The Davy Jones deep gulf shelf discovery by McMoRan Exploration et al. in South Marsh Island blocks 230, 231, 234, and 235 is of major importance for a number of reasons.

It's on the shelf in shallow water (11 ft), and appears to be a major discovery, with a reported net gas pay of more than 200 ft in a section below 22,000 ft.

The main significance of this apparent discovery is that it could open up other areas on the shelf to possibilities of deep discoveries below present producing depths. With today's technology, these areas can be defined and exploited.

In most cases, this production potential will be gas in high pressure-high temperature hostile environments.

Deep potential awareness

The authors in past years have been using petrophysical data to define the presence of geological environments either favorable or unfavorable for commercial hydrocarbon production.

In the case of Davy Jones, the authors were aware of the ultradeep potential in the area and discussed this possibility in a previous article (OGJ, Mar. 19, 2007, p. 34).

A South Marsh Island well in the Davy Jones area that had been drilled to 22,000 ft was used as an example of a deep well still in a favorable commercial environment at total depth and which had still deeper commercial production potential. That well is the McMoRan SMI Block 233 No. 218 well (Fig. 3 in the 2007 article).

The well is a highly commercial producer with an initial completion at 20,200 ft.

It is important for the reader of this article to review the earlier article as it details the procedures used to determine maximum depths for commercial production in the US Gulf Coast and Gulf of Mexico.

Defining producing environments

Figs. 1, 2, and 3 of this article are the same as Figs. 1, 2, and 3 of the 2007 article.

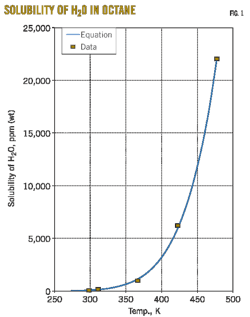

Fig. 1 is a plot of formation pore pressure gradient versus formation temperature. The data have been derived entirely from well logs.

With few exceptions, the expected quality of the production can be determined from this pressure/temperature correlation. In essence, almost all commercial production falls within the bell-shaped curved envelope. We then can actually quantify the hydrocarbon recoveries using this figure.

Note from Fig. 1 that commercial oil volumes are limited to areas where formation temperatures do not exceed 270° F. and formation pressure gradients are less than 0.7 psi/ft (~13.5 lb/gal). Commercial gas environments do not have these pressure/temperature restrictions and therefore can be found in much broader geological environments.

There are restrictions, however, for commercial gas environments, and these restrictions can be determined from petrophysical data using shale resistivities. For example, Fig. 2 is a schematic plot of shale resistivities versus depth for onshore and offshore wells. Usually the top of the abnormal pressure is between 6,000 ft and 10,000 ft.

In the Davy Jones area, this onset of abnormal pressure is deeper, at 12,000 ft to 13,000 ft. Below this depth, as is the case at Davy Jones, there is a short transition (~1,000 ft) to very high pressures that requires mud weights in excess of 17 lb/gal. This apparently is an interval of drilling problems because two strings of casing are usually set to safely drill through it.

The commercial pay zones are encountered below the second string in the depth interval from 13,000 ft to 20,000 ft. As Fig. 2 indicates, commercial environments do not exist within and below the depth at which shale resistivities decrease to a value where extrapolated normal trend values exceed 3.5 times the actual read values.

This is how we define the maximum "cutoff" depth for commercial production. Gas reservoirs are found below this depth, but to the authors' knowledge, none has been found to be of commercial significance. Unfortunately, traditional formation evaluation techniques usually indicate the opposite.

Pressure regressions

More often than not, the shale resistivity ratio will decrease with depth (resistivities increase) below the 3.5 cutoff depth, indicating a possible pore pressure regression.

Pressures can regress with increasing depth if the sand/shale ratio increases, allowing shale fluids to bleed off into adjacent sands that have some areal extent. This causes the shales immediately above and below the sands to compact. This can be noted by the increase of shale resistivities above and below the sands in high-temperature environments.

Other reasons, however, can cause the shale resistivities to regress, such as shale lithology changes or geological age. Mud weights are very rarely cut back in these "regression" environments, and pressure tests of the sands usually confirm the presence of the high pore pressures.

It is the authors' belief that sands below the 3.5 shale ratio cutoff depth, in the environment that exhibits a pressure regression, have been "breached" over geologic time and essentially only residual gas remains in the reservoir. These reservoirs generally have good initial production and pressures but deplete over short periods.

It is arguable that the ultradeep gas sands found at Davy Jones do not fit within the above described cutoff parameters. The magnitude of the data acquired over the years to arrive at our conclusions is from wells drilled at considerably shallower depths than 20,000 ft. Also, we have limited data from wells in environments where the pay intervals are below a "salt weld."

At this time, the significance of the salt weld on our conclusions is unknown. Further, we have not seen the actual data from the deep pay interval in the Davy Jones apparent discovery well. We will have to await the testing of the pay interval before final conclusions can be drawn.

The only significant conclusion that can be drawn at this time is that if the production proves disappointing we have confirmed a simple and inexpensive technique for determining the probability of the presence or absence of commercial reservoirs below presently drilled Gulf Coast wells.

