GULF COAST ECONOMIC LIMITS—4: Gulf Outer Continental Shelf economic limits calculated

In the final part of this four-part series, economic limits for offshore structures in the Outer Continental Shelf (OCS) Gulf of Mexico (GOM) are computed.

We classify 1,962 decommissioned structures between 1986-2009 by structure type, primary production, water depth, and year of removal, and compute production, adjusted gross revenue, and water cut thresholds near the end of their life cycle.

Production and gross revenue provide direct information on economic limits and the commercial status of operations. Water production is an important parameter because the disposal of produced water costs money, and as water production increases so does operating expense.

During the last year of production, historic gross revenues averaged $539,000 for oil structures, $955,000 for gas structures, and $1.1 million for dry gas (no condensate) structures. Water cuts ranged from 66% for oil producers to 80% for gas producers.

Over the last 5 years, the revenue thresholds for oil and gas producing structures have doubled—to $1 million and $1.7 million, respectively—while for dry gas producers the limit has increased to $1.2 million.

For oil structures, economic limits ranged from $298,000 for caissons and well protectors (CAIS/WP) to $911,000 for fixed platforms (FP); for gas structures, thresholds ranged from $884,000 (CAIS/WP) to $968,000 (FP); and for dry gas structures, revenue thresholds varied from $725,000 (CAIS/WP) to $1.4 million (FP).

In terms of product streams, at the end of their life oil structures averaged 28 b/d of oil equivalent and 106 b/d water production for CAIS/WP and 85 boe/d and 202 b/d water for FP; for gas structures, daily production ranged from 616 Mcfd of gas equivalent and 72 b/d water (CAIS/WP) to 681 Mcfe/d and 121 b/d water (FP); and for dry gas structures, production ranged from 629 Mcfe/d and 68 b/d water (CAIS/WP) to 952 Mcfe/d and 45 b/d water (FP).

Resources and production

The Gulf of Mexico outer continental shelf is the most prolific oil producing region in the US and contains nearly one-fifth of US proved oil reserves and about 5% of US gas reserves.

In 2009, about 20% of domestic oil and 11% of gas supply was sourced from the OCS, averaging production of 1.5 million b/d of oil and 6.1 bcfd of gas.

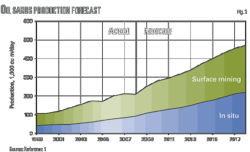

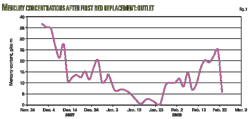

Oil production rose rapidly in the 1960s and has undergone several cycles of increase and decline. From 1991 through 2001, oil production increased, leveling off through 2003, before declining in 2005 due to hurricane activity in the region (Fig. 1). Since 1997, shallow water (water depth <1,000 ft) oil production has steadily declined, while deepwater (water depth >1,000 ft) production does not yet appear to have peaked.

Gas production in the gulf has fallen steadily from 2001 (Fig. 2). Shallow water gas production has dropped beginning from 1996, with deepwater production unable to prevent an overall decline in total production levels.

Structure statistics

Sample set

The US Minerals Management Service maintains a public database of all oil, gas, and water production of wells in the OCS via its Technical Information Management System (TIMS).

Gas production data are expressed as marketable gas, nonassociated and casinghead, adjusted to exclude reinjected gas. Crude oil production includes natural gas liquids and lease condensate. Water production represents water produced, handled, and treated.

The sample set consists of 1,962 structures decommissioned in 1986-2009: 1,045 CAIS/WP and 918 FP (Table 1).

Structures destroyed by hurricanes are excluded from the sample data since destroyed structures may have been prematurely terminated and will not reflect their true economic limit. Structures serving in an auxiliary role that have never produced are also excluded from the analysis because no revenue stream is associated with the structure. No other filtering was performed.

Caissons and well protectors outnumber fixed platforms in less than 100 ft of water two to one (918 CAIS/WP, 435 FP). In more than 100 ft of water, fixed platforms dominate the sample.

About 70% of the structures removed occur in less than 100 ft of water. Over 80% of the sample is gas producers; pure gas structures make up less than 10% of the removals.

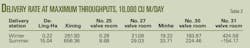

The number of structures decommissioned by year and classified by primary product, structure type, and water depth is shown in Table 2. Data for 2009 removals are not complete.

Structure attributes

Structures are categorized according to:

• Primary product (oil, gas, dry gas).

