Fitch: Credit-quality outlook mostly stable

Barring any substantial drops in crude prices, corporate credit profiles should remain in line with 2009 levels across the oil and gas industry this year, except for the refining and service and supply businesses, reported Fitch Ratings in its 2010 oil and gas outlook.

Inflationary expectations and "significant amounts of liquidity" injected in global financial markets will likely keep crude prices above levels justified by supply and demand fundamentals, with improved cash flows and credit profiles for upstream, oil-focused companies, said Fitch analysts, who assume global economies will have weak, but positive growth this year without a "double-dip" into recession. Fitch's price forecasts for 2010 are $70/bbl for crude, up from $57.50/bbl previously, and $4/Mcf for natural gas, down from $5/Mcf.

The credit outlook is not uniform across the industry, however. Refiners run the most risk as global fuel demand and refinery utilization rates continue to slump. Offshore drillers with deepwater rigs and sizable backlogs will benefit from long-term contracts signed when business was better.

Overall, the service and supply business is suffering a major decline in credit profiles as pricing and utilization rates fall. That will continue this year, with smaller, less-diversified companies under the most stress.

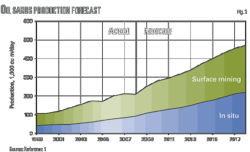

On the upside, increased oil demand as the world economy returns to positive growth rates following reduced upstream investment in 2009 will likely lead to tighter market fundamentals. On the other hand, Iraq's push to increase its oil production and additional output from Brazil and Canadian oil sands will provide more supply.

Producers with large exposure to the US gas market face another year of weak commodity prices. Barring extreme weather conditions, the US gas market is not expected to improve materially for the next 2 years. However, firms that took advantage of the steep contango pricing in the gas futures market by hedging are more likely to weather 2010, Fitch analysts said.

Liquidity, upgrades

Despite increased asset sales to fill capital spending shortfalls, liquidity appears adequate for most of the upstream companies that Fitch rates. Mergers and acquisitions usually increase in weak markets, but the ability of producers to lock in cash flow from higher futures prices may limit the distress fire-sales that buyers hope for.

As in the previous up-cycle, Fitch will limit rating upgrades to companies with "sustained and substantial commitments" to conservative financial and operating profiles. Rating downgrades will be primarily company-specific unless market conditions prove so weak that "most if not all of the issuers" in a sector succumb to the same downward rating pressures.

"Many issuers are entering the current downturn from a position of strength, as they had taken advantage of the robust industry market conditions and unfettered access to banking and capital markets through midyear 2008 to protect their liquidity by extending maturities and increasing revolver availability," said Fitch analysts.

Fitch will continue to focus on cash flow, which should improve moderately because of reduced capital spending budgets, cost resets, and stable-to-higher commodities pricing. "Given the sharp premium associated with liquidity, companies are expected to continue to shift their focus away from growth-oriented objectives toward maintaining strong balance sheets during 2010," analysts said.

Among the firms rated by Fitch, 82% of the integrated companies and 77% of pure exploration and production companies have a stable outlook. By contrast, 60% of companies in the downstream refining and marketing segment "are either on rating watch negative or have a negative outlook." Fitch analysts said, "This is largely, but not entirely, due to the negative factors affecting the sector, which are considered to represent a 'supercyclical' downturn."

Fitch foresees "greater uncertainty" in 2011 when monetary and fiscal stimulus policies are expected to tighten. Interest rate policies are expected to remain "accommodative" in 2010 with attempts to rein in liquidity beginning in 2011 when global interest rates are projected to rise to 1.01%. Inflation is likely to remain muted at 0.8% in 2010 and 0.6% in 2011 as policymakers balance tradeoffs between currency stability and full employment.

Integrated companies

Credit quality remains robust for large, integrated oil companies with oil-heavy upstream portfolios, sizable cash balances, and low net debt. "Integrated oil has generally been the least impacted by volatile commodity prices, due to its high credit quality, significant headroom to absorb incremental leverage, and willingness to take a longer, 'through the cycle' view on reinvesting," said Fitch analysts.

In the US, they said, "The decoupling of oil and natural gas spot pricing has strongly benefited the integrated firms in the current downturn but has also left cash flows reliant on the continued strength of oil prices," they said. While the majors have exposure to gas prices, analysts said, "Their gas portfolios are global in nature and in many cases benefit from oil-linked pricing mechanisms. Should asset sales heat up, this group is expected to be the acquirers, although past practices would indicate that equity financing is the preferred choice for sizable acquisitions or mergers, as was recently demonstrated by the share-based acquisition of XTO Energy Inc. by ExxonMobil Corp."

Unlike lower-rated independents, highly rated supermajors generally need not rely on external bank credit to fund growth since they are able to generate funds internally. Integrated companies historically have benefited from upstream, midstream, and downstream diversification, but margins and volumes for refining and chemicals have been sharply squeezed over the last several quarters. "As a result, integrateds' organic cash flows are heavily reliant on the strength of oil pricing," said Fitch analysts.

