Global perspectives required for risk, opportunity analyses

The world has always held risks for upstream oil and gas companies, and it certainly shows no signs of becoming less risky in the near future. In fact, many would argue quite the reverse based on the prevailing dynamic environment of political tensions, price volatility, fiscal instability, resource nationalism, strong competition from cash-rich national companies and sovereign wealth funds, and risk-averse financial institutions.

Without a healthy tolerance for risk and the vision to see the substantial resource opportunities that exist internationally in the oil and gas business, few companies venture far into international exploration and development activities. International oil companies (IOCs) have accepted this fact for many decades, and for the past decade, so have some of the less resource-rich national oil companies (NOCs).

Opportunity and risk, which go hand-in-hand, are two facets of uncertainty. There are good reasons why oil and gas companies more rigorously evaluate and, where possible, quantify the risks to which their operations, physical assets, and financial resources are exposed.

They also are keen to calculate their potential financial exposure to extreme risk events that occur infrequently but could have devastating effects. This recognition and pressure from tightening regulation have together prompted companies to develop enterprise risk management (ERM) systems to integrate such issues rigorously and systematically.

Quantitative analysis

It is difficult to estimate accurately the likelihood of extreme events’ occurring. Normal and lognormal distributions of historical data are only adequate in relatively static environments when estimating the probable occurrence of future extreme events.

In dynamic, rapidly changing environments, such forecasting methods often underestimate levels of uncertainty, as capital markets and many major international oil and gas companies have learned to their project cost detriment.

Complex mathematical models, such as many of the value at risk (VAR) models popularized in financial circles, are now being used widely in the energy industry to justify risk exposure of both traded and physical asset portfolios. They claim to identify and quantify risk exposures, but these models themselves pose a major threat to the quality of decision-making for two main reasons:

First, such approaches lead companies and their decision-makers to believe they can quantify their risks with unrealistic levels of precision, which often leads to overconfidence in their ability to manage risk and to exposures being underestimated.

Secondly, and the main point of this article, is that it encourages decision-makers to focus too much of their attention exclusively on the downside risks at the expense of considering and trying to identify and exploit the opportunities that are associated with many uncertain situations.

The bigger picture

Opportunities, like risks, require careful identification and evaluation and rarely manifest themselves without efforts being made to seek them out and establish innovative approaches to exploit them.

Risk managers with a downside mitigation mentality are rarely equipped or have the vision or time to recognize and manipulate opportunities into projects that are considered achievable. This article does not recommend ignoring risk analysis and replacing it with an unconstrained search for opportunity. Quite the contrary; much valuable insight emerges from quantitative risk analysis techniques (e.g, Monte Carlo simulation, real options valuations, and VAR and its derivative techniques) even if the numerical calculations involved rarely provide an accurate value or unequivocal decision criteria. Such analysis is clearly required, but not necessarily at the earliest stages of project definition or strategy formation.

Placing a project, asset, portfolio, or nation into an energy industry context using qualitative or semiquantitative techniques to estimate its risks and opportunities in an integrated way is often a more useful starting point from which to approach the first hurdles of the decision-making process.

Such an approach facilitates a global mindset and encourages companies to seek out or recognize from a helicopter view just where opportunities might reside. Adopting such an approach is more likely to enable a risk analyst to conduct the more detailed quantitative analysis. It would focus on upside and downside scenarios that encompass the most probable outcomes and the rare, extreme, but realistically possible outcomes at both ends of the spectrum.

A global context

What is important in the first strategic stages of analysis is that risks and opportunities are initially considered together, with an integrated, systematic, and rigorous approach grounded and presented in a global perspective relevant to the industry. There are several ways this can be done.

The following approach grounds the analysis in the context of proved reserves at the national level, statistics that are readily available. The quality of the proved reserves volumes at the national level varies by region, and confidence in such numbers is rightly questioned for unverifiable numbers presented by several resource-rich nations. However they are useful for distinguishing the resource endowments on the order of magnitude scale that is required.

Other useful global statistics that could be used include oil or gas production volumes, export volumes, and consumption statistics, depending upon the strategy being evaluated or pursued. Reserves are used here because many IOC and NOC upstream companies are seeking, as a strategic priority, new international opportunities to increase and diversify their resource bases.

Insightful quick look

Assigning a score to five factors broadly evaluating country risk and to another five factors broadly evaluating country opportunity provides a fast and effective way to systematically evaluate a large number of countries in a superficial but rigorous manner.

The five attributes proposed to evaluate for scoping risk analysis focus mainly on political, business, and fiscal risks:

- Expropriation or political instability.

- Corruption.

- High administrative burden (in cost and time).

- Community-labor disputes.

- Regressive and inflexible fiscal terms.

The five attributes proposed to evaluate for scoping opportunity analysis are focused mainly on technical, operational, and financial risks:

- Access to large reserves.

- Low finding and development costs.

- Ease of operation.

- Access to equity-debt funding.

- Access to infrastructure-markets.

