OGJ Newsletter

Eni sets production growth target of 3.5%/year

Eni SPA plans to increase its production by 3.5%/year over the next 3 years despite the uncertainty surrounding the economic downturn and energy markets.

It will invest €48.8 billion in 2009-12, slightly less than in its 2008-11 plan; exploration and production will cost €34 billion.

The company said it would aim for a reserves replacement ratio of 130% during 2009-12 and after that would maintain an average production growth of 3%/year to 2015 by stepping up activities in Africa, OECD countries, and Central Asia-Russia.

“More than 90% of production and investments to 2012 will be concentrated in these areas,” Eni said.

The company is confident it can achieve these figures because of the quality of its portfolio in low-cost production areas with large projects that have economy of scale benefits.

Paolo Scaroni, chief executive of Eni, told investors in London that this year its production is expected to be above 1.8 million boe/d, based on an oil price of $43/bbl. In 2012, this will exceed 2 million boe/d, based on a $55/bbl scenario.

In the next 4 years, more than 500,000 boe/d of new production will start, 85% of which is related to projects that will be profitable even if oil prices are below $45/bbl.

By 2012 the company expects to have international gas sales of 124 billion cu m with an average growth of 7% a year, thanks also to the contribution of Distrigas.

Coal-fired plants produce more carbon than LNG

Coal-fired power plants produce 161% more greenhouse gas emissions through their life cycles than plants fueled by LNG, an independent study found.

The study, by PACE Global Energy Services for the Center on Liquefied Natural Gas, also found that two cleaner coal technologies, integrated gasification combined cycle (IGCC) and advanced ultrasupercritical coal (SCPC), produce 70% more GHG emissions than LNG.

“Replacing just one coal plant with LNG-fueled power generation for one year would equate to removing 557,000 cars off the roads. LNG will clearly play a crucial role in helping meet the substantial increase for clean burning natural gas once climate change legislation becomes a reality,” said CLNG Pres. Bill Cooper.

He said the PACE study provides an “apples to apples” comparison by using a representative average of typical US coal and LNG operations for generating electricity. These included a gas-fired power plant supplied with LNG, a coal-fired plant, and plants using the IGCC and SCPC technologies, which are not yet available in the US.

Rockies refiners settle air pollution charges

Two Rocky Mountain refiners agreed to pay more than $141 million to settle federal air pollution charges, the US Environmental Protection Agency and Department of Justice said.

Frontier Oil Corp. agreed to pay a $1.23 million fine and spend $127 million on pollution control upgrades at its Cheyenne, Wyo., and El Dorado, Kan., refineries. Wyoming Refining Co. agreed in a separate settlement to pay a $150,000 fine and spend $14 million on similar upgrades at its Newcastle, Wyo., plant.

The settlements will reduce harmful air emissions by 7,000 tons annually, EPA and DOJ said. They said the agreements require installation of advanced control technologies, which will reduce yearly emissions of sulfur dioxide by some 3,775 tons, nitrogen oxide by some 2,100 tons, and other pollutants by some 1,200 tons. The three refineries’ combined production capacity is 168,000 b/d.

Each refinery also will upgrade leak detection and repair practices to reduce harmful emissions from pumps and valves, implement programs to minimize the number and severity of flaring events, and implement new strategies to ensure continued compliance with the federal Clean Air Act’s benzene waste requirements, according to EPA and DOJ.

As part of its settlement, Frontier agreed to install dome covers on refinery storage tanks at its two plants to reduce volatile organic compound emissions. The company also agreed to correct deficiencies in the refineries’ risk management program, which were identified in a 2006 EPA inspection, including overdue inspections and tests of storage vessels containing toxic and flammable substances.

EPA said that under CAA, facilities that handle large amounts of chemicals are required to develop a risk management program to assess hazards associated with dangerous chemicals. The program must include an accident prevention program and an emergency response plan to deal with accidental releases, the federal agency said.

