Oil-gas price disconnect

Inventories of crude oil and products have been plentiful for the past year, but price volatility has not reflected the more-than-comfortable stock levels. A number of factors have played roles in the price fluctuations, including geopolitics and economic recession.

But the natural gas market has behaved differently. High storage levels of gas have persisted, and drilling for gas in the US fell off the table quickly last year.

The price of oil has rebounded to $80/bbl territory even as crude inventories float above the 5-year range, but gas prices have remained low amid their storage overhang.

Simply put, oil has detached from gas on a btu-value basis.

Oil rig counts rebound

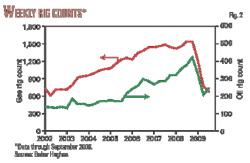

As of Oct. 23, the Baker Hughes rig count of active drilling rigs in the US was 1,048. The weekly rig survey has illustrated a steady rebound from its lowest level of 876 that occurred mid-June. However, it is a 35% drop from the highest level of recent years, which the count hit in January.

At the beginning of this year, the count of US oil rigs stood at its 2009 high at 347, accounting for 21% of the total count of US active drilling rigs. The rigs currently drilling for oil now account for nearly 30% of all active rigs in the US.

A primary driver of the steady slow climb in the US oil rig count is the recent rise in the price of oil. But natural gas prices have remained depressed due to high storage, reducing the need to drill new wells.

Rig counts do follow the trend in prices, though usually with some lag. Fig. 1 shows the movement between the West Texas Intermediate futures prices on the New York Mercantile Exchange and the oil rig count for the period of January 2002 through September 2009.

Gas drilling plummets

For the first time in 11 years, the share of rigs in the US drilling for natural gas dipped below 70% last month, according to the Baker Hughes figures.

The count of gas rigs started to fall in September of last year, as the economic recession took a firm grip and just as Hurricane Ike hit the Gulf of Mexico and Texas. At that time, rigs drilling for gas accounted for about 80% of all US rigs.

Gas prices fell, too. The front-month futures price on the NYMEX plunged to $2.508/MMbtu in early September of this year from a high of $13.577/MMbtu on July 3, 2008.

The shrinking share of gas wells and the consequent rise in the share of oil wells in total drilling is a reflection of oil's detachment from gas on a btu-value basis. As the price of oil has rebounded since its precipitous decline a year ago, it has left natural gas prices far behind.

While the price of oil has soared—to past $80/bbl on the NYMEX last month—gas futures have not moved much higher than $5/MMbtu since the start of 2009.

The heat content of crude oil is 5.8 MMbtu/bbl, which means that on a btu-equivalent basis, oil is trading at three times the price of gas.

The question for the industry to ask is this: will this disconnect between oil and gas last?

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles