and production level. The split could be at a flat rate or on a sliding scale.

Fig. 2 shows the split between CNPC, costs, and government.

The price sensitivity analysis for the remaining present value calculation after tax is between –20% and +20%. The production will gradually increase as will the oil price, capex will decrease, and opex will have a slight decrease or remain the same.

This results in a present value after tax of about $650 million-1,100 million for the project.

Acknowledgment

This article presents the author's views and is unrelated to his work at RWE Dea.

The author

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com