The Russian integrated oil industry remains relatively diversified with seven key producers, none of which exceed more than 25% of total daily production. Despite the recent trend of increased state ownership over the past 5 years, Russia's oil sector remains primarily private with state-owned companies accounting for 30% of total crude output. Meanwhile, Russia's oil industry faces a rapid slowdown of its production growth. In 2008, Russia's average daily oil production declined by 0.7% compared with growth of 10% just 5 years earlier. Fitch expects this to abate, with average production increasing about 1% to 10 million b/d in 2010.

Latin America is dominated by national oil companies, so higher oil prices not only increase cash generation and improve credit metrics but also decrease the political intervention risk in the region, Fisk reported. With the recovery in oil prices, companies are expected to resume aggressive capex programs, which could have a positive impact on future reserves and production prospects. However, Fitch expects production will continue to decline in Mexico and Argentina while increasing in Brazil and Colombia. Venezuelan production will depend largely on the strategy and quota restrictions of the Organization of Petroleum Exporting Countries, analysts said. Lower cost of capital and increased access to both domestic and international debt markets bode well for the business. Fitch expects refining margins to remain positive in 2010 as governments try to offset negative margins in the past.

E&P companies

Credit quality for independent E&P companies will "remain below the highs of the recent past" and should stabilize at 2009 levels, Fisk analysts said. US independents as a group have more exposure to gas prices, which Fitch expects to remain "under considerable pressure" due to too much supply and too little demand. "That said, US E&P companies should benefit from contango market conditions for natural gas futures prices (and the resulting hedging benefits presented to them in 2009), higher oil prices, lower drilling and service costs, and a more responsive capital budget program as many of the long lead-time contracts entered into during the robust market conditions of the past expire," they said.

Improved capital market conditions last year enabled many of these firms to increase liquidity and extend debt maturities. Moreover, many small and large independents plan asset sales. Still analysts said, "Most firms are expected to continue to live within internally generated cash flows, and as a result, reserve and production growth levels should remain well below levels seen since 2004."

Independents have better organic investment opportunities, and Fitch expects them to use cash flows for internal development and production-related projects rather than growth-oriented mergers or aggressive leasehold acquisition programs.

Downstream

The credit metrics for the refining sector "may bottom out at levels worse than those seen during the last industry downturn (2002) and could remain depressed for an extended period, given rising unemployment in many of the developed economies and the potential for a slow economic recovery," Fitch analysts reported.

Currently, 8 of the 13 Fitch-rated refiners globally have negative outlooks, including all of Fitch's North American rated refiners. High fixed costs and low utilization have sharply eroded unit economics and led to significant restructurings by individual companies. Fitch said average refinery utilization may grind lower before gradually improving.

While refiners as a group responded vigorously and early to the downturn by paring back operating costs, cutting shareholder distributions, eliminating noncritical capex, and shuttering some capacity, Fitch noted there may be relatively little left to cut if demand falls further. The shutdown of additional less-efficient refineries would further lower a company's operating structure, but it also will produce higher debt per barrel of refining capacity metrics "as we would not anticipate a proportional amount of debt being retired following further shutdowns," Fitch said.

Meanwhile, leverage to heavy and sour crude economics has been a particular weakness in the current downturn due to the compression in oil spreads, which has hurt the processing economics for cokers, analysts said. And refiners still face the expense of additional environmental and fuels regulation, including increased biofuel requirements and pending greenhouse gas regulation.

Service and supply firms

The outlook for the service and supply business remains poor. Fisk foresees "a modest increase" in drilling the onshore shale plays, but activity in conventional gas plays remains muted because of large supplies and low prices. International drilling activity could see a modest increase with higher oil prices. However, with excess rig capacity in nearly all markets, analysts said, "As older contracts expire, pricing on new contracts (excluding those signed prior to 2009) is expected to be down significantly."

Fitch expects credit quality for the service and suppliers to deteriorate in 2010 "due primarily to amortization of contract backlogs, weak natural gas prices, and the potential for weaker oil prices, weak pricing power (including expectations of falling prices for certain asset classes and geographic locales), and reduced utilization levels for fleets." There could be modest offsets from cost reductions from lower wages, cold-stacking equipment, and any restructuring to reduce overhead expenses.

Deepwater rigs will survive lower commodity prices better than other rig classes over the next 12-18 months. However, analysts said, "The longer-term outlook for these rigs could weaken due to the large number of uncontracted newbuild semis and drillships that will come to market beginning in 2011." The market for jack up rigs and midwater floating vessels has already weakened and is not expected to materially improve during 2010, they said.

The US land rig market will remain bifurcated, with newer units capable of drilling shale resources seeing modest demand increases, compared with weak utilization among older conventional rigs. Service and supply companies with diversified menus of products and services in various geographic areas will best weather the current downturn, analysts forecast.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com