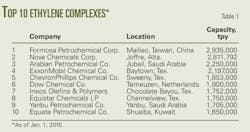

OGJ FOCUS: US OLEFINS—SECOND-HALF 2009: US olefins production rebounds amid global economic recovery

Second-half 2009 saw sustained recovery for the US petrochemical industry, even as broader economies continued to experience credit crises and economic recession. Although plants' operating rates were less than 90% and profit margins for ethylene producers remained under pressure, the economic landscape for the petrochemical industry proved to be much better than most analysts expected during first-quarter 2009.

US refineries operated at higher rates in third-quarter 2009 than in third-quarter 2008, but operating rates in fourth-quarter 2009 fell lower than in fourth-quarter 2008. Despite the year-to-year decline in operating rates in the fourth quarter, merchant sales of refinery-grade propylene were higher in both third and fourth quarters 2009 than in 2008.

Although the petrochemical industry welcomed the rebound in demand for ethylene and propylene, the economic recovery also brought higher costs. Ethylene producers managed to keep pace with rising costs, but profit margins were very thin for those plants that continued to use light naphthas.

Feed slate trends

Ethylene industry's demand for fresh feed averaged 1.50 million b/d in second-quarter 2009 and increased to 1.52 million b/d in third-quarter 2009. Ethylene demand for fresh feed in second and third quarters 2009 was 190,000-200,000 b/d higher (about 15%) than in first-quarter 2009, but feedstock demand remained 130,000 b/d lower than the average for first-half 2008.

Demand in fourth-quarter 2009 averaged 1.56 million b/d. After the strong rebound in the second quarter, ethylene demand for feedstocks was nearly flat during second-half 2009.

Demand for LPG feedstocks (ethane, propane, and normal butane) averaged 1.21 million b/d in third-quarter 2009 and 1.23 million b/d in fourth quarter. LPG feeds accounted for 79% of total fresh feed in third and fourth quarters 2009 vs. 72% of fresh feed in first-quarter 2009. The LPG share of total fresh feed for 2005-07 averaged 70%.

Two factors pushed the LPG feed share to nearly 80%. First, all ethylene producers had strong economic incentives to maximize the use of ethane, and ethane availability was sufficient to support higher demand over a sustained period. Second, operating rates for LPG crackers jumped to 95% of capacity, while multifeed crackers operated at 75% of capacity during third and fourth quarters 2009.

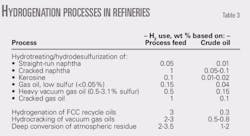

Table 1 summarizes trends in olefin plant fresh feed.

As economies in North America began to recover in third-quarter 2009, ethylene producers responded to the increased demand for ethylene by increasing production to 86-88% of capacity in fourth-quarter 2009. Unless the economies in North America slip back into recession during first-half of 2010, the industry's operating rate is likely to average 88-92%.

Total demand for fresh feedstocks will average 1.55-1.65 million b/d during first and second quarters 2010. Total demand for LPG feedstocks will average 1.25-1.30 million b/d during first and second quarters 2010.

Fig. 1 shows historic trends in ethylene feed slates.

US ethylene production

Ethylene production from fresh feed totaled 13.1 billion lb in third-quarter 2009 and increased to 13.6 billion lb in fourth-quarter 2009. Ethylene production from steam crackers during third-quarter 2009 was 295 million lb higher than in second-quarter 2009. Production in fourth-quarter 2009 was 944 million lb higher than in third-quarter 2009.

Production from LPG plants totaled 4.88 billion lb in third and fourth quarters 2009 and was about 40 million lb less than in second-quarter 2009. Production from multifeed crackers totaled 7.69 billion lb in third-quarter 2009 and increased to 8.0 billion lb in fourth-quarter 2009.

Production from multifeed crackers during third-quarter 2009 was 289 million lb more than during second-quarter 2009, and production in fourth-quarter 2009 was 313 million lb more than during third-quarter 2009.

Table 2 summarizes trends in ethylene production.

Operating rates for LPG crackers averaged 93% of nameplate capacity (based on capacity of 21.6 billion lb/year) during third and fourth quarters 2009 vs. 95% in second-quarter 2009 and 80% in first-quarter 2009.

Multifeed crackers operated at 79% of nameplate capacity (based on capacity of 39.2 billion lb/year) during third-quarter 2008 and increased operating rates to 82% during fourth-quarter 2009 vs. 77% in second quarter and 67% in first-quarter 2009. Operating rates for the industry overall averaged 84% in third-quarter 2009 and improved to 86% during fourth-quarter 2009.

Fig. 2 shows trends in ethylene production.

US propylene production

Industry operating rates improved steadily during second, third, and fourth quarters 2009 and US ethylene production in fourth-quarter 2009 was up 22.5% from production in first-quarter 2009. Propylene from steam crackers, however, lagged the rebound in industry operating rates due to the continued increase in ethane demand.

Coproduct propylene supply totaled 2.33 billion lb in third-quarter 2009 and was 7.4% higher than in second-quarter 2009. Despite the improvement in ethylene plants' operating rates, however, coproduct propylene supply declined to 2.27 billion lb in fourth-quarter 2009 or 3.4% lower than in third-quarter 2009.

Coproduct propylene supply during third-quarter 2009 was almost 240 million lb lower than year-earlier volumes, but production in fourth-quarter 2009 was only 80 million lb lower than in 2008.

Propylene production from LPG feeds totaled 1.19 billion lb in third-quarter 2009 but declined to 1.15 billion lb in fourth-quarter 2009. Production from LPG feeds in third-quarter 2009 was about 120 million lb less than in third-quarter 2008. In fourth-quarter 2009, coproduct propylene supply from LPG feeds was 350 million lb more than in fourth-quarter 2008.

Propylene production from naphthas, condensates, and gas oils totaled 1.14 billion lb in third-quarter 2009 and was 115 million lb lower than during third-quarter 2008. Coproduct yields of propylene from heavy feeds declined to 1.12 billion lb in fourth-quarter 2008, or almost 430 million lb lower than in fourth-quarter 2009.

The year-to-year decline in coproduct propylene was primarily due to the increase in ethane's share of the industry feed slate. In third-quarter 2009, ethane accounted for 56% of total fresh feed vs. 48% in third-quarter 2008. Ethane's share of fresh feed increased to 58% in fourth-quarter 2009 vs. 49% in fourth-quarter 2008.

Table 3 summarizes trends in coproduct propylene supply.

Refinery supply

Refinery propylene sales into the merchant market are a function of fluid catalytic cracking unit feed rates, FCCU operating severity, and economic incentives to sell propylene rather than use it as alkylate feed. Normally, FCCU feed rates increase to their seasonal peaks during second and third quarters. Furthermore, refineries typically operate FCC units at high severity during second and third quarters. Propylene yields from FCC units are higher when those units operate at high severity.

FCCU operating rates tracked the typical seasonal trend during second, third, and fourth quarters 2009. The US Energy Information Administration reported FCCU feed increased by 79,000 b/d and averaged 5.22 million b/d in third-quarter 2009. FCCU feed rates in third-quarter 2009 were also 429,000 b/d higher than in third-quarter 2008—consistent with the quiet 2009 hurricane season vs. the extensive downtime that occurred after September 2008 due to hurricanes Gustav and Ike.

Based on EIA's statistics for October and November and Petral's estimates for December, FCCU feed rates declined by about 300,000-325,000 b/d in fourth-quarter 2009 and averaged 4.87 million b/d. The decline in FCCU feed from third-quarter average was consistent with the overall decline in refinery operating rates. Feed rates in fourth-quarter 2009 were also about 40,000 b/d lower than in fourth-quarter 2008.

Refinery-grade propylene production increased to 3.79 billion lb in third-quarter 2009 and averaged 41.3 million lb/day (Table 4). Merchant sales from refineries were 525 million lb more than in third-quarter 2008 and were 250 million lb more than in second-quarter 2009.

Refinery-grade propylene production declined by more than 200 million lb in fourth-quarter 2009 and totaled 3.58 billion lb, or about 39 million lb/day. Merchant sales, however, were almost 270 million lb more than in fourth-quarter 2008.

US propylene supply totaled 6.12 billion lb in third-quarter 2009 and was 410 million lb higher than in second-quarter 2009 and 289 million lb higher than in third-quarter 2008. Total US supply declined by about 300 million lb in fourth-quarter 2009 and totaled only 5.83 billion lb. Total fourth-quarter production was 191 million lb more than year-earlier volumes.

