South Korean refiners' recovery faces hurdles

Although signs in late 2009 indicated South Korea was fast recovering from the 2008-09 global recession, the South Korean refining industry is still suffering.

Deteriorating refining margins caused refiners to post poor performances for 2009. Oil demand is recovering but still below 1997 levels. Various internal and external factors imply that the difficult situation may be prolonged.

This article examines what South Korean refiners are facing and how they are reacting, especially in the face of changes in the domestic industry climate:

• Stagnant oil demand growth. After peaking at 2.328 million b/d in 1997, oil demand is hovering between 2.2 million b/d and 2.3 million b/d. Sluggish demand growth means that the refiners cannot rely on the domestic market, which in the past guaranteed some level of profitability supported by their market dominance.

Population growth is expected to turn negative in 2019, and government targets for greenhouse gas (GHG) emissions and nonfossil fuels combined imply marginal growth of future oil demand. The South Korean petrochemical industry enters a mature phase, signaling a slow naphtha demand growth to come.

• Stricter biofuel and fuel efficiency regulations. In January 2010, a 2% biodiesel requirement started taking effect. The government is likely to tighten biofuel requirements continuously as a solution to GHG and air pollution problems. Also, the government announced strengthened fuel efficiency standards, which require 48% improvement of fuel efficiency from current levels by 2015.

• Tightening fuel specification. Diesel and gasoline sulfur levels are tightening nationwide and the low-sulfur fuel oil area is extending to most city areas.

• Unfavorable government policies. The government is trying to cut the refiners' domestic margins by encouraging increased competition. While refiners have a strong grip on distribution networks, tariff protection for domestic refineries has been reduced to zero. The record fines on LPG suppliers in 2009 for collusion illustrate changing government attitudes.

In response to these difficulties, South Korean refiners are seeking new growth. Their strategy is evolving from crude distillation unit expansion and competition for expanded domestic market share to a wide variety of areas:

• Upgrading refining facilities. South Korean refiners will complete the current upgrading stage in 2 years. The investment will make South Korea a major source of quality transportation fuels. GS Caltex will emerge as having the most complex refinery in South Korea.

• Upstream investment. While the refiners part-owned by oil giants S-Oil (Saudi Aramco) and Hyundai Oilbank (Abu Dhabi's IPIC), are indifferent to upstream investment, SK Energy and GS Caltex are actively increasing their equities in overseas oil and gas fields. SK Energy is the most active player in upstream investment.

• Alternative energy investment. Besides their core business, South Korean refiners have started investing in alternative-energy technologies. SK Energy is investing in rechargeable batteries for electric and hybrid vehicles. GS Caltex announced it would build a plant for the carbon parts of high-density electric capacitors.

Also, it is noteworthy that Middle East shareholders of refineries have tried to reduce or sell their stakes since 2006, before the refining industry began suffering the aforementioned. The legal conflict relating to the sale of IPIC's shares of Hyundai Oilbank is a hot issue in the South Korea refining industry.

South Korea refiners will need to endure several harsh years. At the same time, opportunities to improve exist in key areas—trading, marketing, and overseas investment—while their world-class competitiveness is maintained through efficient plant operations, economies of scale, and a good geographic location.

A fundamental upturn will be available, however, only with improvement of external conditions: global demand recovery and, most importantly, rationalization of global refining capacity.

Stagnant demand

Among the biggest difficulties South Korean refiners face is sluggish domestic demand for petroleum.

After peaking at 2.328 million b/d in 1997, oil demand including non-refinery feedstock is hovering between 2.2 million b/d and 2.3 million b/d. Considering South Korea's refining capacity of 2.679 million b/d, sluggish demand growth means that refiners cannot rely on the domestic market, which in the past guaranteed some profitability supported by their market dominance.

One reason to expect slow demand growth is an already flat population that will begin to decline towards the end of the decade. South Korea's birth rate is 1.22/woman, the second-lowest in the world after Bosnia and Herzegovina and even lower than 1.26/woman of Japan. According to the government statistics agency, the South Korean population growth rate will turn negative in 2019 (Fig. 1).

