Cash flow analysis assesses China's CBM resource viability

A cash flow analysis determined that the coalbed methane resources in 42 major basins in China were 36% economic, 14% marginally economic, and 50% uneconomic to develop.

The analysis assumed the use of current technology, economic conditions, and China's industrial policies.

CBM resource estimate

China's latest national oil and gas resource assessment, released in August 2008, shows that the country has methane-bearing coals over a 415,000-sq km area in 42 major CBM basins. These basins contain an estimated 36.8 trillion cu m (tcm) of methane (including proved resources and resources not yet proved but that could be proved with current technology) at depths less than 2,000 m. Of this resource, 10.9 tcm are classified as recoverable and are at depths less than 1,500 m.1

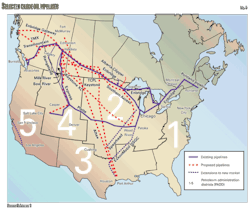

Each of nine large CBM basins (Odors, Qinshui, Junggar, Diandongqianxi, Erlian, Tuha, Tarim, Tianshan, and Hailaer) has a methane resource greater than 1 tcm (Fig. 1). Combined these basins hold 30.9 tcm of methane or 84% China's estimated CBM resource.

China's CBM resource is mainly in the north and northwest with 56.3% in North China, 28.1% in Northwest China, 14.3% in South China, and 1.3% in Northeast China.

A breakdown by depth for the total geologic resource and the portion classified as recoverable are:

• Depth less than 1,000 m—14.3 tcm total, 6.3 tcm recoverable.

• Depth 1,000-1,500 m—10.6 tcm, 4.6 tcm recoverable.

• Depth 1,500-2,000 m—11.9 tcm.

The CBM resource at depths less than 1,000 m and one-third of the resource at depths greater than 1,000 m have the most commercial value.2

Resource characteristics

Many of the coal fields in China have complex geological structures and various tectonic influences.3 4

Large or medium basins such as Odors have relatively simple coal and methane accumulation while smaller basins are more complex.

The structural form of the coals in western and northern regions is good for methane development.

Coalbeds in China have a relatively high gas content. According to a survey of 105 coal fields in China, 43 coal fields (41%) have an average gas content of more than 10 cu m/tonne, 29 coal fields (28%) have an average gas content of 8-10 cu m/tonne, and the other 33 coal fields (31%) have an average gas content of 4-8 cu m/tonne.

The average gas saturation in coals is 44.25% with a 53% average in Northeast China, which is relatively higher than the 30% average of the coals in Northwest China.

The coals in China have a low permeability of 0.002-16.17 md. About 35% has a less than 0.1 md permeability, 37% has a 0.1-1.0 md permeability, and 28% has a greater than 1.0 md permeability. Most coal reservoirs in China are underpressured. The minimum reservoir pressure gradient is only 2.24 kPa/m, and the maximum reservoir pressure gradient is up to 17.28 kPa/m.

The resource density of CBM resource in China varies greatly, ranging from 0.015 billion to 0.722 billion cu m.

Evaluation assumptions

This analysis used a cash flow analysis to determine the economic viability of China's CBM resource5 and defined a CBM target area with a relatively rich accumulation of methane as the basic spatial unit for resource evaluation.3

Because the geological features, resource conditions, and commercial viability of the CBM resource in different gas-bearing zones vary considerably, the use of a target area simplifies the evaluation.

China has about 85 CBM target areas in 42 major gas-bearing basins. The analysis excludes obviously uneconomic target areas such as where the resource is too small or the resource density or gas content too low. This leaves 61 CBM target areas for the evaluation.

The analysis also assumes CBM development on a project basis. The profitability of a hypothetical development project designed to be representative of typical wells in each target area is analyzed to indicate the economic viability of the CBM resource.6

The oil and gas industry uses widely cash flow analysis for resource evaluation for conventional oil and gas as well as for CBM.7 8 The evaluation involves the estimation of future production and the associated cash flow schedules for each development project. The sum of the associated annual net cash flows yields the estimated future net revenue.

The net present value of a project is the sum of the discounted cash flows at a defined discount rate and time period. The equation in the equation box defines NPV. An economic project has a positive NPV.9 10

In the equation, n is the producing life of the target area, NCF is net cash flow, t is time in years, and i0 is the appropriate discount rate that reasonably reflects the weighted average cost of capital or the minimum acceptable rate of return.

The NCF in each year during the producing life of each target area is calculated by simulated CBM production rate, CBM price, investment, operating costs, and tax.11-13

The table shows the main parameters used in the CBM evaluation. Some of these were obtained from the historical production data from the Qinshui CBM basin, China's second largest CBM basin.

Results

Fig. 2 shows the results of the evaluation for the 61 CBM target areas. The areas have NPVs that vary widely from –2.3 billion to 3.1 billion yuan with an average of 282 million yuan.

