Special Report: Capital budgets to rise this year in North America and worldwide

Marilyn Radler

Senior Editor-Economics

Capital expenditures for oil and gas projects in the US will increase 5% this year, according to OGJ's annual spending report. Upstream, midstream, downstream, and corporate capital outlays will total $284 billion. The pace of growth has slowed following last year's rebound from a drop in 2009.

Oil and gas capital expenditures also will climb in Canada this year, up 3.7% to $52.6 billion. This compares with 37% growth in spending for such projects last year.

In Mexico, Petroleos Mexicanos plans a 9% increase in capital spending this year. And outside North America, oil and gas capital expenditures are forecast to remain strong, also climbing from a year ago.

US upstream spending

Capital outlays in the US this year for all upstream projects will total $258.9 billion, compared with $245 billion last year.

Most of this year's expenditures will go toward exploration and drilling, the remainder to production. No Outer Continental Shelf (OCS) bonus is forecast due to the suspension of activity in the Gulf of Mexico.

As of presstime, OGJ does not expect that the Bureau of Ocean Energy Management, Regulation, and Enforcement will conduct any lease sales during 2011, which would be the first year without a Gulf of Mexico lease sale since 1964.

In 2010, the agency's forerunner, the Minerals Management Service, held one lease sale in the Gulf of Mexico. It generated $1.3 billion in bonus payments, compared with the $801 million in bonus payments from two Gulf of Mexico lease sales held in 2009.

A recent study by Wood Mackenzie, sponsored by the American Petroleum Institute, found that aside from the loss of oil and gas production, the current suspension of permits to drill in the Gulf of Mexico could put at risk $70 billion in investment and $18 billion in government revenue between 2011 and 2022 (OGJ Online, Jan. 25, 2011).

In 2009, capital spending sank as a result of the drop in demand for oil and gas during the economic recession. US upstream budgets that year included $175 billion for exploration and drilling, $33 billion for production capital outlays, and $801 million in OCS bonus payments for the two lease sales.

The number of wells drilled in the US declined in 2009 to about 33,830 from 56,550 in 2008, according to API. In 2010, the number of wells drilled rebounded somewhat to 37,892.

OGJ's forecast of 2011 activity assumes that the number of wells drilled in the US will grow 4% from last year. The forecast also assumes that the average cost of drilling an oil or gas well, after dipping in 2009, will climb for the second year in a row.

Other US spending

Total capital expenditures for all other projects in the US this year, including refining, pipelines, and LNG, will decline by 2.5%, OGJ forecasts. Spending in some categories will increase, though.

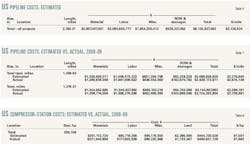

Natural gas pipeline projects will account for a large portion of capital outlays in the US this year. Plans call for construction of 1,480 miles of gas lines in 2011, according to OGJ's Worldwide Pipeline Construction report (OGJ, Feb. 7, 2011, p. 110).

Capital expenditures for the projects, including pump stations and compressors, will total $5.3 billion. This represents a 75% jump in capital outlays for gas pipelines from 2010.

This year's expenditures for crude and products pipelines in the US will decline 84% to $1.4 billion, as plans call for the construction of 483 miles of these lines.

Gulf LNG Energy LLC, owned by El Paso Corp., Crest Group, and Sonangol USA, this year will complete construction of its LNG terminal at Pascagoula, Miss. The total cost of the project was $1.1 billion. The work included two storage tanks with combined capacity of 6.6 bcf. Send-out capacity is 1.3 bcfd.

Other LNG projects recently have been completed, including expansions at Sempra Energy's terminal at Hackberry, La., and at the Southern LNG Elba Island, Ga., terminal.

All other transportation, mining, petrochemical, marketing, and corporate capital spending is expected to be little changed from 2010 as companies concentrate on development elsewhere.

US refining outlays

Capital spending this year at US refineries will fund some large growth projects, maintenance, and all other projects and will total $9.2 billion, climbing 74% from last year.

Valero Energy announced a preliminary capital spending estimate of $2.9 billion for 2011, an increase from its prior plan of $2.6 billion as it will install new hydrocrackers at its Port Arthur, Tex., and St. Charles, La., refineries sooner than originally scheduled.

Valero increased its 2011 budget given the benefits of a new tax law allowing full depreciation this year on capital projects. The company said it has accelerated spending on economic-growth projects, thereby increasing its spending in 2011 by $300 million before the cash-tax benefits that may offset the increase in spending.

The 2011 capital spending estimate also incorporates several major turnarounds in the first quarter and the early part of the second quarter, including reliability investments for a revamp of its St. Charles refinery cat cracker and replacement of coke drums at its Port Arthur refinery, Valero said.

Meanwhile, the 325,000 b/d expansion of Motiva's refinery in Port Arthur, Tex., is scheduled to be completed in early 2012. With a total capacity of 600,000 b/d, this will be the largest refinery in the US.

Canadian E&P, oil sands

Capital expenditures this year in Canada for conventional oil and gas exploration and production will rise 3.1% to $33.5 billion (Can.), up as a result of a rebound in the number of wells drilled.

OGJ forecasts the capital spending for development and upgrading of Canada's oil sands this year will total $15 billion. The Canadian Association of Petroleum Producers (CAPP) estimates that industry capital spending for oil sands development in 2010 was $13 billion.

In 2009, oil sands expenditures declined to $11.2 billion (Can.) from a 2008 peak of $18.1 billion (Can.), according to CAPP.

