OGJ Newsletter

Salazar cancels oil shale lease solicitation

The US Department of the Interior will offer another round of oil shale leases in Colorado and Utah and withdraw the former Bush administration’s proposal for expanded offerings, Interior Secretary Ken Salazar said on Feb. 25.

“We need to push forward aggressively with research, development, and demonstration [RD&D] of oil shale technologies to see if we can find a safe and economically viable way to unlock these resources on a commercial scale. The [RD&D] leases we will offer can help answer critical questions about oil shale, including about the viability of emerging technologies on a commercial scale, how water and power would be required, and what impact commercial development would have on land, water, wildlife, and communities,” he said.

Salazar said he was withdrawing the previous oil shale RD&D lease solicitation because it contained several flaws, including locking in low royalty rates that would shortchange taxpayers.

“The previous administration offered their RD&D oil shale leases just days before leaving office, made the parcels four times the size of the current six RD&D leases, and then locked in low royalty rates and a premature regulatory framework for those leases. If oil shale technology proves to be viable on a commercial scale, taxpayers should get a fair rate of return from their resource,” he said.

Offering leases for 640 acres instead of 160 acres was likelier to provide sufficient reserves to support a commercial operation, BLM said on Jan. 14 when it announced the proposal that Salazar withdrew. The new lease would go to applicants not using technologies used in the first round of oil shale leases, it said at the time.

Salazar said DOI has submitted a notice, which will appear in the Feb. 27 Federal Register, asking the oil and gas industry, local communities, states, and other stakeholders for their advice on what the terms and conditions of the second round of oil shale RD&D leases should be. Comments will be accepted for 90 days.

“Following that, the department will move ahead with a solicitation for RD&D leases, based on sound policy and public input. This will help us restore order to a process that, under the previous administration was turned upside down. We look forward to hearing from the public, industry, and local communities as we move toward offering a second round of [RD&D] leases,” the secretary said.

NEB: LNG demand grows in world market

The LNG industry will capture a growing segment of the global market as demand for natural gas increases, said Canada’s National Energy Board (NEB).

The current global recession should not bear too heavily on the growing demand for natural gas in the long run. Countries are scrambling to secure new sources of gas, “and LNG is definitely in the running,” NEB reported in a recent energy market assessment.

“LNG provides an option to diversify and enhance the reliability of natural gas supply, but ultimately it’s the market conditions, stakeholder involvement, and contractual arrangements that will set the extent of LNG imports,” said Gaetan Caron, NEB chair and chief executive. “In North America alone, the supply of LNG is projected to exceed 5% (5 bcfd) of the total natural gas requirement by 2020.”

LNG was once considered the most likely source to offset the continued decline in production of conventional gas, but the expected increase in LNG imports has not yet materialized, said NEB. In North America, shale gas and other unconventional gas resources have filled part of the gap.

The only Canadian facility equipped to import LNG is the Canaport regasification terminal in St. John, NB. It is expected to become operational this year and will serve markets in Atlantic Canada and New England, where LNG has historically provided up to 25% (184 bcf) of the annual gas requirement.

Indonesian watchdog urges LNG contracts review

Indonesia Corruption Watch (ICW) has urged Indonesia to review contracts on Tangguh as well as Senoro LNG sales and expose the price formulas transparently, according to a press report.

Bisnis Indonesia said a review by ICW shows that the state received 440.44 trillion rupiahs ($37.4 billion) from LNG sales in 2000-08, while ICW calculates the amount should have reached 515.04 trillion rupiahs, a 17% difference.

The state has incurred the losses due to the lack of transparency and accountability in the management of the extractive industries, especially the oil and gas industry, according to Firdaus Ilyas, coordinator of ICW’s data and analysis division.

“The government has never been transparent in explaining their formulas to calculate prices in the closed sales contracts,” Firdaus told reporters in Jakarta.

“The prices have also been below the market prices. Contracts on LNG sales from Tangguh and Senoro really incur losses to the state. This should be reported to the public,” Firdaus said.

He said the profit split is 65% for the state and 35% for the partner contractors, some 5% lower for the state than “the usual” 70%.

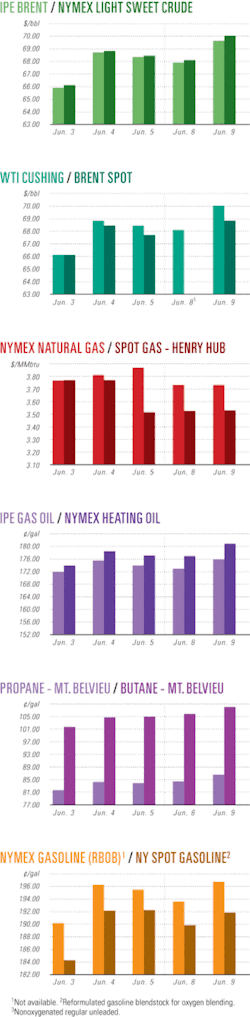

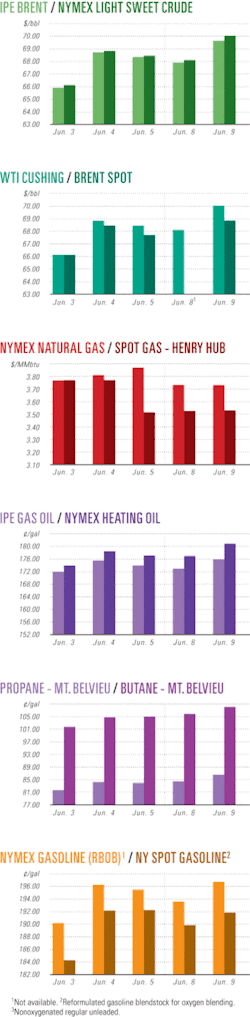

Industry Scoreboardnull

null

null

Exploration & Development Quick TakesWoodside has gas find in Greater Pluto area

Woodside Petroleum Ltd. has made a natural gas discovery with the first well of its 2009 gas exploration drilling campaign in the Greater Pluto region off Western Australia.

Pressure testing of the Martell-1 wildcat on permit WA-404-P in the Carnarvon basin has confirmed a gross gas column of about 110 m thickness and the presence of a gas-water contact.

Woodside requires the extra gas to secure its proposed second LNG train at the Pluto project and roll over the construction workforce currently constructing the project’s first train on the Burrup Peninsula near Karratha.

Martell-1 was drilled with the Atwood Eagle semisubmersible to 3,330 m TD. The find is 100 km northwest of Pluto field. It will be followed up with further drilling on this structural trend later in 2009.

Woodside is operator of WA-404 and has a 50% interest in it. Hess Exploration holds the remaining 50%.

Chevron says Wheatstone can support LNG

Chevron Australia’s wholly owned Wheatstone LNG project off Western Australia has moved a step closer to commercialization following the company’s announcement that the Wheatstone and nearby Iago fields hold sufficient gas resources to support a two-train export LNG development onshore and a domestic gas component.

This assessment comes after a successful seven-well exploration and appraisal program. Chevron declined to put a figure on the reserve estimates.

Wheatstone field is on offshore permit WA-253-P and retention lease WA-17-R and lies about 200 km north of the Pilbara town of Onslow, Western Australian. The field was found in 2004.

Iago field spans two retention permits WA-17-R, owned 100% by Chevron, and WA-16-R, in which Shell Development Australia has a one-third share. This field was discovered in 2000.

Late in 2008, Chevron announced plans to locate the Wheatstone LNG plant at Ashburton North near Onslow. The company expects to begin front-end engineering and design for the project during the second half of this year.

In the meantime, Chevron says that, in support of the Wheatstone and Gorgon projects, it will use two drilling rigs to drill multiple exploration wells in its operated acreage in 2009. One of the rigs is the large Ensco 7500 ultradeepwater semisubmersible, which has been contracted until the end of August 2010 at a day rate of $550,000. The contract includes options to extend by 1-2 years.

Husky proves Liwan as giant field off China

A delineation well has confirmed the giant nature of Husky Oil China Ltd.’s 2006 deepwater Liwan 3-1-1 gas discovery in the South China Sea.

Husky Oil China, which has secured the West Hercules semisubmersible for 3 years with extension options, is preparing front end engineering and design work for the Liwan development project for tender after it obtains results from the next appraisal well on Block 29/26. Then the rig will drill other exploration wells.

The company previously said it could recover 4-6 tcf of gas at Liwan, which it said opened a new hydrocarbon province in the southwestern Pearl River Mouth basin. Husky Oil China didn’t indicate when Liwan production might begin.

