BPZ Energy continues Corvina field drilling

Houston-based BPZ Energy Inc. is testing the latest of six wells it has drilled in the 80 million bbl Corvina field off northwestern Peru. The CX11-15D well reached TD of 9,385 ft MD (6,459 ft TVD) on Jan. 1, 2009. BPZ detailed its Corvina gas-to-power project in its 2006 annual report.1

The company’s onshore support operations and gas-fired, thermoelectric power plant are in the Tumbes region, about 850 miles north of Lima.

Peru assets

BPZ Energy, a Houston-based subsidiary of BPZ Resources Inc., controls 2.4 million net acres in three basins covered by four blocks in northwestern Peru, Z-1, XIX, and XXIII; and XXII (Fig. 1). The company is looking at different geologic plays and is using new technology to reappraise fields with known hydrocarbons on and offshore Peru. It says it has mapped 50 low-risk drilling prospects in previously explored but undeveloped fields.

Offshore Block Z-1 covers 750,000 acres in Tumbes basin and contains several named fields and additional prospects (Fig. 1).

Other operators had drilled 18 wells in Block Z-1’s Albacora, Barracuda, Corvina, Delfin, and Piedra Redonda fields during the 1970s and 1980s, and those five structures tested positive for oil or gas at 6,000-12,000 ft.

Corvina field is about 40 miles south of Amistad gas field, off Ecuador in the Gulf of Guayaquil. Tenneco Inc. drilled two Corvina wells in the mid-1970s. Belco Oil and Gas Corp. drilled three wells in the late-1970s and early 1980s and built the two platforms in Corvina field.

BPZ Energy has drilled six wells at Corvina since September 2006 (see accompanying table).

The initial estimated capital budget of $132.3 million included refurbishing the Corvina CX-11 platform, rehabilitating an existing well and drilling two new wells, installing a 10-mile gas pipeline from the platform to shore, constructing gas processing facilities and a 160 Mw simple-cycle electric generating plant, and building a 40-mile gas pipeline to supply gas to third-party generators in Arenillas, Ecuador. BPZ estimated the 10-mile gas pipeline from Corvina platform to a power plant at Caleta La Cruz would cost $30-60 million (OGJ, Jan. 24, 2005, p. 39).

BPZ’s 2008 capital expenditure plan included $110 million for the gas-to-power project (100% funded by IFC debt) and $105 million for exploration and development, including $52 million for drilling at Corvina.2

Corvina reserves

In late December 2008, BPZ announced independent estimates by Netherland Sewell and Associates Inc. of proved oil reserves at Corvina that were higher than the company’s expectations and up 41% from a February 2008 estimate (OGJ Online, Dec. 29, 2008).

BPZ announced yearend proved oil reserves of 25 million bbl in Corvina field, about 20% above management guidance issued in fourth-quarter 2008.3 The Corvina area represents 6,000 acres out of the 2.4 million net acres the company controls in Peru.

BPZ negotiated reserve-based financing from Natixis, a French corporate and investment bank created in 2006 from the merger of Natexis Banque Populaire and Ixis, and the International Finance Corp. (private-sector arm of the World Bank). Results from the 15D well could convert as much as 5-9 million bbl of probable reserves to proved, the company said.

BPZ had previously certified reserves at Corvina field (proved, probable, possible) of 60 million bbl oil (March 2008) and 284 bcf gas (May 2008).

Z-1 block history

Block Z-1 now has four offshore platforms. The water depths are shallow, averaging 200 ft; only 10% of the area has water 500-1,000 ft deep.

BPZ Energy first became involved with offshore block Z-1 in the coastal Tumbes basin in November 2001 (OGJ, Dec. 17, 2001, p. 34). Together with Tulsa-based Syntroleum Corp., BPZ signed a license agreement for the block with Perupetro, the new license contract grantor. Previously, licenses were issued by Peru’s Ministry of Energy and Mines.

