OGJ Newsletter

General Interest — Quick Takes

Helicopter flights off Europe still crippled

Although helicopter transportation off Northern Europe remained crippled by a cloud of volcanic ash from Iceland at presstime last week, there were no reports of disrupted oil and gas production.

The trade group Oil & Gas UK reported that some of its operator members had begun "scaling back on certain nonessential activities." Crew changes had been disrupted.

NATS, the UK air traffic control authority, suspended routine helicopter flights to oil and gas facilities on the UK continental shelf on Apr. 15 as a volcanic ash moved into the area, threatening to disable aircraft engines (OGJ Online, Apr. 15, 2010).

The ash cloud suspended thousands of airline flights to and from Europe.

On Apr. 20, NATS said parts of Scottish airspace were intermittently open. The area included Aberdeen, an important base for helicopters serving offshore oil and gas installations.

In the southern UK, airspace below 20,000 ft remained closed.

Off Norway, airspace was closed Apr. 20 after having been open at times.

"The oil installations in the North Sea are covered by the cloud," reported Avinor, the Norwegian aviation authority.

Avinor said all European authorities were basing aviation decisions on ash-dispersal forecasts issued every 6 hr by the Volcanic Ash Advisory Centre in the UK Met Office.

API: US gasoline output broke record in March

US refineries produced more gasoline in March—an average 9.3 million b/d—than any previous month on record, the American Petroleum Institute said. Gasoline deliveries, which is how API measures demand, averaged 9.2 million b/d, more than any previous March, it added.

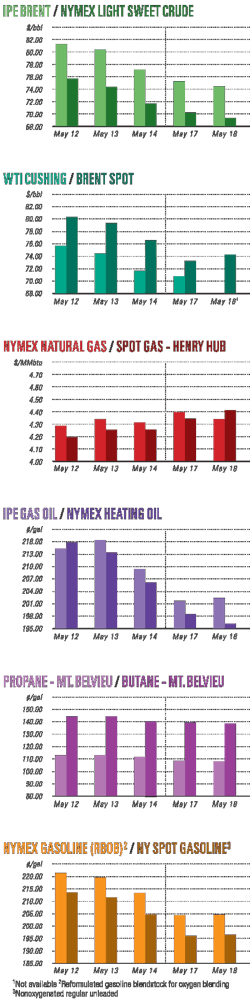

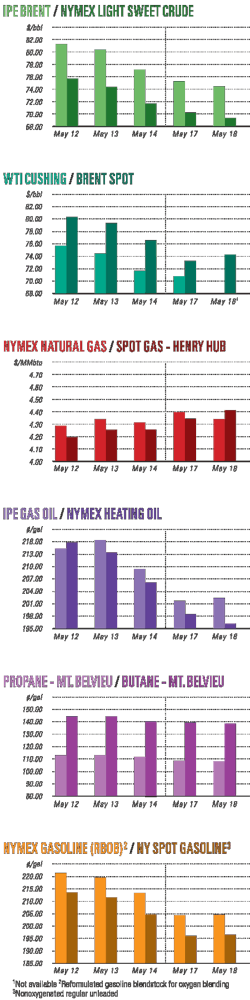

"US refineries are doing yeoman's work meeting consumer demand," API Chief Economist John Felmy said. "Moreover, the record gasoline production in March makes it abundantly clear that supply is not an issue with the higher gasoline prices we've seen. Sharply higher crude oil prices are driving that, and they continue to put upward pressure on the price at the pump."

Gasoline inventories, which totaled 220.7 million bbl at the end of March, were 2.1% higher than a year earlier, according to API's latest monthly statistical report. Oil product prices have climbed nevertheless because oil costs have increased, Felmy told reporters during an Apr. 16 teleconference. "As of this point, we've seen crude prices go up 34¢/gal and gasoline prices 25¢/gal from mid-February," he said.

Demand for other refined products was mixed in March, API said. Jet kerosine deliveries climbed 0.5% year-to-year to an average 1.4 million b/d. Distillate deliveries declined 0.8% to an average 3.7 million b/d from March 2009's average while those of residual fuel fell 1.8% to an average 594,000 b/d during the same period. Total product deliveries rose 3.5% to an average 19.3 million b/d in March from 18.7 million b/d a year earlier.

