GENERAL INTEREST — Quick Takes

ConocoPhillips to sell Lukoil holdings

ConocoPhillips announced plans to sell all its holdings in Russia's OAO Lukoil.

Lukoil already agreed to buy 40% of ConocoPhillips's stake for $3.44 billion. These shares represent a 7.6% overall interest in Lukoil. That transaction is expected to close during the third quarter.

ConocoPhillips expects to sell its remaining stake in Lukoil by yearend 2011, either in open market transactions or directly to Lukoil.

Jim Mulva, ConocoPhillips chairman and chief executive officer, said ConocoPhillips and Lukoil worked closely together for 5 years.

Proceeds from the sale will be used primarily to repurchase ConocoPhillips shares, Mulva said.

ConocoPhillips is trying to sell a total of $10 billion in assets. In June, the company completed a $4.65 billion transaction to sell its 9.03% interest in the Syncrude oil sands project to subsidiaries of Sinopec International Petroleum Exploration & Production Co.

Aussie court OKs Shell, PetroChina bid for Arrow

Australia's Federal Court has approved the $3.5 billion (Aus.) acquisition of Brisbane-based coal seam gas producer Arrow Energy Ltd. by Royal Dutch Shell PLC and PetroChina.

Arrow shareholders had overwhelmingly supported the all-cash proposal during an extraordinary general meeting on July 14. Each share of Arrow was priced at $4.70 (Aus.).

The shareholders also will receive a single share of Dart Energy Ltd. for every two shares of Arrow they hold. Dart now holds Arrow's 90% interest in Arrow International among other assets.

The court's approval has been lodged with the Australian Securities and Investments Commissions on July 30 and Arrow shareholders will receive the cash for their shares on Aug. 6.

Shell Australia Chairman Russell Caplan said Shell and PetroChina will bring LNG expertise and deep access to markets as well as the capital needed for the large-scale, long-life integrated CSG-to-LNG project proposed for Gladstone using the gas resources originally proved up by Arrow in the Surat and Bowen basins of Queensland.

Caplan added that the joint venture with PetroChina will become an important growth asset for Shell and help meet growing demand for cleaner energy in Australia and international markets.

The 50-50 JV will own Arrow's CSG assets and domestic power business as well as Shell's individual CSG assets in the region and its interest in the planned LNG plant on Curtis Island near Gladstone.

Hess to acquire AOG in all-stock deal

Hess Corp., building on several recent acquisitions aimed at diversifying its worldwide portfolio, has agreed to acquire American Oil & Gas (AOG) in an all-stock transaction.

AOG's operations are largely concentrated in the Bakken and Three Forks formations in the Williston basin area of North Dakota, where it controls about 68,000 net acres.

In late March, AOG claimed a $64 million valuation of its oil and gas properties, reporting total proven reserves of 147,510 bbl of oil and 8.66 billion cu m of natural gas at yearend 2009.

In addition to two wells it has drilled since December 2009, AOG plans to drill another five net wells through yearend at Goliath. Besides Goliath, the company owns 530 sq km in the Rocky Mountains.

The acquisition, which adds to earlier deals struck by Hess in Norway and France, will significantly increase the firm's strategic acreage position in North Dakota's Bakken oil play.

AOG also is expected to benefit from a $30 million working capital credit from Hess that will help to finance its exploration and production activities.

Hess's acquisition comes at a time when the firm also is expanding its portfolio overseas. In an effort to increase its reserves, Hess acquired additional interests in Norwegian North Sea offshore fields Valhall and Hod (7.85% and 12.5% respectively) from Total in June for $496 million in cash ( Online, June 22, 2010).

In May, Hess and Paris-based Toreador Resources Corp. announced that they will jointly tackle Toreador's shale oil permits in France's Paris basin, where the Jurassic Toarcian shale covers an area larger than the North Texas Barnett shale play ( Online, May 11, 2010).

Exploration & Development — Quick Takes

EQT presses Marcellus, Huron/Berea activity

EQT Corp., Pittsburgh, said its production subsidiary sold 31.9 bcf of natural gas equivalent in the quarter ended June 30, up 31% for the second consecutive quarter.

EQT said 45% of its gas sales came from horizontal shale wells, up from 28% in the 2009 second quarter. Marcellus shale output, expected to exceed 140 MMcfd by yearend, averaged 55 MMcfd in the second quarter.

Management said EQT doesn't have nearly enough capital to develop its "immense resource base."

The company plans to have drilled 96 Marcellus wells in Pennsylvania and West Virginia and 271 Huron/Berea wells in Kentucky in 2010. It has spudded 62 horizontal Marcellus wells with a 3,550-ft average completed lateral length and 143 Huron/Berea wells with an average 3,920 ft in 2010.

The company is drilling longer laterals, and the length will vary greatly depending on the geometry of its acreage blocks, management said.

