GENERAL INTEREST — Quick Takes

EOG to shed excess shale play acreage

EOG Resources Inc., Houston, has offered for sale two packages of noncore North American gas assets and acreage in gas and liquids plays to partly fund its 2010-11 capital programs.

A package of Canadian shallow gas assets producing 170 MMcfd went on the market 2 weeks ago. EOG is also offering 180,000 acres of US shale gas acreage. Of the 180,000 acres, 117,000 acres are in the gas, gas-condensate, and crude oil portions of the South Texas Eagle Ford play, 51,000 acres are in the Marcellus shale sweet spot in Bradford County, Pa., and 15,000 acres are in the Haynesville shale play. EOG also will sell 20,000-30,000 acres in the Denver basin Niobrara shale oil play out of its 400,000-acre holding. No more divestitures of any size are likely through 2012, EOG said.

EOG said it has spent $1.7 billion accumulating horizontal shale gas acreage the past few years at relatively low prices.

For EOG to properly address all of that acreage under its current capital structure and level of manpower it would have had to run 100 rigs and behave as a company "out of control," said Mark Papa, chairman and chief executive officer. EOG will still pretty much be "going to the max" operationally the rest of 2010 and all of 2011, he said.

The decision to divest was largely philosophical, said Papa. Selling the properties rather than forming joint ventures was based on the desire to have received 100% of the return rather than 50% of the return for 100% of the work, Papa said.

India to trim ONGC, IOC stakes

India plans to cut its stakes of two major oil companies but to retain controlling interests.

According to The Times of India, Oil Sec. S. Sundareshan said the Finance Ministry has approved divestment of a 5% interest in Oil & Natural Gas Corp., India's largest oil and gas company, and a 10% stake in Indian Oil Corp., operator of eight refineries. IOC plans a separate sale of shares to raise funds.

After the transactions, which are subject to further approvals, the government shares would be 69.14% in ONGC and 64.57% of IOC, the newspaper said.

EPA postpones NY hydraulic fracturing forum

The US Environmental Protection Agency has postponed a public meeting in upstate New York about its hydraulic fracturing study that was scheduled for Aug. 12.

EPA said the meeting will be rescheduled for September and moved 65 miles from its Binghamton University to Syracuse.

The meeting was postponed after the Onondaga County Executive's office in Syracuse said that it did not have enough time to prepare for a public meeting on such short notice. EPA tried to move the meeting after expected public attendance and possible protests and rallies grew beyond a point where Binghamton University officials were comfortable hosting it.

The agency then asked Broome County officials in Binghamton for use of an arena there but were turned down. Efforts to find another meeting site within a 40-mile radius were unsuccessful, EPA said.

EPA said it already has held public meetings about the study, which it initially announced in March, in Fort Worth, Tex., Denver, and Canonsburg, Pa.

"The agency is committed to holding a similar meeting in upstate New York," an EPA news release said.

Gas Plus buying Padana Energia from Eni

Gas Plus SPA, Milan, has agreed to buy 100% interest in Padana Energia SPA, which holds exploration and development rights in northern Italy, from Eni.

Gas Plus will pay €175 million and as much as €25 million in relation to production in the next 5 years. Padana holds 11 exploitation concessions, 2 concession requests, and 1 research permission.

The buyer also acquired the option to buy 100% of Adriatica Idrocarburi SPA, which holds concession interests in central Italy. The option expires Sept. 30.

Eni called the sale part of its "initiative to rationalize its portfolio and optimize its operating efficiency in Italy."

Exploration & Development — Quick Takes

Total proceeds with CLOV development off Angola

Total SA reported it will develop Cravo, Lirio, Orquidea, and Violeta (CLOV) fields on Block 17 off Angola.

The fields lie in 1,100-1,400 m of water and Total expects drilling to start in 2012 with first oil in 2014.

The CLOV project is about 140 km from Luanda and 40 km northwest from the producing Dalia field.

The development plan calls for 34 subsea wells tied back to a floating production, storage, and offloading vessels. The CLOV FPSO will have a 160,000 b/d oil processing capacity and be capable of storing 1.78 million bbl.

The fields will produce two types of oil: a light 32-35° gravity oil from Oligocene reservoirs in Cravo and Lirio and a 20-30° gravity, more viscous oil from Miocene reservoirs in Orquidea and Violeta. Total plans to commingle both oil streams and process the stream in a single train before storage. Total estimates that the fields contain about 500 million bbl of proved and probable oil reserves.

CLOV is the fourth deepwater project on Block 17 and will use technologies proven on the previous projects in the block. The two previous projects that are producing are Girassol, which also includes Jasmin and Rosa fields, and Dalia. The Pazflor project is under construction and Total expects oil production from the project to start in second-half 2011. Pazflor will produce the Perpetua, Acacia, Zinia, and Hortensia discoveries.

