GDF Suez' Gjoa shows facility of remote Norwegian hubs

New hub developments in Norway are expected to stimulate exploration and development of existing smaller North Sea discoveries.

As average discovery size decreases in the most mature areas, the ability to tie back to an existing host with adequate capacity can make the difference between a commercial opportunity or a stranded resource.

In the more frontier areas it has been shown repeatedly that a new processing and shipment hub will kick-start exploration on surrounding acreage, leading to new discoveries and satellite developments.

Due on stream in October 2010, Gjoa field is an example of a hub development that will open up a new area of the Norwegian Continental Shelf. Norsk Hydro discovered Gjoa in 1989 in an area of the Norwegian North Sea dominated by giant Troll field. Following successful appraisal drilling in the 1990s, a development plan for the field was submitted in 2006 and approved in the summer of 2007.

With reserves estimated at 1.2 tcf of gas and 135 million bbl of oil and natural gas liquids, Gjoa is the largest field to be developed in the North Sea since Buzzard in the UK.

Gjoa development work

Gjoa has been developed with subsea templates tied back to a semisubmersible production and processing platform. In mid-2010 the platform, designed, engineered, and assembled by Norwegian contractor Aker Solutions, was towed to its final location. Once production commences, expected shortly, oil will be transported to the Mongstad terminal onshore Norway, while gas will be routed to the St. Fergus terminal in the UK.

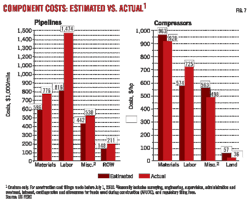

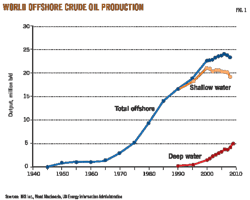

With development costs totaling NK 29.5 billion ($4.9 billion), Gjoa is also one of the largest recent North Sea investments (Fig. 1 and Table 1).

Record levels of activity in Norway have driven up costs across the industry, but Gjoa's relatively remote location and the complexity of its reservoirs have added to its commercial challenges. However, with the majority of capital investment already made, the remaining risks are related to reservoir performance and recovery factor.

Following production start-up later this year, GDF Suez will assume operatorship from Statoil, which used a wealth of Norwegian development experience to lead the construction phase. This will be GDF Suez's first operated development in Norway, continuing the trend of European utilities and downstream backed players that have forged a strong position on the NCS over the past few years.

At peak production in 2011, Gjoa is expected to more than double GDF Suez's production in Norway and will also account for 22% of Norwegian gas volumes exported to the UK in 2011.

Frontier hub in mature region

In isolation Gjoa is clearly an important project, but it could play a far greater role in driving activity in the wider area.

New facilities in an underexploited region create opportunities for existing smaller discoveries while providing an incentive for further exploration.

In the first instance, nearby Vega and Vega Sor fields have both been included in the initial development and will be produced via wells tied back to the Gjoa production platform.

Having previously been regarded as noncommercial, production of Vega and Vega Sor has only been made possible via joint development with Gjoa. The Gjoa infrastructure has been built with flexibility for the inclusion of future tie-ins, and the partners will be looking for further satellite fields and third party income to enhance the return on their investment.

As average discovery size drops, particularly in the more mature areas of the North Sea, this type of hub and spoke development will help enable the commercialization of discoveries that would otherwise have remained stranded.

Gjoa potential catchment area

Gjoa is located in one of the least explored parts of the maturing North Sea.

Only eight exploration and appraisal wells have been drilled on the blocks straddled by the development, and the number of E&A wells drilled on Quadrant 35 is well below the average for surrounding quadrants to the west and south (Fig. 2).

While a giant new find is unlikely, discoveries since 2005 such as Peon, Grosbeak, and Astero clearly demonstrate the area's remaining prospectivity. With limited existing infrastructure—the Fram subsea development being the only other infrastructure located on the quadrant—Gjoa will provide much needed host facilities for future discoveries and an incentive for new exploration.

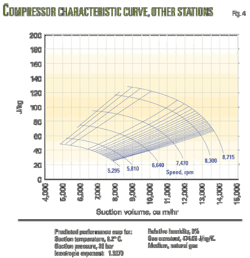

The impact of new infrastructure is clear (Figs. 3 and 4). The number of exploration wells drilled within 50 km of hub developments such as Ula and Norne has more than doubled since their development consent. Even more impressive is the additional 1.6 billion boe of commercial and technical reserves added through exploration and appraisal around the Asgard hub since its project approval in 1997.

Since its development approval, exploration within tieback distance of Gjoa has discovered 150 million boe. But if exploration activity increases in line with observations at other hubs, additional discoveries could add reserves well in excess of initial Gjoa volumes.

In addition to opening a new region of the North Sea for exploration, the Gjoa facilities will also add crucial gas processing capacity to the area. This increase in capacity could accelerate the development of existing and future discoveries that would otherwise have to wait for ullage to become available.

The design capacity of the Gjoa facilities of around 90,000 b/d of liquids and 600 MMcfd of gas means it could comfortably accommodate third party volumes as it comes off peak.

Extending infrastructure to frontier areas

Gjoa has the potential to open an underexplored area in an otherwise mature region of the NCS.

As the project nears completion, other developments that could extend the reach of Norway's infrastructure even farther into one of its most prospective frontiers are progressing.

Statoil's Luva field, in 1,300 m of water, 330 km west of the city of Bodo in the Arctic Circle and 125 km from the nearest producing field, was discovered in 1997 and has remained undeveloped due to its size and remoteness. However, the 2008 Snefrid and Haklang discoveries close to Luva have boosted the area's reserves base, and conceptual studies for a Luva area development are under way.

A new hub development in this area could unlock other nearby discoveries and encourage new exploration activity in a relatively unexplored part of the Norwegian Sea. Only eight exploration wells have been drilled in a 50 km radius of Luva, contrasting with the 38 exploration and appraisal wells and over 900 million boe of additional resources discovered within 50 km of Asgard since it came onstream in 1999. In addition to opening up a new area for E&P activity, Luva development could benefit other discoveries in the Norwegian Sea by redirecting existing gas flows and freeing pipeline capacity sooner than the present infrastructure will allow.

Several major gas discoveries, including Viktoria, Onyx, and Lavrans, have not progressed due to restricted capacity in the Asgard Transportation System. Luva development, potentially via the Nyhamna terminal, could result in new pipelines that would allow a rerouting of gas shipments. With the ATS expected to remain full until at least 2018, a Luva development, initially earmarked for first production in 2017, could provide a welcome boost to capacity from Mid-Norway.

Luva technological hurdles

Major technological barriers will need to be surmounted for Luva to become a commercial reality, not least the challenges associated with operating in a harsh, deepwater environment.

But the lessons learned from Statoil's Snohvit LNG project in the arctic, allied with the deepwater experience of partners ExxonMobil and ConocoPhillips, will prove valuable in establishing the optimal development solution.

And while the initial development of Luva could lead to the recovery of around 2 tcf of dry gas, this could be greatly enhanced by the impact of a new hub on exploration activity, new satellite developments, and increased infrastructure capacity.

The author

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com