Applying a simple scoring system makes the evaluation process quicker and more transparent. Here is a 1-5 scale applied to both risk and opportunity, but extending in different directions from a zero point (an impossible score implying an attribute with no uncertainty-risk or opportunity):

null

An alternative is to use negative numbers for risk and positive numbers for opportunity. The proposed semiquantitative scheme has the advantage of distancing points of high opportunity from those of high risk when cross-plotted graphically. It helps to have a clear verbal description of each score to reduce ambiguity and improve rigor. Thus a more precise definition of each number could be:

- -very low (minimal).

- -low.

- -moderate.

- -high.

- -very high (extreme).

If a score of 1-5 is assigned to each attribute and the scores of all five attributes of opportunity and risk are added separately to yield two scores, those scores can vary between 5 and 25.

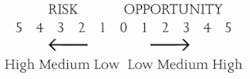

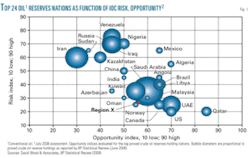

By subtracting 5 from the sum of the five attribute scores and multiplying that sum by 5, the total risk and opportunity scores are simply manipulated into an index scale of 0-100, which is relatively easy to interpret and contrast among nations (Fig.1). Clearly detailed knowledge and understanding of the petroleum industry in the nation being evaluated is required by the analyst to assign a reliable score to each attribute.

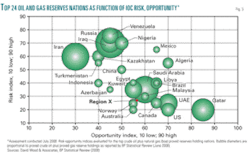

To ground this simplistic analysis in a global context, the risk-opportunity indices for a spectrum of major resource holders can be evaluated and presented graphically with respect to their resource volumes. To illustrate this point Figs.1-3 show such analysis for the top proved reserves-holding countries (yearend 2007 volumes, BP Statistical Review, June 2008) for oil, gas, and gas plus oil (expressed as barrels of oil equivalent using 6,000 cu ft/bbl).

The figures illustrate the same risk-opportunity evaluation—based on my own perceptions—with an IOC perspective in mind in mid-2008. Other analysts might disagree with these based on their own experience or perceptions, or on analyzing from an NOC perspective.

The point of the simple scales proposed is that they can be adjusted and updated easily and regularly in response to events, different opinions, or changing environments, or reassessed from different perspectives (e.g., NOC vs. IOC) in a transparent and rigorous manner.

Depending on whether the analysis is presented in relation to oil, gas, or boe reserves provides different global frameworks. Each framework may be more relevant to certain companies, portfolio strategies, or situations.

After producing the framework, it is relatively easy to highlight the analysis of a region or a country of specific interest in relation to that framework (e.g., Region X highlighted in Figs. 1-3). More usefully, the analysis of the region of interest and the analysis of the global framework nations can be updated as required.

Fig. 2 illustrates the impact of placing the analysis of a region of interest in a natural gas global framework rather than crude oil. Fig. 3 changes the framework again to combined oil and gas proved reserves, but maintains the integrated risk analysis results the same as for Figs. 1 and 2.

These risk-opportunity analysis results can also be expressed in summary tabular form as illustrated in the table or in more detailed form providing the scores assigned to each attribute. As already stated, this approach is simplistic and can only provide a scoping assessment. In many instances, the early stages of the decision-making process can benefit from the insight such analysis can provide rapidly and transparently.

More in-depth analyses

A more in-depth risk and opportunity analysis is likely to be required in order to sanction major investments.

Earlier David Wood OGJ publications and executive reports have explored the many-faceted nature of exploration and production asset and portfolio risk analysis and suggested ways in which this might be effectively conducted. It is not suggested that such a detailed analysis be replaced by the approach outlined here, rather recommended that the two approaches complement each other, with the quick-look approach useful in the context of seeking out opportunities.

It is perhaps also important to recognize that the global framework used to ground the risk-opportunity analyses can in some cases itself hide or obscure some opportunity. Again the reserves framework clearly illustrates this point. It is appropriate to use proved reserves statistics above as they are the volumes in which the industry by definition believes with the highest levels of confidence.

However, from an exploration and future development context, it is often the lower-confidence categories of reserves and yet-to-find resources in a region that may be more relevant to identifying future opportunities. Hence it may make more sense for certain analysis to be grounded in the less accurate potential resource framework rather than proved reserves framework.

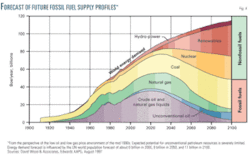

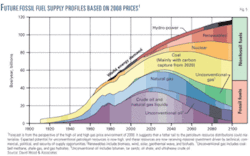

Figs. 4 and 5 further illustrate this point, forecasting remaining fossil fuel resources from two perspectives or snapshots in time.

Fig. 4 is a forecast based on that made by Edwards in the mid-1990s when crude oil prices were less than $20/bbl and North American natural gas prices were less than $2/bbl.

It forecasts a situation in which exhaustion of the finite global fossil fuels is well advanced towards the end of the 21st Century, with production peaking well within the first quarter of this century. It further suggests limited potential for nonconventional hydrocarbons— including coalbed methane, shale gas, deep tight gas, methane hydrates, tar sands, bitumen, and oil shales—and for new enhanced oil recovery technologies that might recover substantial residual resources from conventionally depleted giant reservoirs in which large volumes of petroleum remain in situ.

