OGJ Newsletter

General Interest — Quick Takes

Iraq signs oil security pact with Britain

Iraq's parliament signed an agreement allowing as many as 100 British Royal Navy Trainers to return for up to a year to help Iraq protect its vital southern oil export terminals.

"The parliament passed the Iraqi-British security pact," said Abbas al-Bayati, a member of parliament's security and defense committee. Without explanation, he said a bloc of politicians withdrew from the vote.

The British security pact failed to pass during parliamentary sessions in July because of opposition from some politicians, particularly those loyal to Shia cleric Moqtada al-Sadr, who reject any foreign troop presence in Iraq.

In August, Iraq's South Oil Co. let a project management contract to AOC Holdings subsidiary Japan Oil Engineering (JOE) for front-end engineering and design to restore and upgrade southern Iraq's Fao export oil terminal.

Under the contract valued at ¥3 billion, JOE and Yachiyo Engineering Co. will help South Oil Co. design pipelines to connect a land-based oil storage facility with two sea-based shipping terminals 50 km off Basra in the Persian Gulf (OGJ Online, Aug. 6, 2009).

Most of Iraq's 2 million b/d of oil exports are shipped through the two oil terminals off Basra, where Iraq also faces problems with oil smugglers, border disputes with Iran, and a host of other security issues.

Chaparral Energy, United Refining to merge

Privately owned independent Chaparral Energy Inc., Oklahoma City, and publicly held United Refining Energy Corp., a special purpose acquisition company, agreed to merge in a deal valued by company officials at $1.8 billion.

The combination is expected to close by Dec. 11 and will retain the Chaparral name. Founded in 1988, Chaparral has a large inventory of low-risk exploitation prospects as well as near-term, high-potential drilling projects. Since 2003, management has increased the company's reserves and production by 21%/year. At the end of June, it had proved reserves of 146 million boe, 62% of which is oil. Production in this year's first half averaged 21,000 boe/d.

United Refining in New York was formed last December to acquire energy assets through merger, capital stock exchange, asset acquisition, stock purchase, reorganization, or similar combinations. At the end of September, it held $452 million in trust.

Chaparral has acquired and enhanced properties in its core areas of the Midcontinent and the Permian basin, as well as in the Gulf Coast, the Ark-La-Tex region, North Texas, and the Rocky Mountains. It has several enhanced oil recovery (EOR) projects under way using carbon dioxide injection and has identified other candidates with the potential for substantial reserve and production growth, said company officials.

John A. Catsimatidis, United Refining's chief executive and chairman, will become executive chairman of the combined company. Chaparral's senior management will remain in place, including cofounder Mark A. Fischer, chairman and chief executive; Joseph O. Evans, chief financial officer; and Robert W. Kelly II, senior vice-president and general counsel.

"Chaparral's management team has demonstrated the ability to find lucrative oil and gas properties at prices that have resulted in superior returns on investment," said Catsimatidis. The merger is subject to approval of United Refining shareholders.

Fischer said, "This merger will give Chaparral access to capital we need to exploit our large inventory of drilling and development opportunities and to significantly step up our EOR program."