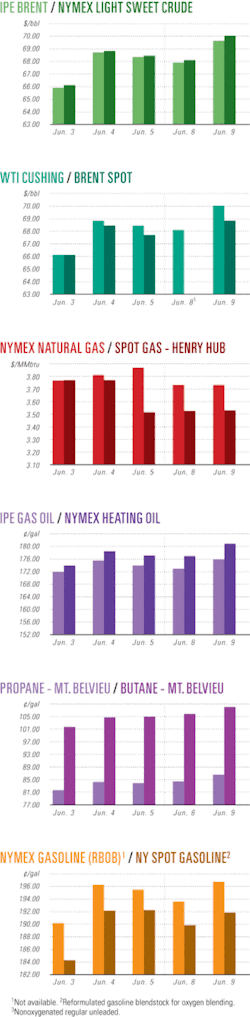

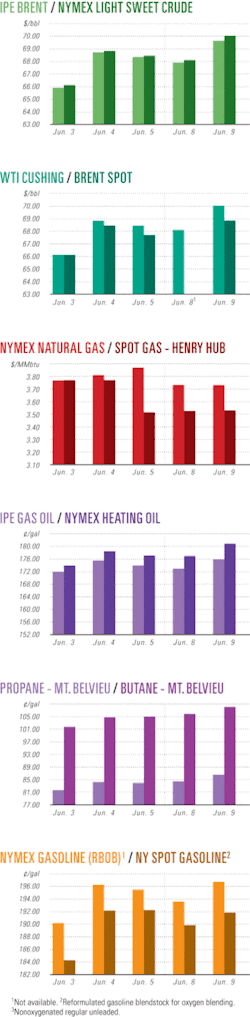

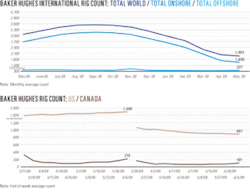

Industry Scoreboardnull

null

null

Exploration & Development Quick TakesTotal appeals Tempa Rossa delay order

Total SA has decided to appeal a decision by an attorney of Italy’s law courts to suspend for a year the development concession on Tempa Rossa oil field in southern Italy, a measure prompted by a preliminary investigation that revealed “corruption” and “faked” bids involving some €10 million.

Total expressed indignation over what it described as a “serious and prejudicial decision” at “a very preliminary stage” of the investigations.

The head of Total Italia, Lionel Lheva, and two other executives of the company were put under house arrest last December. Another Total executive who doesn’t live in Italy, was also considered implicated. A total of 15 people, including a Democratic Party deputy, are involved.

Tempa Rossa oil field was discovered by an Italian company in the late 1980s. The development concession was awarded to Total in 2002. It is scheduled to be on stream in 2011 with production estimated at 50,000 b/d.

Nexen discovers oil in UK North Sea

Nexen Inc. said its Hobby exploration well in the UK North Sea discovered oil on Block 20/1N near the Golden Eagle discovery.

Future appraisal is pending in the Golden Eagle area, which includes discoveries at Golden Eagle, Pink, and now Hobby.

The Pink discovery well encountered 57 ft of net oil pay and was followed up with a sidetrack delineation well that encountered 134 ft of net oil pay.

Pink might be codeveloped with Golden Eagle. Nexen has a 34% operated interest in Golden Eagle and a 46% operated working interest in Pink.

It operates Hobby with 34% interest. Other partners are Maersk Oil North Sea UK Ltd. 36% interest, Petro-Canada 25% interest, and Edinburgh Oil & Gas 5% interest.

Nexen strengthens position in Northeast BC

Nexen Inc., Calgary, has 100% interest in 126,000 acres in Northeast British Columbia in an emerging Devonian shale gas play that could become one of North America’s most significant shale gas plays.

The land position includes 88,000 acres in the Dilly Creek area of the Horn River basin.

Nexen spent $180 million in 2008 to drill, complete, and test wells and build infrastructure. One horizontal well was completed and tied in last winter and is producing at rates in line with expectations and competitor wells. Nexen plans to complete and tie in two wells later this winter. It is building all-season roads.

The company in 2009 plans to enhance its understanding of optimal drilling and fracturing techniques, including by drilling and testing multiple wells from a single pad. Three of the wells are to be drilled and completed by midyear and on production before winter. The other wells will be drilled later subject to favorable economic and financial conditions.

Nexen previously estimated that the Dilly Creek lands contain 3-6 tcf of recoverable contingent resource. Further appraisal activity is required before it can finalize these estimates, establish commerciality, and book reserves.

Equatorial Guinea’s Douala gets another find

Noble Energy Inc., Houston, said its Carmen exploration well near the southeast corner of Block O in the Douala basin off Equatorial Guinea is an oil and gas discovery.

The well, drilled to 11,550 ft in 150 ft of water, cut 26 ft of net oil pay and 13 ft of net gas pay. It was drilled to test a Lower Miocene reservoir and won’t be flow-tested for now, Noble Energy said.