Fig. 3 shows trends in coproduct and refinery merchant propylene.

Ethylene production costs

Ethane and propane accounted for about 81% of total ethylene production in third-quarter 2009. Production costs for ethylene in the Houston Ship Channel (based on full spot prices for all coproducts) based on purity-ethane feeds averaged about 22¢/lb in third quarter.

Production costs based on ethane increased by less than 1¢/lb in third-quarter 2009 and provided ethylene producers with incentives of 4-7¢/lb to switch from heavier feeds. Production costs for purity propane averaged about 23¢/lb. Propane also provided ethylene producers with incentives of 3-6¢/lb to switch from heavy feeds.

Feedstock prices, coproduct values, and ethylene plant yields determine ethylene production costs. Petral maintains direct contact with the olefin industry and tracks historic trends in spot prices for ethylene and propylene. We use a variety of sources to track trends in feedstock prices. Some ethylene plants have the necessary process units to convert all coproducts to purity streams. Some do not have, however, the capability to upgrade mixed or crude streams of various coproducts and sell some or all their coproducts at discounted prices. We evaluate ethylene production costs in this article based on all coproducts valued at spot prices. |

In fourth-quarter 2009, production costs based on purity ethane jumped to an average of 29-30¢/lb and reached 32¢/lb in December 2009. Producers that could increase their use of ethane had incentives of 3-8¢/lb to switch from heavy feeds.

Production costs based on purity propane jumped to 33¢/lb in fourth quarter. Although costs based on propane remained higher than for purity ethane, ethylene producers had incentives of 4¢/lb to switch from light naphthas.

Average production costs for natural gasoline during third-quarter 2009 averaged 28-29¢/lb and were 7¢/lb higher than ethane and 5-6¢/lb higher than for propane. In fourth-quarter 2009, ethylene production costs based on natural gasoline jumped to 38¢/lb and were nearly 9¢/lb higher than for ethane and 5¢/lb higher than for propane.

Table 5 summarizes trends in ethylene production costs.

Ethylene pricing, margins

Contract prices for ethylene increased by 0.75¢/lb in third-quarter 2009 and averaged 32¢/lb. The contract benchmark prices in second-quarter 2009 had reached a high of 33.3¢/lb in June, but buyers were successful in negotiating a reduction of almost 4¢/lb in July. Rising production costs, however, especially for heavy feeds, supported increases in August and September. The benchmark price increased to 34.3¢/lb in September.

Benchmark prices rose steadily during fourth-quarter 2009 and averaged 40.3¢/lb, or 8.3¢/lb higher than the average for third-quarter 2009. The benchmark for December 2009 settled at 42.8¢/lb.

Spot ethylene prices increased by 2.1¢/lb in third quarter and averaged 25.9¢/lb. Spot prices dipped to 21.9¢/lb in July 2009 but jumped to 29.8¢/lb in September. In July, spot ethylene prices were 7.6¢/lb less than the contract benchmark. By September, the discount for spot ethylene narrowed to 4.5¢/lb.

During fourth-quarter 2009, spot ethylene prices averaged 32.9¢/lb and were 7.0¢/lb higher than the average for third-quarter 2009.

Margins based on the contract benchmark prices were stronger for all feedstocks in third-quarter 2009. Margins based on purity-ethane production costs averaged 10.4¢/lb vs. 10.0¢/lb in second-quarter 2009. Margins based on propane averaged 9.3¢/lb and were 2¢/lb higher than in second-quarter 2009.

Ethylene producers were also happy to see positive margins for natural gasoline and light naphthas. Profit margins for natural gasoline feeds averaged 3.6¢/lb in third-quarter 2009 vs. a loss of 2.1¢/lb in second-quarter 2009.

As the demand for petrochemicals continued to improve during fourth-quarter 2009, margins for ethane improved and averaged 10.9¢/lb. Margins for propane and natural gasoline weakened. Margins based on propane narrowed to 7.2¢/lb and margins based on natural gasoline narrowed to 2.3¢/lb.