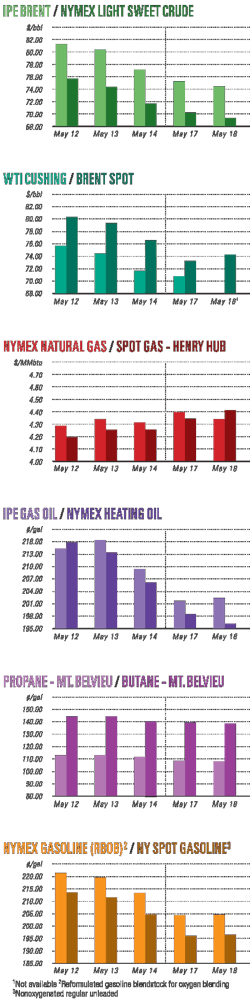

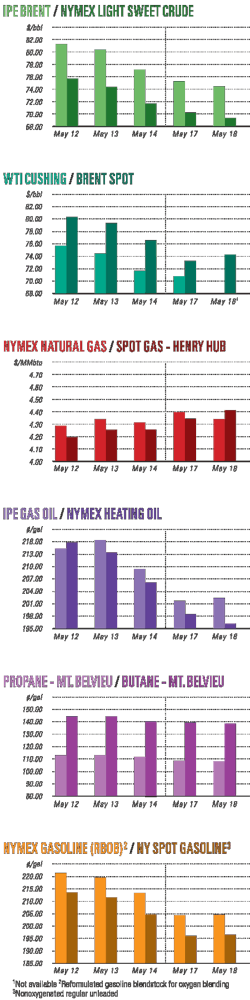

Industry Scoreboard

Exploration & Development — Quick Takes

ExxonMobil reportedly buying stake in Jubilee

ExxonMobil Corp. reportedly has agreed to buy a stake in Jubilee oil field off Ghana from privately owned Kosmos Energy LLC, several media organizations have said. The Financial Times reported that the pending transaction was worth $4 billion.

"ExxonMobil routinely evaluates potential development opportunities around the world. We do not comment on the details of commercial discussions or opportunities," Patrick McGinn, ExxonMobil spokesman for upstream media relations, told OGJ in an e-mail.

A sale would require approval from Ghana's government, legal experts have said. Tullow Oil PLC operates Jubilee and owns 34.7%. Kosmos owns 23.49%. Other partners include Anadarko Petroleum Corp. 23.49% and Ghana National Petroleum Corp. 13.75%.

ExxonMobil already holds some of the largest acreages in West Africa including operations in Angola, Nigeria, Chad, Equatorial Guinea, and Niger. Ghana is part of an emerging play in northern West Africa. The play includes Sierra Leone (OGJ, Sept. 28, 2009, p. 36.)

Raymond James & Associates analysts said there do not appear to be any proved reserves associated with this deal, but the unbooked resource potential of Jubilee is estimated at 600-1,800 MMboe gross.

"This is Exxon's first entry into Ghana, and it has plenty of cash on hand to do so—$16 billion as of second-quarter 2009," RJA said. "The major's move signals growing interest in the area and bodes well for future development."

Kosmos is led by James Musselman, formerly Triton Energy Ltd. chief executive officer. Triton discovered oil off Equatorial Guinea before Triton was sold in 2001 to Amerada Hess Corp., which is now Hess Corp.

Newfield, Hess plan Marcellus joint venture

Newfield Exploration Co. and Hess Corp. plan to start drilling in 2010 on a joint exploration venture to exploit gas in Devonian Marcellus shale in northeastern Pennsylvania.

Newfield will operate the 50-50 venture, which covers as much as 140,000 gross acres in Susquehanna and Wayne counties.

Newfield noted it has gained shale gas experience in the Woodford shale in Oklahoma's Arkoma basin since 2003. It now has nearly 300 MMcfd of gas equivalent gross operated production capacity in 300 horizontal wells, and its 165,000 net acres are almost entirely held by production.

Hess has built unconventional oil expertise in the Williston basin Bakken oil play in North Dakota with horizontal wells and multistage fracturing. The two companies expect to finalize agreements in coming weeks for the Appalachian basin program.

Total starts development on Timimoun project

Algeria's Sonatrach, Total SA, and Cepsa said the Algerian National Oil and Gas Development Agency has approved their development plan for the Timimoun natural gas project in Algeria.

According to Total, the approval is the outcome of an exploration and appraisal program begun in 2003, during which six wells were drilled.

Total said development work should begin in the fourth quarter, with gas production scheduled to start in 2013. Timimoun is expected to produce about 1.6 billion cu m/year of gas at its peak.

Operation of the Timimoun project will be jointly conducted by the stakeholders: Sonatrach 51%, Total 37.75%, and Cepsa 11.25%. The development plan entails drilling around 40 wells to tap eight structures over an area of 2,500 sq km.

The plan also includes construction of gas gathering and processing facilities, as well as a connection to the Sonatrach pipeline that will carry gas from fields in west-central Algeria to Hassi R'Mel.

Eni adds to exploration acreage in Pakistan

In a joint venture with Pakistan Petroleum Ltd. (PPL) and Royal Dutch Shell PLC, Italy's Eni SPA, as operator, won an exploration license for onshore Sukhpur block in the Sindh province north of Karachi, Pakistan, near Eni-operated producing areas of Bhit and Badhra.

During a recent meeting in Rome with Pakistan President Asif Zardari, Eni Chief Executive Paolo Scaroni expressed his company's commitment to share its expertise and technology in the development of Pakistan's oil and sector under the Protocol of Cooperation signed last March with the Pakistani government.