• Structure type (caisson, well protector, fixed platform).

• Water depth (0-100 ft, 101-200 ft, 201-1,000 ft).

Primary product is determined by the structure's cumulative gas-oil ratio (CGOR) measured in cubic feet gas per barrel oil produced. A CGOR <10,000 cf/bbl is used to identify oil structures; a CGOR >10,000 cf/bbl identifies gas structures; dry gas structures have no condensate production.

Operational metrics

Operational metrics include:

• Gas-oil ratio GOR (Mcf/bbl).

• Water cut WC (%).

• Gross revenue ($1,000).

• Daily oil production (b/d).

• Daily gas production (Mcfd).

• Daily water production (b/d).

• Daily oil equivalent production (boe/d).

• Daily gas equivalent production (Mcfe/d).

Water cut is the percentage of water produced per total fluid (water and oil) production. Most OCS platforms discard their produced water directly into the ocean but have stringent regulations on the entrained and dissolved oil and other chemicals in the waste stream. A few operators reinject produced water.

Gross revenue is computed based on annual oil and gas prices adjusted using the Consumer Price Index (CPI). Quality adjustments and transportation expenses are not incorporated in the analysis.

Daily oil and gas equivalent production are computed based on a heat-equivalent basis.

Time horizon

Operational performance is measured the last year of production and the third year before the end of production.

The last year of production indicates the last year of commercial operation while the third year before the end of production represents a predictor of future noncommercial activities. For each metric, two time horizons are considered, 1986-2009 and 2005-09, to compare historic averages against the current market environment.

Categorization

We commence analysis at a high level of aggregation and sequentially add layers to the base category. We begin with a primary product classification and delineate by vintage, structure type, and water depth.

Model results are organized as follows:

• Primary product: Tables 3-4 (1986-2009), Table 5 (2005-09).

• Primary product, structure type: Tables 6-7 (1986-2009), Table 8 (2005-09).

• Primary product, structure type, water depth: Table 9 (1986-2009), Table 10 (2005-09).

As we consider additional attributes, the number of elements that populate each new layer will decrease. At some point it may not be possible to calculate meaningful statistics. Hence, along with more homogeneous categorizations, additional uncertainty arises because of reduced sample size. If the number of category entries falls below 15-20, sample bias may result.

Primary product

Gross revenue threshold

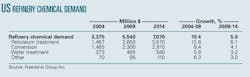

During the last year of production, average gross revenues ranged from $539,000 for oil structures to $924,000 for gas structures to $1.1 million for dry gas structures (Table 3). The standard deviations are denoted in parentheses and are large, indicating the diverse nature of the assets within each categorization.

The distribution of gross revenues at the end of production is depicted for oil, gas, and dry gas producers in Figs. 3-5. Large spreads indicate the diverse nature of the structures.

Third year metrics serve as a signpost to gauge when structures will become marginal in the near future (specifically, in 3 years). At the third year before the end of production, gross revenues averaged $2.2 million for oil structures, $4.7 million for gas structures, and $4.3 million for dry gas structures (Table 4).

Production threshold

Daily end-of-life production ranged from 50 boe/d for oil structures to 647 Mcfe/d for gas structures and 788 Mcfd for pure gas structures (Table 3). On a heat-equivalent basis, oil producers achieve a smaller production limit relative to gas structures (50 boe/d vs. 113-131 boe/d), likely due to the impact of the oil premium.

Three years before the end of production, daily production ranged from 199 boe/d for oil structures to about 3,400 Mcfe/d for gas and dry gas structures (Table 4). These values are four to five times larger than the last year production threshold.

Water production

During the last year of production, water streams ranged from 144 b/d for oil structures to 95 b/d for gas structures to 57 b/d for pure gas structures (Table 3). For every barrel of OCS oil produced, 4.8 bbl of water was processed and handled the last year of production. Gas wells produce smaller quantities on an absolute basis: 95 b/d for gas and 57 b/d for pure gas structures.

The average water cut for oil structures the last year of production was 0.66; for gas structures, 0.80 (Table 3). Water cut for gas producers is relative to condensate production. Note that the absolute and relative water production statistics are computed per individual category and are independent; hence, they cannot be inferred from one another.

End-of-life water and oil production is shown in Fig. 6. The majority of the data cloud falls above the division line, indicating greater water production than oil production.

