Special Report: Worldwide Gas Processing: New plants, data push global gas processing capacity ahead in 2009

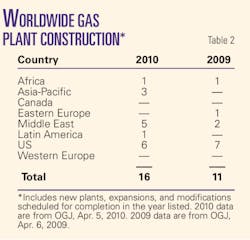

New gas processing capacity in the US, Middle East, and Africa and new and adjusted capacities for Russian processing combined in 2009 to reflect a nearly 3% gain worldwide.

Global net gas processing capacity grew by more than 7.3 bcfd with the Middle East adding more than 3 bcfd, the US more than 1.4 bcfd, Africa more than 500 MMcfd, and Russia 1.8 bcfd mostly for its new Sakhalin plant.

The new data for Russian capacity and new information for three other plants not formerly listed have led OGJ to revise Russian totals for 2009 to 3.8 bcfd from 2008's figure of 1.4 bcfd. That adjustment is almost entirely responsible for total capacity for countries of Eastern Europe as of Jan. 1, 2010, growing to nearly 5.9 bcfd from almost 2.8 bcfd in 2008.

Overall global natural gas production in 2009, however, declined by about 6%, more than 6.5 bcfd, at least partly in response to the continuing global recession and to flattened or declining gas prices, depending on the region (OGJ, Mar. 8, 2010, p. 60).

Countries of Western and Eastern Europe and Africa all saw major slides in gas production in 2009. Western Hemisphere and Asia-Pacific production was essentially flat 2008-09, with about a 500-MMcfd increase in the US offset by about that much a decline in Canada.

Gas processing capacity in the US, however, moved ahead by 2%, but Canada's growth was flat for the second year running (Table 1). For the entire world and removing the adjusted figures for Russia, OGJ's data show that capacity grew by a bit more than 2%.

Furthering a trend first observed for 2005, natural gas processing capacity outside the US and Canada continued to outgrow combined capacities in the world's two largest gas processing countries. For 2009, processing capacities of the two North American nations held at solidly less than 50% of world capacity.

With both the Middle East and Africa anticipating additions of even more capacity, that discrepancy will likely grow, possibly retarded only by a spurt of new gas plant projects in the US to handle richer shale gas in such plays as Marcellus (Pennsylvania and New York) and Eagle Ford (Texas).

Highlights

NGL production in both Canada and the US barely moved in 2009, as NGL output from the two countries' gas plants continued a trend evident for several years but bucked somewhat in 2007.

Total NGL production for the two North American countries crawled up to 108.5 million gpd, or 37% of global NGL production, the same as for 2008. For 2007, the countries' combined production was 130.4 million gpd, or more than 44% of global NGL production. For 2006, the figure was 38.7% of world totals; for 2005, slightly more than 33%; and for 2004, more than 34%.

On Jan. 1, 2010, OGJ data show that US gas processing capacity stood at nearly 74 bcfd, up from more than 72 bcfd for 2008; throughput in 2009 fell slightly from 2008, averaging slightly less than 45 bcfd (less than 62% utilization); and NGL production, more than 76 million gpd, compared with about 75.7 million gpd for 2008 (Table 1; Fig. 1).

On Jan. 1, 2010, gas processing capacity outside Canada and the US stood at more than 133 bcfd; throughput outside Canada and the US for 2009 averaged 80.4 bcfd, flat compared with 2008, up from 77.8 bcfd in 2007 and 80 bcfd in 2006.

NGL production in 2009 outside the US and Canada averaged 182 million gpd, again flat compared with 2008, up compared with 163 million gpd in 2007 and 170 million gpd in 2006 but still off of 2005 production of more than 201 million gpd.

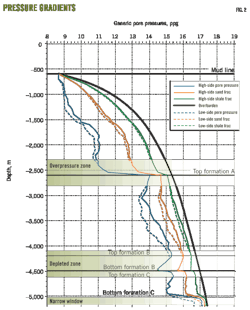

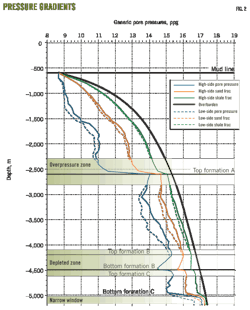

Fig. 2 shows pricing differentials in the US between LPG—the most widely traded NGL on the world market—and crude oil for the first trading day of each month in 2009. Crude oil prices in 2009 returned to less volatile patterns. The chart shows the historically normal relationship between LPG and crude oil continued throughout 2009. (An accompanying article, beginning on p. 62, discusses international trade in LPG and ethane.)

Sources

Oil & Gas Journal's exclusive, plant-by-plant, worldwide gas processing survey and its international survey of petroleum-derived sulfur recovery provide industry activity figures.

Canadian data are based on information from Alberta's Energy and Utilities Board that reflect actual figures for gas that moved through the province's plants and are reported monthly to the EUB. For 2000 for the first time, OGJ took these data for all of Alberta and compiled annual figures and thereby created a new baseline for data comparisons thenceforth.

(Effective Jan. 1, 2008, the province realigned the EUB into two separate regulatory bodies: the Energy Resources Conservation Board to regulate the oil and gas industry and the Alberta Utilities Commission to regulate utilities.)

In addition to EUB figures for Alberta and to operators' responses to its annual survey, OGJ has supplemented its Canadian data with information from the British Columbia Ministry of Energy, Mines and Petroleum Resources and the Saskatchewan Ministry of Energy & Resources.

Activity

Following is a review of project plans and progress over the last 15-18 months.

Mideast

Saudi Aramco's Ju'aymah NGL fractionation plant near Ras Tanura is, according to the company, the largest fractionation plant in the world after a fourth fractionation module was commissioned in July of last year. Expanded capacity for the plant now reaches 1.1 million b/d.

Part of the Hawiyah NGL project, the Ju'aymah plant produces ethane, propane, butane, and heavier gases. The company says the plant can export and import butane and natural gasoline to and from Ras Tanura and will be able to exchange propane with Ras Tanura, once an ongoing propane pipeline project is completed.

In January this year, the first unit of Saudi Aramco's 1-bcfd gas plant at the 500,000-b/d Khursaniyah oil field was ready to start operations. A second was to have started by mid-year.

The plant processes sour gas from Abu Hadriya, Fadhili, and Khursaniyah fields. It has two NGL trains and would also process gas from offshore Karan field.

The plant will be able to produce 560 MMcfd of sales gas and 280,000 b/d of ethane and NGLs. About 450 MMcfd of gas from the first phase of the Karan gas project is to come on stream by mid-2011.

Karan is the first nonassociated offshore gas field Saudi Aramco has developed. The onshore plant, about 160 km north of Dhahran, will be able to process 1.8 bcfd of Karan Khuff gas (OGJ Online, Nov. 2, 2009).

The gas will move in a 110-km subsea pipeline to onshore processing at the Khursaniyah gas plant. Offshore, Karan consists of four production platforms connected to a main tie-in platform that will feed sour gas to the subsea pipeline.

The completed Khursaniyah plant will process gas through three trains, each with an inlet capacity of 600 MMscfd. The trains will include gas sweetening, acid-gas enrichment, gas dehydration, and supplementary propane refrigeration.

Also operating since earlier this year is the expansion to the Hawiyah gas plant of 800 MMcfd, raising plant capacity to 2.4 bcfd.

Work is well under way to produce natural gas and NGLs at Saudi Aramco's Shaybah field in the Rub al-Khali in a four-phase, 20-year plan. The field has estimated reserves of 25 tcf. The Shaybah field has been producing 500,000 b/d of Arabian Extra Light, with its associated gas flared or reinjected.

In September 2009, Saudi Aramco awarded KBR a contract for frontend engineering and design and project management for the Shaybah NGL program.