Reuters news service quoted a Pakistani official as saying Eni is likely to double its investment in Pakistan to $3 billion as early as next year. However, Scaroni said future investments depend on new discoveries.

Eni also is exploring for gas and oil off Pakistan. Longer term, Scaroni said he's interested in transporting gas from Turkmenistan, Kazakhstan, and Iran—where Eni now operates—to markets in Pakistan, India, and China. He said Zardari supports Eni's ambition to initiate that project.

The Italian company has been in Pakistan since 2000 and was the first international company involved in exploration and production of gas with an equity production of 56,000 boe/d. It holds 15 exploration licenses (3 offshore and 12 onshore), and 7 production or development licenses (3 operated) in that country.

Drilling & Production — Quick Takes

Kazakhs peg Khvalynskoye field at $5 billion

Development of Khvalynskoye natural gas field in Kazakhstan's sector of the Caspian Sea will cost $5 billion in the first phase, Kairgeldy Kabyldin, chief executive officer of state-owned Kaz-MunaiGaz (KMG), told delegates at the Kazakhstan International Oil & Gas Exhibition & Conference.

Kabyldin's remarks follow a statement by Total SA that it signed a heads of agreement (HOA) establishing the principles of a partnership with KMG for development of Khvalynskoye.

Located in 25 m of water in the Caspian Sea on the border between Kazakhstan and Russia, Khvalynskoye is a conventional gas-condensate field to be developed by Russia's OAO Lukoil, operator. Gas from the field will go to Russia.

Total and GDF Suez Group will invest $1 billion in the project, which is expected to start producing as much as 9 billion cu m/year of gas in 2016.

The agreement, which boosts Total's role in the region, was signed in the presence of Kazakh President Nursultan Nazarbayev and French President Nicolas Sarkozy, who was on a visit to Kazakhstan (OGJ Online, Oct. 6, 2009).

Khvalynskoye is jointly owned with Lukoil, which said it had not concluded a production-sharing contract with KMG yet and would keep its 50% stake.

Meanwhile, under the terms of the HOA, Total and GDF Suez will acquire a participation of 25% (Total 17%, GDF Suez 8%) from the initial 50% stake held by KMG.

Energy XXI to boost Main Pass 61 oil output

Three development wells, one of which found a new oil pay zone, are to be completed shortly in Main Pass 61 oil and gas field in the Gulf of Mexico off Louisiana, said Energy XXI (Bermuda) Ltd., Houston.

Energy XXI, field operator with 50% working interest, said an exploration tail for the CY-2 horizon at the MP 61 C-9 well cut 10 net ft of high quality oil below 8,000 ft true vertical depth, proving the existence and trapping of hydrocarbons below the main field pays. It plans to pursue the CY-2 and other deeper horizons with future drilling.

Logs at the C-9 well also indicate a greater-than-expected 122 net ft of oil pay in the BA-4AA1, BA-4AA2, BA-4AA2B, and J-6 sands at 7,145-7,810 ft TVD. TD is 9,000 ft TVD. The company plans to complete the J-6 sand in November. The other three sands represent proved reserve bookings and recompletion opportunities after J-6 depletes.

Logs at the A-11 well indicate 61 net ft of J-6 oil pay, also for completion in November. TD is 7,386 ft TVD.

Logs at the A-10 well indicate 45 net ft of hydrocarbon pay in J-6 in an updip attic area and with a gas-oil contact near the top of the sand. The company sidetracked A-10 away from the gas, drilled to 7,187 ft TVD, and found the J-6 full to base with 73 net ft of oil pay. It is to be completed by November.

Meanwhile, the South Timbalier Block 21 No. 128 well was reconditioned in the D-7 sand at 11,400 ft TVD and went on production Sept. 13 at a net 1,400 boe/d, 75% oil. Energy XXI is operator with 100% working interest, 83.3% net revenue interest.

The company recompleted the No. 75 well in the Rob E sand at 9,300 ft, and it came on line Oct. 6 at 700 boe/d net.

Suncor plans work for Alberta oil sands plant

Suncor Energy Inc., Calgary, let a contract to KBR Canada to carry out turnaround services next year for its oil sands plant in Fort McMurray, Alta.

KBR Canada will provide turnaround planning, management, and execution for the shutdown and maintenance of the plant, including direct-hire labor resources and management of subcontractors.

Other services include planning, scheduling, change management, cost estimating, forecasting, and integrating KBR's work with Suncor and other turnaround participants.

Over the next decade, Suncor plans to double oil sands production from the plant to more than 500,000 b/d.

Last month Suncor Energy reported average oil sands production of 302,000 b/d. Year-to-date, oil sands production at the end of September averaged 295,000 b/d. "Production volumes were impacted by planned maintenance to a vacuum unit, which began on Sept. 8," the company said.

Processing — Quick Takes

Qatar inaugurates Pearl GTL control room

Qatar Energy Minister Abdulla bin Hamad Al-Attiyah inaugurated the central control room at the massive 140,000 b/d Pearl gas-to-liquids (GTL) plant in Qatar.

The move signifies that commissioning of the project—which will produce liquid transport fuels and 120,000 boe/d of natural gas liquids and ethane—is imminent. This project is expected to position Qatar as the GTL capital of the world.

The central control room is a large hushed chamber, with four main banks of high-powered computers. It comprises almost 1,000 control cabinets hosting 179 servers that are programmed with 12 million lines of software code. The system is linked to every part of the plant by about 5,850 km of underground cables.

"While testing begins on the many thousands of pieces of equipment that have already been installed in the plant, construction continues and is expected to be complete around the end of 2010. Production ramp-up will then take around 12 months," said Pearl partner Royal Dutch Shell PLC.

Shell is buiding the plant in partnership with Qatar Petroleum. Peter Voser, Shell chief executive officer, hosted a senior Qatari delegation that also included Mohammed Saleh Al-Sada, minister of state for energy and industry affairs, Qatar Petroleum directors, and members of the Pearl GTL management committee.

Voser said, "Over 48,000 people are working on the Pearl GTL site—the largest single construction site in the oil and gas industry today. Much work remains to be done but we are on schedule to deliver."

The plant will process about 3 billion boe over its lifetime from the North field, which stretches from Qatar's coast out into the Gulf.

Petrobras starts refining of first presalt crude

Brazil's Petroleo Brasileiro SA (Petrobras) began refining 264,000 bbl from Tupi field—its first load of oil from the presalt region—at the Henrique Lage refinery in Sao Jose dos Campos, Sao Paulo state.

Petrobras said Tupi's oil is rated as "paraphinic" and, according to the Bureau of Mines characterization factor, its specific gravity is 29.2° gravity, equivalent to a density of 0.877.

"This oil's sulfur level is low—the lower, the easier it is to meet future, increasingly strict specifications for all derivatives and particularly for naphtha and diesel," the Brazilian firm said.

Additionally, it said that oil coming from the Tupi Field has "low naphthenic acidity and good yield, as it does not generate fuel oil, the product with the least value added."

The Tupi reservoir lies more than 3,000 meters under the seabed, beneath 2,000 meters of salt, in 2,140-meter-deep waters 300-km off the São Paulo state coast.

According to Petrobras, recoverable volumes in the Tupi area are estimated at 5-8 billion bbl of "high-quality, light oil and natural gas."

Transportation — Quick Takes

Shell's Australian FLNG timed for 2016 start-up

Royal Dutch Shell PLC does not expect to start production from its proposed floating LNG (FLNG) project in the Browse basin off Western Australia until at least 2016, according to the company's draft environmental impact statement.

Although the front-end engineering and design process (contracted to Technip SA of France and Samsung Heavy Industries of South Korea) has begun, Shell does not expect to make a final investment decision until early 2011.

The $5 billion, 600,000-tonne FLNG facility is expected to take 5 years to build.

Meanwhile, Shell intends to drill eight subsea production wells on its Prelude and Concerto gas discoveries in the Browse basin 475 km north-northeast of Broome. Development drilling is scheduled to begin in 2013 and take 2 years. The wells will be tied back to subsea manifolds before being connected to the FLNG vessel via flowlines and riser.

The vessel tow from the South Korea construction yard (Technip and Samsung also have the contract to build the FLNG), along with installation and hook up, will take about 6 months, with commissioning in late 2015 before first production the following year.

Production is estimated to comprise 3.6 million tonnes/year of LNG, 1.3 million tpy of condensate, and 400,000 tpy of LPG.

