Tanker market earnings for the half-year ended March 2010 firmed 48.0% over the prior 6 months. The upward momentum came despite a 3.9% drop in oil sea trade and 7% growth in the tanker fleet, with floating storage of speculative oil and the continued marginalization of single-hull tankers helping absorb some of the potentially excess tonnage.

Clarkson Research Services Ltd., London, detailed the reasons behind these market movements and offered forecasts of future market direction in its Spring 2010 "Shipping Review and Outlook: A Half-Yearly Review of the Shipping Market."

According to Clarkson data, the tanker market, comprised of both modern and early-1990s VLCCs, modern Suezmax, modern Aframax, and both dirty and clean-products carriers, averaged $17,615/day in earnings from September 2009 to March 2010, a 48% increase from the $11,901/day seen March 2008 to September 2009. Greater than 50% increases in both categories of VLCC earnings, to $44,689/day (modern) and $40,692/day (early 1990s), led the upward momentum, with earnings for all segments moving up from the previous 6 months (Table 1).

Clean-products tankers' earnings rose even more rapidly, recovering to $12,435/day from 6-month earlier levels of $7,301/day, a more than 70% increase.

Another example of market strength, according to Clarkson, were March 2010 spot VLCC day rates of $52,066. These were below both the recent market peak of $71,000/day in January 2010 and the 2008-09 average of $58,827/day but were nonetheless a marked improvement from the $18,876/day seen in September 2009.

Even with signs of strength in the market, however, Clarkson pointed to both modest anticipated growth in crude and products demand and 45.2 million dwt of new vessel deliveries as potentially placing pressure on rates over the course of 2010.

Clarkson balances the new tonnage deliveries against a similar amount of single-hull tonnage due for phaseout in predicting a 2% growth in the overall tanker fleet over the course of 2010, to 443.8 million dwt. It also, however, notes use of single-hull tankers still in service having already been scaled back to an average of 2.4 cargoes/year in 2009 from 7 in 2006 as a potentially bearish market factor and slippage in newbuild deliveries from shipyards as potentially bullish, seeing market volatility and earnings as tied most directly to trends in storage and delivery slippage.

This article will detail some of the other findings in a few of the numerous vessel categories covered twice a year by Clarkson in its Shipping Market Outlooks.

Market outlook

Average tanker earnings improved 17% over the 6 months ending March 2010, led by a 45% improvement in spot rates, according to Clarkson. Clarkson noted that earnings remained down compared to the 2008-09 average despite their period-to-period improvement. The average Aframax spot rate nearly quadrupled between September 2009 and March 2010. Rates for a 1-year clean-products time charter, by contrast, were unchanged over the same period.

Crude tankers of all categories gained ground against 2008-09 average spot rates over the 6 months, led by VLCCs. The 2008-09 average spot rate for a VLCC was $58,827/day, vs. $18,876/day at the start of September 2009 and $52,066/day at the start of March 2010. Rates for a 1-year time-charter of the same vessel type, however, rose just 6%, to $39,000/day, according to Clarkson, remaining 20% below their 2008-09 average.

Ship values were mixed, with crude tankers registering increases between 1% and 10% over the period, while 5-year old clean product tanker values (30,000 dwt) slipped 4% to $22 million.

VLCC

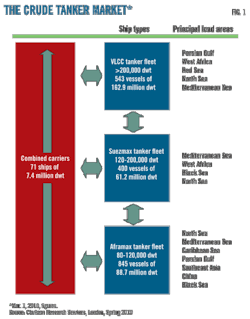

By Mar. 1, 2010, the VLCC fleet totaled 162.9 million dwt, (Fig. 1) up substantially from the 147.6 million dwt in place Sep. 1, 2008, but only marginally from the 162.0 million dwt level of Sept. 1, 2009. Clarkson sees single-hull scrappage as shrinking the fleet to 155.2 million dwt by yearend 2010. Three single-hull tankers had been phased out in 2010 by Mar. 1, with 78 remaining for the balance of the year. A 61-million-dwt VLCC order book, however, will see the fleet expand to 172.3 million dwt by yearend 2011, according to Clarkson.

Clarkson attributed the relatively sustained recovery in the VLCC spot market for the 6 months ending Mar. 1, 2010, to increased oil demand and cold weather in northern Europe and China. Estimates suggest as many as 35 VLCCs could have been used as floating storage between October and December 2009, helping further push spot rates up to a January 2010 peak of $71,000/day. A weakening contango, however, saw February average spot VLCC earnings soften to $43,331/day.

The time-charter market also firmed, with 1-year rates for 1990s-build tonnage reaching $35,000/day by March 2010 compared to $34,000/day at yearend 2009 (Fig. 2, Table 2).

Clarkson noted that the Organization for Economic Cooperation and Development oil demand is not expected to improve in the coming years, with expanding Chinese and Indian economies instead being the primary contributors to global demand increases. China's focus on Venezuelan oil could increase VLCC tonne-mile dwt demand, according to Clarkson, with increased Indian chartering also firming VLCC rates.

Clarkson described the short-term outlook for the VLCC spot market as more positive than 6 months earlier, with high levels of scrapping acting to reduce the overall fleet and any further delivery slippage of new vessels potentially helping mitigate the expected 2011 fleet increase.

It balanced this assessment, however, by noting that global oil demand is unlikely to return to 2007 levels for some time, placing pressure on the shipping market in the future.