Total E&P Angola operates Block 17 and has a 40% interest. Partners include Statoil 23.33%, Esso Exploration Angola (Block 17) Ltd. 20%, and BP Exploration (Angola) Ltd. 16.67%.

Bolivia gets deeper-pool gas-condensate find

Repsol YPF-Bolivia has reported a deeper-pool gas-condensate discovery in Rio Grande field in southeastern Bolivia.

The RGD-22 well, in the Rio Grande contract area 34 miles southeast of Santa Cruz de la Sierra, located 1 tcf of gas in place in an undisclosed formation and can be placed on production quickly. It flowed 6 MMcfd of gas and 160 b/d of condensate on initial tests.

The well is part of a project to deepen existing wells to increase hydrocarbon production. Rio Grande field was discovered in 1962 and has been on production since 1968 from formations as deep as 8,200 ft.

The operator, YPFB Andina, is a public-private partnership held 50.408% by the Bolivian government and 48.922% by Repsol YPF-Bolivia. Andina supplies 39% of Bolivia's natural gas and 37% of its condensate.

Repsol produced 1.9 million bbl of oil and condensate and 315 bcf of gas in Bolivia in 2009 and had reserves of 102 million bbl of oil equivalent. The company is developing Huacaya and Margarita fields, aiming to boost gas output to 567 MMcfd by 2013 from 81 MMcfd today.

Iraq oil discovery's test rate improved

Gulf Keystone Petroleum Ltd. reported a stable test rate of 1,250 b/d of 19.7° gravity oil at the Shaikan-1 discovery in Iraq Kurdistan, up from 128 b/d on a test in 2009.

The natural flow, which the company said resulted from a much-improved test setup, came from the Jurassic Mus formation at 1,627-67 m at 50 psi flowing wellhead pressure with a gas-oil ratio of 10 scf/bbl.

Furthermore, tests using a low-capacity electric submersible pump resulted in rates up to 2,250 b/d of oil.

The workover rig will now test Jurassic Sargelu at 1,450-1,510 m and then configure the well for long-term production testing. The 283 sq km Shaikan block is 90 km northwest of Erbil.

John Gerstenlauer, chief operating officer of Gulf Keystone, said, "This retest of the Mus formation demonstrates that even this very low GOR zone is capable of substantial natural flow production rates when properly configured. In addition, it gives us further encouragement for future development, having demonstrated significantly increased production values even with a low capacity ESP."

Norway approves Marulk field development

The Norwegian Petroleum Directorate has approved plans for the development of Marulk gas-condensate field in the Norwegian Sea via two subsea wells linked to the production vessel on nearby Norne oil field.

According to DONG Energy, a partner, work already has begun because the NPD earlier this year allowed operator Eni Norge AS to sign contracts before receiving formal development approval.

The Norne production vessel will control the Marulk wells. Marulk, discovered in 1992, lies in 370 m of water about 30 km southwest of Norne. DONG estimates total commercial reserves at 71 million boe. Production, starting in the second quarter of 2012, will be from Cretaceous Lysing and Lange sandstones at about 2,800 m.

Niobrara positive feel grows on cautious EOG

EOG Resources Inc. said its comfort level is rising slowly in the Niobrara shale oil play in the Denver basin as it awaits more well production history before formulating reserves estimates.

Whether the heavily fractured reservoir's size will be very large or more moderate remains uncertain, EOG said.

Running four exploratory rigs on 100,000 of its 400,000 net acre position, EOG said its Crittter Creek 2-03H and 4-09H wells are producing at managed restricted rates of 570 and 600 b/d of oil after staged fracs in 5,500-ft laterals in Niobrara. EOG has 100% working interest.

Critter Creek, part of the company's Hereford prospect, is southwest of the company's Jake 2-01H discovery well, in 1-11n-63w, Weld County, Colo. (OGJ Online, Apr. 19, 2010).

The early Jake and Elmer wells have produced 150,000 bbl/well in their first 6 months on line and appear to be stabilizing at 150 b/d each.

Having drilled the first wells on 640-acre spacing, EOG has begun testing closer spacing. The company is monitoring the contribution to production from formation fractures vs. the matrix and believes the matrix is kicking in in some but not all wells. And it is still experimenting with stimulation methods.

EOG said it mapped the entire basin when deciding to establish the play. It avoided Silo itself, a sweet spot developed in Laramie County, Wyo., in the 1980s, because it appeared largely developed short of extension or infill potential. However, EOG does hold acreage north and south of Silo. OGJ

Drilling & Production — Quick Takes

E.On Ruhrgas starts Babbage gas flow off the UK

E.On Ruhrgas UK E&P Ltd. has started production from Babbage gas field in the southern UK North Sea.

E.On Ruhrgas, the operator, expects the field to produce more than 5 billion cu m of gas over 20 years. The production rate will be 2 million cu m/day when all wells are online.

The first phase of development included the installation of a platform in 42 m of water about 80 km off the coast, the drilling of three production wells, and the laying of 28 km of pipeline to connect the field with existing production facilities.

Two more wells will be drilled in a second development phase next year. Fifteen workers will staff the platform in the first 2 years of operation, after which the facility will be managed from shore.

Eastern Barnett combo play turns horizontal

Horizontal wells have proven successful in an area of the North Texas Barnett shale combo play previously designated for vertical wells, prompting EOG Resources Inc. to change its mix of 2010 wells.

Meanwhile, successful drilling on the play's west side led EOG to expand its definition of the core of the combo play to 150,000 net acres from 125,000.

EOG, which holds 25,000 acres on the play's eastern side marked for vertical drilling, estimated ultimate recovery will reach 260,000 bbl of oil, 412,000 bbl of natural gas liquids, and 3 bcf of gas from the Settle 1H horizontal well based on the first 3 months of production. The well cost $4 million to drill and complete, yielding a rate of return greater than 100%.

Another promising east-side well is the horizontal Richardson 3H in far western Cooke County went on production at 325 b/d of oil and was still cleaning up after frac treatment.

In Montague County, initial rates are 344 b/d and 2.5 MMcfd of gas at King 1H, 323 b/d and 1.7 MMcfd at Olden B-1H, and 500 b/d at Alamo B-6H. Rates at all four wells are restricted to minimize frac sand flowback. EOG's working interest is 92-98% in all of the wells.

EOG revised its 2010 Barnett combo drilling plan to 200 horizontal and 34 vertical wells from 126 horizontal and 120 vertical wells originally, saying the switch will likely increase its overall rate of return.

The company is running 14 rigs in the play, where several multiwell patterns are on after-frac flowback.

ADMA-OPCO upgrading Zakum water injection

Abu Dhabi Marine Operating Co. (ADMA-OPCO) let a contract worth about $350 million to McDermott International Inc. to upgrade water-injection equipment at giant Zakum oil field off Abu Dhabi.

In a pressure-upgrade part of the project, McDermott will install new pumps, piping, and transformers; modify instrumentation and equipment; and reinforce water injection modules at the Zakum Central supercomplex and Zakum West supercomplex 6 miles to the west.

In a capacity upgrade part of the project, McDermott will provide engineering, procurement, and construction services for a new 3,250-tonne deck housing a new water treatment and injection system, power generation equipment, and six-legged jacket.

RWE Dea orders gas platforms

RWE Dea AG awarded an engineering, procurement, and construction contract to the Heerema Fabrication Group for a minimum facilities platform for Breagh A gas field in UK Block 42/13. Earlier this year, it also awarded HFG an EPC contract for a minimum facilities platform for Clipper South in UK Blocks 48/19 and 48/20.

Breagh A field is in 62 m of water about 100 km east of Teesside. Gas will be exported via a 20-in. pipeline to be laid from the platform to the UK mainland.

RWE Dea estimates Breagh and the surrounding fields have the potential to be the largest natural gas discoveries still to be developed in the UK Southern North Sea. The gas field is a conventional Carboniferous reservoir and the company expects further upside potential in the surrounding exploration blocks.

For Breagh A, HFG will construct the jacket, topsides, and piles at its Vlissingen yard in the Netherlands, with a planned delivery date of late July 2011. The jacket will be about 85-m high and weigh 4,000 tonnes, including piles. The platform will have a 1,400 tonne topsides.

Clipper South field is in 23 m of water about 169 km east of the Theddlethorpe gas processing terminal.

The Clipper South gas field lies in the Sole Pit basin of the Southern North Sea and will produce from the Rotliegend tight-gas play fairway. Gas will be exported to the UK.

HFG also will construct the jacket, topsides, and piles for the Clipper South in its Vlissingen yard, with a planned delivery date of early July 2011. The jacket will be about 40-m high and weigh 1,160 tonnes, including piles. The topside will weigh about 2,000 tonnes.

RWE expects initial gas production from Clipper South during first-quarter 2012 followed by gas production from Breagh in third-quarter 2012. Operator RWE Dea holds an aggregate 70% interest in Breagh with the remaining 30% held by Sterling Resources UK Ltd.

CNOOC starts up Bohai Bay oil field

CNOOC Ltd. has brought Bozhong (BZ) 19-4 (shallow formation) oil field on production in China's Bohai Bay and raised estimates of peak flow rates.

The state-owned company said the field will reach peak output of 15,600 b/d "within the year." In a February strategy preview, CNOOC projected Bozhong field peak production at 8,000 b/d.

CNOOC developed the field with two wellhead platforms installed in 21 m of water about 7 km northwest of BZ 25-1 oil field (OGJ, June 14, 2010, Newsletter). The development makes use of BZ 25-1 facilities.