This illustrates a limited vision that peak oil advocates continue to promote as implying that the oil and gas industry is already in irreversible decline.

The world envisioned in Fig. 4 is one in which some 50% of the world’s energy must come from renewables and nuclear by 2100 because fossil fuel resources would be in an advanced state of depletion.

In contrast, Fig. 5 is a forecast based on a high-priced petroleum environment with a vision of many opportunities for unconventional petroleum resources. Indeed the resource base, high prices, and the political will to back the development of innovative, but high-cost, technologies to exploit the unconventional petroleum resources suggests that fossil fuels may be supplying similar absolute volumes in 2100 as they were in 2000.

Opportunities remain

Clearly petroleum resources are not in unlimited supply, and nuclear, renewables, and new sustainable energies yet to be developed ultimately will be required.

The Fig. 5 vision, however, suggests that much opportunity remains within the petroleum industry for those willing to accept associated risks such as periods of lower prices or emissions penalties-carbon capture costs rendering costly exploitation projects subcommercial.

Lessons from the past 50 years suggest that prices are not likely to remain high indefinitely, and resource distributions are not likely to follow Gaussian distributions (i.e., bell-shaped curves) to their extremes.

For interested analysts

An expanded and more detailed accompanying report and operational worKbook on E&P Risk Management by David Wood is available for purchase through the OGJ Online Research Center.

The 17,500-word report focuses on risks and opportunities surrounding international fiscal designs and issues of fiscal instability.

It includes 19 figures and is accompanied by Excel worKbooks (in Excel 2003 and Excel 2007 formats) that enable quick-look and high-level risk and opportunity analyses applying the methodology proposed in the article, for a country or region.

For additional information, contact: www.ogjresearch.com

Topic: Research Reports

Report Title: Fiscal design strategies and fiscal instability impact oil & gas risk and opportunity analysis and international oil company decision-making

E-mail: [email protected]

Tel: (918) 831-9488

The unconventional oil and gas industries will probably have to weather low price challenges and expensive technology development periods. However, the industry has a record of technical innovation second to none, and it is reasonable to expect at least some technical solutions that will commercially unlock many of the vast unconventional resources currently just out of reach.

Further opportunities within the petroleum industry materialize when that is coupled with the political realization within the Organization for Economic Cooperation and Development that an undesirable future is one in which Russia and the extreme wings of the Organization of Petroleum Exporting Countries and the emerging Gas Exporting Countries Forum—dominated by Russia—hold major industrial powers for ransom and repeatedly force them into deep recession.

For integrated risk and opportunity analysis in the petroleum industry to be most valuable in seeking out opportunities, that analysis needs to be grounded in a global vision and framework that provides space for opportunities to exist.

Opportunities will remain obscured or buried deep below the risks, no matter how detailed and quantitative the analysis, if risk analysis is considered in isolation or risk and opportunity analysis are within a constrained framework.

Companies that seek and can find the opportunities in the fat-tail of remaining global petroleum resources in regions with broadly manageable risks seem more likely to prosper within the industry.

On the other hand, those companies that focus their resources in applying flawed enterprise risk management systems on a limited range of risks seem destined to miss opportunities and probably will be caught by unexpected extreme risks.

ERM systems that exclude operational risks and other important but hard-to-quantify risks from their routine financial exposure evaluations and fail to focus on potential operational opportunities tend to be constrained to mitigating certain risks that they systematically underestimate. This is because they look myopically at the part of the uncertainty spectrum they unrealistically believe can be measured and predicted with precision. Such approaches, although mathematically elegant, frequently do not ground their high-level analyses in an appropriate global framework.

Excel worKbook available

An Excel worKbook providing the analytical framework (five attribute risk and opportunity methodology), with graphical displays similar to those included in Figs. 1-3 of this article, is available from OGJ (see box above).

The worKbook includes tables listing summary risk and opportunity indices and the individual attribute scores for:

- The 58 countries holding the most proved oil reserves.

- The 58 countries holding the most proved natural gas reserves.

- The 58 countries holding the most proved oil plus gas boe reserves.

All are ranked in descending order.

The individual attribute scores represent the author’s perception at a snapshot in time in mid-2008. These can be overwritten with readers’ preferred assessments, making the tool easy to tailor for use by many analysts.

In addition, an executive report compiling several articles on risked portfolio analysis in the upstream oil and gas industry and detailed risk analysis methodologies are also available from OGJ.

Bibliography

BP Statistical Review of World Energy, June 2008.

Edwards, T., Estimates of 21st Century World Fossil Fuel Reserves, AAPG Bulletin 8, 1997.

Wood, D.A., E&P asset portfolio risk analysis: A multifaceted problem, (OGJ, Sept. 29, 2003, p. 49; Oct. 6, 2003, p. 28; and in an OGJ Executive report).

The author

David Wood ([email protected]) is an international energy consultant conducting project evaluation, research, and training, based in Lincoln, UK, and operating worldwide. He specializes in the integration of technical, economic, risk, and strategic information to aid portfolio evaluation and management decisions. He holds a PhD from Imperial College.