The first appraisal well, drilled and tested in 1,345 m of water 350 km southeast of Hong Kong, was drilled to 3,887 m true vertical depth below sea level.

The Liwan 3-1-2 well, which cut 36 m of net gas pay in the main reservoir zone, flowed at an equipment-restricted rate of 53 MMcfd, indicating that deliverability could exceed 150 MMcfd.

The predrill 3D seismic interpretation indicated a direct hydrocarbon response at the Liwan 3-1-2 location, which the company’s analysis indicated was present over a majority of the 55 sq km closure.

Block 29/26 covers 3,965 sq km and is one of six held by Husky Oil China in the South China Sea. China National Offshore Oil Corp. has the right to participate in the Liwan development with up to a 51% working interest. Husky Oil China also holds one exploration block in the East China Sea.

Liwan is 330 km east of Hainan Island and 195 km east of Husky’s Wenchang oil development (see map, OGJ, Dec. 17, 2001, p. 62).

Firms press Utica shale gas work in Quebec

Operators reported progress in unlocking gas from fractured Ordovician Utica shale in the St. Lawrence Lowlands area of Quebec.

Forest Oil Corp., Denver, completed three wells at rates of 100-800 Mcfd each in spite of being unable to fully recover frac fluids because the area lacks a coiled tubing unit. The company tested each well, on a farmout from Junex Inc., Quebec City, in a different section of the Utica shale to gather data for future completions.

“Although sustained rates were not as high as anticipated, the tests have allowed Forest to identify the section of the shale it intends to target in future test wells,” Forest Oil said.

Forest Oil, which plans to continue tests after winter, said it “proved the ability to successfully drill the wells horizontally and pump multistage slickwater frac jobs without major operational issues.”

Farmor Junex plans to drill two wells to Utica shale on its Nicolet land block in 2009 and frac the St-Augustin-de-Desmaures well drilled near Quebec City in 2008.

Junex also participated in the Champlain 1H horizontal well on its Becancour-Champlain acreage in 2008 but didn’t reveal the results. The well has a 900-m lateral in the Utica shale.

Drilling & Production Quick TakesIraq allows higher stakes in drilling projects

In an effort to attract investment, Iraq has reversed earlier plans and will let international oil companies hold as much as 75% stakes in oil drilling projects.

“There is no option for us but to do that in order to attract [IOCs] to start developing these fields,” said an official of the Iraqi oil ministry, marking a change in plans unveiled last October.

At the time, government plans for the country’s first oil licensing round since the end of the US-led war in 2003 would have allowed IOCs’ minority stakes of up to 49% in any joint venture with the government.

However, even under the new dispensation, IOCs still will not be allowed to book oil reserves—a sign the government intends to reserve close control over the nation’s oil and gas.

The change of policy came after a 3-day meeting last week in Istanbul between Iraq oil ministry officials and executives of 32 IOCs, among them Chevron Corp., Royal Dutch Shell PLC, and BP PLC.

The meeting came amid Iraqi government hopes of having several agreements with IOCs in place by June for the development of six oil fields and two gas fields, with work to start by yearend.

The policy reversal also coincided with an announcement by Norway’s DNO that it is preparing for increased production as tie-in operations near completion on the link between Tawke oil field, in Iraq’s Kurdistan region, and the country’s northern pipeline system.

“As a result of the good progress made on the Tawke development during 2008, we are now preparing for increased production at low cost from a substantial reserve base, without further investments,” said DNO managing director Helge Eide.

The Kurdistan Regional Government (KRG), following talks with the Iraqi oil ministry last year, informed DNO that oil exports from Tawke oil field could begin during the first quarter.

That decision also represented a change of policy by Baghdad, which previously had said contracts awarded by KRG without federal government approval were illegal.

DNO holds a 55% stake in Tawke field in a production-sharing agreement with KRG.

PTTEP unit lets contract for Montara project

Thai state company PTTEP Australasia has awarded a $116 million (Aus.) contract to Perth-based engineering and construction firm Clough Australia for the installation of the Montara oil facilities in the Timor Sea.

Clough will transport and install the 750-tonne Montara wellhead platform deck and the 285-tonne mooring buoy with nine associated mooring legs, about 26 km of infield pipelines, and the 100-tonne Swift field subsea manifold.