The Block Z-1 license provides an initial exploration period of 7-13 years. If exploration is successful, the total contract term for crude oil production can extend 30 years and for natural gas and condensates, 40 years.2

In July 2004, BPZ Energy assumed the operatorship of Block Z-1 and was authorized to certify the block’s gas reserves. In December 2004, BPZ obtained certification of 4.02 tcf of gas potential (proved, probable, and possible) in Block Z-1.

In February 2005, the Peruvian government designated BPZ Energy as operator of the block with 100% interest. BPZ began signing agreements for gas sales. In August 2005, BPZ Energy signed an engineering, procurement, and construction (EPC) contract for a power plant project in northwest Peru with Houston-based BTEC Turbines LP.

In December 2005, BPZ Energy announced:

- Plans to redevelop Albacora oil field, in the northern part of the block.

- Signing a 24-month drilling contract with Petrex SA, Latin American subsidiary of Italy’s Saipem SPA, a worldwide drilling and construction company of Eni Group, to start a drilling campaign in the Corvina gas field with a platform rig capable of drilling to 16,000 ft.

BPZ Energy paid $5.5 million to upgrade and mobilize the Petrex rig and received a “competitive fixed day rate and exclusive rights” to use the rig, at the company’s option, during the 2-year period beginning with the rig’s delivery in September 2006. In addition, after the guaranteed 2-year period, the company has the option to extend the contract “for an additional year at market rates.”1

By June 2006, BPZ confirmed plans to begin drilling the offshore Corvina gas field.

Equipment

It acquired and equipped a deck barge with a 200-ton crane to transport the drilling rig from dock to platform and act as a tender for drilling operations at Corvina and other properties off Peru. BPZ energy acquired the deck barge and related equipment, including a smaller, 35-ton crane, two winches, and related spare parts for about $6 million from Seattle-based KRS Marine.1

BPZ also refurbished a dock in Talara, Peru, to facilitate the company’s drilling and logistical operations and secured all tubular goods to meet planned needs for the first two gas wells of the initial three-well drilling campaign at Corvina.

On July 19, 2006, BPZ mobilized the Petrex rig to the Corvina CX-11 platform and spud its first well, the CX11-21XD, in September (Fig. 2).

Manolo Zuniga, president and chief executive officer of BPZ Energy, described the operating environment. “Block Z-1 is near the equator. The waters are calm and there are no hurricanes. Conditions are relatively benign.”4

21XD well

BPZ reported that the 21XD well reached TD of 10,457 ft MD (9,234 TVD) in November 2006. During the final stages of completing the first Corvina well, BPZ reported a mechanical problem caused by a gas kick following the cementing of the 7-in. liner in the Zorritos formation. This caused cement and several joints of drill pipe to block part of the 95/8-in. intermediate casing.1 All obstructions were successfully cleared.

In January 2007, BPZ Energy announced that all required testing equipment had been delivered and installed at the well. BPZ ran four drillstem tests (DSTs) in February on separate potential pay zones across 413 ft in the Lower and Upper Zorritos formations. It announced results in March—40 MMcfd of natural gas and 3,150 bo/d—and temporarily completed the well as an oil producer in April 2007.

The final production test after completion yielded 5,900 bo/d with 920 psia of wellhead pressure.

BPZ spent $55.9 million to drill and complete the 21XD and 14D producing wells.2

16X well

The CX11-16X well was drilled before BPZ entered the Corvina field, to a TD of 8,684 ft MD.2 In May 2007, BPZ completed the CX11-16X workover and began a series of four DSTs, including one in a formation previously untested in the entire basin.2 BPZ completed the 16X as a gas well in June 2007 and it was making 20 MMcfd.

BPZ spent $7.1 million to drill and recomplete the 16X, run seismic, and cover other related expenses.2

In June 2007, BPZ leased two oil-production barges for 2 years, with options to purchase, with a capacity of 40,000 bbl each.