The long-term overall plan (2014-33) includes a 7.2 bcfd gas processing plant and six NGL-recovery trains.

First phase will run in 2014-17 to build two NGL trains capable of handling 2.4 bcfd. Second phase will run in 2018-23 to build a third, 1.2-bcfd NGL train.

Phase 3 will encompass 2024-28 and build the fourth and fifth NGL trains that will have combined capacities of 2.4 bcfd. The final phase will run in 2029-33 and build the sixth NGL train capable of processing 1.2 bcfd.

Saudi Aramco plans a pipeline able to move up to 228,000 b/d of ethane and NGLs from the Shaybah field to its 260,000-b/d fractionation plant in Juaymah. And plans are under way to expand the Berri gas plant to produce 250,000 b/d of NGLs from Shaybah production.

In Syria, just before yearend 2009, President Bashar al-Assad inaugurated the South Central Area gas processing plant to handle production from Abu Rabah, Qumqum, and al-Fayyid fields. Inlet capacity at the plant is more than 7.5 million cu m/day (about 264 MMcfd) and will send out 6.2-7.2 million cu m/day of sales gas.

In November 2009, the Hayyan oil and gas processing plant opened in Jihar field west of Palmyra, processing oil and gas from fields operated by the Hayyan Oil Co. Production capacity at the new plant is 6,000 b/d of oil and 650,000 cu m/day (nearly 23 MMcfd) of gas.

Elsewhere in the Arabian Gulf, Abu Dhabi's ADGAS hired Hyundai Heavy Industries in a $1-billion engineering, procurement, and construction contract for the emirate's integrated gas development plant on Das Island.

The company said the project involves processing an additional 1 bcfd of high-pressure gas and moving it from Abu Dhabi Marine Operating Co.'s offshore Umm Shaif field through a new 46-in. pipeline to new ADGAS processing on Das Island. There the gas will be conditioned and sent through the 30-in. offshore associated-gas pipeline to Habshan.

The project is part of other projects in Abu Dhabi that are all targeted for completion by third-quarter 2013.

Also late last year, Abu Dhabi Gas Industries Ltd. signed four contracts totaling $9 billion for EPC and commissioning of the project, including the Habshan 5 processing plant, Habshan 5 utilities and offsite, the fourth Ruwais NGL train, and storage tanks at Ruwais.

The IGD project being built at Habshan 5 in southwestern Abu Dhabi, will include four gas-processing trains with total capacity of 2 bcfd.

The Habshan 5 complex will also include four sulfur-recovery units to recover as much as 99.9%. Upon commissioning, Habshan 5 will supply 900 MMcfd of sales gas, 12,000 tonnes/day of NGLs, and 5,000 tpd of liquid sulfur.

Propane, butane, paraffinic naphtha, and sulfur produced at the plant will be exported, while the ethane will be feedstock for the nearby petrochemical complex.

In Oman in late 2009, Petroleum Development Oman awarded an EPC contract to South Korea's GS Engineering and Construction for the Saih Nihayda gas compression project and debottlenecking of the Saih Nihayda gas processing plant.

Saih Nihayda field in central Oman has been producing gas since 2005. Debottlenecking the plant will increase capacity to 25 million cu m/day from 20 million cu m/day.

Africa

Algeria's Sonatrach awarded a $1.1 billion contract in mid 2009 to build gas gathering and processing in Rhourde Nouss. The plant will supply natural gas to the LNG plant at Arzew.

Included are gathering to tie in four Rhourde Nouss gas fields in southeastern Algeria—Rhourde Nouss Central, Rhourde Nouss Southwest, Rhourde Adra, and Rhourde Adra South—and a gas treatment at Quartzites de Hamra.

To be completed in 2012, the project will allow Algeria to process and treat 3.5 billion cu m/year of gas. It would also produce 16,000 b/d of condensate.

Earlier last year, Sonatrach awarded $1.35 billion in EPC contracts to build gas treatment plants at Gassi Touil field.

