Canada's share grows as US oil suppliers change

In 2009, when domestic production satisfied only 40% of its demand for oil, the US relied on imports from 40 countries.

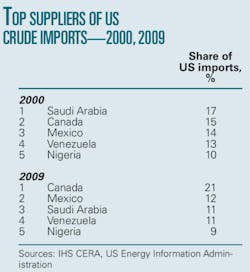

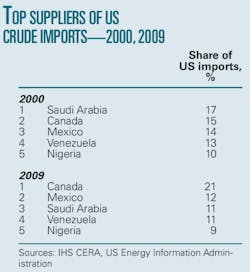

For the last 10 years, five countries have supplied 70% of those supplies—Canada, Mexico, Saudi Arabia, Venezuela, and Nigeria. Some of them cannot maintain current export levels over the next 20 years, said IHS Cambridge Energy Research Associates Inc. (IHS CERA) in a report on Canadian oil sands and the US market.

Venezuela's oil production peaked at 3.2 million b/d in 1997 and fell to 2.5 million b/d in 2009. "Although Venezuela has awarded new blocks in the Orinoco oil belt, there are execution challenges," said IHS CERA analysts. The analysts said Venezuela's production might grow again by 2020, rebounding almost to current production levels by 2030. "A risk to future US imports is the possibility that larger portions of Venezuelan crude could go to other markets, such as China," said IHS CERA.

With its current production decline, 2%/year increase in demand for oil, and minimal development of new supply, Mexico soon could become a net importer of oil. In 2004-08, combined US imports of crude from Mexico and Venezuela dropped to 2.5 million b/d from 3.2 million b/d. "A more conducive investment climate for oil production in both Mexico and Venezuela would be required to reverse the current trend of production decline," the report observed.

Saudi Arabia recently increased its oil production capacity to 12.5 million b/d, said IHS CERA. "The next project, Manifa, is not planned for production until 2014," the analysts said. Moreover, they said, "With the start-up of Khurais at 1.2 million b/d in 2009, Saudi Arabia has brought on stream one of the largest projects ever. Given the ample spare capacity due to decreased oil demand from traditional export locations and an outlook for long-term flat oil demand growth in the developed world, Saudi Arabia has been actively seeking to grow exports to new growth markets in China and India."

Nigeria is struggling to bring its production up to capacity after several attacks by militants have caused "a sizable portion" of its supply to be shut in. "New offshore developments should help to offset declines, and the outlook is for relatively flat production capacity over the next 20 years," said IHS CERA.

On the other hand, "Canada's share of US crude oil imports rose from 15% in 2000 to 21% in 2009, underscoring the deep and growing economic and trading relationship between the two neighbors." The analysts reported, "US total crude oil imports from Canada were 1.9 million b/d, and the Canadian oil sands alone contributed half of this supply." In the third quarter of 2009, oil sands imports hit a new high in excess of 1 million b/d and represented "the third largest source of crude oil imported into the US."

The analysts reported, "Oil supply from Canada is stable, proximate, connected by pipelines, and part of a limited set of oil development opportunities in which private oil companies—including US firms—can openly and securely invest. By 2030 in a high-growth scenario oil sands could contribute 36% of total US oil imports. In a moderate-growth case, oil sands could grow to 20% of US oil imports, up from 8% today."

Oil accounts for more than 40% of total US energy consumption and will remain critical to future US energy supply, the report asserted. Despite the possibility of relatively flat oil demand growth to 2030, the US still will be the world's largest oil market for the next 20 years.

Certainly oil will continue as the largest source of transportation fuel in that period. Considering current technologies and costs, even with subsidies, oil alternatives such as biofuels, electric vehicles, and natural gas vehicles are more expensive than oil, the report said.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com