The Montara project includes development of the main Montara field along with the outlying Swift and Skua fields all lying about 690 km west of Darwin in the Ashmore-Cartier region of the Timor Sea. They lie in 80 m of water in the AC/L7 and AC/L8 production licenses.

Clough will use its upgraded Java Constructor vessel for the assignment. Work is scheduled to begin towards the end of June, and the vessel will be employed for about 4 months, Clough said.

PTTEP expects the Montara to start producing crude and gas in the fourth quarter.

PTTEP bought the previous 100% owner of Montara fields—private company Coogee Resources Ltd.—in late 2008 for $170 million [$248.4 million (Aus.)] (OGJ Online, Dec. 30, 2008).

Processing Quick TakesTotal chemical unit’s explosion trial begins

Trial began Feb. 23 against Total SA’s fertilizer affiliate Grande Paroisse and the manager of the company’s Toulouse plant where a workshop containing waste ammonitrates exploded in 2001. The company and manager are accused of homicide, causing injury to workers, and involuntary destruction.

In what is considered one of the worst industrial catastrophes in France since World War II, the Sept. 21, 2001, explosion killed 31 people, injured 2,400, damaged 30,000 buildings, and destroyed 1,000 jobs. While denying blame, Total and its insurance companies have distributed €2 billion in compensation.

The crux of the proceedings will be to determine the cause of the explosion. Total and Grande Paroisse employees deny responsibility, rejecting the premise that chlorine got mixed in with the ammonitrates, causing the explosion. A number of other possibilities have emerged, including that it may have been an act of terrorism.

The trial is scheduled to last 4 months.

BP reports small fire at Carson refinery

BP PLC experienced a small fire on the conveyer belt in its coke barn at the Carson, Calif., refinery, a company spokesman told OGJ. No injuries were reported.

The fire happened late on Feb. 23, the spokesman said. “There was no damage to the coker and the refinery continues to produce coke. We don’t know what caused the fire, [but] an investigation is under way.”

The refinery has a capacity of 275,000 b/d and produces gasoline, diesel, jet fuel, and petroleum coke. The coker can process 70,000 b/d. The refinery, which is on more than 630 acres of land, supplies about 25% of the Los Angeles gasoline market.

Doosan lets contract for S. Korean coal gas plant

Doosan Heavy Industries & Construction Co. Ltd. has let a contract to Foster Wheeler Italiana SPA for the front-end engineering design and technical services for a coal gasification island in South Korea. The value of the contract was not disclosed.

Foster Wheeler will also help to secure long-lead items, develop a capital cost estimate, and provide technical training on gasification and technical support during the engineering, procurement, and construction phase.

This subcontract underpins a coal-based integrated gasification combined cycle (IGCC) plant, which will be operational from the end of 2014. Foster Wheeler will use Royal Dutch Shell PLC’s technology for the gasification plant to produce electricity from a solid or liquid fuel.

“First, the fuel through gasification is converted to syngas, which is a mixture mainly of hydrogen and carbon monoxide. Second, the syngas is cleaned to remove sulfur compounds and finally is converted to electricity in a combined cycle power block consisting of a gas turbine, a heat recovery steam generator, and a steam turbine” said Foster Wheeler.

Doosan is the EPC contractor for the IGCC plant. The project is partially supported by the Korean government as a part of national research, development, and demonstration projects.

YPF lets contract for delayed coking unit

YPF SA has let a contract to Foster Wheeler Iberia to design a new fractionation unit and gas plant for the delayed coking unit at the 189,000 b/d La Plata refinery in the province of Buenos Aires.

The two-drum delayed coker, which can process 27,925 b/sd, will replace an old one. The fractionation section and gas plant is expected to be completed by the end of the third quarter.

The delayed coker will use Foster Wheeler’s SYDECSM delayed coking technology, which is a thermal conversion process that converts heavy residue feed into high-value transport fuels.

La Plata refinery has a conversion rate of 69%.

Nigeria’s Capital Oil plans Lagos refinery

Nigeria’s Capital Oil & Gas Industries Ltd. plans to build a refinery in Lagos with the state government.

The partners want to form a joint venture and are carrying out an environmental impact assessment for the 100,000-200,000 b/d refinery. They hope to lay the foundation stone by yearend. Construction is expected to take 4 years.

