SPECIAL REPORT: Conditions improving for floating LNG production

John Vautrain

Purvin & Gertz Inc.

Singapore

Christopher Holmes

Purvin & Gertz Inc.

London

Historically LNG has relied on a small number of land-based production and regasification sites, but this is changing. As more remote and deeper water gas resources have been identified, the limits of land-based LNG production have come into greater focus.

Floating LNG (FLNG) technology holds promise economically to open new areas to production.

FLNG

In this article we will focus on three key issues related to capital cost, modularity, and the insurance attributes of FLNG installations. Capital cost and modularity provide key advantages that support selection of FLNG over land-based LNG installations when the conditions are right. Insurance is a potentially important area that could contribute to decisions on scale and modularity of the FLNG installation chosen.

We believe the capital cost of FLNG is not always a hurdle. Depending on the situation, FLNG can be less costly than land-based LNG development.

The modular aspect of FLNG technology offers the ability to redeploy expensive assets at appropriate times in the overall project life, thereby achieving capital efficiency. Modularity can improve the economics of FLNG installations by reducing capital employed at key times.

Insurance is a potential stumbling block for FLNG, since no such installation has ever been insured. We have investigated insurance-industry attitudes toward FLNG and determined that insurability may be a function of scale, something to be considered in developing FLNG projects.

Capital cost

Fig. 1 shows the two alternatives considered.

In conventional LNG development, an offshore gas field is developed through an FPSO at the production site. The FPSO recovers condensate and LPG and dehydrates the gas for export via a subsea pipeline to onshore LNG production.

The FLNG option combines the functions of the FPSO and LNG production onto a floating vessel at the production site. Condensate is exported from the FLNG vessel in addition to LNG. In the event LPG is produced, that too would be loaded from the FLNG vessel.

FLNG is most appealing when the export pipeline would be particularly long or costly. In those cases the capital cost savings achieved by avoiding the requirement for the export pipeline along with the FPSO are sufficient to offset the extra capital and operating costs associated with FLNG.

The costs of gas pipelines to LNG production ashore can be substantial. For remote offshore locations the cost of a gas export pipeline to the shore-based LNG production can add perhaps 40% or more to the cost of the LNG plant. Avoiding this cost in favor of FLNG can provide attractive increases to the project's economic returns.

Some gas resources have been discovered for which export pipelines may cross seismically active areas. Risk is associated with such lines in the event of an earthquake that causes lateral displacement across the line.

Table 1 shows the capital costs of a 4 million tonne/year (tpy) shore-based LNG plant and two cases of FLNG for the same capacity. The field production costs are equal for these examples.

Costs for the FPSO and export pipeline, however, are not incurred in the FLNG cases. The export pipeline in this example is estimated for 600 km (about 373 miles) to shore. Laying large-diameter export pipelines in deep water and possibly seismically active zones is quite expensive; the estimated cost in this example is $2.5 billion (about $6.7 million/mile).

The capital cost advantage for FLNG does not entirely depend on a costly export pipeline. In this example even excluding the pipeline costs, FLNG costs are comparable or slightly lower than onshore costs. That difference is attributable to the cost savings of not requiring a separate FPSO, offsetting the higher costs of the FLNG vessel as compared with the onshore LNG plant.

FLNG vessels incorporate functions of the FPSO and the shore-side LNG production into one vessel. Large-hull sizes are required not only to provide deck space for gas liquefaction and other functions but also to provide needed LNG and condensate storage. The footprint for the required processing and living quarters establishes the overall hull outline. The hull depth is a function of the need for storage and for strengthening the hull.

In the examples above the hulls are quite large. For the smaller, 2-million-tpy FLNG vessels, the hull's overall length (LOA) may be about 320 m, on the order of a very large crude carrier. Storage would be required for more than 200,000 cu m of LNG. Ability to store sufficient LNG and condensate is critical in the sizing of the vessel.