Of 115 horizontal wells EQT has spudded in the Marcellus play, only 34 are on line, 27 are drilling with large rigs or being "top holed," 38 are awaiting fracs, and 16 are completed and awaiting hookup. The company does not start gas flowing until it has finished all completion work on a pad.

One Marcellus well that has been on line 90 days has an estimated ultimate recovery of 8.8 bcf. The $5.3 million well has a 5,300-ft lateral with 4,800 ft of pay and 16 frac stages. EQT began frac work July 28 at another Marcellus well with a 8,400 ft of pay in a 9,000-ft lateral and has pumped the first two of a planned 28 frac stages.

EQT revised its estimate of midstream cost in support of its Marcellus development to $1.29/Mcf from $1.98/Mcf. That figure plus efficiencies from pad drilling and increased production per well have doubled the all-in aftertax return rate to an average 63% at a flat $6/MMbtu and hiked the rate to 23% at $4/MMbtu.

The company took a $4.5 million charge in the quarter for terminating a contract for the processing and disposal of recovered frac water. It no longer requires that capacity because it is using 90-100% of recovered frac water to frac new wells.

Tullow finds Butiaba's thickest pay in Uganda

An appraisal well in the Butiaba region of Uganda Block 1 encountered more than 40 m of net oil-bearing reservoir, the thickest oil pay encountered in the Butiaba sector, said Tullow Oil PLC.

The Ngiri-2 appraisal well found the 40 m of net pay in two zones in a 131-m gross oil-bearing interval. The well went to 892 m 1.7 km north of the Ngiri-1 discovery well on the Warthog prospect (see map, , Feb. 16, 2009, p. 34).

Tullow Oil noted that after 32 successes in 33 wells the Lake Albert Rift basin still delivers from the upside potential. The company said it has discovered more than 950 million bbl of oil and estimates the yet-to-find prospective resource at 1.5 billion bbl.

Logging and sampling operations at Ngiri-2 confirmed the presence of movable oil in both zones. The lower zone encountered an oil-water contact, and pressure data from the upper zone indicate the possibility of a deeper contact than expected.

Reservoir quality is excellent, akin to Kasamene field in Block 2, where a production rate of 3,500 b/d of oil was achieved during testing in 2009.

Ngiri-2 is the first of a multiwell appraisal program planned to further evaluate the extent and recovery potential of Ngiri field. Tullow plans to drill the Ngiri-3 and Ngiri-4 downdip appraisal wells designed to establish oil-water contacts and reservoir distribution.

Tullow suspended Ngiri-2 and is moving the rig to the Mpyo-1 wildcat location. Tullow operates its 100% interests in Blocks 1, 2, and 3A.

Tullow said, "This continued success supports our planning for the accelerated basinwide development with our future new partners Total and China National Offshore Oil Corp."

Regulatory fears, cost fuel Laurentian pullout

ConocoPhillips Canada Resources, in partnership with BHP Billiton Petroleum, withdrew as of June 9 a request to renew the St. Pierre & Miquelon (SPM) permit in French waters in the Atlantic south of Newfoundland and a June 29, 2009, request to license the 545-sq-km, 5-year Langlade exploration permit, south of the SPM acreage.

Spokesman Rob Evans told that ConocoPhillips Canada is still "analyzing the results of our recent exploration well in the Laurentian subbasin and no final decisions have been made regarding future activities in the area."

Evans was referring to the East Wolverine hole drilled early this year on adjoining Laurentian acreage in Canadian waters on a license that recently expired. Since January, ConocoPhillips Canada has acquired two further exploratory licenses, EL 1118 and EL 1119, where, as on the French side, water depths can reach 2,000-3,000 m.

The licenses lie 380 km southwest of St. John's. ConocoPhillips Canada obtained the SPM acreage from ExxonMobil Canada in 2005.

Thierry Basle, SPM development director, said ConocoPhillips withdrew from the French Laurentian permits because of the high cost involved in holding licenses in both jurisdictions and also out of caution over deepwater drilling regulations that might loom after the Gulf of Mexico Macondo oil spill.

The former Gulf Canada Resources Ltd. drilled the only well in French Laurentian waters in 2001. No further drilling or seismic work have occurred even though the basin is an eastern extension of the Scotian and Sable subbasins where important gas and oil volumes have been proved in fields such as Sable Island, Venture, Cohasset, and Panuke.

The Langlade permit is open to competing offers until Aug. 30, confirmed Charles Lamiraux, chief geologist in charge of exploration permits in France's hydrocarbon administration. Bardoil Energy SAS, a small, little known SPM company, in June 2009 requested the overlapping but larger Permis d'Hermine, a 5-year, 1,312-sq-km research permit.