Construction of oil sands development projects—including the Kearl project, jointly owned by operator Imperial Oil and ExxonMobil Canada—will account for a large portion of this year's capital spending in Canada.

The first phase of the Kearl project is targeted to start up in late 2012, with initial output of about 110,000 b/d, according to Imperial. One mine is planned for the project life of more than 40 years, taking production capacity up to 345,000 b/d, but current plans do not include any on-site bitumen upgrading facilities. The project team is evaluating its refining options, including possible integration with North American refineries owned by Imperial and ExxonMobil.

The Jackpine Mine at the Athabasca Oil Sands Project was completed last year, adding capacity of 100,000 boe/d to the existing Muskeg River Mine capacity of 155,000 boe/d. But once the expansion of the Scotford upgrader is on line early this year, production there will rise toward capacity.

Canadian Oil Sands Trust, the largest joint venture owner of Syncrude, announced that its capital costs will total about $930 million (Can.) in 2011, including $620 million for major projects and the remainder for regular maintenance of the business and other projects.

Suncor Energy Inc. announced a $6.7 billion (Can.) capital spending plan for 2011, with $4.18 million allocated to oil sands operations.

About $2.8 billion of Suncor's total budget will fund growth projects, primarily at the company's oil sands operations, while $3.9 billion in spending is targeted to sustaining existing operations, including planned maintenance to support reliability and further deployment of new tailings reclamation technology, Suncor said.

The majority of growth spending will be directed toward expansion of Suncor's Firebag in-situ oil sands facilities. Firebag Stage 3 is slated to begin production late in the second quarter of this year, ramping up toward capacity of 62,500 b/d of bitumen over about 24 years.

Suncor also is directing 2011 growth spending toward the Fort Hills oil sands mining project and resuming construction of the Voyageur upgrader, two key elements in the company's longer-term growth strategy.

While Suncor's primary growth focus remains on its large oil sands resource base, 2011 growth spending of $1.1 billion is planned for development outside Canada and offshore operations, and $90 million is allocated to renewable energy projects.

Other Canadian expenditures

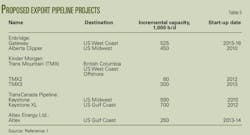

A decline in pipeline construction will outweigh a large increase in spending at refineries to result in a collective decrease in 2011 midstream, downstream, and corporate oil and gas capital expenditures in Canada.

OGJ's Worldwide Pipeline Construction report finds that plans call for 149 miles of natural gas pipelines and 236 miles of crude and products pipelines to be laid in Canada this year. Total capital spending for all these pipeline projects will be $865 million (Can.).

In 2010, plans called for the construction of 627 miles of new natural gas pipelines and 409 miles of crude oil and products pipelines in Canada. These projects are estimated to have cost a combined $2.8 billion.

Capital spending this year at Canadian refineries will total $1.7 billion, a 70% increase from a year ago. Petrochemical expenditures are also expected to climb to $50 million from $40 million last year, while marketing outlays are unchanged at $500 million.

All other capital spending in Canada including other transportation and corporate expenditures will increase by about 20% from last year.

Spending elsewhere

This year Pemex plans capital spending of $22.2 billion, up from 2010 outlays of $20.4 billion. Of the total, the company said it has allocated 85% to upstream projects, including maintenance.

In its most recent E&P spending survey, released in December, Barclay's Capital found that outside North America, upstream capital spending budgets will rise 12% this year to $363.3 billion. This is based on the investment bank's survey of 141 companies (OGJ, Jan. 3, 2011, p. 20).

Among the companies in its survey, Petrobras will spend $28 billion this year in upstream capital outlays, up from 2010 E&P spending of $24 billion, Barclay's estimates. This increase is driven by the company's expansion in deepwater activity, most notably development of Tupi field.

Barclay's also estimated that Ecopetrol will boost its 2011 E&P spending by 14% to $5.14 billion and that Petroleos de Venezuela will increase its upstream capital expenditures this year by the same percentage to $4.5 billion.

Middle East, Caspian markets

Research and analysis firm Infield Systems in January released its Offshore Middle East & Caspian Sea Oil & Gas Market Report to 2015, which finds that Iran and Saudi Arabia will drive offshore capital spending in the Middle East and Caspian region from 2011-15.

Infield Systems expects a 33% increase in offshore capital spending in the Middle East and Caspian to $39.9 billion over the period compared to 2006-10. Much of this growth will be driven by an expected $6 billion increase in Iran to around $12 billion.

Capital expenditures in Saudi Arabia will reach $5.8 billion over 2011-15, up from $4.5 billion over the previous 5-year period. Combined, Iran and Saudi Arabia will contribute 44% of total offshore capital outlays in the region between 2011 and 2015, according to the report.

Capital spending in Qatar is expected to drop markedly during 2011-15 period compared to the previous 5-year period, perhaps a reflection of the moratorium until 2014 on further development of North Field, the report said.

Israel also is expected to become a steady contributor to the regional offshore oil and gas scene during the forecast period, largely through new offshore gas projects in the eastern Mediterranean Sea, including some deepwater developments, Infield Systems said. Just over $2 billion is expected to be spent in Israel over the next 5 years, compared to $272 million during 2006-10.

Azerbaijan, the largest oil and gas producer in the Caspian Sea, is expected to continue headlining capital expenditures in this region, the report said, and Kazakhstan, Russia, and Turkmenistan are expected to contribute $1.6-2 billion in expenditure each over the forecast period.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com