The 10th successful well on the acreage, Carmen is the first oil discovery on Block O, which also contains the Belinda and Felicita gas-condensate discoveries. Carmen confirmed that the oil sourcing extends from Block I, where the company has the Diega and Benita oil discoveries.

Noble Energy plans to recalibrate seismic to identify other similar opportunities while it plans for first production in 2012.

Drilling & Production Quick TakesTNK-BP starts production from Siberian fields

Anglo-Russian oil joint venture TNK-BP Holding reported it has started commercial production at Urna and Ust-Tegus fields in the Uvat area of the Tyumen region in Siberia, feeding crude into the 264-km pipeline that connects the fields with the OAO Transneft pipeline system.

Urna and Ust-Tegus, which lie in the eastern part of Uvat, hold an estimated 300 million tonnes of oil in place, including 100 million tonnes of reserves. Plans call for the production of some 1.5 million tonnes of crude from the fields in 2009.

At the same time, TNK-BP expects to spend some $500 million on the Uvat project, including the drilling of development wells and construction of other necessary field facilities.

TNK-BP said it has invested $925 million in field development and construction at the fields.

In 2008, TNK-BP increased its oil production over 2007’s by 2.6% to 601 million boe, the company said.

Nexus enters into negotiations for FPSO

Nexus Energy Ltd., Melbourne, has entered negotiations with Single Buoy Moorings (SBM) for the supply of a floating production, storage, and offloading vessel for its Crux liquids project in the Browse basin off Western Australia.

The negotiations center on the integrated construction, supply, and operation of an FPSO.

SBM has already been involved in the engineering and design of the gas processing, liquids extraction, and compressions facilities for the project.

Nexus says it also has finalized a settlement with FPSO supplier Viking Oil & Gas International and Viking Shipping following the termination of a memorandum of understanding signed in 2007 for the project. Nexus will pay Viking $12 million by the end of May. A further contingent payment of $5 million is to be made later in 2009 if certain unstated major divestment and liquidity events occur.

Petrobras, Mitsubishi plan $830 million drillship

Brazil’s Petroleo Brasileiro SA (Petrobras) and Mitsubishi Corp. have agreed to form a 50-50 joint venture to construct and operate a drillship having the capacity to drill in water 10,000 ft deep.

The firms said the ship, which is to be completed and delivered in June 2010, will cost $830 million. The two firms said they will cover 10-15% of the cost of the vessel, with the new joint venture to procure the rest of the funds itself.

On delivery, the joint venture will charter out the vessel to an affiliate of Schahin Engenharia SA, a leading drillship operator in Brazil. The Brazilian firm will provide drilling services for the exploration and development of Petrobras’s deepwater oil and gas fields in Brazil and overseas.

The announcement follows reports last December that Petrobras obtained $750 million in financing from a group of Japanese banks, including Sumitomo Mitsui Banking Corp., Mizuho Corporate Bank, and Banco de Tokyo-Mitsubishi UFJ Ltd.

Petrobras said the money would be used to finance its investment program, including expansion of a refinery based in Sao Jose dos Campos, Sao Paulo.

The Brazilian firm, which said the loans will have a maturity of 10 years, did not immediately reveal the financing cost or other details as the contract has a confidentiality clause. However, Petrobras’s Chief Financial Officer Almir Barbassa said the conditions of the loan were “pretty reasonable” and “attractive,” although “not as good as a year ago.”

PDVSA pays due bills for Mariscal Sucre drillship

Neptune Marine & Drilling Ltd., a subsidiary of Singapore-based Jasper Holdings, said Venezuela’s state-owned Petroleos de Venezuela SA (PDVSA) has paid $25.95 million to settle overdue bills in connection with its Mariscal Sucre natural gas project.

The payments cover, among others, all day rate invoices for drilling services provided to PDVSA from Oct. 1 to Dec 18, 2008, Neptune said, adding that it “continues to operate under the drilling contract with PDVSA.”

With the payments from PDVSA, Neptune said, “certain breaches in the loan agreement entered into between another subsidiary, Neptune Marine Invests AS and certain banks have also been cured.”

Last June, PDVSA took delivery of the drillship Neptune Discoverer under a $785 million contract with Neptune for the drilling of 21 wells at the offshore Mariscal Sucre natural gas project.

Since then, the Mariscal Sucre project has seen several key developments, including a 2,500-sq-km, 3D seismic survey conducted over the block in September by Norway’s SCAN Geophysical.

“The first processing steps are very promising and show very good data quality, which will allow PDVSA further to refine its development in this area,” PDVSA said of the survey.