The number of target areas with commercial development viability (NPV >0) is 34 or 56% of the evaluated target areas. The other 27 target areas (44%) are uneconomic (NPV <0) to develop under current economic and technological condition.

Of the 27 uneconomic target areas, 15 target areas could be economic with innovative development and management technologies coupled with a more preferential industry policy. These marginally economic areas have NPVs from –400 million yuan to 0.

The analysis shows that, of the total 85 areas, 34 (40%) are economic, 15 (18%) are marginally economic, and 36 are uneconomic (42%).

Fig. 3 shows the economic viability of CBM resource in China in terms of target areas, while Fig. 4 shows the economic viability based on CBM volumes.

To generate Fig. 4, the evaluation calculated the resource volume in each target area on a volumetric method. The results on a cash flow basis indicate that 36% of China's CBM resource is economically viable, 14% is marginally economic, and the remaining 50% is uneconomic to develop under current technological conditions and economic situation.

One useful way to view the size and nature of the CBM resource base is as a resource triangle or pyramid (Fig. 5).14 At the top of the pyramid is the high-quality CBM resource, much of which is easy to develop. This higher quality CBM resource to date has produced 30.8 billion cu m of methane and holds 170 billion cu m of proved resources.15

In the middle of the pyramid are the 13.2 tcm economic and 5.1 tcm marginally economic portions of the unproved CBM resource base. Toward the bottom of the pyramid is the lower quality, uneconomic resource, totaling 18.3 tcm.

At the base and inside the pyramid, still out of view, is the new, still to be assessed and discovered CBM resource.

The CBM resource within the resource pyramid is dynamic. It can move vertically with progress in technology and knowledge, from an initial low quality, high cost resource to a higher quality resource. Exploration and new resource appraisals can enable the still unassessed CBM resource inside the pyramid to emerge.16

Acknowledgment

China's National Key Projects for Science and Technology Development through the Technology and Economic Evaluation of Coalbed Methane Development project under project number 2009ZX05042-001 and EU-China Energy and Environment Program through the Feasibility Study of Coalbed Methane Production in China project under Grant Number EuropeAid/120723/D/SV/CN provided funds for this work.

References

1. Liu, C.L., et al., Methodologies and results of the latest assessment of coalbed methane resources in China Natural Gas Industry (Translated from Chinese), Vol. 19, No. 11, 2009, pp. 130-32.

2. Che, C.B., et al., "Exploration and development prospects of coal bed methane (CBM) resources in China," China Mining Magazine (Translated from Chinese), Vol. 17, No. 5, 2008, pp. 1-4.

3. Wang, H.Y., Enrichment and Reservoir Laws of CBM in China, Petroleum Industry Press, 2004, pp. 30-36.

4. Eleventh Five-Year Plan for CBM Development and Utilization, National Development and Reform Commission (NDRC), Beijing, 2005.

5. Petroleum Resources Management System, SPE/WPC/AAPG/SPEE, 2007.

6. Luo, D.K., et al., Feasibility Study of Coalbed Methane Production in China. Beijing: China University of Petroleum, Department of Business Administration, 2008.

7. Abdel-Aal, H.K., Petroleum Economics and Engineering, 2nd Edition. Marcel Dekker Inc., New York, 1992.

8. Dhir, R, et al., "Economic and reserve evaluation of coalbed methane reservoirs," JPT Vol. 43, No. 12, 1991, pp. 1424-31.

9. Goerold, W., "Powder River Basin Coalbed Methane Financial Model," University of Colorado Natural Resources Law Center Coalbed Methane Conference, Denver, Apr. 4-5, 2002.

10. The Economics of Powder River Basin Coalbed Methane Development, US DOE, Washington, DC, 2006, available on http://fossil.energy.gov/programs/oilgas/publications/coalbed_methane/06_prb_study.pd.

11. Mian, M.A., Project Economics and Decision Analysis, Volume I: Deterministic Models, Tulsa: Pennwell, 2002.

12. Kuuskraa, V.A., and Boyer, C.M. II, "Economic and Parametric Analysis Coalbed Methane," Hydrocarbons from Coal; Rice, D.D. editor, AAPG, Tulsa, pp. 373-94.

13. Luo, D.K., and Dai, Y.J., "Economic Evaluation of Coalbed Methane Production in China," Energy Policy, Vol. 37, No. 10, 2009, pp. 3383-89.

14. Masters, C.D., et al., "Distribution and quantitative assessment of world crude oil reserves and resources," 11th World Petroleum Congress, 1984, pp. 229-37.

15. Huang, S.C., et al., "Coalbed methane development and utilization in China: Status and future development," China Coal (Translated from Chinese), Vol. 35, No. 1, 2009, pp. 5-10.

16. Kuuskraa, V.A., The Unconventional Gas Resource Base, Advanced Resources International Inc. White Paper, Unconventional Gas Series, July 2007.

The authors

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com