The larger, 4-million-tpy FLNG vessel would be considerably larger and provide substantially more storage. But the LOA of this vessel may be as much as 500 m, considerably larger than a VLCC. Many shipyards will be able to accommodate the smaller FLNG vessels as opposed to the larger vessels, construction of which will pose difficulties.

FLNG technology is under active development. Generic designs from several technology providers may be suitable for the smaller FLNG size presented above. Design at the larger scale is less well developed. Consequently technology risk associated with scale-up will be higher and more time may be required to develop the larger FLNG scale. Offsetting the scale-up risk and time, economy of scale would tend to make larger FLNG trains more cost-effective up to limits imposed by the hull.

The cost of a floating LNG vessel often is higher than the corresponding cost of shore-side LNG production of the same capacity. That is attributable to the requirement for a hull as well as the need for more compact designs. The cost of the 4-million-tpy production vessel in the example is about $300 million higher for FLNG of the same capacity. Overall capital cost savings of $3.4 billion are possible with FLNG in lieu of onshore LNG in this example. Installing two smaller FLNG vessels carries higher capital cost than the single FLNG vessel option.

Scale, modularity

The optimal design is not always the cheapest. For this example we have shown an option of two independent FLNG units sized at 2 million tpy, each needed to achieve the required overall capacity. Economy of scale in the LNG facilities makes the multiple-unit option considerably more expensive than the single FLNG option by $800 million, but still less expensive than the onshore option.

How could the greater capital cost of the multiple FLNG vessels be justified?

Two key factors bear consideration when selecting FLNG unit size:

• The ability to scale the FLNG production unit over time to match the required capacity.

• The ability to insure the FLNG unit.

In Fig. 2, the 4-million-tpy LNG rate is maintained for 7 years. Field and market development requires 3 years and after Year 10, production decline begins. The first LNG vessel would begin production in Year 1, whereas the second vessel is not required until Year 3. After Year 14 the second vessel can be relocated to production duties elsewhere.

While the maximum capital employed in the case of two LNG vessels is higher than the capital employed for one larger vessel, the efficiency achieved by being able to relocate the one vessel to new production duties offers overall savings and optimal returns.

The opportunity to redeploy capital in response to natural production decline is valuable. This attribute of FLNG technology facilitates monetizing smaller gas resources particularly in the 3-tcf and smaller range.

Insurability

A second advantage of using smaller FLNG vessels is insurability.

Insurance is important and insurance companies, while generally familiar with the FLNG concept, have not yet faced the task of actually writing policies for FLNG. Despite FLNG technology having elements of novelty, the key concern is the attitude of the insurance market toward offshore risk in general and the capacity of the offshore insurance market to absorb that risk. These factors tend to support use of smaller FLNG vessels.

Many insurance companies organize themselves into the upstream and downstream segments. The upstream segment insures offshore and floating facilities. The downstream segment would insure onshore LNG plants and the like.

Insurance for offshore gas developments and FPSOs is very common and is not a factor relevant to determining whether to pursue floating or onshore LNG. Likewise, insuring onshore LNG plants is common, and insurers well understand the risks. Insurance issues distinguishing FLNG and onshore LNG can be identified as the gas export pipeline in the case of the onshore plants and the FLNG vessel itself in the FLNG option.

Depending on location, the gas export pipelines may present unusual technical features and challenges requiring unusual insurance considerations. Deepwater pipelines are common in the Gulf of Mexico and the number of vessels capable of laying the lines is increasing. Nevertheless, the technology is still relatively new. In locations with unusual seismic features or bottom conditions, deepwater pipeline considerations will increase.

Insuring deepwater pipelines is likely to appeal to only a narrow segment of the insurance industry. Insuring such lines in the presence of unusual technical or seismic features is likely to narrow the field and increase insurance costs further. Nevertheless, we consider it probable that in even difficult cases such insurance could be obtained.

The FLNG vessel will pose its own insurance problems. The estimated maximum loss (EML) for an onshore LNG plant can be determined by indentifying single events that might inflict the most damage on the plant. Loss of LNG containment leading to vapor cloud explosion is such an event. Designers of onshore LNG plants can mitigate the effect of such an event by providing spacing between equipment so that the EML of the plant might be 30% of the plant cost. In the hypothetical case that an onshore LNG plant will cost $5.5 billion, the EML might be estimated at $1.65 billion.

