OGJ Newsletter

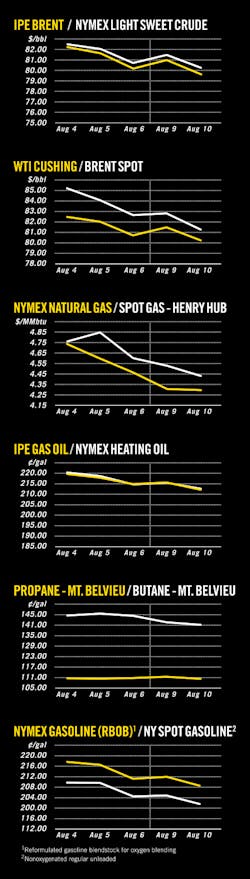

The official with the world's most influence over oil supply says he finds the recent range of crude oil prices comfortable.

Ali Al-Naimi, Saudi Arabia's minister of petroleum resources and minerals, told reporters at a conference in Singapore that oil prices, which have strayed little from a range of $70-80/bbl this year, are "in a very comfortable zone," according to Reuters.

A recent rally has pushed the crude price above $80/bbl but is no cause for alarm, Al-Naimi said. The prevailing trading band should continue "for some time," he said.

"If I can be audacious, I would say producers, consumers, and companies are all happy with this price," he said.

India's Singh pushes foreign oil venturesIndia's prime minister has made explicit his country's push to own oil resources abroad.

Speaking at the Petrotech conference in New Delhi, Manmohan Singh said India's requirement for hydrocarbon energy would increase by 40% in the next 10 years while its domestic production rises by 10%.

India consumes about 3 million b/d of oil and imports about 2 million b/d. "All national oil companies are mandated to also pursue for equity oil from overseas oil-producing countries," Singh said.

EPA delays announcing ozone regulation changesThe US Environmental Protection Agency asked a federal court on Nov. 1 for an extension until Dec. 31 for filing its proposed revisions of its 2008 ozone standards. It was the second time the agency delayed changes which EPA Administrator Lisa P. Jackson termed "long overdue" in January.

"EPA is working hard to finalize an ozone standard that is based on what the science tells us about this threat to Americans' health, but completing this rulemaking is taking longer than anticipated," EPA said. "EPA is committed to signing a final rule on the reconsideration of the 2008 ozone standard by the end of the year."

EPA said it also intends to propose the implementation plan requirements that will help ensure that state governments, local governments, and Indian tribes have the guidance they need to identify common sense, cost-effective strategies to protect public health.

EPA originally planned to announce the proposed revisions in August, but delayed it until the end of October. The latest delay shows that the proposed reduction of allowable ozone non-attainment levels to 60-70 ppb from 75 ppb is unreasonable and unworkable, an API official contended on Nov. 2.

"The industry has been clear with EPA about concerns with the proposed new ozone standard since the opening of the comment period," said Howard Feldman, API's regulatory and scientific affairs director. "We hope that this extension signals that EPA is being more deliberative in finalizing this rule because it realizes that the proposed new ozone standard would put nearly 100% of the United States in non-attainment and subject every state to erroneous and costly requirements."

Devon Energy Corp., Oklahoma City, drilled 407 wells in North American plays in the quarter ended Sept. 30 with an overall 99% success rate.

The company is running 17 operated rigs in the Permian basin and holds nearly 1 million net acres in the Avalon shale, Bone Spring, Wolfberry, and several other plays. The company's production from the basin rose to 44,000 b/d of oil, condensate, and natural gas liquids in the quarter, up 18% from the year-ago quarter.

Devon drilled three horizontal wells in the quarter in the Texas Panhandle Granite Wash play that combined to average 4,290 boe/d, including 605 b/d of oil and 1,450 b/d of natural gas liquids. Average net working interest is 65%.

The company hiked North Texas Barnett shale net production 8% to a record 1.2 bcfd of gas equivalent, including 40,100 b/d of liquids.

The western Oklahoma Cana-Woodford shale averaged a record 117 MMcfed, a 122% increase. The company plans to start up its 200 MMcfd Cana gas processing plant near Calumet in Canadian County by the end of 2010. Capacity is expandable to 600 MMcfd.

In Canada, net production from Devon's Jackfish oil sands project 200 miles northeast of Edmonton, Alta., averaged 21,300 b/d in the quarter. Jackfish was taken offline for scheduled plant maintenance in the last 3 weeks of the quarter and resumed operations Sept. 30.

Construction of the second Jackfish project is 90% complete. Devon will begin injecting steam at Jackfish 2 in the 2011 second quarter. First production is expected by the end of next year.