PROCESSING — Quick Takes

Western Refining idling Yorktown refinery

Western Refining Inc. is suspending operations at its 70,000-b/d Yorktown refinery in York County, Va.

Citing "the poor outlook for East Coast refining margins," the company said in a press statement that it will continue to operate the Yorktown products terminal.

In the statement, the company said it "is evaluating all strategic alternatives, and if the situation improves would consider restarting refining operations."

It said the shutdown will take 6 weeks.

The refinery has fluid catalytic cracking and coking units in addition to distillate and naphtha hydrotreating, reforming, and LPG polymerization units.

Western Pres. and Chief Operating Officer Jeff Stevens called the move a "necessary decision driven by the ongoing challenging refining margin environment experienced on the East Coast, the continued low price differentials between light-heavy crudes, and poor coking economics."

The announcement came as Western reported net income of $14.4 million for the quarter that ended June 20. In the comparable quarter of 2009 the company lost $28.5 million before extraordinary items.

Western also has a 125,000 b/d refinery in El Paso and a 40,000 b/d refinery near Gallup, NM.

Contract let for Ruwais base oils plant

Abu Dhabi Oil Refining Co. (Takreer) has let a contract to Shaw Group Inc. for project management consulting services during the engineering, procurement, and construction phase of a base oils plant at the Ruwais Industrial Complex in Abu Dhabi.

Takreer, a unit of Abu Dhabi National Co., is doubling capacity of the Ruwais refinery to 817,000 b/d and expanding a petrochemicals complex at the site (OGJ, Oct. 27, 2008, Newsletter). The refinery expansion is to be complete in 2014.

The Shaw contract involves a plant able to produce 500,000 tons/year of Group III base oils and 100,000 tons/year of Group II base oils. Start-up is scheduled for 2013.

TRANSPORTATION — Quick Takes

El Paso launches open season for MEPS project

El Paso Midstream Group Inc., a subsidiary of El Paso Corp., on Aug. 9 began a 30-day, nonbinding open season to solicit interest for its proposed Marcellus Ethane Pipeline System (MEPS).

The open season is scheduled to close Sept. 10. Subject to sufficient customer interest, MEPS plans to negotiate terms with interested parties that would be contained in transportation agreements. A binding open season is scheduled for October.

MEPS would transport as much as 60,000 b/d ethane at fractionation plants in the Marcellus shale to destination interconnect points with third-party ethane pipelines and storage facilities in the Baton Rouge, La. MEPS would use a combination of new pipeline and existing pipeline segments, expected to be acquired from Tennessee Gas Pipeline Co. and converted to ethane service. El Paso has targeted an in-service date of Apr. 1, 2013.

Both MarkWest Liberty Midstream & Resources LLC and Cumberland Plateau Pipeline Co. LLC also have proposed systems to move Marcellus ethane to the US Gulf Coast (OGJ Online, June 4, 2010).

Newfield repairs Malaysian export line

Newfield Exploration Co. announced Aug. 9 the resumption of more than 20,000 b/d oil production from its East Belumut field, on Block PM 323 off Malaysia, following repairs to a damaged export pipeline.

East Belumut was offline for 4 weeks, following damage to the pipeline connecting the East Belumut platform to the Tinggi platform, roughly 17 miles away. An unidentified vessel caused the damage. East Belumut is about 160 miles off peninsular Malaysia in 240 ft of water.

Newfield estimates deferred production in third-quarter 2010 stemming from the pipeline damage of about 300,000 bbl, as compared with original estimates of 500,000-600,000 bbl. Newfield operates PM 323 with a 60% interest.

The company estimates its total Malaysian production as of mid-2009 at 40,000 b/d from seven shallow-water developments. Newfield expects 2010 total company production will be 283-288 bcf equivalent, an increase of at least 10% over 2009.

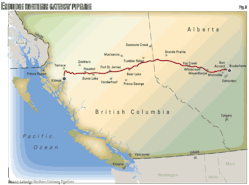

TransCanada withdraws permit request for pipeline

TransCanada has withdrawn its request to the Pipeline and Hazardous Materials Safety Administration for a special permit that would have allowed TransCanada to operate the proposed Keystone XL line at a slightly higher pressure than US regulations for oil lines. After listening to concerns from the public and various political leaders, TransCanada withdrew its special permit application. Keystone XL will implement the additional safety measures that would have been required under the special permit. These measures offer an enhanced level of safety and would allow TransCanada to request a special permit in the future, the company said.

When completed, the project will increase the commercial capacity of the overall Keystone Pipeline System to 1.1 million b/d from 590,000 b/d. Keystone XL is a planned 1,959-mile, 36-in. oil line starting in Hardisty, Alba., and moving through Saskatchewan, Montana, South Dakota, and Nebraska.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com