The company planned to use one barge, the Nomoku, as an FPSO for oil produced at Corvina and the second, the Nu’uanu, to transport produced oil to the Talara refinery, about 70 miles to the south.2

14D well

The CX11-14D well was spud June 21, 2007, and reached TD of 7,750 ft MD on Aug. 18, “slightly ahead of the 60-day time line,” BPZ announced. The well intersected multiple prospective pay zones in the Upper Zorritos and Cardalitos formations.

In September, the well tested 1,700 bo/d on a 5/8-in. choke through perforations in the Upper Zorritos formation at 7,150 ft. (OGJ, Sept. 17, 2007, p. 58).

BPZ announced in October 2007 that it ran seven DSTs and tested a cumulative 104 MMcfd of gas and 2,400 bo/d from the 14D well. The first six tests were in the Upper Zorritos formation, with the first two testing the oil zone and the other four testing the gas zone; the seventh test targeted the Cardalitos formation located immediately above the Upper Zorritos.2

The company also announced in October that it leased two tankers from the Peruvian navy to transport oil from Corvina field. This allowed BPZ to begin oil production from the Corvina platform in November 2007.

On Nov. 21, 2007, BPZ notified Perupetro of a commercial discovery in Block Z-1 field.2

Royalties under BPZ’s contract vary from 5% to 20% based on production volumes. Royalties start at 5% if and when production is less than 5,000 boe/d and are capped at 20% if and when production surpasses 100,000 boe/d.2

18XD well

In November 2007, BPZ spud the CX11-18XD well, updip from the 21XD well, which tested 60 MMcfd of gas and 5,900 bo/d.

The well reached TD of 8,792 ft MD and was completed Jan. 1, 2008. It tested 5,950 bo/d.

On Jan. 30, 2008, one of the Peruvian Navy tankers that BPZ had chartered, the 7,500-bbl capacity “Supe,” caught fire and sank near the Corvina platform. It was being used to store oil produced from Corvina’s 21XD and 14D wells. At the time of the accident, BPZ reported that the Supe tanker held 1,300 bbl of oil, “most of which is believed to have been burned in the fire.” There was no apparent damage to BPZ facilities, but platform operations were halted and production (4,200 bo/d from the 21XD and 14D wells) and testing of the 18XD well was temporarily suspended.

On Mar. 12, 2008, BPZ received clearance from the OSINERGMIN, the government agency responsible for auditing the safety of energy investments in Peru, to resume operations at the CX-11 platform.2

In April 2008, BPZ announced 5,350 bo/d from continued testing of the 18XD well. In December 2008, it announced 5,950 bo/d from the well.

20XD well

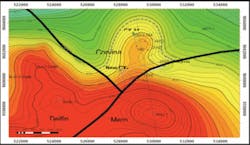

BPZ spud the CX11-20XD well May 29, 2008, and reached TD Aug. 25. It has the longest step-out of any of the Corvina wells, reaching 77º toward the southeast (Fig. 3). In October 2008, the 20XD well came in better than expected as BPZ’s best well yet. The 20XD well is BPZ’s fourth oil-producing well in Corvina field (Well 16X is purely gas), flowing at a cumulative 10,268 bo/d from two DSTs from four different sands.

BPZ drilled the 20XD well above the assumed oil-water contact, and the well has produced 100% oil (no water).

15D well

BPZ Energy spud its most recent well, the CX11-15D, in November 2008, attempting to target the probable oil in place area.2 It reached a total depth of 9,385 ft MD (6,459 ft TVD) on Jan. 1, 2009 (OGJ Online, Nov. 21, 2008). The well has been drilled, logged, cased, and cemented a month ahead of schedule. As a result of encouraging oil shows, BPZ said it would conduct DSTs to evaluate each sand. This could potentially prove up more reserves than originally expected, as BPZ plans to bring the well on production immediately.