The proportion of water will rise until the cost of handling exceeds the value of the hydrocarbons produced. Commercial production is often limited by this water-handling cost. From the third year to the end of production, water production increased at a faster rate than oil production, and the water cut ratios increased on average, from 0.62 to 0.66 (oil structures) and 0.68 to 0.80 (gas structures).

Gas-oil ratio

Gas production typically increases at the end of an oil structure's life cycle, and this is readily observed by comparing the average GOR of oil structures the last year (GOR = 35,000) against the third year of production (GOR = 13,000). For gas structures the correspondence is variable.

2005-09 horizon

Over the last 5 years, gross revenue averaged $1 million for oil structures, $1.7 million for gas structures, and $1.2 million for pure gas structures (Table 5). The values depicted are higher than the adjusted historic averages and reflect the recent commodity price and higher service cost environments.

On a production basis, oil structures produced to 43 boe/d, while gas and pure gas structures produced to 647 and 788 Mcfe/d, slightly lower than historic averages (Table 5). Production thresholds are expected to be more stable than gross revenues because the commodity price variation is not considered in the analysis.

Primary product, structure type

Gross revenue threshold

During the last year of production, gross revenues for oil structures averaged $298,000 for CAIS/WP and $911,000 for FP; $884,000 for CAIS/WP and $968,000 for FP for gas structures; and $725,000 for CAIS/WP and $1.4 million for FPs for dry gas structures (Table 6). For oil and dry gas structures, the difference between major and minor structures was significant, as expected, while for gas structures, the metrics are in reasonably close proximity.

Three years before the end of production, average gross revenues for oil structures ranged from $1.7 million for CAIS/WP to $3 million for FP; from $3.9 million for CAIS/WP to $5.4 million for FP for gas structures; and from $3.2 million for CAIS/WP to $5.3 million for dry gas structures (Table 7). Here the difference between the structure types and number of active wells become more obvious.

Production threshold

During the last year of production, daily oil production ranged from 28 boe/d for CAIS/WP to 85 boe/d for FP for oil structures; daily gas production ranged from 676 Mcfe/d for CAIS/WP to 681 Mcfe/d for FP for gas structures; and from 629 Mcfe/d for CAIS/WP to 952 Mcfe/d for FP for pure gas structures (Table 6). These values differentiate in the expected direction across structure type and each primary product.

Water production

Minor structures are expected to have less water production than major structures because of the nature of the facility and design constraints, and this was observed in the empirical statistics. During the last year of production, water production averaged 106 b/d for CAIS/WP and 202 b/d for FP oil structures; for gas structures water production averaged 74 b/d for CAIS/WP and 121 b/d for FP (Table 6).

Water production increased during the end of a structure's life cycle at a faster rate than oil production, with water cut ratios increasing across each structure type, from WC = 0.58 to 0.65 (oil structures, CAIS/WP), 0.66 to 0.67 (oil structures, FP), 0.67 to 0.80 (gas structures, CAIS/WP), and 0.69 to 0.80 (gas structures, FP). See Tables 6 and 7.

2005-09 horizon

Over the time horizon 2005-09, average gross revenues for oil structures during the last year of production, ranged from $683,000 for CAIS/WP to $1.3 million for FP; $2 million for CAIS/WP to $1.5 million for FP for gas structures; and $328,000 for CAIS/WP to $1.9 million for FP for pure gas structures (Table 8). Relative to historic averages, revenue thresholds for oil and gas structures ranged from 1.4 to 2.3.

Over the time horizon 2005-09, daily production ranged from 25 boe/d for CAIS/WP to 58 boe/d for FP for oil structures; 704 Mcfe/d for CAIS/WP to 525 Mcfe/d for FP for gas structures; and from 135 Mcfe/d for CAIS/WP to 698 Mcfe/d for FP for pure gas structures (Table 8). Production thresholds are slightly smaller on average than historic values.

Primary product, structure type, water depth

Water depth provides a finer delineation of structure categorization and as a proxy measure of distance to shore, so for all other things equal, economic limits should increase with water depth, and generally speaking, these trends are observed in Table 9. Small sample categories may not be representative.

Over the time horizon 2005-09, only gas structures are adequately populated to yield reliable comparisons (Table 10). Average gross revenues for gas structures in 0-100 ft the last year of production were $2 million for CAIS/WP. For FP, gross revenues ranged from $1 million (0-100 ft) to $1.6 million (101-200 ft) to $2.2 million (201-1,000 ft).

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com