Andy Clifford

Saratoga Resources Inc.

Houston

Elizabeth Goodman

Saratoga Resources Inc.

Covington, La.

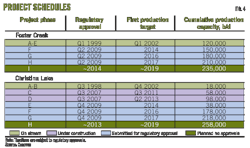

Part 1 of this article described the play concept and evaluation techniques for shallow gas in Grand Bay field in southeast Louisiana and gave examples of field analogs (OGJ, Dec. 6, 2010, p. 68).

Part 2 will show a specific case study from Grand Bay and Main Pass 47 fields, including reprocessing of Saratoga's proprietary 3D survey, cased-hole logging, and examples of specific prospects and well economics.

Numerous shallow gas prospects have been identified at Grand Bay with potential for up to 50 bcf of undeveloped, shallow Plio-Pleistocene gas that will be targeted through recompletions and with the drillbit in the next 2-3 years.

Grand Bay field history

Saratoga Resources has documented a large number of these shallow gas plays at Grand Bay, some of which have confirmed gas pays from existing well control to match the seismic anomalies.

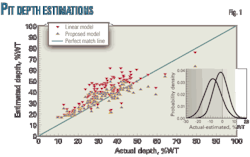

Fig. 1 is an arbitrary 3D line across Saratoga's Grand Bay field showing numerous seismic amplitudes associated with multiple shallow gas sands, some of which have been logged, some completed, and others untested.

Grand Bay field is located in Plaquemines Parish, La., 60 miles southeast of New Orleans, east of the Mississippi River in the Mississippi Delta in as much as 6 ft of water. The field has produced approximately 213 million bbl of oil and 262 bcf of gas since its discovery in 1938. The field's production to date has been from 64 productive horizons, ranging in depth from 1,600 ft to 13,000 ft.

Naturally occurring natural gas seeps have long been known to exist at Grand Bay and other fields in southeastern Louisiana. Fig. 2 is a photo taken in December 2009 of such a seep located in the heart of the field close to Tank Battery 12.

Grand Bay 3D seismic

A high quality, proprietary 3D seismic survey was shot in late 1994 by Eagle Geophysical for Greenhill Petroleum with an OPSEIS Eagle recording system.

The data were acquired using dynamite with 50-ft shot holes with 5 lb of Pentolite. There was a brick pattern of shots and rammed marsh phones with 471 lines by 423 traces, covering 90 sq miles and giving nominal CDP fold of 4,600%. The average far offset is 24,500 ft.

Greenhill deliberately shot the data in a SW-NE orientation in order to better image the fault pattern in the field, which generally runs in a NW-SE direction. Because of existing field infrastructure, including facilities, wells, and flowlines, acquisition of 3D seismic data over the heart of the field was compromised, and as a result the CDP fold of the data is lower compared to the data around the flanks of the field.

The data were originally processed by Geco-Prakla. Data were binned to 122.87 by 122.87 ft. Velocity analysis was done on a ½-km grid. Processing included the following:

- 3D surface consistent statics.

- 3D DMO and NMO.

- 3D Flex Binning to achieve CDP fold of 6,000%.

- One pass 3D migration.

- FXY noise attenuation.

The Greenhill 3D survey appears to be close to zero phase with a frequency range up to approximately 60 Hz and an average frequency of 15 Hz.

A second, speculative 3D survey was acquired by Western Geophysical covering Grand Bay field as part of a larger regional survey in 1998. These data were reoriented from Greenhill's orthogonal orientation to a north-south direction, which is less than optimal for fault delineation and data capture in the field.

The Western 3D survey was processed using parameters for common offset rather than Kirchhoff and, more importantly, is 120° out of phase relative to the earlier Greenhill survey.

Grand Bay field and rights to the Greenhill 3D dataset were acquired in mid-2005. Saratoga reprocessed the Grand Bay 3D data in early 2008 to enhance the data at all levels, sharpen fault definition, and emphasize seismic amplitudes.

The reprocessed 3D has much better definition of faults, which assists with directional development wells targeting attic reserves at conventional depths. Reprocessing products include Pre-Stack Time Migration Relative Amplitude Processing (PSTM RAP), Similarity Cube, Offset Stacks, Angle Stacks,and Prestack Kirchhoff Time Migrated CDP Gathers.