MMS issues ruling on gas flaring, venting

The US Minerals Management Service published a final rule on Apr. 16 setting limits on flaring or venting of natural gas into the atmosphere from wells on federal offshore leases. The rule also amends regulations that limit production rates from offshore wells, it said.

The rule establishes criteria for flaring and venting, and sets limits on the time gas may be flared or vented during situations, according to MMS. It said while the vast majority of gas produced offshore is captured and brought to market, the rule recognizes that small amounts of flaring and venting sometimes are necessary, such as when equipment fails to work properly and the operator must divert flowing gas to a controlled flare or vent system for safety reasons.

MMS said the final rule requires installation of meters to accurately measure all flared and vented gas on facilities that process more than 2,000 b/d of oil—a change based on a recommendation from the Government Accountability Office. In a report, "Natural Gas Flaring and Venting—Opportunities to Improve Data and Reduce Emissions," GAO said MMS should keep more accurate records to determine the amount of gas flared or vented, and the volumes of greenhouse gases that such releases contributed to the atmosphere each year.

While it has monitored total amounts of gas flared and vented from federal offshore leases in the past, operators have not been required to differentiate between the two categories, MMS said. They will be required to report flaring and venting volumes separately to the agency under the new rule to improve data collection, it said.

ExxonMobil chief notes mistrust of business

Economically stifling regulation comes from a mistrust of private business that needs attention from industry and public officials, says the chairman and chief executive officer of ExxonMobil Corp.

At a meeting of the Houston World Affairs Council, Rex W. Tillerson spoke of the importance in the energy business of "investing for the long term" and in developing people and technology through "a sustained, disciplined, and consistent approach."

Such an approach depends on consistent regulation.

"In the decades ahead, it will be more important than ever for governments to encourage free trade, uphold the rule of law, and build the stable legal and regulatory frameworks that allow for long-term investment and long-term corporate citizenship efforts to make a difference," Tillerson said.

"Often the policy changes that are most damaging to entrepreneurs and innovation flow from a fundamental mistrust in the private sector. Leaders in the private and public sector both have a responsibility to challenge the basis and perceptions for this mistrust."

Citing expectations that global energy demand will increase by one-third in the next 25 years, Tillerson said fossil fuels will dominate supply "for decades to come." He predicted energy-related emissions of carbon dioxide will increase about 1%/year through 2030.

And he emphasized the link between energy and water, with production of each depending on supply of the other.

"Striking the right balance is crucial to addressing this environmental challenge and in providing people around the world access to both energy and water in sufficient amounts to enable economic growth," he said.

Tillerson received the council's Jesse H. Jones and Mary Gibbs Jones Award for International Citizen of the Year.

Exploration & Development — Quick Takes

Japanese firms raise oil, gas spending

Leading Japanese oil and gas exploration companies, responding to an uptick in international oil prices, plan to increase their spending to develop oil and gas fields, according to media reports.

Japan's Nikkei business daily reported that the moves by these firms are partly driven by government support, including loans by the Japan Bank for International Cooperation.

In a draft of its energy policy released in March, the Japanese government set a goal of acquiring half of the nation's fossil fuel imports through Japanese interests in production, up from about 25%.

In connection with that policy, Mitsui Oil Exploration Co., the third-ranked firm in Japan in terms of oil and gas production, has earmarked ¥300 billion for investment over 3 years starting this fiscal year—an increase of 130% over the previous 3-year period.

The Nikkei said half of Mitsui's outlays will go to boosting production, while the other half will be used for exploration and to acquire equity stakes in exploration projects.

Mitsui plans to focus on such regions as northern Africa, the Middle East, and North America. The company will also consider taking over other oil development firms.

Mitsui Oil's current oil and gas production stands at 100,000 boe/d, with most of it coming out of Thailand. The paper said that Mitsui aims to increase production by 50% in 3-5 years.

Meanwhile, Inpex Corp., Japan's leading oil exploration firm, intends to spend an all-time high ¥990 billion on development and exploration in fiscal 2010-11, a 60% rise over the estimated figure for fiscal 2008-09.

The company plans to expand investment related to a large Australian gas field project, laying out ¥130 billion this fiscal year and ¥300 billion in fiscal 2011 for the project, which is slated to begin production in 2015.