In Tunisia last year, technical problems at BG Tunisia Ltd.'s new 100-MMcfd Hasdrubal gas processing plant forced the company to delay start-up to December. The new onshore gas processing and LPG production plant lies on the Tunisian coast between La Skhira and Sfax adjacent the existing BG Tunisia 174-MMcfd Hannibal plant.

The Hasdrubal plant is a 50/50 joint venture of BG Tunisia and Tunisian state-owned oil and gas exploration and production company Entreprise Tunisienne D'Activités Pétrolières. It processes production from the rich-gas, condensate, and associated oil offshore Hasdrubal field, in the Gulf of Gabes about 69 miles east of Sfax.

The plant train encompasses gas separation, mercury removal, gas dehydration with molecular sieve, H2S and CO2 removal, export gas compression, condensate stabilization, condensate storage, and export.

The Hasdrubal plant exports sales gas to the Tunisian gas grid and condensate to storage through a new 41-mile pipeline along the coast to La Skhira. The plant will also produce separate streams of propane and butane for distribution as cylinder gas (www.hydrocarbons-technology.com).

And in Nigeria in December last year, delays in completing repairs on the Trans-Forcados pipeline stalled start-up of the 130-MMcfd Ovade-Ogharefe gas processing plant in Delta state. The pipeline was damaged by sabotage earlier in the year.

Construction of the plant is by Pan Ocean Oil Corp., Nigeria's only indigenous oil and gas joint-venture operator with the Nigerian National Petroleum Corp. Located in oil mining lease No. 98 in the northern part of the Niger Delta, the 130-MMcfd plant will deliver about 65 MMcfd at the start with capacity to reach a peak of about 200 MMcfd.

The plant will produce NGLs, LPG, and residue gas for the national gas grid through the Nigerian Gas Co. pipeline to supply power generation plants. The liquids will be mixed with crude oil for export.

In Nigeria this year, Shell Petroleum Development Co. expects to commission the Gbaran-Ubie integrated oil and gas project in Bayelsa State.

At peak production, the project will produce around 1 bcfd of gas and 120,000 b/d of crude oil and condensate. Shell is drilling more than 30 new wells and building a central processing plant to treat both oil and gas.

The plant will deliver 100 MMcfd of residue gas to the 225-Mw Gbarain National Integrated Power Project and the Bayelsa State power plant at Imiringi. Some of the gas will supply local power stations in the Niger Delta. The rest will supply Nigeria LNG's plant at Bonny. The oil will be exported from SPDC's Bonny crude oil terminal.

Future expansion plans call for the project to produce up to 2 bcfd.

Last month, press reports from Ghana stated that work was under way for first-phase construction of a gas processing plant for Jubilee oil field production. The gas plant will be located at Bonyere in the Jomoro District in the western region and process gas from Jubilee field for both local and international markets.

First phase of the project is estimated to cost about $300 million. The second phase will involve an extension of the pipeline to Takoradi to power the Aboadze thermal plant and an upgrade to the gas plant's capacity. Total cost of the entire project was put at $1.1 billion.

Ghana will become an oil exporter in fourth-quarter 2010, when production begins at the 1.8-billion bbl offshore Jubilee field.

Asia

In Asia late in 2009, China National Petroleum Corp. started up a gas processing plant on the banks of the Amu Darya River in Turkmenistan as the injection point for gas headed east to China through the new Turkmenistan-Uzbekistan-Kazakhstan-China gas pipeline (Central Asia Pipeline).

This project can supply China with more than 5 billion cu m/year (about 480 MMcfd). Chinese officials stated the pipeline's capacity could be expanded to 30 billion cu m this year.

CNPC began building the No. 1 gas-treatment plant in June 2008 in Block A of the Bagtyiarlyk production-sharing contract area on the right bank of Turkmenistan's Amu Darya River.

CNPC said the plant is one of two it plans for the pipeline from Turkmenistan, via Uzbekistan and Kazakhstan to China's northwestern Xinjiang region.