Devon sanctioned Jackfish 3 and filed a regulatory application in the quarter. Construction could start by the end of 2011. Start-up is targeted for 2015.

Providence touts prospects off IrelandRock physics modeling and a seismic inversion study have revealed the presence of a potential direct hydrocarbon indicator at the top of the primary Lower Triassic reservoir interval at a prospect in the Irish Sea 10 km off Dublin, said Providence Resources PLC, Dublin.

The Dalkey Island prospect is in 25 m of water in the Kish Bank basin. Providence holds an operated 50% equity interest in Licensing Option 08/2 with its partner, Star Energy Group.

Direct hydrocarbon indicators have been noted from analogous producing oil and gas fields in the Liverpool Bay producing area. In addition, detailed petroleum systems analysis has suggested that the underlying Carboniferous section, which to date has not been drilled in the basin, may also be prospective for oil, Providence said.

This potential has been highlighted by the 33/22-1 well, which was drilled on the edge of the basin and which encountered residual oil in Upper Carboniferous sands. Seismic mapping of the Upper Carboniferous has revealed a large structural trap that directly underlies the Lower Triassic Dalkey Island prospect.

Meanwhile, Providence has been offered an exploration license over Rathlin Island, off Northern Ireland in the North Channel 90 km north of Belfast. Northern Ireland's Department of Enterprise, Trade and Investment offered the license in response to Providence's application.

The initial license term is 5 years with a decision on a well commitment required within 3 years. Providence committed to perform technical studies of the subsurface geology during the first 3 years to determine the petroleum potential and inform the decision on the well commitment. Providence will operate the license with 100% equity interest.

Providence pointed to hydrocarbon shows and recovery of some oil on test at the 2008 Ballinlea-1 onshore well at a location interpreted to be on the Rathlin basin margin. The island is interpreted to directly overlie the most mature and potentially most productive part of the basin, the company said.

Anadarko group tests Tarakan basin findA group led by Anadarko Petroleum Corp. is evaluating an appraisal program and plans to shoot more seismic around an oil and gas find discovery in Indonesia's Tarakan basin on East Kalimantan.

The Badik discovery, drilled to 12,950 ft in 230 ft of water on the Nunukan PSC, encountered 133 net ft of oil and gas pay in high-quality Upper Miocene deltaic sandstones.

Anadarko is block operator with 35% working interest. PT Medco E&P Nunukan has 40%, and BPRL Ventures Indonesia BV and Videocon Indonesia Nunukan Inc. have 12.5% each.

Husky appraises S. China Sea gas fieldHusky Energy Inc. said the second appraisal well has demonstrated a north extension to the Liuhua 29-1 discovery well on Block 29/26 in the South China Sea.

Core and log data from the Liuhua 29-1-3 well verified the presence of an excellent quality reservoir with 60 m of gas pay. Husky said it is confident the well is capable of high flow rates.

The West Hercules semisubmersible drilled the well to 2,900 m below sea level in 682 m of water 3 km north of the Liuhua 29-1 discovery well and cased it for possible reentry and development as a producing well later.

Once well data are integrated, more appraisal drilling will be determined to further define the resource size and prepare a development plan, Husky said.

Liuhua 29-1 field is 43 km northeast of Liwan 3-1 field, Husky's first major discovery in Block 29/26, and 20 km northeast of Liuhua 34-2 field.

The rig has resumed development drilling at Liwan 3-1 field, for which Husky Oil China Ltd. expects to submit a development plan within a few months.

Liwan 3-1 and Liuhua 34-2 are to be developed in parallel with first gas production targeted for 2013. Liuhua 29-1 will share common gas processing and transportation infrastructure.

Neuquen block holds unconventional targetsApache Corp.'s Argentine subsidiary and Americas Petrogas Inc., Calgary, plan to explore a western Neuquen basin block in Argentina that has conventional oil and gas and unconventional gas exploration targets.

Energicon SA, a private Argentine company, is also a party to the agreement, which covers the 249,943-acre Huacalera block. Drilling is to start in late fourth quarter 2010 or the first quarter of 2011.

Apache will carry Americas Petrogas in drilling an exploratory well to 13,400 ft to penetrate the Lower Cretaceous Mulichinco, Upper Jurassic Tordillo, and intervening Vaca Muerta formations. Mulichinco and Tordillo are important producing zones. Old wells encountered tight gas.

Vaca Muerta is a thick source rock that offers shale gas potential. Depending on the successful testing of the well from various formations, Apache also agreed to carry out at its own cost a 100 sq km 3D seismic program.

Apache will operate with 51% working interest, Americas Petrogas and Energicon will have 19.5% each, and Gas y Petroleo de Neuquen will have 10%.

The agreement is subject to government and other approvals that are expected by the end of November.

Drilling & Production — Quick TakesExxonMobil completes Point Thomson wellsExxonMobil Corp. said it has successfully drilled and tested the PTU-15 and PTU-16 development wells in Point Thomson Unit on Alaska's North Slope ahead of the yearend 2010 target.

The two wells were directionally drilled from shore to a measured depth of more than 16,000 ft to the targeted gas-condensate reservoir more than 1½ miles offshore beneath the Beaufort Sea.

The reservoir, 60 miles east of Prudhoe Bay, is abnormally pressured in excess of 10,000 psi and is estimated to hold about 25% of the North Slope's discovered gas resource.

Concurrent with the drilling of the two development wells, activities are also focused on engineering and environmental permitting that are critical for project development. ExxonMobil said it has invested about $1.5 billion in Point Thomson, including more than $730 million in the last 2 years.

ExxonMobil said it continues "to work with the State of Alaska to resolve outstanding issues in order to maintain the pace and momentum of Point Thomson development," adding, "Point Thomson gas is critical to the success of an Alaska gas pipeline project."

Barrett runs rigs in Utah's West TavaputsKeying off a record of decision on the federal environmental impact statement covering the West Tavaputs project in Utah's Uinta basin, Bill Barrett Corp., Denver, expects to drill as many as 20 wells in the field by yearend.

The company initiated a two-rig development program and spud the first well Oct. 27.

West Tavaputs is among the company's largest development assets based on its current reserve base of 325 bcf of gas equivalent proved and 1.3 tcfe proved, probable, and possible reserves.

The company had an approximate 96% working interest in production from 186 gross wells in its West Tavaputs shallow and deep programs as of Sept. 30. The resumption of drilling "offers growth in the shallow Mesaverde and Wasatch zones as well as upside opportunity through the shallow Green River oil, Mancos shale and deep formations," the company said.

West Tavaputs produced a net 62 MMcfed in early November, down from the third quarter average of 69 MMcfed.

Bill Barrett Corp. reduced its 2010 capital spending projection to $475-485 million from $495-520 million before acquisitions. The spending reduction reflects additional capital for West Tavaputs drilling and a large reduction in projected outlays as the result of drilling and completion cost efficiencies in the Piceance basin in Colorado.

US gas output little affected by liquids shiftThe shift of capital spending and drilling toward liquids-rich and away from dry gas basins because of the relatively high price of oil to gas will only have a slight negative effect (if any) on US gas production, according to Barclays Capital Inc.

It noted that a simple calculation tends to overestimate the effect of the shift on gas production because liquids-rich areas also have high initial gas production rates.

Barclays also determined that rigs moving to liquid-rich areas such as the Eagle Ford and Granite Wash are from less-productive areas or areas such as the Haynesville in which the time to drill and complete a well is much longer.

The net effect is that rigs are more productive in the liquids-rich areas and therefore the shift will affect only slightly US gas production growth, according to Barclays.

PROCESSING — Quick TakesStrike ends at France's refineriesWorkers at France's 12 refineries have gone back to work Oct. 29 as the last holdouts at Total SA's Gonfreville, Donges, Feyzin, and Grandpuits facilities voted to end the strike. Also unblocked now are the two oil terminals of Le Havre in Normandy and Fos-Lavera on the Mediterranean.

The strike began Oct. 13 at 8 refineries, but impacted the 4 refineries in southern France earlier on as the Marseille Fos-Lavera terminals were blocked by the CGT for 33 days in an effort to ward off privatization of the Marseille port.

There are now 38 crude tankers, 20 product tankers, 13 butane-propane, and 7 chemical carriers that are to start docking as early as tonight, indicated the Marseille port authorities.

Strikers at Fos-Lavera subsequently joined in with the other refinery strikers to force the government to backtrack on its pension-reform plan. The situation is now nearly normal at retail outlets with all oil depots unblocked and 80% of the outlets supplied.

The oil companies have been making up for refinery shut downs with soaring product imports from Amsterdam, Spain, Italy, and Russia. Total's spokesman told OGJ the company's product imports have increased fourfold.

Jean-Louis Schilansky, president of the oil trade union UFIP, noted that about 100,000 tonnes/day of products were being imported. The amount includes gasoline, which is usually never imported due to overcapacities in France.

Shilansky also indicated that the strike will cost the oil industry hundreds of millions of euros. Already hit with overcapacities and tight margins, France's refining industry will have trouble recovering from the strikes, noted other industry sources, not wanting to be identified.

Williams Partners to buy Piceance basin assetsWilliams Partners LP will buy Williams Cos. Inc.'s gathering and processing assets in Colorado's Piceance basin for $782 million, the companies reported. Williams owns about 77% of Williams Partners, including the general-partner interest.

The assets include the Parachute natural gas plant (OGJ Newsletter, Oct. 8, 2010), three other treating plants with combined processing capacity of 1.2 bcfd, and a gathering system of about 150 miles. More than 3,300 wells are connected to the gathering system, said the companies, including pipelines up to 30-in. OD.

Williams Partners' total for the assets will include $702 million in cash and $80 million in WPZ limited-partner and general-partner units. The transaction is to close in November.

Williams Partners expects the new assets to generate about $105 million in "segment profit plus depletion, depreciation and amortization" for its midstream business in 2011.

Repsol, Mexican firm form biofuels ventureRepsol and Group KUO of Mexico City have formed a 50-50 company based in Mexico to develop a biofuels business based on jatropha curcas, an oil seed with a high content of inedible oil. The new company, KUOSOL, initially will plant and cultivate 10,000 hectares of jatropha curcas on barren land in Yucatan, Mexico.

In addition to the oil seed, the bush also yields large amounts of biomass for use in the generation of steam and electrical power. Repsol said the project, with an initial investment of $80 million, will meet European Union Renewable Energy Directive requirements for cuts in greenhouse gas emissions. Group KUO in 2008 began a 300-hectare pilot project to produce biodiesel from jatropha curcas oil seeds in Yucatan.

TRANSPORTATION — Quick TakesPlains to boost Midcontinent crude capacity

Plains All American Pipeline LP announced its Midcontinent Expansion Project, providing additional takeaway capacity for increased crude production in the Cleveland Sand, Granite Wash, and Colony Wash development areas.

The MEP expansion includes connecting Plains' Cushing, Okla., terminal and segments of its Kansas and Colorado pipeline systems to the White Cliffs pipeline, entering into a 10-year capacity lease with the White Cliffs pipeline, and completing capacity expansions to three segments of Plains' Oklahoma pipeline system.

MEP will add as much as 38,000 b/d on Plains' Kansas and Oklahoma pipeline systems at an estimated cost of about $25 million. The project will be completed in stages, with Plains expecting final completion by third-quarter 2011.

Plains last year bought receiving pipelines, a manifold system, and 400,000 bbl of oil storage capacity at Holly Corp.'s 85,000-b/d refinery in Tulsa (OGJ Online, Oct. 22, 2009).

Newfield Exploration Co., Houston, is evaluating as many as 30 horizons in the Granite Wash (OGJ Online, July 23, 2010), while Linn Energy LLC in July completed what may be the highest rate well reported in the trend at a 24-hr rate of 27 MMcfd of gas and 3,190 b/d of condensate.

Plains to build Bakken North crude pipeline

Plains All American Pipeline LP announced plans to reverse its Wascana pipeline system and build a new pipline, Bakken North, to provide additional takeaway capacity for growing Bakken crude production.

The Bakken North Project would provide crude oil transportation service from Trenton, ND, to Regina, Sask. At Regina, Plains would connect to third-party carriers providing access to Cushing, Okla. and PADD II delivery points.

The 12-in. OD Bakken North pipeline will extend 103 miles from Trenton to the southern terminus of Plains' Wascana system at an initial design capacity of 50,000 b/d (expandable to 75,000 b/d). Plains' estimates the project cost (to the 75,000 b/d capacity) at $160-200 million.

Subject to permitting, Plains anticipates placing the Bakken North Project into service in fourth-quarter 2012.

North Dakota hit a record in terms of rigs running this year, surpassing a record set in the early 1980s, according to the American Petroleum Institute's latest monthly and quarterly statistical report (OGJ Online, Oct. 15, 2010).

Floating LNG terminal awarded for Indonesia

Indonesia's state-owned Perusahaan Gas Negara has awarded a project management contract for a floating LNG terminal to Foster Wheeler AG's global engineering and construction group. The terminal will be built in Medan, North Sumatra, Indonesia. Foster Wheeler did not disclose the contract's value.

Foster Wheeler's scope of work includes technical assistance through the initial phase of development of the project, conceptual design of the terminal, basic design of the subsea and onshore pipeline as well as preparation and issuance of an invitation to bid for engineering, procurement, and construction, EPC bid evaluations, preparation of the EPC contract, and support to PGN in EPC contract negotiation.

Based in Zug, Switzerland, with operational headquarters in Geneva, Foster Wheeler will fill the role of owner's engineer during the EPC phase of the project through to start-up of the terminal.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com