Also, the structural shift from energy-intensive heavy industries to high-technology and service industries has depressed oil demand. And there are other developments that may inhibit demand growth.

The First National Energy Framework, announced by the Ministry of Knowledge Economy in August 2008, suggests that South Korea's oil demand will reach 2.290 million b/d in 2020 and decline to 2.178 million b/d in 2030. According to the top energy plan, which lays the foundation of various energy-related plans and regulations, South Korea's primary energy consumption will grow at 1.1%/year, to 300.4 million tonnes of oil equivalent in 2030 from 233.4 million toe in 2006. Oil's share in total energy consumption will decrease to 33.0% from 43.6% over the same period (Table 1).

Although these figures are more target than forecast, their implications are clear: Government policies will not support a big jump in oil demand.

Also, the government set up greenhouse-gas emission targets in November 2009. President Lee Myung-Bak announced that South Korea would reduce its GHG emissions by 30% from "business as usual" scenario, or by 4% from 2005 levels. The government will allocate emission targets to each economic sector starting in 2013; many industries will need to substitute oil consumption with natural gas or other energy sources to meet the goals.

Note that there was much controversy over the emission targets. Industries expressed concerns about the preliminary targets, arguing that even the lowest option of a 21% reduction (an 8% increase from 2005 level) would be difficult. The government, however, chose the toughest option to show its will to lead the environmental movement in East Asia.

South Korea expects this decision to help develop the environmental industry as a next economic growth driver. GHG reduction may be a serious threat to oil demand because, after coal, oil is the second largest source of GHG emission per unit of consumption. GHG reduction targets will help nuclear power and natural gas to cut into oil's share in total energy consumption.

Besides energy use, demand for petrochemical feedstock seems to have reached a plateau. Since the 1970s, South Korea's petrochemical industry has witnessed an explosive production growth accompanied by an increase in naphtha consumption. Naphtha demand 1990-98 had grown by 20.5%/year on the back of government support and growth of related industries.

That rate slowed to 3.7%/year 1998-2009, since the South Korea petrochemical industry has been entering a rationalization phase mainly due to the emerging of cost-competitive Middle East players and China's continuous investments in its petrochemical industry. Now, South Korean petrochemical companies are seeking overseas growth rather than domestic.

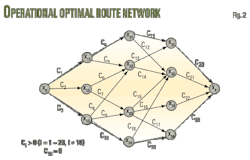

LG Chem and Hanwha Chemical are running PVC plants in China. Hanwha Chemical also participates in a joint-venture with Sipchem for an ethylene-derivative plant in Saudi Arabia. And, Honam Petrochemicalis investing in a joint venture for an ethylene cracker in Qatar, which is scheduled for 2013. Facts Global Energy expects South Korean naphtha demand 2009-20 to grow marginally at 1.6%/year (Fig. 2). Currently, all the South Korean ethylene crackers are naphtha based.

Transportation fuels

Biofuel requirements are another threat to South Korean refiners. In January 2009, South Korea required a 1.5% blending of biodiesel into auto diesel, and in January 2010, a 2% biodiesel requirement took effect. South Korea has no specific requirement for bioethanol yet.

The government is likely to tighten biofuel requirements continuously as a solution to GHG and air pollution problems. Also, these requirements are to contribute to South Korea's energy security by diversifying energy sources and easing high dependency on Middle East crude oil.

Opportunities are limited for refiners to profit from biofuels, as the government allows only small and medium companies to produce them. This is another example of unfriendly government attitudes to refining conglomerates. Note that FGE's demand forecast includes biodiesel consumption.

Also, new regulations on fuel efficiency will come into effect. In July 2009, the government unveiled strengthened fuel-efficiency standards. According to them, all car manufacturers must raise their average fuel efficiency to 17 km/l. (≈40 mpg) by 2015. Alternatively, they can choose 140 g/km of GHG emission. It is far tighter than previous levels of 14.3 km/l. for under 1,600-cc cars and 11.0 km/l. for 1,600-cc cars and larger.

In contrast to the previous standards, which were only guidelines, manufacturers that violate this standard will be fined, the amount as yet undetermined. Last year, the average mileage of South Korean car manufacturers was 11.47 km/l., which means the average fuel efficiency should be raised by 5.5 km/l., or 48%.

All in all, FGE expects South Korea's petroleum demand to grow at 0.8%/year 2009-20, compared with primary energy consumption of 2.6%/year. Over the same period, nuclear power will remain the outperformer, staging a 5.1%/year growth rate and coal will grow at 3.1%/year.

Renewable energy will grow at 7.0%/year, but its share will remain marginal. FGE expects renewable energy to account for only 4.0% of primary energy consumption in 2020 (Fig. 3).

As far as fuel oil is concerned, we expect consumption 2009-20 to decrease by 34% while other product demand will grow even at marginal rates. Fuel oil is being substituted for by coal and natural gas in power generation and industrial sectors. Gasoil consumption in the industrial sector will decline as well, while its demand in transportation will be firm.

FGE expects demand for jet fuel to recover from the recent global downturn, H1N1 virus scare, and weak South Korean won to grow at 2.0%/year to 2020. Gasoline and LPG demand will both grow by 1.3%/year supported by steady transportation demand. Naphtha consumption will grow by 1.6%/year (Table 2).

Tightening fuel standards

South Korea continues to tighten its fuel standards.

In January 2009, 10-ppm sulfur levels for diesel and gasoline came into effect, and the benzene allowance has been reduced to 0.7% from 1.0%.

In the same month, fuel-oil regulations tightened as well. Three cities—Dongducheon, Yangju, and Paju—were added to the 0.5%-sulfur area, and the Cheju Province and 21 cities such as Anyang and Pohang were added to the 0.3%-sulfur area.

The government plans to apply 0.5% or 0.3% sulfur fuel-oil restrictions to most cities by 2012. Currently, all metropolitan cities—Seoul, Pusan, Daegu, Incheon, Ulsan, Gwangju, and Daejun—are bound under 0.3% sulfur fuel oil.

Pressure for competition

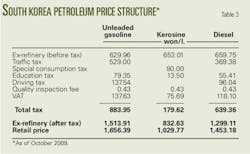

The government is increasing pressure on refiners to curb high fuel prices. Gasoline and diesel prices in November 2009 were 1,655.28 won/l. (≈$1.43/l.; $3.77/gal) and 1,451.89 won/l., respectively, compared with 5-year average of 1501.60 won/l. and 1,220.60 won/l.

A major reason for high fuel prices is the high taxes. Tax accounts for 53% of gasoline retail prices and 44% of diesel retail prices. However, the government's financial burden—fiscal deficit on an increase and needs for economic stimulus—and heavy traffic in metropolitan areas make it difficult to lower the petroleum tax. Consequently, the government is trying to lower prices by cutting refiners' domestic margins by encouraging higher competition (Table 3).

Figs. 4 and 5 compare domestic ex-refinery prices vs. Singapore prices. The figures show the gap between domestic prices and international prices has narrowed since 2008, when the government started increasing pressure on the refiners. Note that there is a difference in product specifications between South Korea and Singapore. For example, South Korea has a lower research-ocatne standard of 91 for unleaded gasoline and a tighter diesel sulfur standard of 10 ppm.

Market dominance of the four refiners comes from strong retail networks. As of September 2009, South Korea had 13,100 retail stations. SK Energy is the largest with 4,709 outlets. GS Caltex and Hyundai Oilbank each has 3,531 and 2,362 outlets, respectively. S-Oil has a small number of retail stations, 1,819, compared with its refining capacity. Consequently, it exports a higher share of products than other refiners.

The number of "no pole sign" retail stations, which are not bound to a certain refiner, is 348 and oil product importers have 10 retail stations. These two kinds of gas stations account for only 2.8% of the total, which limits the opportunities for importers to expand market share. Imported oil product's market share in total transportation fuels was only 0.5% in 2008 (Table 4).

Currently, South Korea has the same import tariff of 3% for both crude oil and oil products, with the exception of 2% for LPG imports. The government had maintained a 4% tariff gap between crude and product but in 2007, with oil prices skyrocketing, reduced the tariff gap to 2% in order to curb domestic oil prices through higher competition with imported oil products.

In 2008, the government imposed a 1% import tariff on both crude oil and oil products and, in 2009, raised both tariffs to 3% as oil prices stabilized. This tariff status means that there is no protection for domestic refiners, but it is still hard for oil importers to extend market share drastically due to various nontariff barriers such as requirements for storage tanks (45 days of average imports with a minimum of 47,000 bbl), a certain level of inventory (30 days of average imports), and refiners' tight grip on distribution networks.

As seen in the tariff policy, the government has been making efforts to lower domestic oil prices by reducing local refiners' influence on the market. The four refiners have more than 98% of the retail market share, and the government suspects that oligopoly is one of the major reasons for high fuel prices.

Consequently, the Fair Trade Commission last year started nationwide probes on oil prices and the Ministry of Knowledge Economy announced that it was considering loosening fuel standards to promote more fuel imports. In May 2008, the government lowered minimum inventory requirements for oil product importers to 30 days of average imports from 40 days. Also, from 2009, new retail stations are allowed in large shopping marts, which is part of the effort to encourage increased competition among refiners. Previously, gas stations in crowded areas were prohibited for safety reasons.

As evidence of the pressure, in December 2009, the Fair Trade Commission imposed a fine of 668.9 billion won ($582 million) on LPG suppliers. The two LPG importers and four refiners—SK Gas, E1, SK Energy, GS Caltex, S-Oil, and Hyundai Oilbank—were accused of having raised domestic LPG prices from January 2003 to December 2008.

The combined fines for the six companies were the heaviest imposed by the commission. SK Energy was waived the entire fine (160 billion won; $139 million) for openly admitting collusion first. It received a remission of 50% of the fine to 99 billion won ($86 million).

Upgrading investment

In recent years, South Korean refiners made substantial investments in upgrading to produce light, clean products (Table 5). The aim is to increase profits by improving the margins without crude distillation unit expansion given limited market growth.

While the logic is sound, the problem is that they started a bit late. As FGE pointed out in a 2007 advisory, "they all desire to do the same thing at the same time."

The upgrading investment is expected to make South Korea a major source of quality transportation fuels. The conversion ratio (FCC, HDC, coker, and VBU divided by CDU capacity) will increase to 24% in 2012 from 14% in 2006, and distillate treating capacity will increase to 28% from 23% of CDU capacity over the same period.

Consequently, the product mix will change substantially. Gasoline yield will rise to 14% from 9%, and diesel yield will increase to 32% from 26%. Fuel oil's share in total production is expected to decrease to 8% from 22% (Fig. 6).

In June 2008, SK Energy started its No. 3 upgrading unit, which consists of a 60,000-b/d residue fluid catalytic cracker and an 80,000-b/d residue hydrodesulfurization unit. To feed the upgrading unit stably, SK signed a contract for additional crudes from Saudi Arabia. With the completion of upgrading, SK Energy now has 127,000-b/d FCCUs, a 34,000-b/d hydrocracker, a 104,000-b/d catalytic reformer, and a 6,000-b/d of alkylation unit.

FGE estimates SK is able to produce an additional 29,000 b/d of gasoline, 13,000 b/d of LPG, and 7,000 b/d of diesel. Also, with the new desulfurization unit, SK can produce more low-sulfur fuel oils, required for power generation in metropolitan areas. SK is still in a net import position for LSFO.

In 2008, SK completed the No. 3 lube base oil plant in Dumai, Indonesia, in partnership with Pertamina. The plant produces 75,000 b/d of Group III lube base oil, raw material of high quality lube oil with high viscosity index level. SK has more than 50% of the global market share in the Group III lube base oil market.

On the other hand, the upgrading project for SK's Incheon refinery has been delayed to 2016 from its initial target of 2011. SK planned to invest 1.5 trillion won ($1.3 billion) in an upgrading project consisting of a 70,000-b/d vacuum distillation unit, a 40,000-b/d FCC, and a 40,000-b/d visbreaker.

SK's Incheon refinery with 256,000-b/d crude capacity has virtually no upgrading units except for a 29,000-b/d catalytic reformer, and it has been suffering from negative hydroskimming margins for years. Its utilization rates are hovering around 45%, dragging the whole company's rates below 80%. SK Incheon is importing around 20,000 b/d of condensate to feed its catalytic reformer.

GS Caltex has adjusted its upgrading project schedule in face of worsening cracking margins. Originally, it planned to complete a new 53,000-b/d FCC and a 55,000-b/d hydrocracker in 2011, but the hydrocracker got pushed forward to 2010 and the FCC was delayed to 2012. In 2007, it completed its first 55,000-b/d hydrocracker as well as a 60,000-b/d residue desulfurization unit. And, in December 2008, a 70,000-b/d diesel desulfurization unit was completed.

In 2009, GS's lube base oil capacity was increased by 5,000 b/d to 18,000 b/d. GS Caltex is producing Group II lube base oil. The refiner will have the most upgraded refinery in South Korea in 2 years. After GS Group was split from LG Group in 2005, the petroleum business has become the group's core business, drawing major investments.

With the completion of all its upgrading projects through 2012, GS Caltex will produce virtually no fuel oil. GS Caltex's fuel-oil production was 104,000 b/d in 2008, and the upcoming FCC and hydrocracking capacity is 108,000 b/d. To maintain its share in the fuel oil market, it would need to import heavier crudes.

In an effort to secure feedstock for upgrading units, GS Caltex has expanded its CDU capacity by 100,000 b/d for the last 2 years. The completion of the new FCC and hydrocracker will increase GS Caltex's gasoline production by 31,000 b/d, middle distillate by 37,000 b/d, and LPG by 18,000 b/d. At the same time, most of the fuel oil production will disappear.

Hyundai Oilbank will complete its new 52,000-b/d FCC and 66,000-b/d residue desulfurization unit by third-quarter 2011. With the upgrading facilities, Hyundai will be able to raise its crude runs. In 2009, slim diesel cracking margins depressed its utilization rates to around 80%. The upgrading units will increase its gasoline production to 52,000 b/d from 26,000 b/d as well as LPG and diesel.

Different from other refineries, S-Oil has been relatively free from upgrading needs because it already finished FCC and hydrocracker projects in the 1990s. Based on its healthy cash flow, it has been providing high dividends to shareholders. Currently, it is the most complex refinery in South Korea.

Instead, S-Oil started construction of a new BTX plant worth 1.4 trillion won ($1.2 billion). The plant, scheduled for June 2011, will produce 900,000 tpy of paraxylene and 280,000 tpy of benzene. To secure feedstock for the BTX plant, a 50,000-b/d condensate splitter is under construction.

Upstream investment

Another response to changes in the refining industry is increasing exploration and production investment. While refiners part-owned by oil giants S-Oil (Saudi Aramco) and Hyundai Oilbank (Abu Dhabi's IPIC) are indifferent to upstream investment, SK Energy and GS Caltex are actively increasing their equities in overseas oil and gas fields.

The government is also supporting E&P business through tax benefits, government E&P loans, and the overseas activities of the Korea National Oil Co. investment. Most of South Korea's equity crudes are not being shipped to South Korea, but equity production contributes to lowering exposure to fluctuating crude prices. KNOC accounts for more than 50% of total South Korean equity production.

SK Energy is the most active player in upstream investment. As of third-quarter 2009, SK is producing 40,500 b/d of equity crudes and natural gas from overseas fields. As of the end of 2008, its oil and gas reserves reached 520 million bbl. Its E&P investment amounted to 451 billion won ($390 million) in 2008, 491 billion won ($430 million) in 2007, and 294 billion won ($250 billion) in 2006.

SK Energy has a long history of overseas E&P investment dating from 1984, when it launched its first E&P project, the Marib oil field in Yemen. Recently, SK's E&P has focused on Latin America. Around three quarters of its reserves are in Latin America, specifically Peru and Brazil.

The Camisea block, or Block 88, is producing 93,000 b/d of natural gas and condensate and SK has a 17.6% stake. SK Energy is also participating in the Peru LNG project, which will liquefy natural gas from Block 88 and Block 56 and export primarily to Mexico. SK has a 17.6% stake in Block 56, which moved to production in 2008.

In Brazil, SK is producing 7,300 b/d of equity crudes from Block BMC-8 with a 40% share. Block BMC-32 is expected to start production soon. SK is also taking part in three exploration projects in Colombia. In Asia, SK is participating in five E&P projects in Vietnam and Indonesia. SK has a 9% stake in Block 15-1 of Vietnam, which is producing 128,000 b/d of crude. In the Middle East, SK has invested in eight E&P fields and three LNG projects in Oman, Qatar, and Yemen.

GS Group, which split from LG Group in 2004, is conducting E&P business through two companies, GS Holdings and GS Caltex. GS Holdings invests in projects led by South Korean consortia including KNOC, and GS Caltex invests in projects led by international consortia including Chevron, Mitsui, and BP.

GS Caltex is a 50:50 joint venture between GS Holdings and Chevron. GS Caltex has invested in Block A of Cambodia, West Kamchatka, Block L10/43 and L11/43 of Thailand, and the Inam field of Azerbaijan. GS Holdings has invested in Block NEM I, NEM II, WOKAM of Indonesia, Block 16 and Block 39 of Yemen, South Karphovsky of Kazakhstan, and Bazian field of Iraq. GS Group started overseas E&P investment in 2003, buying 15% shares of Cambodia Block A from Chevron.

Alternative energy investment

Besides their core business, South Korean refiners started investing in alternative energy technologies in an effort to find the next generation of growth drivers. SK Energy is investing in rechargeable batteries for electric and hybrid vehicles. In October 2009, SK Energy signed contracts for rechargeable battery supply with Mitsubishi Fuso, a subsidiary of Daimler Group, and CT&T, a South Korean electric vehicle manufacturer.

SK is also considering building charging points for electric vehicles at its 4,700 gas stations. Currently, SK is producing lithium ion battery separators, a core part of small-sized batteries for mobile phone and laptop computers, with a capacity of 1.3 million sq m/year.

In May 2009, GS Caltex announced it would build a plant for carbon parts of high-density electric capacitors, which are used for hybrid electric vehicles, in partnership with Nippon Oil Corp. GS Fuel Cell, a subsidiary of GS Group, is producing a fuel-cell system powered by hydrogen.

Stock sell-down

It is noteworthy that Middle East shareholders of South Korean refineries have tried to divest since 2006, before the refining industry started suffering the aforementioned difficulties.

In 2007, Hanjin Group, a logistics conglomerate of South Korea, bought S-Oil's treasury stocks, accounting for 27% of total issued shares. With the transaction, Saudi Aramco's stake in the tradable shares decreased to 34% from 47%.

IPIC of the UAE also tried to sell its share of Hyundai Oilbank in 2007. IPIC issued a tender for its 70% stake in Hyundai Oilbank acquired in 1999 and 2003. Hyundai Heavy Industries, however, the former owner of Oilbank, filed a petition with the International Court of Arbitration under the International Chamber of Commerce in early 2008, arguing that it had a preferential right to purchase the stocks under a shareholder agreement.

Despite the court's decision in favor of HHI, IPIC is refusing to sell its shares, saying that the international court's decision is incorrect and not applicable to South Korea. In December 2009, HHI filed suit against IPIC in the Korean law court.

The author

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com