Then, in November, Atlantida Socotherm, a subsidiary of Socotherm, was awarded a contract for the concrete weight coating of the 115-km Dragon-Cigma pipeline that will be installed as part of the Mariscal Sucre LNG project.

The project is one of three major developments being developed by PDVSA, each of which will consist of a separate liquefaction train at the Gran Mariscal de Ayacucho (Cigma) natural gas complex in Guiria.

The first train will source gas from the Plataforma Deltana project, with exports estimated at 4.7 million tonnes/year. PDVSA’s foreign partners include Galp, Chevron, Qatar Petroleum, Mitsubishi, and Mitsui.

The second train will source gas from the Mariscal Sucre project, also exporting an estimated 4.7 million tonnes/year. PDVSA’s foreign partners for this project include Galp, Enarsa, Itochu, Mitsubishi, and Mitsui.

The third train will source an as-yet undetermined amount of gas from Blanquilla-Tortuga fields. PDVSA’s foreign partners include Gazprom, Petronas, Eni, and Energias de Portugal.

According to PDVSA, the total investment in the three LNG projects could reach $20 billion, with first exports expected by 2013.

Processing Quick TakesEni lets refinery contract to GE Oil & Gas

Eni SPA has let a contract to GE Oil & Gas for the largest refinery reactors of their type ever to be manufactured. The reactors will be a critical part of Eni refining and marketing division’s project to boost production at its refinery in Sannazzaro, Italy.

The reactors, which will weigh 2,000 tons each, will be the centerpiece of a new process technology designed to enable Eni to produce more middle distillates from each barrel of feedstock.

The refinery will highlight a proprietary Eni process called Eni slurry technology that enables increased efficiency in unconventional oils, heavy oils, and residues distillation. Unlike other heavy oil cracking processes, the process produces no residues.

The two reactors are scheduled for delivery to the Eni refinery in first quarter 2011, with commercial operation expected in 2012.

Eni mulls over downstream asset divestitures

Italy’s Eni SPA has said its capital spending on refining and marketing will be slashed by 30% to €2.8 billion under its strategic plan because of the weak global economic outlook. It also will reduce its workforce in this area by 6% in Italy.

Therefore, the company is pondering selling some of its downstream assets in Italy, including its 84,000 b/d Livorno refinery on the Tuscan coast in northern Italy.

Angelo Caridi, head of refining and marketing at Eni, said at a briefing in London that falling global demand, increasing energy efficiency, and the growth of biofuels were behind the poor outlook.

The amount of high value middle distillates, such as diesel fuel, will rise to 45% of refining output in 2012 compared with 40% in 2008.

“In refining, Eni plans to increase the complexity and the yield in medium distillates, exploiting proprietary technologies,” it said.

This year, Eni plans to start up three hydrocracking units and in 2012, a new plant at its Sannazzaro refinery, which would account for the majority of investments in this area under the plan.

The company saved more than €1 billion at the end of 2008 through its efficiency program. This figure is expected to be doubled by 2012, both in real terms and versus the 2005 baseline.

Indonesia outlines refinery, upgrade plans

Indonesia’s state-owned PT Pertamina, aiming to reduce fuel imports by boosting domestic supply, plans to construct two new refineries and upgrade an existing facility.

“We still import fuels in a large volume,” said Indonesian President Bambang Susilo Yudhoyono, adding that, as a matter of economic efficiency, Pertamina “will build three refineries within 3-5 years.”

Pertamina Corp. Sec. Toharso said two of the planned refineries would be new: one in Bojonegara, Banten, and another in Tuban, East Java. The third project, meanwhile, will be an expansion of the existing refinery at Balongan in West Java.

The total capacity of the three planned refineries will be 400,000 b/d, Toharso said, adding that Pertamina is looking for partners for oil supplies as well as for financing of the new facilities.

“We’re considering an Iranian company to become our crude oil supplier,” Toharso said. “But the process is progressing slowly and we’re trying to expedite this.”

The decision to construct new refineries comes as Indonesia’s domestic demand has far outstripped Pertamina’s production.

In 2008, Pertamina produced 227.2 million bbl of fuels and imported 142.1 million bbl. In 2007, Pertamina produced 226.1 million bbl of fuels and imported 138.7 million bbl.

However, despite the need for new refining capacity, officials earlier this week said that Pertamina has no plan to import diesel oil and kerosine this year under the firm’s public service obligation (PSO) as production by its own refineries would be sufficient.