As an example, Fig. 3 is the McMoRan well discussed above, drilled in 2002, in the vicinity of the 2009 Davy Jones apparent discovery. The 2002 well, with the TD at 22,000 ft, is very encouraging for deeper commercial production.

It is still in a favorable pressure/temperature environment at TD and never reached the 3.5 shale ratio at any shallower depth. This well supports the fact that deeper commercial production is possible below 22,000 ft in the general area.

Good and bad reservoirs

Fig. 4 is a well that contains numerous good producing reservoirs.

Note that below 13,000 ft there is an appearance of a pressure regression where the actual producing reservoirs are encountered. Also note that mud weights used to drill below 13,000 ft were 17.8 to 18 lb/gal.

Measured pore pressures in numerous sands in this well confirmed the need for drilling with the high mud weights. So in this case the "pressure regression" is not due to a pore pressure reduction in the sands. The presently producing zone is at 17,200 ft in a favorable geological environment.

Also note from this plot that the maximum depth for commercial production in the area of this well occurs at 18,200 ft and all the significant pay sands are above this depth. Any gas sands encountered below this depth, in the authors' opinion, would not be of commercial importance.

Fig. 5 is an example of a poorly producing well with the appearance of numerous "pressure regressions." This well does not encounter the 3.5 ratio cutoff to TD at 20,600 ft. Therefore, deeper commercial production is possible in the vicinity of this well.

Note, however, that this well was a poor producer from two completed sands. The lower zone at 19,800 ft has 40 ft of net gas pay with good (24%) porosity and low (20%) water saturation, but the shale resistivities above and below this sand fall in the noncommercial gas window of Fig. 1, where cumulative production is almost always below 1 bcf.

This zone depleted after producing 892 MMcf. The upper zone at 18,200 ft falls within the commercial envelope but was noncommercial, most likely because it had only 8 ft of net gas pay situated at the top of massive water sands.

Resistivity profiles

Fig. 6, a plot from a well in SMI 231, has a very different resistivity profile from the other wells in this article.

Note that the pressure transition occurs 1,000-1,500 ft shallower than the other examples. This probably indicates that the well is higher on structure than the other wells.

Also, the absence of extensive "pressure regression" intervals below 12,300 ft is likely caused by the lack of sands needed to dewater adjacent shales. In other words, the sand-shale ratio is much less in this well than the others.

Further note that except for the short interval at 13,500-700 ft, where there are some commercial reservoir-quality sands, the entire section below 12,300 ft is within a nonfavorable producing environment. The fact that the 3.5 shale ratio was encountered at 13,900 ft would preclude any chance of commercial production below this depth in this well and other wells in the immediate vicinity.

Completion costs a factor

Fig. 7 is an example in which deeper drilling is warranted.

This well was drilled to 20,000 ft and did not encounter the shale ratio cutoff value over the entire depth.

A gas sand with 16 ft of net pay is present at 18,150 ft, but the shales above and below indicate the gas sand is within the noncommercial window of Fig. 1, where the maximum recovery would be less than 1 bcf and the well was P&A. The authors agree that the zone would not warrant the cost of completion.

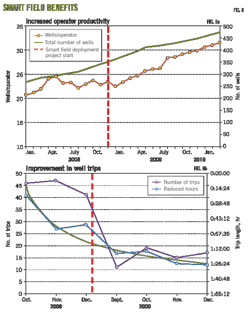

The Stone Energy dry hole in Fig. 8, drilled in 2006 to 19,800 ft, was the well McMoRan reentered and deepened to 29,000+ ft that encountered the reported 200 ft of net gas pay and is the Davy Jones discovery well. There are no pay sands in the SMI main producing interval (12,200 ft to 17,300 ft) in this well.

The well did, however, encounter the noncommercial cutoff depth at 17,400 ft and was bottomed in a nonfavorable environment at 19,800 ft.

The authors' basic conclusion, therefore, is that no commercial production is possible below 17,400 ft at this location.

By all traditional evaluation techniques, the Davy Jones well should be a highly commercial discovery with major ramifications for the Gulf Coast/Gulf of Mexico. Using the authors' evaluation techniques, however, this well is likely to be disappointing in its production performance.

Possible weak points

The weak point in the author's negative prediction is that Davy Jones is so unusual that the shale data do not fit within the massive statistical data the authors have been collecting for the past 50 years that support our conclusions.

The authors have had little petrophysical information on wells drilled below 20,000 ft that are included in the data from which they have arrived at their conclusions. These conclusions have been developed from Gulf Coast wells drilled mostly above 15,000 ft.

So the question of commerciality will be answered by the future production testing of the ultradeep Davy Jones pay section.

If the well proves successful, as believed by most, it will be completely different from other Gulf Coast wells and establish, in the authors' opinion, a new set of shale parameters for the evaluation of ultradeep wells.

A positive conclusion that can be drawn, if the production testing is disappointing, is that we have further confirmed a simple method for evaluation of areas where deeper commercial discoveries are possible. This method, along with traditional seismic and geological techniques, opens the entire Gulf Coast for deeper commercial production in areas where wells have already been drilled and bottomed in favorable environments.

A deeper seismic anomaly in these areas would certainly warrant further investigation.

The authors

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com