Intertanko predicts a sluggish tanker market moving forward, with lackluster economic and demand forecasts combining with use of vessels for storage, vessel recycling, and deferred vessel deliveries to create uncertainty. In its 'Annual Review and Report 2009-10' the association of tanker owners and operators noted that the industry had started 2010 in better shape than might had been expected, given the 7% fleet growth and decline in seaborne trade also cited by Clarkson (see lede tran article p. 110).

Looking forward, however, Intertanko described the continued growth in tanker supply as the fundamental problem faced by the industry, outweighing the mitigating factors which allowed the year to begin on a positive note, including strong oil demand in China and slippage in newbuild deliveries. Intertanko also cited Oslo-based broker R.S. Platou in noting that some 6% of the fleet had been in use as storage when 2010 began. An 80% decline in northbound part-laden VLCC transits though the Suez Canal to just 51, with only 11 VLCCs transiting southbound in 2009 compared to almost 500 in the early 1990s, also reduced tanker supply by increasing tonne-miles as ships transitted via the Cape of Good Hope instead.

Product tankers were hit worst by the economic downturn, according to Intertanko, with a 15% drop in US products imports to 3.2 million b/d in 2009 following the 7% drop seen in 2008. The 10,000-60,000 dwt product tanker fleet has grown by an average 6%/year since 2001, the association said.

Tanker supply

Intertanko sees tanker supply continuing to increase over the next few years even if all single-hull vessels were sold for recycling by end-2010 (Fig. 1). As of early-March 2010 41.5 million dwt single-hull tankers were still in service, not including those in layup or being used for storage, according to Intertanko. These included:

• 17.7 million dwt VLCC (64 ships).

• 4 million dwt Suezmax.

• 4.7 million dwt Aframax.

• 15.1 million dwt 5,000-60,000 tonnes.

Intertanko says 6.3 million dwt of the total, mainly below 60,000 dwt should have been phased out before 2010 and are likely trading in domestic markets or undergoing unreported conversion or recycling. The association also noted that a number of VLCCs were also inactive at the beginning of 2010 and would likely remain inactive while awaiting conversion or recycling.

In considering the likely use of tankers for storage during 2010, Intertanko cited US Energy Information Agency estimates that OPEC surplus oil production capacity would likely increase to 5.3 million b/d in 2010 from 4.4 million b/d in 2009, perhaps reducing trader incentives to hold stocks in expectation of higher prices moving forward.

Intertanko also expects a large number of newbuild vessels to enter the market in 2010, even taking into account on-going slippage of deliveries.

Tanker activity

At the same time Intertanko expects the tanker fleet to expand during 2010, it cites Poten & Partners in noting a decline in spot tanker booking over the course of 2009. Dirty spot chartering declined by 7% in 2009, according to the association's annual report, led by a 15% drop in Suezmax bookings. VLCC fixtures dropped by 7% and Aframax by 4%, while bookings of Panamax vessels actually gained 1% (Fig. 2).

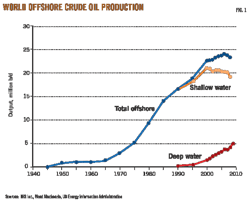

Oil production

Intertanko describes Middle East oil production as one of the key drivers of the tanker market, with freight rate slumps tending to follow low Middle East production (Fig. 3). The association notes peak Middle East oil production in June 2008 of 23.8 million b/d, having slipped to 20.7 million b/d by March 2009. Average oil production in the region declined by 2 million b/d over the course of 2009, according to Intertanko, equivalent to a reduced need of 40 VLCCs/year on an AG-to-Japan basis.

Oil demand

Following 2 years of decline, Intertanko expects global oil demand to return to growth in 2010, citing International Energy Agency forecasts for a 1.6 million b/d increase, most of which will come from non-OECD countries and be supplied from the Middle East, increasing tanker tonne-miles.

Intertanko, however, cautions that the current recovery will likely be sluggish, citing such circumstances as:

• Uncertain unemployment and house price directions in the US.

• Huge budget deficits in Europe.

• Increasing signs of a real estate bubble in China.

Fig. 4 shows trends for world oil demand, seaborne trade, and tanker fleet growth. Since 2006 tanker fleet growth has overtaken oil demand and tonne-mile increases and remains stronger.

Intertanko also sees efforts to become more fuel efficient and to reduce CO2 emissions as fixtures in the supply-demand landscape, with the attendant effects on hydrocarbon-based energy consumption moving forward.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com