Profit margins based on the contract benchmark are almost always stronger than margins based on spot ethylene prices. Profit margins based on spot ethylene prices and production costs for purity ethane ranged 3-4¢/lb during third and fourth quarters 2009. Profit margins for purity propane averaged 3.1¢/lb in third-quarter 2009, but margins broke even in fourth-quarter 2009.

Prices for all grades of propylene move in tandem with each other, and differentials between grades are generally constant within a narrow range. We highlight trends in refinery-grade prices and discuss differentials between polymer and refinery-grade propylene. The premium for polymer-grade propylene covers operating costs and profit margins for the various merchant propane-polypropylene splitters in Texas and Louisiana. |

Finally, production based on spot ethylene prices and costs based on natural gasoline generated losses of 2.5¢/lb in third-quarter 2009 and 5.0¢/lb in fourth-quarter 2009. The persistent weakness in profit margins based on spot ethylene prices indicates that the economic environment has a lot of room for improvement in 2010.

Fig. 4 shows historic trends in ethylene prices (spot prices and net transaction prices); Fig. 5 shows profit margins based on contract ethylene prices and composite production costs.

Refinery, polymer grade C3=

Spot prices for refinery-grade propylene increased by almost 16¢/lb during third-quarter 2009 and averaged 49.9¢/lb. The premium for refinery-grade-propylene prices vs. unleaded regular gasoline prices was 16¢/lb in third-quarter 2009 vs. 2.5¢/lb in second-quarter 2009.

In fourth-quarter 2009, spot prices for refinery-grade propylene ranged from a low of 40¢/lb in October to a high of 46.6¢/lb in December. For the quarter overall, however, spot prices were nearly unchanged and averaged 44.2¢/lb. Spot refinery-grade propylene prices averaged 13.2¢/lb premium to conventional unleaded regular gasoline for fourth-quarter 2009, or nearly 3¢/lb less than in third-quarter 2009.

The contract benchmark for polymer-grade propylene increased by 14.2¢/lb in third quarter and averaged 47.7¢/lb. The contract benchmark premium vs. spot refinery-grade propylene was 2.8¢/lb in third-quarter 2009 vs. 4.4¢/lb in second-quarter 2009. The contract benchmark increased to 50.2¢/lb average for fourth-quarter 2009 and the premium vs. refinery-grade propylene averaged 6.0¢/lb.

Mid-2010 outlook

OPEC responded to the collapse in crude oil prices during second-half 2008 with a series of agreements to reduce production. In accord with these agreements, crude oil production from Organization of Petroleum Exporting Countries' members declined by 2.96 million b/d July 2008 through March 2009.

Even though OPEC achieved only 85-90% compliance with its final agreement, production curtailments were sufficient to tighten the global crude oil supply/demand balance and to spark a sustained price rally after February 2009.

Although OPEC gradually increased production during second and third quarters 2009, production rose in tandem with recovery in demand, and WTI cash prices reached $80/bbl in mid-October 2009. The seasonal decline in refinery crude runs and the seasonal squeeze on refinery profit margins were strong bearish influences and WTI prices slipped to $70-72/bbl by mid December.

WTI prices staged a strong but relatively brief rally from mid-December through early January and reached $82/bbl before bearish seasonal pressures once again pushed prices lower. During most of January, crude oil prices were under substantial bearish pressure.

Seasonal supply/demand influences will swing from bearish to bullish during the second and third quarters 2010, and WTI prices will likely increase to $84-88/bbl in second quarter and $92-98/bbl in third-quarter 2010.

The projected rally in crude oil and refined products prices will carry prices for ethylene feedstocks and coproducts higher during second and third quarters 2010.

During fourth-quarter 2009, ethylene production costs (full cash costs) increased for all major feedstocks (ethane, propane, and light naphthas). Purity ethane consistently yielded the lowest ethylene production cost, averaging 29¢/lb for fourth-quarter 2009. Light naphthas consistently yielded the highest production cost, averaging 38¢/lb for fourth-quarter 2009.

Ethylene production costs will likely average 40-46¢/lb during second-quarter 2010 and 45-55¢/lb in third-quarter 2010. Spot ethylene prices will average 45-50¢/lb during second-quarter 2010 and 50-55¢/lb during third-quarter 2010. Profit margins will average 5-7¢/lb for purity ethane and 3-5¢/lb for purity propane.

The author

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com