IEA: Refinery investments set for 2012 rebound

Following a slowdown in refining capacity investments this year, next year will see a slew of refinery projects completed, the International Energy Agency said in its latest monthly oil market report.

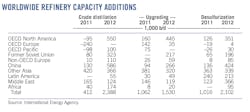

IEA finds that as much of 2.4 million b/d of crude distillation capacity will be added worldwide during 2012. Most of this investment will occur in developing Asian countries. China will add 586,000 b/d of crude distillation capacity next year, or 25% of the world's total additions.

Global distillation capacity additions of only 412,000 b/d this year have provided some respite for refiners, the agency said. With annual worldwide oil demand growth forecast at 1.2 million b/d, surplus refining capacity should shrink and result in better margins for refiners.

OECD capacity changes

North America will add 550,000 b/d of crude distillation capacity in 2012 following this year's 95,000 b/d contraction. Member countries of the Organization of Economic Cooperation and Development (OECD) posted 3 years of net capacity reductions, but 2012 will reverse that trend, IEA said.

Mexico's 150,000 b/d expansion at Minatitlan is expected to come on line next year, and Motiva's 325,000 b/d expansion at Port Arthur will make it the largest refinery in the US and one of the top 10 in the world.

IEA forecasts that OECD Pacific countries will combine for a 100,000 b/d increase in crude distillation capacity next year. No change is expected in OECD Europe next year following this year's 240,000 b/d decline in capacity.

So far only Royal Dutch Shell PLC's Harburg refinery in Germany and its Clyde refinery in Australia are the only 2012 closures included in IEA's analysis.

Non-OECD capacities

This year's non-OECD capacity additions are dominated by India, which IEA says will account for 400,000 b/d.

Key projects in India include the expected commissioning of Bharat Oman's 120,000 b/d Bina refinery and HPCL-Mittal Energy Ltd.'s 180,000 b/d refinery in the third quarter, plus an 80,000 b/d expansion of Essar's Vadinar refinery in the fourth quarter.

In China, only small expansion projects will be completed this year following several years of substantial capacity growth, but China National Petroleum Corp. participated in Chad's first refinery, which is outside N'Djamena and started up this month with 20,000 b/d of capacity, IEA said.

The agency's figures show that desulfurization capacity additions in China next year will total 424,000 b/d, up from this year's 136,000 b/d in added capacity.

In the Middle East next year, crude distillation capacity growth will slow to 124,000 b/d from this year's 165,000 b/d, but desulfurization projects will surge with the addition of 366,000 b/d of capacity vs. this year's 123,000 b/d of added capacity.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com