Drilling & Production — Quick Takes

Shell starts Gbaran-Ubie flow in Nigeria

Oil and gas production has begun from Shell Petroleum Development Co. of Nigeria's five-field Gbaran-Ubie project in the Niger Delta of Nigeria.

At capacity next year the project will be able to produce 1 bscfd of gas and 70,000 b/d of oil. A gas processing plant that's part of the project is yielding 200 MMscfd of gas from the first two of 33 wells to be brought online (, June 7, 2010, p. 52). The Gbaran-Ubie fields cover 250 sq km in Bayelsa and Rivers states.

Most of the gas feeds the Nigeria Liquefied Natural Gas plant at Bonny. Gbaran-Ubie gas also will fuel electric power generation plants at Imiringi and Gbaran.

Statoil starts producing oil from Morvin

Statoil Petroleum AS started oil production from the subsea completed Morvin field in the Norwegian Sea Block 6506/11. A 20-km pipeline ties back Morvin to the Asgard B platform on the Halten Bank.

Morvin is an 8.7 billion kroner (2007 value), two subsea template development with four production wells in 350 m of water. The discovery well drilled in 2001 found oil in Middle Jurassic sandstones in the Garn and Ile formations at a depth of about 4,500 m.

Statoil expects Morvin initially to produce about 24,000 boe/d with production increasing to 51,000 boe/d after start-up of a second well. The company estimates that the field will recover 70 million boe during its 15 year life.

Statoil is the operator and holds a 64% interest in the field. Partners are Eni Norge AS 30% and Total E&P Norge AS 6%.

Flow starts from Arcadia field in Egypt

Oil production has begun from Arcadia field on the Meleiha Concession in the Western Desert of Egypt.

Eni SPA, the major interest holder, said the Arcadia-1X well went online only 45 days after discovering oil in the Lower Cretaceous Alam El Bueib formation. Production uses nearby Meleiha facilities. The well also tested gas in the deeper Jurassic Katatba formation.

Eni said the field will produce up to 3,000 boe/d after four more wells are drilled in 2010 and 2011.

The company holds a 56% participating interest in the concession through its wholly owned affiliate Ieoc. Other concession interests are Lukoil 24% and Mitsui 20%.

The Arcadia operator is Agiba, a joint operating company owned equally by Ieoc and Egypt General Petroleum Co.

Targeting deeper zones in the Western Desert and better appraisal of past discoveries, Eni has begun a 3D seismic survey on the concession focusing on deep Lower Cretaceous and Jurassic strata.

Ultra adds acreage to Marcellus core position

Ultra Petroleum Corp., Houston, said it has hiked its Marcellus shale acreage position to 255,000 net acres in Pennsylvania, making it one of the play's 10 largest landholders.

The company said it has identified undeveloped reserves of 8 tcf of gas equivalent in the Marcellus play in addition to its 12 tcfe in Wyoming.

Ultra added 85,000 net acres in the first half of 2010 to its Marcellus core position in Tioga, Lycoming, Potter, Clinton, and Centre counties.

Companywide production was 97 bcf of gas and 649,800 bbl of condensate in this year's first half, up 17% from the 2009 first half, and 50.4 bcf and 327,900 bbl in the second half, up 18% from the 2009 second quarter.

In the second quarter Ultra completed 48 wells averaging 27 frac stages/well for a total of nearly 1,300 stages. In the first half the company ran 2,380 frac stages across almost 90 wells, an average of 26 stages/well. Both figures are above the 2009 comparable periods.

Ultra participated in drilling 37 gross Pennsylvania Marcellus horizontal wells that averaged 4,400-ft laterals and 12 frac stages. It connected 20 gross Marcellus horizontal wells in the second quarter.

Production peaked at 46 MMcfd on the second quarter, when it averaged 33 MMcfd. The average rate on day 60 exceeds 3 MMcfd among all the 36 gross Marcellus horizontal wells that were on production as of June 30.

PROCESSING — Quick Takes

Williams Partners to build Colorado gas plant

Williams Partners LP plans to expand its cryogenic processing capacity in the Piceance basin, the partnership announced July 29 as part of its second-quarter 2010 earnings release.

It will build a 450-MMcfd gas plant at Williams's Parachute, Colo., complex. The new plant will be capable of recovering up to 25,000 b/d of NGLs.

It will be in service in 2013 to process Williams's natural gas production in the Piceance basin, which currently exceeds processing capacity at Williams Partners' Willow Creek plant.

The proposed expansion of the Parachute plant is subject to "certain final approvals," said the report.

The earnings report also reviewed an announcement earlier in the month that it will increase ownership of Overland Pass Pipeline Co. LLC to 50%. Currently, Williams Partners owns only 1% with the remainder owned by Oneok Partners LP. A previously announced option price was about $425 million.

Subject to regulatory approvals, said the company, Williams Partners expects to close the transaction in third quarter with an effective date of June 30. The company plans to fund the purchase price with a combination of cash on hand and/or borrowings from its existing credit facility, said the earnings report.