Capital Oil, a private company, focuses on Nigerian downstream activities and the importation, local sourcing, storage, marketing, and distribution of petroleum products.

If the refinery is built, it would be a major initiative for Nigeria as the nation has a total installed state-owned refinery capacity of 445,000 b/d. However, the refineries have not run at full utilization due to sabotage, infrequent power supplies, fire, poor management, and maintenance turnarounds. Consequently, Nigeria imports most of its fuel products.

Nigeria National Petroleum Corp. is carrying out a turnaround and maintenance program to restart the 100,000 b/sd Kaduna refinery in March, a delay of 2 months on its revised deadline due to congestion at the port in Lagos and to clearance of materials for imported equipment. Kaduna’s program was expected to be finished last August.

The Warri refinery was restarted in February 2008 after being idle for 2 years following militant’s sabotage. NNPC’s subsidiaries operating the refineries have struggled to maintain them as they have limited funds to do so. In addition, authorization for work that exceeds this threshold requires separate negotiations with NNPC.

Transportation Quick TakesGolar, LNG Ltd. agree on Gladstone LNG project

Golar LNG Ltd. has signed a heads of agreement with Liquefied Natural Gas Ltd. (LNG Ltd.) that outlines covering joint development of a 1.5 million tonne/year LNG liquefaction plant at Gladstone, Queensland.

The plant will produce LNG from coalbed methane produced from Arrow Energy Ltd.’s gas fields in Central Queensland.

Gladstone LNG Pty. Ltd. will build the plant, and Golar and LNG Ltd. agreed to each take an equity position of 40% in the joint venture. Arrow Energy has an option to take the final 20%. The estimated development cost for the LNG facility is $500 million.

The LNG will be loaded onto LNG carriers for export markets. First production is currently scheduled for late 2012. The project also offers expansion opportunities.

Under terms of the HOA, Golar will purchase the full LNG output from the project on a fob basis. Deliveries will employ at least two of Golar’s existing LNG carriers, the company said.

Golar anticipates that, in addition to financing raised at the project level, it also will be able to raise financing in connection with the offtake arrangements.

Shenzhen LNG terminal could cost $1 billion

A proposed LNG regasification terminal in China’s western Shenzhen province, designed to supply Hong Kong’s CLP Holdings Ltd., may require an investment of as much as $8 billion (HK) ($1 billion), according to local media.

The South China Morning Post, citing unidentified sources, said CLP, which will own 24.5% of the project, would have to invest about $2 billion (HK), while PetroChina Co. would put in $4 billion for its 51% controlling stake and Shenzhen Gas Corp., $2 billion for its 24.5% interest.

The cost is slightly lower than the $10 billion LNG receiving terminal CLP proposed for South Soko Island off Lantau Island that the company scrapped in August 2008 after the Hong Kong and central Chinese governments agreed to source the fuel from Shenzhen.

“The project won’t be cheaper, because gas storage tanks will have to utilize imported materials even though construction and land costs may be lower in Shenzhen,” one source told SCMP.

The preliminary cost estimate of $8 billion marked another step forward for the LNG project after the parties settled their stake sizes and construction began 2 weeks ago on the 2,472-km West-East gas transmission pipeline that will transmit gas to Shenzhen from Central Asia.

Discussions were continuing on which party would be responsible for building a separate 16-km gas pipeline to transmit the fuel to CLP’s gas-fired Black Point power plant in Tuen Mun from the planned LNG processing plant in Dachan Bay west of Shenzhen, sources said.

The processing plant will receive gas from Xinjiang in the northwest through the West-East pipeline and from LNG shipments from overseas oilfields. PetroChina owns the 93 billion yuan ($13 billion) pipeline as well as its interest in the LNG terminal project.

A CLP spokeswoman told SCMP that details of the LNG project such as gas pricing, volume, and timetable were still being discussed. PetroChina declined to comment.

A source estimated that CLP would likely source gas from the planned LNG terminal and from smaller gas fields of mainland offshore oil and gas supplier China National Offshore Oil Corp., whose existing supplies to CLP from Yacheng, Hainan, would run out by 2013.

CLP’s Black Point power station consumes 3.4 bcm/year of gas.

Under an agreement between the Hong Kong and central Chinese governments, Hong Kong has been promised a supply of at least 1 bcm/year by 2013 when the pipeline will come online.