Special Report: EOR/Heavy Oil Survey: CO2 miscible, steam dominate enhanced oil recovery processes

About this report... Every 2 years, the Oil & Gas Journal surveys worldwide projects that use various injection technologies to enhance oil recovery. Tables showing the projects surveyed start on p. 41, while the following pages describe events and trends affecting EOR activity levels. |

Carbon dioxide injection and steam injection process as shown in Oil & Gas Journal's exclusive biennial enhanced oil recovery (EOR) survey, p. 41, account for most of the enhanced oil recovered in the world.

Based on responses to the survey, 193 US EOR projects produced 663,000 bo/d (Tables 1 and 2) at the beginning of 2010, or about 21,000 b/d more than the 644,000 b/d from 183 projects listed in the 2008 survey (OGJ, Apr. 21, 2008, p. 41).

Outside the US, the number of projects is increasing, although operators for many did not provide new or updated information from that listed in the previous survey.

Survey description

OGJ published its first EOR survey on May 3, 1971, and the survey has been biennial since 1974.

The 2010 EOR survey (Tables A through E) includes projects that involve injecting fluids, other than water or methane, into a reservoir to enhance oil recovery. Operators use the injectants during initial production, after primary depletion, or after secondary production, which also is known as tertiary recovery.

The most common injectants include:

• Steam in heavy oil fields at shallower depths.

• Air for in situ combustion projects.

• Carbon dioxide in lighter oil fields.

• Hydrocarbon miscible gas in lighter oil fields.

• Chemicals and polymer in lighter oil fields.

Several projects also use an acid gas that is a concentrated stream of hydrogen sulfide and carbon dioxide. Apache Canada Ltd. has a pilot in Zama field in northwestern Alberta that produces about 1,000 bo/d. Chevron Corp. also injects sour gas as part of its second-generation project in Tengiz field in Kazakhstan. A third project that will inject acid gas is Petroleum Development Oman's $1 billion Harweel project in southern Oman.

PDO expects production for Phase 2AB of the project to produce about 40,000 bo/d when fully commissioned. Start-up is planned for 2010 and PDO has said that the potential in the next decade is to increase production to 100,000 bo/d from the 10-field Harwell cluster of oil fields (OGJ, Nov. 5, 2007, p. 52).

US projects

OGJ's survey shows that EOR contributed 663,000 b/d to US oil production (Tables 1 and 2), a 21,000 b/d increase from the previous 2008 survey.

The survey includes 193 active projects, an increase of 10 compared with the 2008 survey.

Production from US projects that use thermal methods peaked in 1986 at 480,000 bo/d and has declined to the current 292,000 bo/d, or 2,000 bo/d less than shown in the 2008 survey. The 2010 production total includes information supplied by Chevron Corp. in 2008 because the company declined to provide an update. Therefore, 2010 US thermal production values might be less than listed in the survey.

Besides Chevron, Aera Energy LLC, a venture of ExxonMobil Corp. and Shell Inc., operates extensive steam EOR projects in California. At the beginning of 2010, its EOR projects were producing 91,400 bo/d from 16 projects compared with 95,000 bo/d at the beginning of 2008.

Of Continental Resources Inc.'s eight combustion projects in North and South Dakota, and Montana, the company indicates that five are complete with the other three nearing completion.

Thermal projects tend to have long lives. For instance, the fire flood in Louisiana's Bellevue field started in 1970 and continues to produce 220 bo/d, and steam injection started in the Tulare formation in California's Belridge field, now operated by Aera, in 1961. The zone currently still produces 27,000 bo/d.

A new project in the survey is MegaWest Energy Corp.'s steam injection project in Deerfield field, Vernon County, Mo.

Besides Missouri, the US has other heavy oil reservoirs such as those in the Maverick basin in South Texas. TXCO Resources operated two steam pilots recently in the basin and estimates that the area contains about 7-10 billion bbl of oil in place at a 1,500-2,000 ft depth. Some of the oil has a –2-0° API gravity.

In the US, CO2 injection has accounted for recovering about 1.5 billion bbl of oil, and US CO2 sales for EOR reached an estimated 3 bcfd in 2008 (OGJ, Dec. 7, 2009, p. 41). CO2 source fields provide most of the CO2 injected in North American EOR projects. About 83% comes from source fields, 10.6% from natural gas plants, 1.4% from fertilizer plants, 4.9% from coal gas synfuels, and 0.1% from ethylene production.

A recent assessment by the US Department of Energy's National Energy Technology Laboratory and Advanced Resources International Inc. determined that with state-of-the-art best practices CO2-EOR has a potential for recovering more than 47 billion bbl of oil and application of next-generation technologies could recover more than an additional 30 billion bbl from US oil fields (OGJ, Apr. 12, 2010, p. 52).

This expansion in CO2-EOR also is contingent on the availability of a plentiful and low-cost source of CO2, such as the potential CO2 source made available by regulations that would require industrial plants to reduce greenhouse-gas emissions by sequestering CO2.

The 2010 EOR survey lists 109 ongoing US CO2 miscible projects compared with 101 projects in the 2008 survey. Oil production from these projects also has increased to 272,000 b/d from the 240,000 b/d shown in the previous survey.

Units of Occidental Petroleum Corp. continue to add CO2 projects. Oxy now operates 31 projects compared with 29 listed in the 2008 survey. The 31 projects produce nearly 85,000 b/d as a result of EOR.

Denbury Resources Inc. also has added CO2 floods and is continuing to build pipelines for delivering CO2 to other fields. The company now has 17 miscible and immiscible CO2 floods compared with 15 listed in the previous survey. All of its CO2 floods are in Mississippi except for one in Louisiana, although with the completion of the Green pipeline it will start in 2010 to inject CO2 in Oyster Bayou and Hastings fields in Texas.

Denbury also signed a merger agreement with Encore Acquisition Co. (OGJ, Nov. 9, 2009, p. 26) that had announced development of an CO2-EOR project in Bell Creek field, southeastern Montana. The project involves building compression adjacent to the ConocoPhillips-operated Lost Cabin gas plant in Fremont County, Wyo., and installing a 206-mile pipeline to transport compressed 50 MMscfd of CO2 to Bell Creek. At Bell Creek, the company would reactivate 275 wells and drill as many as 75 wells to establish a five-spot injection pattern.

Encore estimated the production response from 100% utilization of the available CO2 at more than 6,500 b/d by 2015, with output remaining at that level for 10 years.

Encore's said its potential CO2-EOR projects might recover 30 million bbl from Bell Creek, 37 million bbl from Elk basin, 61 million bbl from South Pine, and 136 million bbl from other fields in the Cedar Creek anticline.

Most US hydrocarbon miscible projects are on the North Slope of Alaska with the largest in the Prudhoe Bay and Kuparuk River fields. The survey only includes three US EOR projects that involve injecting surfactants, polymers, or other chemicals. These projects tend to be smaller and have shorter lives. Even though the US might have many more of these type of projects, information on them was not available.

Canadian EOR

The oil sands in Alberta contain large amounts of bitumen that may be recovered with in situ processes such as steam-assisted gravity drainage (SAGD) and cyclic steam injection. Alberta's Energy Resources Conservation Board estimated that, of the 170-billion bbl remaining established reserves at yearend 2008, about 135 billion bbl were recoverable with in situ methods (OGJ, July 13, 2009, p. 38). ERCB also forecast that bitumen production from in situ projects would increase to 1.29 million b/d by 2018 compared with 0.58 million b/d in 2008.

In situ oil sands projects currently producing include:

• ConocoPhillips Canada's Surmont SAGD with a design capacity of 25,000 b/d.

• Devon Energy Corp.'s Jackfish Phase 1 SAGD project with a design capacity of 35,000 b/d.

• Connacher Oil & Gas Corp.'s Great Divide SAGD project that was producing 4,000-6,000 b/d in 2009 and has a design capacity of 10,000 b/d.

• Suncor Energy Inc. MacKay River SAGD project that produces 22,000 b/d and Firebag SAGD that produces 30,000 b/d.

• Nexen Inc.'s Long Lake SAGD that produces about 30,000 b/d.

• Cenovus Energy Corp.'s SAGD Christina Lake project that produces about 7,000 b/d and its SAGD Foster Creek project that produces 35,000 b/d.

• Japan Canada Oil Sands SAGD Hangingstone pilot that produces an average 7,000 b/d.

• Shell Canada Energy Ltd.'s Orion SAGD with a design capacity of 10,000 bo/d and its 18,000 b/d cyclic steam projects at Peace River.

• Canadian Natural Resources Ltd.'s Primrose in situ cyclic steam project that produces 65,000 b/d.

• Husky Energy Crop.'s Tucker SAGD project that produces 6,000 b/d.

• Petrobank Energy & Resources Ltd.'s white sands toe-to-heel air injection demonstration project that produces several 100 b/d.

The largest steam project in Alberta remains Imperial Oil Ltd's. Cold Lake, producing about 140,000-150,000 b/d with cyclic steam injection. Imperial, in a recent outlook, said the field has produced more than 1 billion bbl and the best years for the field are still ahead. In the presentation, Imperial also said a combination of recovery enhancements and an ongoing drilling program will maintain current production at about 150,000 b/d.

CO2-EOR also may increase Alberta EOR production as more CO2 becomes available in response to regulations for limiting greenhouse-gas emissions.

Other countries

Chevron operates the Duri and North Duri steamfloods on Sumatra Island but did not provide an update of current production. The company also operates a steamflood in the Neutral Zone between Saudi Arabia and Kuwait.

Other countries with active EOR projects include China and Venezuela. Because operators in China have not replied with updated EOR information for several years, this year's list deleted the projects in China, although probably most are still in operation, especially the polymer injection in Daqing and the heavy oil steam projects in the Liaohe, Shengli, and Xinjiang areas.

Petroleos de Venezuela did reply to OGJ's survey and added three new projects as well as one planned project. The company, however, did not update the information on its other projects. Two of its new projects are SAGD pilots.

Petroleos Mexicanos continues to inject nitrogen in the offshore Cantarell and Ku-Maloob-Zappfield fields as well as in the onshore Jujo Tecominoacan field.

Bankers Petroleum Ltd. in a recent presentation said that in 2010 it will start a steam injection pilot in Albania's Patos Marinza oil field with oil production starting 2011.

In Ecuador, Ivanhoe Energy Inc. recently completed its first well in heavy oil Pugarayacu field and started a cyclic steam pilot. The field, discovered more than 30 years ago, contains an estimated 4.5-7 billion bbl of oil in place (OGJ, Oct. 27, 2008, p. 41).

Petroleum Development Oman besides its Harweel sour-gas injection project has operated since 2007 a steam injection pilot in Amal West (OGJ, Nov. 5, 2007, p. 56). In a Feb. 15, 2010, media briefing, PDO said its board had approved full-scale development of steam injection in Amal West and East fields.

The company will develop the fields with a steam drive in Amal West and cyclic steam injection in Amal East. Its development plan calls for drilling 300 new wells during a 14-year period with facilities completed by yearend 2012.

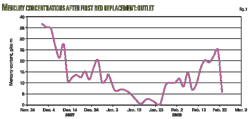

PDO in 2010 also will commission the Marmul polymer injection project (Fig. 1) and is continuing work on the Qarn Alam steam-injection project. The company expects Qarn Alam to be operation in 2011 and produce 40,000 bo/d from a carbonate reservoir.

Also in Oman, Occidental Petroleum Corp. continues with the expansion of the Mukhaizna steamflood.

Abu Dhabi Co. for Onshore Operations started a CO2-EOR in its Northeast Bab's Rumaitha field. In a presentation, ADCO said that the project is the first CO2-EOR pilot in the Middle East. The company also has plans for more CO2-EOR pilots in several major reservoirs.

SBI Energy in its April 2010 EOR Worldwide report notes that Saudi Aramco plans a CO2-EOR demonstration project in Ghawar, with the project starting in 2013.

In Colombia, Pacific Rubiales Energy Corp. plans to initiate a pilot of its synchronized thermal additional recovery process (Fig. 2) in the heavy oil Rubailes field. In a recent presentation, PRE said the field contains 4.2 billion bbl of original oil place and that its EOR could increase the recovery from the field by 10-40%. The field under primary production currently produces about 113,000 b/d and PRE expects to produce 170,000 b/d by yearend 2010.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com