Overland Pass pipeline includes a 760-mile NGL pipeline from Opal, Wyo., to the Midcontinent NGL market center in Conway, Kan., along with 150 and 125-mile extensions into the Piceance and Denver-Julesburg basin basins in Colorado.

Williams Partners' NGL volumes from its two Wyoming plants and its Willow Creek plant in Colorado are dedicated for transport on Overland Pass Pipeline under a long-term shipping agreement.

Aramco lets Yanbu refinery contracts

Saudi Aramco has signed a series of engineering, procurement, and construction contracts for the 400,000-b/d export refinery it plans at Yanbu Industrial City on Saudi Arabia's Red Sea Coast.

The refinery will process Arabian Heavy crude and yield 90,000 b/d of gasoline, 263,000 b/d of ultralow-sulfur diesel, 63,000 tonnes/day of coke, and 1,200 tonnes/day of sulfur.

The contracts:

• Tecnicas Reunidas (Spain)—coker package.

• Saudi Services (Saudi Arabia)—high-voltage electrical package.

• SK Engineering & Construction Co. (South Korea)—crude package.

• Dayim Punj Lloyd (Saudi Arabia)—offsite pipelines package.

• Daelim (South Korea)—gasoline and hydrocracker packages.

• Rajeh H. Al-Marri (Saudi Arabia)—onsite pipeline relocation package.

• ENPPI (Egypt)—tank farm package.

Under a contract awarded earlier, Abdulrahman Al-Shalawi Establishment is preparing the 5.2 million-sq-km site for construction.

Sale talks end for Montreal East refinery

Shell Canada Products is proceeding with the announced closure of its 130,000-b/d Montreal East refinery after ending talks with a potential buyer (, Jan. 25, 2010, Newsletter).

Shell had been negotiating sale of the refinery to Delek US Holdings Inc., which operates a 60,000-b/d refinery in Tyler, Tex., and has distribution and petroleum retail businesses.

After negotiations ceased, Shell said it had been working on detailed planning for conversion of the refinery to a terminal in parallel with a year-long effort to find a buyer.

"During this time, more than 100 companies were contacted regarding the asset, none of whom saw an acceptable future for the site as a refinery," said Richard Oblath, Shell vice-president, downstream portfolio.

He said Shell would convert the refinery into a terminal "as soon as possible" after completion of a regulatory review.

TRANSPORTATION — Quick Takes

El Paso receives approval to build Ruby line

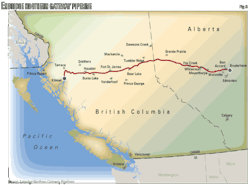

El Paso Corp. announced Aug. 2 that the Ruby Pipeline Project has received approval from the US Federal Energy Regulatory Commission to begin construction. Ruby will extend 680 miles, using 42-in. OD line pipe and four compressor stations to transport natural gas from an existing supply hub at Opal, Wyo., to interconnections near Malin, Ore. Initial design capacity is 1.5 bcfd.

In April Ruby received FERC approval of its application of public convenience and necessity for the project ( Online, Apr. 7, 2010).

The most recent approval recognizes that all required permits and approvals have been granted, including those pertaining to Section 106 of the National Historic Preservation Act, and that El Paso may now being line construction. Ruby received its US Bureau of Land Management right-of-way grant July 13.

El Paso began construction of the pipeline July 31, and anticipates having it in service March 2011

El Paso has entered into agreements with Global Infrastructure Partners (GIP), whereby GIP will invest up to $700 million in the Ruby project. Upon satisfaction of various closing conditions, GIP will then acquire a 50% equity interest in the project.

Magellan launches open season for W. Texas line

Magellan Midstream Partners LP announced July 29 launching an open season to assess firm customer interest to transport crude oil from West Texas to the partnership's East Houston terminal. Magellan is evaluating the reversal and conversion of a portion of its 18-in. OD Houston-to-El Paso refined products pipeline, formerly known as the Longhorn pipeline, to crude oil service. This system's potential crude transportation capacity would be up to 200,000 b/d.

Magellan is particularly considering reversal of the pipeline segment from Crane, Tex., to Houston. Crane is about 30 miles south of Odessa, Tex. If the reversal and conversion move forward, the partnership would still be able to transport at least 60,000 b/d of refined products to the El Paso market by enhancing the operational connectivity of its nearby infrastructure.

The project scope remains under review, but current preliminary estimates for the potential reversal and conversion of this pipeline system, connectivity enhancements for refined products service, and associated storage are approximately $150 million. Interested customers must submit binding commitments to Magellan by Sept. 15.

Magellan is also evaluating pipeline connections to transport crude oil and condensate from the Eagle Ford shale formation to its East Houston terminal, which may be included in a future open season.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com