Suezmax

On Mar. 1, 2010, the Suezmax fleet totaled 400 vessels and 61.2 million dwt, up 1.3% from yearend 2009 levels. Clarkson expects a further 6.5 million dwt to be delivered this year, with 22 vessels totaling 3.2 million dwt being phased out. With 9.9 million dwt forecast to be delivered in 2011 and phaseout of single-hull vessels having been completed by then, Clarkson sees further fleet growth ahead.

Prices for newbuild Suezmax vessels stood at $61.75 million as of March 2010, down 1.2% from yearend 2009. Prices for 5-year old vessels, however, firmed 4.4% to $59 million, according to Clarkson (Fig. 3).

Spot earnings peaked in January 2010 at $50,195/day, up 40% from September 2009. As was the case with VLCCs, however, earnings slipped 44% to $27,902/day during February. Even with the spot softening, time-charter rates for 1-year on a modern vessel firmed 4.8% from the end of 2009 to $22,000/day.

Volatile earnings in November and December reflected a tightening of supply and demand for tonnage, according to Clarkson. But an emerging tendency to combine two Suezmax cargoes into a single VLCC cargo for shipment east also developed, with a long-term supply agreement between Angola and China potentially continuing this tendency.

Clarkson expects spot rates in the Suezmax sector to remain subdued in the short term, noting that West African oil production will have to rise sharply to balance expected additions to the fleet. Nigerian production did increase over late 2009 and early 2010, but militant attacks and political instability seem unlikely to be resolved soon, according to Clarkson, complicating potential medium-term output growth.

Aframax

By Mar. 1, 2010, the Aframax fleet had increased to 88.7 million dwt. Another 7.6 million dwt scheduled for delivery over the balance of 2010, only partially offset by single-hull scrappage of 3.2 million dwt, will continue to expand the fleet, according to Clarkson. Deliveries in 2009 totaled a record 10.6 million dwt, despite non-delivery rates of 33%.

Aframax earnings ended 2009 at $28,049/day and slipped over the next 2 months to $9,413/day, still above August 2009 levels of $5,509/day, according to Clarkson. Clarkson ascribed shrinking Aframax rates between September 2009 and February 2010 to heavy refinery maintenance schedules and weak refining margins in the Mediterranean. Caribbean activity was countered by weak US demand.

Clarkson expects the large Aframax order book to outweigh anticipated improved oil demand and associated demand for the vessels and weaken earnings in 2011. The increased demand will be driven partly by improved prospects for Caspian-region exports through the Black Sea, Clarkson said, at least partially countering the anticipated long-term decline in North Sea production.

Products

Clarkson reported a softer clean products market during the first 2 months of 2010, with average spot earnings dropping 8% to $14,889/ton. Clarkson expects the active products tanker fleet to grow by 8.3% over the balance of the year, noting an 82-vessel Panamax order book (equivalent to 21% of the total fleet) as of Mar. 1 combined with even greater growth in the Aframax sector.

This growth in the fleet could lead to tonnage oversupply. Despite such concerns, however, the value of 5-year old 35,000-dwt vessels increased 13% to $22 million, and Clarkson described the outlook for the products tanker market as fairly positive if projected increases in global oil demand come to pass.

Chemical

Mar. 1, 2010, saw spot freight rates move up on most chemical routes from yearend 2009, according to Clarkson. Rates for 15,000 tonnes Persian Gulf-Far East rose 34.6%, with Rotterdam-to-Houston for 5,000 tonnes rising 35.6%, the sharpest increase. Clarkson noted that demand along this route was forcing charterers to look for available parcel space a month or further forward.

Houston-Far East rates for 5,000 tonnes slipped 5.2% while Rotterdam-Far East rates for the same size vessel were flat at $80/tonne, the highest rate in the market. November export opportunities to Asia as the benzene arbitrage opened helped raise chemical shipment prices late in 2009, leading to the relative softness seen at the start of 2010. But Clarkson described subsequent rates as stable.

As with the other tanker segments, Clarkson sees some signs of a recovery in fundamental chemical demand but tempers this with the still-present possibility that the second half of a double-dip recession might lie ahead.

LNG

Clarkson described the LNG segment as oversupplied, with as many as 17 vessels thought to be idle as a result of delays to the start-up dates of terminals vessels had been built to serve.

A number of projects originally scheduled for start-up in the early part of this decade have yet to reach final investment decisions, with increased difficulty in securing asset financing in the current economic environment raising the possibility that gas will never flow from at least some of the pending projects, according to Clarkson.

Despite this supply overload, China LNG Shipping ordered a 147,100-billion cu m vessel from domestic Hudong Zhonghua shipyard in February 2010, with Clarkson expecting MOL to order four vessels by yearend (split between Chinese and South Korean yards) and leaving open the possibility that orders beyond even these four might occur.

Prospects for short-term recovery depend on demand for gas improving, according to Clarkson, while medium-term LNG shipment prospects are tied more closely to liquefaction projects expected to start 2013-16, a number of which have already been delayed from 2010-12, remaining on their new schedules.

Clarkson particularly cited projects in Nigeria, Algeria, and Iran in this regard. The continued proliferation of floating storage and regasification units as import terminals could also provide some medium-term demand, Clarkson said.

Longer-term, Clarkson sees the steady stream of projects still on the books, however, as suggesting continued confidence in the LNG business as a whole and eventually accommodating tonnage already built.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com