The paper said Idemitsu Kosan Co. plans to spend as much as ¥200 billion on oil and coal development over the three years through fiscal 2011, up roughly 150% from the previous 3 years.

Idemisu Kosan aims to lift oil output by about 30% to 34,000 b/d, the paper said.

BLM approves Oak Mesa unit development plan

The US Bureau of Land Management approved a unit agreement for orderly and efficient development of natural gas leases in the Oak Mesa area of Delta County in western Colorado, the US Department of the Interior agency said.

The unit was proposed by federal leaseholders on 25,000 acres of public and private land in Delta County, BLM's Colorado state office said. The federal mineral rights are all existing leases held by Gunnison Energy Corp., Retamco Operating Inc., and Richard A. Peterson, it said.

Jerry Strahan, deputy state BLM director for energy, lands, and minerals in Colorado, said the unit's approval does not authorize gas development in the area. "These leaseholders already have the right to apply for permits," he explained. "The unit agreement merely eliminates internal lease boundaries within the unit area and requires a schedule for development, allowing for more orderly and efficient development of the oil and gas resources. Unit boundaries are based on the geology of the area."

The administrative action provides for exploration and development of the area by a single operator, who must drill a test well within 6 months, he continued. It does not authorize surface disturbance or drilling on the approximately 23,000 acres of federal land within the unit, Strahan said. BLM will need to analyze these activities, which are subject to approval under the National Environmental Policy Act as well as from BLM, on a case-by-case basis, he indicated.

Cygnus appraises as southern gas basin giant

A group led by GDF E&P Suez plans to shoot a field-wide 3D seismic survey over Cygnus field in the UK North Sea Southern Gas basin.

Preliminary estimates of Cygnus reserves and prospective resources could be as high as 2 tcf of gas based on new well information, said partner Endeavour International Corp., Houston. That would make Cygnus one of the largest fields in the southern gas basin.

Endeavour, which expects gas production to start from Cygnus in 2011, in mid-March launched a study of strategic alternatives for its North Sea assets. GDF discovered Cygnus in 2006.

The Cygnus discovery well and five appraisal wells support a common fieldwide gas-water contact within 10 ft with the exception of the 44/11-2 well in the extreme southwest, Endeavour said. The recent drilling has extended the field to the north and west.

The 44/11a-4 appraisal well encountered a high-quality, gas-saturated Leman sand reservoir 54 ft high to prognosis with 130 ft gross and 85 ft net sand thickness. The well was flow-tested at a rate of 28 MMcfd. TD is 12,207 ft true vertical depth subsea.

The rig will move to the southern part of the field to drill a sixth appraisal well, 44/12a-E.

Drilling & Production — Quick Takes

CO2 pact signed for New Mexico EOR project

A Houston operator plans to buy a 5-year supply of carbon dioxide for an enhanced oil recovery project in Milnesand San Andres field, Roosevelt County, NM.

First CO2 would be delivered to the field by August 2012 through a 25-mile pipeline that the operator, Enhanced Oil Resources Inc., would build from the existing Cortez pipeline that transports CO2 from Colorado to the Permian basin.

EOR Inc. is under contract to buy 27.4 bcf of CO2 from Kinder Morgan CO2 Co. LP at market price. Projected oil recovery from CO2 injection on 3,000 acres, based on a completed 12-month pilot project, is 5.31 million bbl of proved and probable reserves and 8 million bbl if possible reserves were recovered.

EOR Inc. controls 5,600 acres in the 6,000-acre field. The 3,000-acre Phase 1 project is modeled to include as many as 89 producing wells and 64 injectors. Phase 1 peak oil production at the 2P level is expected to reach 2,200 b/d of oil within 3 years of the start of injection.

Before injecting CO2, EOR Inc. will conduct a drilling program to reduce the current 40-acre well spacing to 20 acres and possibly to 10 acres later. This infill drilling is expected to raise primary recovery, increase daily production, and provide a better conduit between producers and injectors.

Full development of the 5,600 acres could require as many as 140 producers to recover up to 14 million bbl of proved, probable, and possible reserves. The company hopes to double Milnesand oil production to 1,000 b/d by yearend.

EOR Inc. said, "Our CO2 pilot result has confirmed our expectations that considerable value can be generated at Milnesand and by analogy, at our adjacent 18,000-acre Chaveroo field by the use of CO2 flooding."