Predrill estimates for the well (proved) were 6-9 million bbl, but as a result of DSTs, the well could prove up more. For context, 6-9 million bbl would mean increasing total company proved oil reserves by 24-36%.

The well’s actual flow tests were not available when this article went to press but were expected by late January or early February.

New power plant

BPZ initially planned a three-phase gas development project in Peru:1

- Build an integrated 160-Mw Corvina gas-to-power project requiring 40 MMcfd of natural gas.

- Build a 78-km (49-mile) pipeline from Caleta Cruz, the terminal point of the Corvina field pipeline, to the city of Arenillas in southwestern Ecuador and export 75 MMcfd of natural gas to Arenillas.

- Build a 200-km (125-mile) pipeline and export 150 MMcfd to Guayaquil, Ecuador.

In June 2006, BPZ announced that it has signed a memorandum of understanding with Suez Energy Peru SA (SEP) to evaluate the sale of natural gas from BPZ’s Corvina field as fuel for a planned 180-Mw, gas-fired, thermoelectric power plant to be developed by SEP near the town of Arenilla, Ecuador.

In September 2008, BPZ signed a contract to secure new turbines for its power plant. It made an initial down payment with GE Energy for three LM6000 gas-fired turbines with an option for a fourth; delivery is expected in fourth quarter this year. Each turbine has a capacity of 45 Mw and will consume 8 MMcfd equivalent of gas feedstock.

BPZ says the power plant is expected to be fully operational May 2010.

In September 2008, Raymond James analysts said, “Assuming current power prices in Peru (about $50/Mw-hr), the equivalent gas price BPZ would receive from power sales is about $6.05/Mcf.”5

No joint venture

Shares of BPZ soared in July 2008 after the company said it was in talks with a unit of Royal Dutch Shell PLC about jointly developing properties in Peru. BPZ and Shell Exploration Co. signed a memorandum of understanding in June 2008 to negotiate a farmout agreement with the “ultimate goal of jointly developing Blocks Z-1, XIX, and XXIII” (OGJ Online, Dec. 2, 2008).

The MOU called for Shell to commit to a three-phase exploration and appraisal program, spending up to $300 million on 12 wells to earn up to 50% of gas reserves at Mancora and deepwater leads in Block Z-1.

BPZ and Shell agreed to discontinue farmout negotiations, the companies announced on Jan. 8.

Zuniga said BPZ “will continue appraising Corvina while preparing to drill in Albacora, continue ramping up oil production, and proving up reserves.” It will also continue developing the gas-to-power project, which anchors its gas monetizing strategy.

Oil sales

BPZ announced separately, on Jan. 8, a new, long-term oil sales contract with the Peruvian government to deliver about 17 million bbl of crude from Corvina field to the state-owned Talara refinery over a period of 7 years. The contract has a referential value of about $1.3 billion, according to PeruPetro.

Corvina’s oil sales price will be equivalent to a basket of crude oils based on a 15-day average of Forties, Oman, and Suez blend crude oil prices (as quoted in the Spot Crude Prices Assessment published in Platt’s Crude Oilgram Price Report), less $1/bbl.

References

- BPZ Energy Inc., 2006 Annual Report, www.bpzenergy.com.

- BPZ Energy Inc., 2007 Annual Report.

- Horowitz, Darren. and Chwaleba, Maggie, Raymond James Energy Daily Update, Jan. 5, 2009.

- Stowers, Don, “Developing Energy—Providing Opportunities,” Oil & Gas Financial Journal, October 2007, p. 24.

- Akins, J. Marshall, Gerry, Collin, and Eagen, William, Raymond James Energy Daily Update, Sept. 30, 2008.

BPZ Energy has drilled six wells from the CX-11 platform in the Pacific, off northwestern Peru (Fig. 2, from BPZ Energy Inc.).

This structural map of the Corvina complex off Peru shows the well paths of the six wells drilled from the CX-11 platform and the location of the new CX-14 platform to the southwest (Fig. 3; image from BPZ Energy).