In neighboring Kazahkstan, Turgai Petroleum has built a gas processing plant to process 150 million cu m/year (about 14.5 MMcfd) of gas to produce 105 million cu m of dry gas and 68 tonnes/year of LPG for residential use.

The plant and associated pipelines replace extensive gas flaring in the region.

In Pakistan earlier this year, Pakistan Petroleum Ltd. inaugurated the Hala gas plant in Sindh with installed capacities of 12.5 MMcfd gas, 28 tonnes of LPG, and 1,500 b/d of NGL.

Cost of the plant was $30-40 million.

The Hala block straddles a joint venture of Pakistan Petroleum, which operates it with 65% working interest, and Mari Gas Co., which holds the remaining 35% interest.

Elsewhere in Pakistan, sales of natural gas to Sui Northern Gas Pipelines Ltd. commenced from the new central processing plant at Manzalai, Tal block, and were to reach 120 MMcfd in the plant's initial phase. Sales by 2013 are anticipated to reach 300 MMcfd.

Pakistan granted a petroleum concession and exploration license to the Hungarian state oil and gas company MOL in the TAL block (3370-3) along with joint-venture partners Oil & Gas Development Co., Pakistan Petroleum, Government Holdings (Pvt.) Ltd., and Pakistan Oilfields Ltd.

Europe

In March, Total SA and Dong Energy AS received a green light from the UK government to develop Laggan and Tormore gas fields west of the Shetland Islands. Total estimates that the fields contain 230 million boe of reserves and will have a 500-MMscfd peak gas production or a 93,000 boe/d peak when condensates are included.

The £2.5 billion development lies in 600 m of water on Blocks 206/1a, 205/4b, and 205/5a, about 87 miles off the Shetlands. As part of the development, Total will build a new gas processing plant at Sullom Voe on Shetland; first gas is expected from the project in 2014.

From the plant, gas will flow by 143-mile export pipeline into the existing Frigg UK line. That line will transport the gas to a Total-operated Saint Fergus gas terminal, north of Aberdeen.

Total also acquired Chevron North Sea Ltd.'s interest (10%) and Eni UK Ltd.'s interest (20%) in the fields. Total holds an 80% interest with the remaining held by Dong E&P (UK) Ltd.

In Turkey, Otto Energy Ltd. in March of this year reported construction of the Edirne gas plant had been completed in Turkey. Gas sales were to begin as soon as Botas, the state-owned pipelines and trading company, completed a hot tap on its 14-in. main line to create the delivery point for the Edirne gas.

Otto has finalized gathering and tolling agreements with the joint operators of the Edirne plant to process the gas from Edirne fields. The Edirne joint-venture partners consist of Otto (35%), Transatlantic Mediterranean Int. (55%), and a local Turkish company Petraco (10%).

In August of last year, BP PLC's Russian joint venture TNK-BP Ltd. announced plans to build a new gas processing plant that will allow the company to use nearly 100% of its associated gas by 2012.

To be built near Pokrovsky field in the Orenburg, the new plant will able to handle 450 million cu m/year of gas.

It will allow TNK-BP to bring up the overall level of flared associated gas utilization to almost 100% by 2012, said press reports. TNK-BP is already revamping gas pipelines and compressor stations and expanding its existing Zaikino gas plant, also in the Orenburg.

In January of last year, Romanian oil company Petrom inaugurated a new gas processing plant at the Midia oil terminal on the Black Sea in an investment said to be €90 million.

The Midia new plant will be able to process 3.8 million cu m/day and, according to Petrom, along with 340 tonnes/day of condensate.

Americas

In August last year in Mexico, a consortium led by ICA Fluor began building a cryogenic natural gas processing plant for state oil company Pemex. The plant will take 2 years to build and process 200 MMcfd from Pemex's gas fields in the Poza Rica area of northern Mexico.

The plant will separate products such as propane and butane from natural gas, and cost about $270 million to build.

Canada's National Energy Board earlier this year approved a new gas plant to serve increased shale gas production from the Horn River basin in British Columbia.

Spectra Energy Corp.'s BC Field Services subsidiary will build the 250-MMcfd Fort Nelson North gas processing plant on about 200 acres 75 km northeast of Fort Nelson, BC.

The new plant will expand the company's processing services to basin producers, adding to capacity at the older 1-bcfd Fort Nelson gas plant, which OGJ gas processing data show has been operating at less than 500 MMcfd. The new plant is north and west of the existing plant.

More than a year ago, Spectra Energy announced it had received firm commitments of 760 MMcfd for gathering and processing capacity from seven producers operating in the Horn River basin. Those commitments were subsequently turned into firm contracts.

They are in support of Spectra's activities to expand gathering and processing around Fort Nelson to accommodate as much as 830 MMcfd of incremental gas from Horn River producers.

Spectra Energy President Greg Ebel said last year the company's plan involved staged expansions of existing Fort Nelson area infrastructure. The expansion, which began last year and will run into 2012, includes reactivating 500 MMcfd of existing capacity at the Fort Nelson gas plant, looping and reconfiguration of area gathering and compression, and construction of the Fort Nelson North plant at Spectra Energy's existing Cabin Lake compressor station—the subject of the NEB's ruling.

In the US in August last year, Williams opened its $350 million, 450-MMcfd Willow Creek natural gas processing plant in Rio Blanco County, Colo. (photo p. xx). The single-train cryogenic plant can produce more than 20,000 b/d of NGLs from the Piceance basin.

Production from the plant flows to Midcontinent markets via Oneok Partners' Overland Pass pipeline.

Also in August, Enterprise Products Partners LP, Houston, announced plans to build a new 75,000-b/d NGL fractionator at Mont Belvieu to handle growing NGL volumes from production in the Rockies, Barnett shale, and emerging Eagle Ford shale in South Texas.

The expansion's design is to be based on the company's 75,000-b/d Hobbs fractionator in Gaines County, Tex. that started up in August 2007.

When completed in early 2011, the new plant will increase Enterprise's NGL fractionation capacity at Mont Belvieu to about 300,000 b/d and net system-wide capacity to about 600,000 b/d, said the company announcement.

Earlier this year, Targa Resources Partners LP, Houston, also said it would expand NGL production capacity at Mont Belvieu by increasing capacity by 28% at its Cedar Bayou fractionator.

The company will add 60,000 b/d in first-quarter 2011 to increase the facility's capacity to 275,000 b/d. The company's maximum gross production capacity in the Texas and Louisiana Gulf Coast would expand to 439,000 b/d.

Also in April this year, Oneok Partners LP, Tulsa, announced plans to invest about $405-$470 million through yearend 2011 on projects to expand gathering and processing in the Bakken shale in Williston basin in North Dakota and the Woodford shale in Oklahoma.

These projects are part of a previously announced $2.5-$3.5 billion in projects the company has identified for investment by yearend 2015.

Included is construction of the new 100-MMcfd Garden Creek natural gas processing plant in eastern McKenzie County, ND, and related expansions. Oneok estimates these expansions will cost $150-$210 million and double the partnership's processing capacity in the Williston basin. Completion is expected in fourth-quarter 2011.

In addition to the new plant, Oneok's natural gas gathering and processing segment will invest $200-$205 million during 2010-11 for new well connections, expansions, and upgrades to existing gas gathering in the Bakken shale.

These investments include:

• Expansion and upgrade of gas gathering and addition of new compression to serve the new Garden Creek plant.

• Gas gathering and compression upgrades to bring the existing 100-MMcfd Grasslands gas plant in McKenzie County to full capacity by yearend 2010.

• $90 million to connect more than 300 wells in 2010 and about 400 wells in 2011 to the partnership's Williston basin gathering system.