Shell says the offshore project will have a low environmental footprint on its location away from migration paths for whales and turtles that seasonally pass up and down the Western Australian coast.

The FLNG project will come on stream after the company's proposed onshore coal seam gas-LNG project at Gladstone, Queensland, in joint venture with Arrow Energy begins production in 2014.

Toyo Engineering, Hitachi enter LNG business

Toyo Engineering Corp. and Hitachi Ltd. said they will join forces to make a full-fledged entry into the global market for LNG plants, according to media reports.

Japan's Nikkei Business Daily (NBD) reported that Hitachi will provide rotating equipment and power control software while Toyo Engineering will manage projects including plant design, equipment procurement, and construction.

US plant equipment manufacturer Chart Industries Inc. is also part of the tie-up, and will provide equipment for chilling and liquefying the gas, along with technologies to treat it.

NBD said the alliance will target small, undeveloped gas fields mainly in Australia and Indonesia, and will market relatively small plants that can produce as much as 2 million tonnes/year of LNG.

Australia and Indonesia hold an abundance of undeveloped small and midsize gas fields that would not be profitable if large plants were constructed for them, the paper said.

Many projects, which boast 5-10 million tpy capacity, cost hundreds of billions of yen and even more than ¥1 trillion to build.

The smaller plants the Toyo Engineering alliance is seeking to build cost 20% less to construct, including power generation equipment. They also take nearly a year less to build than the 4 years needed for most large plants.

The new group already has been commissioned by the Japan External Trade Organization to conduct a feasibility study on small and midsize gas fields in Papua New Guinea, NBD said.

Dredging project to improve ops at Long Beach

The Port of Long Beach and the US Army Corps of Engineers announced a $40 million harbor-dredging project to improve navigation for oil tankers and other ships by removing and relocating nearly 1.5 million cu yards of sediment from the seafloor.

The dredging involves four separate locations. The primary focus is a turning basin south of the BP PLC oil terminal on Terminal Island (Pier T), which will be deepened to 76 ft, the same depth as the main channel. The deeper inner basin means large tankers no longer will need to unload part of their oil outside the breakwater to safely reach berth.

The new depth also allows ships to turn safely in the inner basin. Oil tankers must point toward the ocean when docked so that they can quickly move away from the berth in an emergency. The BP terminal is one of the busiest oil terminals on the West Coast.

Accumulated sediments at Catalina Ferry basin, near the mouth of the Los Angeles River, also will be dredged to improve the safety of the ferries between Long Beach and Catalina Island.

The project also includes the removal of contaminated sediments from the West basin, left over from past US Navy operations.

The dredge materials will be used to fill about 12 acres at the northern half of ITS Terminal in Pier G. The newly filled area will be incorporated into the terminal in early 2013 and help expand the use of on-dock rail.

The dredging, scheduled to begin in March 2010, is partially financed by federal stimulus funding. The projects will support 180 jobs for the next 2 years.

Oiltanking Holding, TOPS reach settlement

Oiltanking Holding Americas has settled a lawsuit it filed earlier in 2009 against Enterprise Products Partners LP and Teppco O/S Port System LLC, its former partners in the proposed Texas Offshore Port System. Oiltanking filed suit in April following the withdrawal of the other two companies from the project.

Gus Spaepen, Oiltanking GMBH's managing director, confirmed settlement of the lawsuit, but would not disclose terms. Public filings by both Enterprise and Teppco report that each will record a $33.5 million expense connected to the settlement, slightly less than the $34 million non-cash charge the companies reported when they left the project (OGJ Online, Apr. 22, 2009). The settlement removes any legal impediment to moving the project forward.

In August 2008, affiliates of Enterprise, Teppco, and Oiltanking formed a joint venture to design, construct, own, and operate a new Texas offshore oil port and pipeline system for delivering waterborne crude to refining centers along the upper Texas Gulf Coast.

TOPS design includes an offshore port, two onshore storage facilities with about 5.1 million bbl of crude storage capacity, and an associated 160-mile, 1.8 million b/d pipeline. Total cost of the project was estimated at $1.8 billion. TOPS would use two single-point mooring buoys in about 115 ft of water capable of offloading 100,000 bbl/hr.

Long-term supply contracts with Motiva Enterprises LLC and an affiliate of ExxonMobil Corp. total about 725,000 b/d (OGJ Online Aug. 18, 2008).

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles