OGJ150 financial results down in '09; production, reserves up

The 2009 financial results for the OGJ150 group of companies were off sharply from a year earlier, although the group's oil and gas production and reserves totals mostly climbed from 2008.

Most companies were challenged by lower commodity prices and softer energy demand during last year's economic weakness. Worldwide demand for oil in 2009 fell 1.5% to average 84.7 million b/d, according to the International Energy Agency.

Demand declined in the developed countries of the Organization for Economic Cooperation and Development but increased in the developing countries outside the OECD, boosted by demand growth in Asia and the Middle East.

There are 137 companies in this edition of the OGJ150. Last year's group contained 141 firms (OGJ, Sept. 21, 2009, p. 22).

To qualify for the OGJ150, oil and gas producers must have their headquarters in the US, be publicly traded, and hold oil or gas reserves in the US. Companies appear on the OGJ150 list ranked by total assets. The list also reports rankings for total revenue, net income, stockholders' equity, capital expenditures, production, reserves, and US net wells drilled.

Companies based outside the US appear on the OGJ100 (see accompanying article, p. 64).

The 137 firms in the OGJ150 group posted combined 2009 earnings of $27 billion, down from $71 billion a year earlier. Combined revenues for the group declined 35% to $848 billion.

Changes

Although the OGJ150 group contains fewer companies than a year ago, there are nine firms new to the group this year. One of these, No. 118 Black Raven Energy Inc., was listed as PRB Energy Inc. in this special report as recently as 2 years ago before it entered bankruptcy.

Some companies listed in last year's edition do not appear in the current group as a result of mergers, bankruptcies, and other reasons.

Since the previous edition of the OGJ150, Petro Resources Corp. changed its name and is now listed as Magnum Hunter Resources Corp. Meanwhile, PetroSearch Energy Corp., last year No. 112 by assets, merged with Double Eagle Petroleum Co., currently No. 90.

Aspen Exploration Corp. and Dominion Energy Inc. no longer appear in the compilation, having sold their properties, and Foothills Resources is now a private company and so is no longer part of the OGJ150.

Three companies listed a year ago, Aztec Oil & Gas Inc., GSV Inc., and Rock Energy Resources Inc., are no longer filing 10K reports with the US Securities & Exchange Commission.

Parallel Petroleum Corp., last year No. 71, is not listed this year because it is now a limited liability company.

There are six limited partnerships and four royalty trusts in this year's group.

Oil, gas results

The combined worldwide liquids production of all the companies in this year's OGJ150 declined slightly during 2009, down just 0.5% to 2.794 billion bbl, but their total worldwide gas production climbed 3% last year, totaling 16.5 tcf.

Total worldwide liquids reserves for the OGJ150 group of companies increased 2%, while worldwide gas reserves increased more than 3% to 211.96 tcf.

The 147 companies in the group tallied 12,800.6 US net wells drilled during 2009, a sharp decline from their 2008 count of 24,886.7.

Still, the group last year boosted its oil and gas production and reserves volumes in the US. Production of crude, condensate, and natural gas liquids in the US posted the largest gain over 2008, climbing more than 7% to 1.076 billion bbl for the OGJ150 group.

The group's liquids reserves in the US during 2009 climbed 5%, while its US gas reserves increased 3%. The combined US gas production of the OGJ150 group during 2009 was 10.6 tcf, up from the 2008 total of 10.1 tcf.

Financial performance

In all, 95 companies in the OGJ150 group posted net losses for 2009. This compares to the previous OGJ150 group of 141 firms, of which 65 recorded losses for 2008.

Ranked No. 38 by assets, SandRidge Energy Inc. posted the third-largest net loss for 2009 among the OGJ150 group. SandRidge reported that its net loss applicable to common stockholders of $1.78 billion, including a $1.69 billion noncash full cost ceiling impairment, was attributable to lower oil and gas prices during 2009.

The highest-ranking company in the group to report a loss for 2009 is No. 4 Anadarko Petroleum Corp., which reported a $103 million net loss for the year as a result of quarterly losses in the first half.

Oil prices were sharply lower in the first three quarters of 2009 compared to the unusually high levels they reached in the corresponding 2008 periods. The start of the recession in the US resulted in a plunge in oil prices in the final 2008 quarter.

The US wellhead price of oil averaged $54.55/bbl in the fourth quarter of 2008, down from an average of $113.14/bbl in the 2008 third quarter.

For 2009, the US wellhead price of oil averaged $56.33/bbl, down from the 2008 average of $94.22/bbl.

Gas prices also were off sharply from 2008. For 2009, US wellhead gas averaged $3.71/Mcf, down from $7.95/Mcf a year earlier.

No. 1 ExxonMobil Corp. recorded the highest earnings for the year at $19.28 billion. Second in earnings is No. 2 Chevron Corp., with annual income of $10.56 billion. With $4.86 billion in net income, ConocoPhillips posted the third-highest earnings for the year.

There are 18 companies in the OGJ150 group that posted 2009 net income in excess of $100 million, and 29 in the group recorded a net loss of more than $100 million for the year.

Earnings of oil and gas producers and refiners were lower through the first three quarters of 2009 as a result of lower commodity prices and depressed demand for petroleum products, which hurt refining margins.

Cash refining margins were markedly weaker in the US last year vs. 2008. The East Coast margin averaged just 20¢/bbl for 2009, down from $22.64/bbl a year earlier, according to figures from Muse Stancil & Co.

For Gulf Coast refiners, the average cash refining margin sank to $3.03/bbl from a 2008 average of $9.09/bbl. Midwest refining margins were down 50% from 2008.

Fast growers

The table listing the year's fastest growing companies, a key piece of each year's OGJ150, does not appear in this edition of the special report because no companies qualified for the list.

To qualify for the list of fast growers, a company in the OGJ150 must have recorded positive net income for both 2009 and 2008 and posted an increase in net income in 2009. Excluded from this list of fast growers each year are limited partnerships, newly public companies, and subsidiaries.

Most of the companies in this year's compilation failed to qualify for the list of fast growers simply because their net income fell from 2008 or because they posted a net loss for 2009.

Kinder Morgan CO2 Co. LP did not qualify for the list, although it recorded an increase in earnings from 2008, because it is a limited partnership.

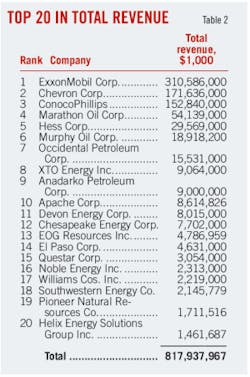

Top 20 companies

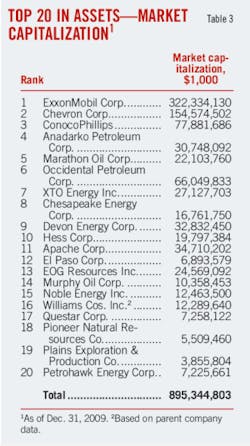

The top 20 companies in the OGJ150 group as ranked by yearend 2009 assets recorded a slightly smaller decline in earnings last year than did the entire group. These top 20 companies posted collective 2009 earnings of $34.19 billion, which was a 54.5% decline from a year earlier.

But since these 20 companies are so large, their results drive the combined results of the entire group. At $952 billion, the assets of the top 20 firms represent 89% of the assets of all 137 companies.

This group of 20 firms includes most of the same ones as it did in last year's OGJ150. The top six—ExxonMobil, Chevron, ConocoPhillips, Anadarko, Marathon Oil Corp., and Occidental Petroleum Corp.—are unchanged in their rankings by assets from last year.

Plains Exploration & Production Co. and Petrohawk Energy Corp. moved into the top 20 this year, taking the place of last year's No. 16 Dominion Energy and Newfield Exploration Co., which moved to No. 21 from No. 20 a year ago.

Capital and exploration expenditures by the top 20 companies during 2009 declined 19% from a year earlier to a combined $103.76 billion. The top 20's count of net wells drilled in the US fell to 7,803.7 from a 2008 total of 14,508.2.

The top 20 companies' worldwide oil and natural gas liquids production declined last year by 1%, totaling 2.58 billion bbl, but their liquids production in the US climbed almost 8% to 867.8 million bbl. This group's combined gas production also increased in the US last year, as did its worldwide gas production, and the top 20 firms reported a collective gain in worldwide and US reserves of both oil and gas over their 2008 totals.

Income leaders

The top three companies as ranked by assets—ExxonMobil, Chevron, and ConocoPhillips—also reported the highest 2009 earnings in the OGJ150 group. ExxonMobil reported a 57% decline in annual earnings, while Chevron's net income declined 56% from a year earlier.

ConocoPhillips's 2009 net income rebounded from to $4.858 billion from a year-earlier loss of $17 billion. ConocoPhillips posted a $31.76 billion loss for the fourth quarter of 2008 due to charges, including a $7.4 billion write-down on the company's investment in Lukoil and a $25.4 billion impairment of all its E&P segment goodwill, the difference between the purchase price of assets and their net worth (OGJ, Mar. 16, 2009, p. 30).

The No. 4 OGJ150 company in terms of 2009 earnings is Occidental Petroleum, followed by XTO Energy Inc., Marathon, and Murphy Oil Co.

Contango Oil & Gas Co. ranks at No. 69 by assets, but the Houston-based company is the 20th company in the group in terms of 2009 earnings. Contango's net income last year was $55.86 million, down from $256.9 million a year earlier.

Spending, drilling leaders

ExxonMobil, Chevron, and ConocoPhillips also top the list of the OGJ150 companies in terms of their 2009 capital and exploratory spending. ExxonMobil and Chevron each reported an increase in such outlays last year from 2008, but ConocoPhillips reported that its annual capital spending last year shrank 43%.

Marathon is fourth on the list of the top 20 companies in 2009 capital and exploratory spending, followed by Chesapeake Energy Co., Devon Energy Corp., and Anadarko.

Ranked at No. 23 by assets, Southwestern Energy Co. ranks at No. 15 in 2009 capital spending with outlays totaling $1.78 billion.

XTO Energy is No. 11 among the top companies in spending but ranks first on the list of the most US net wells drilled for 2009. The number of US wells drilled by the most active companies in the OGJ150 group is down sharply from a year earlier.

In 2009, XTO Energy drilled 1,058.8 net wells in the US; this is down from a total of 1,247 a year earlier. Chesapeake Energy is second in 2009 US wells drilled at 1,003, which is down from the company's 2008 number of net wells drilled, which was 1,733.

The 20 companies with the most US net wells drilled combined for a total of 9,519.4 wells in 2009 compared with last year's 20 leaders in that edition of the OGJ150, which combined for 16,354.4 US net wells drilled.

Production, reserves leaders

Chevron leads the OGJ150 firms in US production of crude, condensate, and NGL with a total of 177 million bbl of output during 2009, up from 154 million bbl a year earlier.

ExxonMobil reported the highest worldwide liquids output for the year at 725 million bbl, followed by Chevron with 674 million bbl.

ConocoPhillips is second in US liquids production, with a total of 153 million bbl, and third in worldwide liquids output for 2009. A year earlier, ConocoPhillips led the group in US liquids production with 157 million bbl of output.

ExxonMobil is third among the OGJ150 companies in 2009 US liquids production but first in worldwide gas production, with output of 2.383 tcf.

XTO Energy overtook the previous leader in US gas production, ConocoPhillips, with the highest 2009 production of 855 bcf. During 2009, ConocoPhillips's gas production in the US slipped to 850 bcf from its 2008 total of 896 bcf.

The five companies in the OGJ150 with the largest US liquids reserves at yearend 2009 are unchanged from a year ago. ConocoPhillips leads the group with 1.905 billion bbl of liquids reserves in the US, followed by ExxonMobil, Occidental, Chevron, and Anadarko.

Devon is sixth in US liquids reserves now with 559 million bbl of oil reserves in the US. In the previous edition of the OGJ150, Devon was seventh on the list following Apache Corp.

And the same four companies lead the OGJ150 group in worldwide liquids reserves as a year ago. These are ExxonMobil, Chevron, ConocoPhillips, and Occidental. Devon has the fifth-largest worldwide oil reserves in the group, while previously Devon was eighth.

Chesapeake now leads the OGJ150 group in US gas reserves, reporting a surge to 13.5 tcf for 2009 from 11.3 tcf a year earlier. XTO Energy, which held the largest US gas reserves previously, is now second with 12.5 tcf, and ExxonMobil is third with almost 11.7 tcf.

ExxonMobil remains atop the list of worldwide gas reserves holders with 34.44 tcf, followed by Chevron, ConocoPhillips, and Chesapeake. In the previous OGJ150, ConocoPhillips was second in worldwide gas reserves, followed by Chevron and XTO Energy.

Click here to download the pdf of the OGJ150 financial results

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com