For an FLNG unit, the EML is higher. EML for an offshore structure typically is considered to be 100%. In the case of an FLNG vessel, the insurers would consider the possibility that the vessel suffer sufficient calamity to cause it to sink.

The ability of individual insurers to accept risk for any one calamity is limited. That is, the insurers have a maximum amount of money they are allowed to put at risk at a single facility. In the hypothetical circumstance described above, an insurer would consider that $1.65 billion is at risk on the $5.5 billion facility. If a particular insurer has a limit of $200 million, then it could accept about one eighth of the risk on the facility and would need to find syndicate partners to accept the remaining seven eighths.

In the case of FLNG unit, if the overall capital cost of a unit is $5.8 billion, then that same insurer might find that it could accept only 3.4% of the overall project insurance and would need to find syndicate partners to accept the other 96.6%, a far more difficult proposition.

Furthermore, the capacity of the offshore insurance industry is limited to perhaps $3-3.5 billion/calamity. The requirement to insure a risk of $5.8 billion probably exceeds the capacity of the industry. More insurance capacity might be developed to handle such a risk but developing such capacity is costly.

In the case of the dual LNG vessels, the overall insurance requirement is larger at $6.6 billion. But the maximum calamity to be insured is $3.3 billion, since single events causing both vessels to sink are highly improbable. The need to expand the capacity of the insurance industry is far smaller than in the case of one larger FLNG vessel.

In practice the insurer would need to consider not only the loss of the facility but also the business interruption loss as well. In that event, if the required insurance were to exceed the maximum underwriting capacity of the market, then the facility might be uninsurable.

The novelty of the FLNG technology is a negative factor from an insurance point of view. Some insurance companies may be reluctant to participate in FLNG insurance until an FLNG unit has been operating for several years. Consequently the insurance capacity available from existing underwriters may be less than the $3-3.5 billion estimated above in early years of FLNG technology operation.

We believe that FLNG units would be insurable, but the capacity and willingness of the offshore industry to underwrite the insurance could be limiting. Larger FLNG vessels may be so costly that the need to increase insurance industry capacity may make securing insurance so expensive that the insurance cost would become a material factor favoring smaller, multiple units.

Overall liquefaction costs

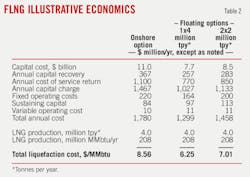

Table 2 illustrates overall economics for the three options considered.

Capital recovery for each case is assumed to occur over a 30-year operating life. As discussed above, the operating-life assumption for FLNG can carry less risk than for onshore options since the plant can be relocated in the event that gas reserves are depleted.

Invested capital requires a cost-of-service rate of return. In practice the rate of return is a function of the capital structure and includes debt and equity components and is charged against the undepreciated part of the invested capital. In this example, we assigned a 10%/year return on the total invested capital to represent a utility rate of return. The total capital charge is the sum of the capital recovery and the cost-of-service return portion.

Ongoing costs must be recovered. These include both fixed and variable operating costs as well as sustaining capital. Sustaining capital is an allowance for capital replacements of operating items which are necessary to continue operations. Sustaining capital excludes investments for new capacity.

Total annual costs include all the components above. Dividing total annual costs by the annual throughput provides the full costs of liquefaction.

In this example FLNG production offers superior economics compared with onshore LNG production. Avoided costs of the FPSO and export pipeline were keys in favoring FLNG. Larger scale FLNG vessels are favored over smaller versions on grounds of cost of liquefaction, but smaller vessels have advantages from insurance and modular-unit-redeployment point of view.

Of course these results will not be universally favored. As the scale of the LNG installation increases, the attractions of FLNG are considerably less. Nevertheless, FLNG will find its place in LNG production and contribute beneficially in the right circumstances.

The authors

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com