On Feb. 11, the director general of oil and gas of the ministry of energy and mineral resources, Evita Legowo, told a meeting of the Energy Commission of the House of Representatives that Pertamina would import only premium gasoline this year.

She said that premium gasoline consumption under the PSO this year had been set at 123.856 million bbl, while the refineries could produce only 68.35 million bbl, leaving Pertamina to import 55.506 million bbl.

Transportation Quick TakesJapan welcomes LNG supplies from Sakhalin-2

Japanese Prime Minister Taro Aso and Russian President Dmitry Medvedev are scheduled to attend a ceremony Feb. 18 on Sakhalin Island to mark the onset of operations at the Sakhalin-2 LNG liquefaction plant at Prigorodnoye.

Under the Sakhalin-2 project, natural gas will be transported from offshore fields to the Prigorodnoye liquefaction plant for the production of 9.6 million tonnes/year (tpy) of LNG, with 60% of it bound for Japan.

Under contracts of as long as 20 years, Russian LNG will account for 7% of Japan’s total LNG imports, allowing the Asian nation to diversify its sources of energy supply.

At their Feb. 18 meeting, the Russian and Japanese leaders also will discuss possible funding for future LNG projects, such as Sakhalin-3, according to Eiichi Sasaki, energy representative for the Japan Bank for International Cooperation (JBIC).

In fact, Sasaki told delegates at the Russian Shelf 2009 conference that JBIC “is prepared to support Sakhalin-3 if Japanese companies are involved.” He added that JBIC is primarily interested in projects in the Far East and Sakhalin that are focused on energy supply to Japan.

The Sakhalin-3 project includes the Veninsky block being developed by Russia’s state-owned OAO Rosneft and China’s Sinopec, and the Kirinsky, East Odoptinsky, and Ayashsky blocks, which have yet to be assigned.

Sakhalin-3 is expected to come on stream in 2017-20, according to Russia’s draft Gas Industry Development Strategy, with peak production reaching as much as 28.6 billion cu m/year of gas.

The onset of supplies of LNG from Sakhalin-2 coincided with reports that a consortium of Japanese utility firms has agreed to a drastic cut in supplies from Indonesia, falling to 2-3 million tpy from 12 million tpy.

Raden Priyono, chairman of Indonesia’s upstream oil and gas regulating body BPMigas, said that under the new agreement, the Japanese consortium will buy 3 million tpy of LNG during 2011-15, and 2 million tpy during 2016-20.

The consortium, comprised of Kansai Electric Power Co., Osaka Gas Co., Chubu Electric Power Co., Kyushu Electric Power Co., Toho Gas Co., and Nippon Steel Corp., will buy a total of 25 million tonnes of gas from Bontang LNG plants in East Kalimantan.

Priyono, who said that Japanese buyers have agreed to waive any penalties for undelivered LNG, added that the new contract price will be “much higher” than the price under previous contracts.

Libya takes delivery of two oil tankers

Libya’s state-owned General National Maritime Transport Co. (GNMTC) has taken delivery of two 115,000-dwt oil tankers, the Al-Qadisiyah and Al-Jala, from Cido Shipping of Japan.

The Al-Qadisiyah, built in 2008 and formerly called the Pacific Fantasy, holds 835,000 bbl of oil, while the Al-Jala, built in 2007 and formerly called the Pacific Light, holds 825,000 bbl of oil.

The two deliveries are part of a six-ship deal GNMTC brokered last December which also included four Aframaxes of around 115,000 dwt each, which the Libyan firm bought from Turkey’s Geden Lines.

The complete six-ship purchase, with a total transport capacity of some 5 million bbl, enabled Libya to expand its oil shipping capacity to 11.8 million bbl, according to state media.

State news agency Jana quoted GNMTC’s development department chief Tarek Youssef as saying the recent purchases bring GNMTC’s total fleet to 18 tankers. Of these, 13 are crude carriers, 3 are oil products carriers, and 2 are LPG carriers.

In making the purchases, Jana said, “The company took advantage of the current global crisis to acquire the tankers at prices 20% lower than in normal circumstances.”

Jana credited Libyan leader Muammar Gadhafi’s son Hannibal Gadhafi, who is the manager of GNMTC, for the business strategy of buying ships during a global economic downturn, which had adversely affected the shipping industry.

Jana quoted the younger Qadhafi as saying the price paid for each ship was $67-68 million, which compared favorably with an earlier asking price of $85-90 million.