In March 2009, Oneok completed a $46-million expansion of the Grasslands plant and since 2007 has invested more than $80 million in new well connections and related upgrades to existing gas gathering in the region.

In 2010-11, Oneok will invest an additional $55 million in the Woodford shale in Oklahoma on natural gas gathering and processing and NGL segments.

These investments will connect the partnership's western Oklahoma gas gathering to its existing 135-MMcfd Maysville gas plant in Garvin County, central Oklahoma, allowing it to accommodate growing production in the Woodford shale. The project is under construction and expected to be completed during fourth-quarter 2010.

These investments also include about $20 million for new well connections in 2010-11 to gather more Woodford shale volumes.

In the partnership's NGL segment, capital investments include expansion of the partnership's existing Oklahoma NGL gathering system to connect to the new 200-MMcfd gas plant currently under construction by Devon in Canadian County, Okla., and expected to be completed by yearend or early 2011. This expansion will increase accessibility of this new supply to the partnership's Arbuckle pipeline and Mont Belvieu, Tex., fractionation.

Only a few weeks ago, Enbridge Energy Partners LP, Houston, announced it will add a cryogenic gas processing plant on its Anadarko natural gas gathering system in the Texas Panhandle.

The 150-MMcfd capacity plant is needed to handle a resurgence of horizontal drilling the NGL-rich Granite Wash, said the announcement.

When operating in first-quarter 2011, the new plant will increase the Anadarko system's total processing capacity to more than 650 MMcfd. In addition to this cryogenic plant, the company will also add field compression and pipeline to accommodate increasing Granite Wash gas production.

At the same time, Dominion, Richmond, Va., said it plans to expand natural gas gathering, processing, and transportation for Marcellus shale and Appalachian production.

Dominion will install gathering, processing, and transportation for growing production of high-btu gas in the Marcellus shale areas of Marshall and Wetzel counties, W.Va., and surrounding counties in West Virginia, Pennsylvania, and Ohio.

In cooperation with Exterran Holdings Inc., Houston, Dominion will deliver residue gas from two plants Exterran will build and operate in Ohio and West Virginia.

Dominion's Marcellus 404 Project will provide firm and interruptible transportation, as well as gathering and processing, for as much as 300 MMcfd and fractionation capacity for 32,000 b/d of NGLs. The processing and fractionation will be in north-central West Virginia.

Residue gas will be delivered into Dominion Transmission's pipeline system or into one of several other gas outlets near Clarington, Ohio. As part of the project, Dominion will convert TL-404, an existing transmission pipeline in Ohio and West Virginia, into wet-gas service.

Plans call for the project to be phased in, providing 45 MMcfd initially and ultimately expanded to 300 MMcfd.

Exterran will install two gas processing plants: an 8-MMcfd plant in Carlisle, Ohio, and a 10-MMcfd plant in Schultz, W.Va. The company will own and operate the two plants under a 12-year agreement with Dominion.

Commercial operation at the Carlisle plant is set for January 2011; at the Schultz plant for May 2011.

The Carlisle plant, according to the joint announcement, will allow more local gas to be processed and delivered into Dominion's East Ohio local gas distribution system.

The Schultz plant will allow more local gas to be produced into Dominion's gathering system in West Virginia, processed there, and delivered to markets through Dominion Transmission's interstate pipeline system.

Late last year, Range Resources Corp. completed the third phase of its natural gas processing infrastructure expansion in the Marcellus shale, bringing total capacity in the region to about 180 MMcfd.

This phase of the expansion included 120 MMcfd more cryogenic gas processing capacity, 20 miles of additional gathering and residue-gas pipelines, and 21,000 hp of additional compression, the company said.

Range said it was developing additional high-btu gas expansion to raise its total gas infrastructure capacity to 185 MMcfd by third-quarter 2010 and to more than 300 MMcfd the middle of next year.

Before this third expansion, processing capacity for high-btu gas was about 155 MMcfd, said the company, while gathering capacity for dry gas that does not require processing was about 25 MMcfd.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com