The Greenhill 3D seismic data, as originally processed, were never adequate to show the possible presence of shallow Plio-Pleistocene gas accumulations.

Because of the known presence of shallow Plio-Pleistocene gas discoveries to the immediate north of Grand Bay, Saratoga wanted the ability to tie directly into analogs such as the Commerce gas wells at Coquille Bay, 8 miles northwest and Badger's gas wells at Main Pass 47 at 2 miles to the north (described in Part 1 of this article).

Fig. 3a shows a 3D arbitrary line through the QQ-15 well derived from the original 1993 processed data.

Because of the heavy muting and the poor continuity of seismic reflectors, it is extremely hard or impossible to see any amplitudes associated with shallow gas.

Fig. 3b shows the same 3D arbitrary line as Fig. 3a but derived from Saratoga's 2008 reprocessed data. Note the strong amplitudes above 0.600 sec TWTT, especially around the QQ-15 well. Better continuity of shallow reflectors and cleaner definition of faulting are also evident when comparing Figs. 3a and 3b.

Saratoga now has a data set that defines this shallow gas as being amplitude associated, as it ties to several analogs across the field and in surrounding areas. Saratoga's reprocessing of the Grand Bay 3D seismic clearly showed the location of a number of shallow gas sands that could be targeted for future drilling and-or recompletions in existing wellbores.

SE Baptiste prospect study

One of the best amplitude anomalies coincided with the SE Baptiste Prospect.

The QQ-15 well had been drilled to a total depth of 10,300 ft in 1968 with cumulative production of over 140,000 bbl of oil plus 2.3 bcf of gas from three deeper sands (29M, 19, and 10B sands) until November 2008. The existing logs began at a depth of 2,544 ft.

The amplitude at the 1,550-ft sand level appears to be masked by shallower amplitudes at the 1,200-ft, 1,050-ft, and 800-ft levels (Fig. 3b). There could also be a low-velocity sag underneath these sands caused by shallower gas, affecting the apparent depth of the 1,550-ft sand to the SW of the well.

The 1,050-ft sand may also be absorbing seismic signal, thus masking the amplitude at the 1,550-ft sand. This gives stronger credibility to the 1,050-ft sand having enough gas to actually cause this phenomena and not just low-saturation "fizz" gas, and allows for a greater areal extent of amplitude for the 1,050-ft amplitude. This masking was taken into account when the extent of the 1,550-ft sand was calculated. The areal extent of the seismic amplitude varies from 130 to 260 acres, depending on which seismic attribute is used but could be as large as 600 acres.

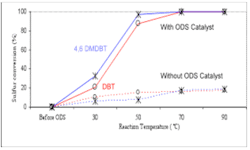

Part 1 of this article explained the application of amplitude variation with offset (AVO) and the presence of AVO anomalies in the shallow Plio-Pleistocene section.

An AVO analysis of the amplitudes around the QQ-15 well showed strong increased amplitude vs. offset (Fig. 4). The 1,550-ft sand is highlighted by the red arrow in Fig. 4. Note the strong trough over peak response, especially in the near and mid offsets. The response is much diminished to the far offsets. However, the 1,200-ft sand (green arrow) and the 1,050-ft sand (blue arrow) have increased amplitudes with offset.

Saratoga ran a reservoir saturation tool (RST) log in the well. Interpretation showed a potential 5 NFG coincident with the seismic amplitude at a depth of 1,550 ft (Fig. 5). RST logs were also run in the MP-47 SL 195 QQ-3, QQ-4, and QQ-5 wells.

The RST log confirmed the presence of 5 NFG in the 1,550-ft sand, which was the same sand that had produced in the Badger-2 well to the north in Main Pass 47 (see Fig. 10 in Part 1 of this article).

With the encouraging results from the RST interpretation, the QQ-15 well, being the higher of the two wells that encountered the 1,550-ft sand, was determined to be the best suited to test the shallow amplitude play. If it worked, Saratoga would be able to reevaluate the RST logs run in a number of other wells.

No reserves were booked for the 1,550-ft sand in the QQ-15 well prior to the recompletion. The expected IP rate was 1,000 Mcfd with gross recoverable reserves of 296 MMcf. Saratoga recompleted the 1,550-ft sand in November 2008 for $570,000. The zone was perforated, gravel packed, and put into production. The actual IP rate was 1,648 Mcfd.

The well is still producing at a rate of almost 600 Mcfd with 39 b/d of water through a 23⁄64-in. choke with 200 psi FTP almost 2 years later. It has cumulative production of over 250 MMcf through June 2010 and is conservatively expected to ultimately produce 545 MMcf. These reserves equate to an average pay thickness of 4 NFG and areal extent of 260 acres, so if the areal extent of the gas sand is actually 600 acres, then the recoverable reserves could be closer to 1 bcf.

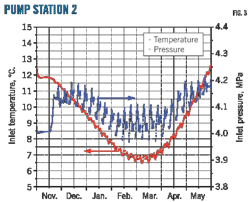

Fig. 6 is a plot of historical production for the 1,550-ft sand in the QQ-15 well. Note the hyperbolic decline rate of 23% and cumulative production of 250 MMcf through June 2010.

Shallow gas prospectivity

Saratoga has mapped a large number of follow-on shallow gas prospects, few of which have yet been incorporated into the company's independently audited third party reserve estimates.

Several more possible gas accumulations at the 1,550-ft sand section have already been identified and mapped. These will likely all be tested with greater confidence following the success in the QQ-15 well in the next 2-3 years.

Fig. 7 is a summary map showing all seismic amplitudes related to prospects, leads, and some of the known accumulations around Grand Bay. The prospects are shown by the yellow polygons with magenta, blue, or green borders depending on their depth, as indicated in the legend.

Prospects are more advanced in terms of their analysis, compared to leads, and are named. Although more detailed analysis is ongoing, the mapped prospects, leads, and known accumulations represent close to 50 bcf of recoverable reserves.

Some examples of shallow gas anomalies associated with existing Grand Bay wells are a 165-acre amplitude, associated with the 1,550-ft sand, penetrated by the QQ-183 well (Cafe O-Lay Prospect) and a 98-acre amplitude associated with the 2,300-ft sand, penetrated by the GPLD-10 well (Sweet Pea Prospect). Both wells are plugged and abandoned, and neither well logged the shallow section.

Saratoga's GPLD A-191 well, drilled in late 2008, logged several shallow gas intervals with 11 NFG in the gross 2,139-3,176 ft interval, even though the 3D data showed no amplitudes associated with the sand. The lack of amplitudes is believed to be due to lower fold in the heart of the field because of shooting constraints around existing field infrastructure.

We will now describe a couple of specific examples of near-term drilling candidates.

Duckpond Prospect

The Duckpond Prospect is located ¼ mile southeast of the GPLD A-184 (A-184) well.

This well contained probable 9 NFG with 1.8 ohms of resistivity (Rt) in the 900-ft sand and possible 3 NFG with 1.5 ohms Rt in the 1,050-ft sand. The A-151 well was drilled near the center of the prospect but, like most wells in the area, was not logged above 2,000 ft.

The 3D arbitrary line in Fig. 8 shows a clear trough tie with the 900-ft sand in A-184 and a fairly good event tie with the 1,050-ft sand. The figure contrasts strong amplitudes across the prospect with wet sand amplitudes in the vicinity of the A-184 and A-100 wells. The same intervals have productive analogs, in association with amplitude anomalies, 4 miles north in the vicinity of the QQ-2 and QQ-15 wells, discussed earlier, as well as the Commerce and Badger wells, described in Part 1 of this article.

Seismic structural geometry suggests a SW-NE oriented channel with stratigraphic separation from the two sands encountered flat to high in the A-184 well. Net effects of apparent velocity sag are indeterminate. Some lines show a more or less classic gas sag; in others dips appear to be real. Objectives are so close to the mute zone that an attempt to map overlying data, trying to get above the sag, has been inconclusive.

The two prospective 900-ft and 1,050-ft sands are associated with strong trough over peak amplitude anomalies, exhibiting positive Class 3 AVO response (Fig. 8). Compared with the AVO analysis described earlier with regards to the SE Baptiste Prospect, there is a strong increase in amplitude versus offset with the Duckpond Prospect (Fig. 9). The red arrow corresponds to the 1,200-ft sand, the green arrow to the 1,050-ft sand, and the blue arrow to the 900-ft sand.

Structure and amplitude maps, coupled with AVO far minus mid and mid minus near map displays, along with a grid of vertical seismic displays have been used to risk reserves. Fig. 9 shows the 900-ft sand amplitude that covers an area of 635 acres. Fig. 10 shows the 1,050-ft sand amplitude that covers a smaller area of 430 acres, but note the extent of the overlying 900-ft sand amplitude that might be masking the underlying 1,050-ft sand.

AVO maps of fars minus mids and mids minus nears show favorable increase in amplitude with offset. They were constructed by first snapping to fars, mids, and nears, before extracting amplitudes, and amplitudes are scaled from zero to a negative maximum for each horizon so that any color, other than dark blue, shows an increase with offset.

The SW-NE "stripe-like" orientation of the amplitudes seen in Figs. 10, 11, and 12 could be at least partially due to aliasing (an artifact of the SW-NE shooting pattern of the original seismic data).

To quantify AVO response and to estimate potential reserves, two polygons, drawn from AVO response, were drawn. An outer polygon represents the entire area of positive amplitude response (maximum aerial extent of the potential reservoir), and the inner polygon shows more or less connected area of maximum response (thickest and-or most likely pay).

These two areas can then be used with isopach values as high and low limits to a probabilistic estimation of potential pay. The 900-ft sand maximum/minimums are 635 and 100 acres, respectively; the 1,050-ft sand maximum/minimums are 430 and 78 acres, respectively.

A trough to peak isopach map of each horizon was made to estimate potential pay thickness. The 900-ft sand in A-184 ties in well with its trough to peak mapping event. But the 1,050-ft sand does not. The 130 ft sand interval on the well log doesn't match the 35 to 45 ft indicated by the trough to peak seismic measurements. Either a shale break is present, near the top of the sand, or the mapping event comes from an entirely different source, such as a channel fill.

Risks associated with the evaluation of the Duckpond Prospect include the following:

- One well, located outside of the prospect area on a low relief feature, doesn't give enough subsurface information to calibrate amplitude against hydrocarbon content or to separate velocity sag from structure.

- Data in the Grand Bay field facility area just north of the prospect are poor to nonexistent, which distorts evaluation of the updip trapping mechanism and migration pathway. The Romere Pass fault is a likely migration path, but evidence for it this shallow is inconclusive.

- For either a structural or stratigraphic trap, the separation from sands in A-184 is not clear

- The prospect is very close to the shallow limits of available data.

- Amplitudes, even with AVO support are indicative, but not proof, of gas accumulations. Position of the amplitudes with respect to the trap is good supporting evidence, but this prospect, at least superficially, is a stratigraphic trap, and so the amplitudes are the main evidence for a trap.

Gross recoverable reserve estimates for the Duckpond Prospect are 1,363 MMcf for the 1,050-ft sand, and 900 MMcf for the 900-ft sand. Monte Carlo simulation calculates maximum recoverable reserves of 1,920 MMcf, assuming 635 acres of areal extent with 20 NFG for the 1,050-ft sand and 1,290 MMcf, assuming 430 acres of areal extent with 20 NFG for the 900-ft sand. Duckpond Prospect reserves are categorized as probable undeveloped.

Oyster Prospect

The Oyster Prospect is a seismic amplitude associated with a bypassed 3,750-ft sand encountered in the SL 195 QQ-47 (QQ-47) well at 3,754 ft.

The QQ-47 well had 18 NFG on water with a distinct gas-water contact (GWC) at 3,772 ft. The seismic amplitude covers an area of 88 acres but could be as large as 265 acres.

Fig. 13 is a 3D arbitrary line across the Oyster Prospect through the QQ-47 well that has the log pay. Note the strong trough signature and other similar looking amplitudes, all of which are untested. Fig. 14 shows the 3,750-ft sand amplitude map associated with the PSTM RAP data. The brightest part of the amplitude, around the QQ-47 well, covers an area of 88 acres.

Assuming 88 acres of areal extent and 18 NFG, gross recoverable reserves for Oyster Prospect are 1,272 MMcf but there is considerable upside if the gas sand covers the larger areal extent of 265 acres or if the sand thickens away from the QQ-47 well. A proposed well on the prospect should see 34 NFG to the GWC. These reserves are categorized as proved undeveloped.

Shallow well design and economics

Exploration wells to test the shallow Pliocene gas deposits at Grand Bay can be drilled and completed for less than $1 million.

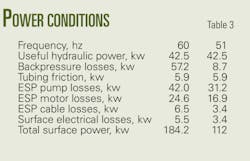

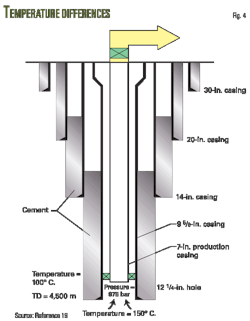

Crescent has designed a low-cost drilling option for Saratoga for the Duckpond Prospect. The 1,900-ft well is expected to take 6 days to drill, log, and run casing plus a further 5 days to complete and an assumed 2 days for mobilization and demobilization. It will be a vertical, normally pressured wellbore to test prospective shallow gas zones.

The AFE for a completed well has a P50 estimate of $750,000. This assumes use of a shallow draft inland barge rig, and 16-in. drive pipe is the only string needed to drill the well to TD. The well will use a 9.7 ppg fluid to drill to TD due to the differential density effect of a shallow gas reservoir.

Completion will involve running a 7-in. production string. An additional $250,000 is assumed for dredging and tieback to existing facilities and-or flowlines.

The Duckpond Prospect would likely be drilled in mid-2011. The most likely development scenario would involve completion of the deeper 1,050-ft sand with gross recovery of 1.36 bcf followed by the later recompletion of the shallower 900-ft sand.

Capital expenditures of $1 million have been assumed for drilling and completion. Assuming an IP rate of 1,000 Mcfd and an abandonment rate of 287 Mcfd, the 1,050-ft sand delivers a PV10 = $1.685 million, discounted ROI = 2.8, IRR = 78.7%. The 1,050-ft sand would produce until February 2016, when the 900-ft sand recompletion would occur for capital expenditure of $50,000.

Initial and abandonment rates would be the same as for the deeper reservoir. The 900-ft sand is assumed to produce until September 2019. Gross reserves for the 900-ft sand are 0.9 bcfg. The upper sand recompletion delivers a PV10 = $1.338 million, discounted ROI = 47.9, IRR = 350.0%. Total project PV10 = $3.023 million.

Saratoga can take advantage of existing field infrastructure and available compression, thereby enhancing the project economics. These economics assume COB June 30, 2010, NYMEX strip pricing. Shallow gas development is attractive to an operator such as Saratoga, despite relatively soft natural gas prices, because of the ongoing need for gas for gas lift of existing oil wells in the field.

Summary

The shallow Plio-Pleistocene gas play appears to have been largely neglected in southeast Louisiana despite a number of successful completions. Oil companies have not pursued this play because of low historical gas prices, small pool sizes, and increased costs related to compression and gravel pack completions. Other factors relate to the poor seismic imaging of the shallow section and lack of logging.

Saratoga has demonstrated that this play can be pursued economically by careful seismic analysis, cased-hole logging, and taking advantage of existing field infrastructure.

While such shallow gas reserves are small in size, they represent a "lagniappe" to operators such as Saratoga, focused on more traditional development options but in need of gas lift gas to enhance oil production or to simply develop it commercially in its own right.

While we have recognized about 50 bcf potential in and around Grand Bay, we would expect that this shallow gas play is ubiquitous and likely exists elsewhere in all of Southeast Louisiana with a very rough estimate of up to 1 tcf of potential for all fields between surface and 5,000 ft. Our 50 bcf estimate does not cover all the fields in Fig. 3 or Table 1 in Part 1 but only Grand Bay plus portions of Coquille Bay and Main Pass 47.

Acknowledgments

The authors are grateful to the following whose work contributed greatly to this study: Jim Miller for his work on the Duckpond Prospect, Mindy Stuart for the prospect economics on the Duckpond Prospect, Crescent Drilling and Production Inc. for the Duckpond well design work, Dan Todd for his geophysical processing prowess in providing us with a great data set, and to David Connolly of dGB for his chimney analysis work.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com