Suncor starts Ebla gas deliveries in Syria

Suncor Energy Inc., Calgary, started commercial gas deliveries from the $1.2 billion (Can.) Ebla gas development in central Syria through facilities with a capacity of 80 MMcfd.

The project covers more than 300,000 acres in Ash Shaer and Cherrife fields in the Central Syrian gas basin. The Ebla development comprises the gas producing wells, a gas gathering and compression station, 80 km of pipeline, and a gas treatment plant.

The plant extracts condensate and liquefied petroleum gas. Gas deliveries began Apr. 19 to the Syrian national gas grid for the local market.

Suncor operates in Syria through its Petro-Canada subsidiary. Petro-Canada entered Syria in 2002, via the purchase of Veba Oil & Gas assets.

In late 2006 Petro-Canada became the operator of the production-sharing agreement for Ash Shaer and Cherrife fields in the Palmyra region and the associated Ebla gas development project.

Under the terms of the PSC, Petro-Canada and General Petroleum Corp. will form an operating company that will have the operating responsibility for the Ebla gas development.

InterOil lets contracts for Elk-Antelope fields

InterOil Corp. has signed an agreement with Japan's Mitsui & Co for the joint funding and operation of preliminary works for a proposed condensate stripping facility to be constructed at InterOil's Elk-Antelope fields in Papua New Guinea's Gulf province.

The agreement involves all work required to move the project through front-end engineering and design to a final investment decision. Under the deal, Mitsui will carry InterOil for its 50% of the costs.

The plant will be capable of processing 400 MMcfd of gas to yield about 9,000 b/d of condensate. The plan is to reinject the dry gas back into the reservoir for reproduction once the proposed Liquid Niugini Gas LNG facility has been built.

InterOil says the early cash flow from condensate will provide a stable financial platform for the LNG project and enhance the benefits of the project to the LNG joint venture.

Antelope field flowed at record levels last year when the No. 2 well recorded rates of 705 MMcfd of gas plus 11,200 b/d of associated condensate.

Processing — Quick Takes

Petrobras buys out Okinawa refiner

Brazil's Petroleo Brasileiro SA (Petrobras) plans to turn Okinawa refiner Nansei Sekiyu KK into a wholly owned subsidiary and an Asian oil supply base.

Petrobras is to acquire the remaining 12.5% of Nansei from Sumitomo Corp. for an undisclosed sum. The Brazilian firm acquired 87.5% of Nansei from TonenGeneral Sekiyu KK for ¥5.5 billion in 2008 (OGJ Online, Apr. 2, 2008).

Initially, Petrobras was to furnish Brazilian crude to Nansei to be processed into light oil and raw chemical material for export to Asian markets. But it has since decided to use Nansei as a base for storing and exporting oil to other Asian refineries. Petrobras will deliver 1.8 million bbl of oil to Nansei every 2 months for onward shipment.

Petrobras is expected to begin selling its crude from Nansei this month. According to market reports, it is to ship 950,000 bbl of medium heavy Roncador 28 crude from South America to Nansei, with the arrival date scheduled Apr. 18-19 after a 5-week voyage via the Cape of Good Hope and the Malacca Strait.

Petrobras cannot process the 24-28° gravity crude at the Nansei refinery, however the oil is said to be a good match for Asia's markets as China and South Korea recently developed upgrading capacities to process heavier grades.

Petrobras has five 100,000 cu m storage tanks at the facility.

The shipments are likely to add more than 33,000 b/d to Brazil's crude sales to northeast Asia, though traders said changing price conditions and freight economics could prompt Petrobras to sell part of the cargo before it reaches Okinawa.

Traders said the new export strategy will help Petrobras split transoceanic shipments into smaller vessels, supplying refineries that lack port facilities or storage to receive very large crude carriers in Japan, South Korea, China, and Malaysia.

Sumitomo and Petrobras originally were to spend as much as ¥100 billion to upgrade the Nishihara facilities and boost the cost competitiveness of the refinery as an export base. But Petrobras shelved those plans last April due to reduced demand. Instead, it focused on use of the storage tanks to implement its new export strategy.

Petrobras will shut down the 100,000 b/d Nansei Sekiyu KK refinery for maintenance from May 17 to July 2.

Dominion to expand processing in W.Va., Ohio

In separate announcements, Dominion, Richmond, Va., said it plans to expand natural gas gathering, processing, and transportation for Marcellus shale and Appalachian production.

Dominion will install gathering, processing, and transportation for growing volumes of high-btu gas being produced in the Marcellus shale areas of Marshall and Wetzel counties, W.Va., and surrounding counties in West Virginia, Pennsylvania, and Ohio.

In cooperation with Exterran Holdings Inc., Houston, Dominion will deliver residue gas from two gas plants Exterran will build and operate in Ohio and West Virginia.

Dominion's Marcellus 404 Project will provide firm and interruptible transportation, as well as gathering and processing, for as much as 300 MMcfd and fractionation capacity for 32,000 b/d of NGLs. The processing and fractionation will be in north-central West Virginia.

Residue gas will be delivered into Dominion Transmission's pipeline system or into one of several other gas outlets near Clarington, Ohio.

As part of the project, Dominion will convert TL-404, an existing transmission pipeline in Ohio and West Virginia, into wet-gas service. The company announcement said producers may connect directly to TL-404 or request Dominion to construct additional gathering to deliver their production to TL-404.

Plans call for the project to be phased in, providing 45 MMcfd initially and ultimately expanded to 300 MMcfd. Initial service will be available about a year after the company has received commitments from producers adequate to support the project. Processing and fractionation will be phased in "to correspond with producer needs," said Dominion.

Exterran will begin immediately to design, build, and install two gas processing plants, an 8 MMcfd plant in Carlisle, Ohio, and a 10 MMcfd plant in Schultz, W.Va. The company will own and operate the two plants under a 12-year agreement with Dominion.

Commercial operation at the Carlisle plant is set for January 2011; at the Schultz plant for May 2011.

The Carlisle plant, according to the joint announcement, will allow more local gas to be processed and delivered into Dominion's East Ohio local gas distribution system.

The Schultz plant will allow more local gas to be produced into Dominion's gathering system in West Virginia, processed there, and delivered to markets through Dominion Transmission's interstate pipeline system.

Transportation— Quick Takes

Flex LNG discusses floating LNG project

Norwegian company Flex LNG Ltd. said it is in advanced discussions with an Asian national oil company to join a floating LNG (FLNG) project off Australia. Without naming the company, Flex said the proposed project will be a joint venture development involving one or more technical and commercial partners.

A possible pairing could be with Thailand's PTT Exploration & Production PLC (PTTEP), which plans to use an FLNG vessel to develop its gas assets in the Timor Sea. Last year PTTEP canceled a heads of agreement with Golar LNG Ltd. for a joint project in Australia but said at the time it was still interested in developing its isolated gas fields off northern Australia.

In the meantime, Flex has been working with Samsung Heavy Industries Co. Ltd. to develop a floating production, storage, and offloading LNG vessel and has four ships incorporating liquefaction units already under construction in South Korea.

The company also has an option to acquire control of Jersey-based Minza Oil & Gas Ltd. that has 100% interest in permit JPDA 06-101A in the joint petroleum development area between East Timor and Australia.

The permit contains the one-well Chuditch gas discovery made by Royal Dutch Shell PLC in 1998. Minza acquired 800 km of 2D seismic data over the permit in 2009 and expects to drill one exploration well in the near future.

Shell lets contract for first LNG-FPSO vessel

Samsung Heavy Industries said it received a $1.2 billion order from Royal Dutch Shell PLC for construction of a LNG floating production, storage, and offloading vessel, which is the first vessel in a 15-year supply contract signed a year ago.

"This marks the full-fledged launch of a historic project that will be recorded as the world's largest contract of its kind," said SHI Chief Executive Officer Roh In-sik, referring to the 15-year contract he signed in July 2009 with Shell and Technip SA.

Under the contract, SHI will be the exclusive supplier of LNG-FPSOs to Shell for the next 15 years. Industry experts predict that as many as 10 LNG-FPSOs priced at $5 billion each eventually will be ordered. SHI and Technip will jointly design the ship, and Geoje Shipyard will exclusively build it. The vessel will be 468 m long, 74 m wide, 100 m high, and weigh 200,000 tons.

Construction will begin in 2012, with delivery set for 2016. When delivered, the LNG-FPSO will produce 3.5 million tonnes/year of natural gas from fields off northwestern Australia.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com