Special Report: Gas Shale—2: Lessons learned help optimize development

Exploring for resource quality, building advanced technological capability, pursuing improved performance and cost efficiencies, and adopting high-value entry strategies are some factors leading to successful exploitation of gas shales.

Our first article on gas shales (OGJ, Sept. 28, 2009, p. 39) introduced the numerous geological, engineering, and economic challenges facing optimum exploration and development of gas shales, including how operators have addressed and learned from these challenges. This second article pursues these important topics in more depth.

The third and final article in this series will examine emerging shale plays in North America and other settings, as well as environmental challenges facing shale development.

Resource quality

No single factor is more important than rigorously establishing and then capturing the core area of a gas shale basin or play.

Each gas shale play we have assessed has, in general, three grades of resource quality:

1. Compact core sweet-spot area.

2. Reasonably sized average productivity area.

3. Extensive fringe area, often called the goat pasture.

The core area of a gas shale play, with rich resource concentrations of 150-200 bcf/sq mile, provides a massive economic advantage over the fringe area with its much leaner resource concentrations of 50-70 bcf/sq mile.

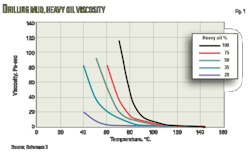

For example, in the Barnett shale gas play that covers nearly 8,000 sq miles, a quarter of the basin area (the core area) has high resource concentrations and outstanding horizontal wells, with average estimated ultimate recoveries of 2.8 bcf (3 bcfe with NGLs) and much higher recoveries by the best individual wells (Fig. 1).

In comparison, the fringe area contains half of the basin area and has horizontal wells that average about 1 bcfe. Given relatively similar well drilling and completions costs, it is clear why identifying and capturing the core area provides much lower finding and development costs per Mcf and thus major competitive advantage to operators with substantial core area acreage.

Resource settings

High resource quality for gas shales requires the convergence of a series of favorable reservoir properties beyond thick net pay. These include adequate porosity, greater than 3%, and high reservoir pressure, ideally overpressured, to pack more gas into a given volume of shale and keep natural and induced fractures open during early production.

High-quality shale properties also include favorable thermal maturity—vitrinite reflectance (Ro) of 1.5% or greater—to place the shales in the dry gas window and avoid unfavorable relative permeability effects caused by oil blocking the small pore throats and permeability pathways common to many of the gas shale plays. A few combination oil-gas shale plays with higher permeability intervals embedded in the shale matrix do exist, however, such as in the northern portion of the Barnett shale gas play.

The shales require a sufficiently high organic richness (TOC greater than 2 wt %) for generating abundant volumes of gas, some of which is adsorbed by the thermally mature organics.

As introduced in Part 1, adsorptive capacity is most important for shallow gas shales, while porosity becomes the dominant gas storage mechanism in deep gas shales (Fig. 2). While TOC decreases with thermal maturity, the remaining higher maturity organics have high adsorptive capacity, contributing to higher gas in-place concentrations.

In addition, higher thermal maturity shrinks the in-place organics and helps create more pore space for storing gas (Fig. 3). The presence of preserved diatoms in the shale formation also can provide enhanced storage space, accounting for the higher porosity volumes reported for gas shale deposits such as the Haynesville.

An often-overlooked high quality shale property is favorable in situ stress. The in situ tectonic stress of the shale formation influences both the permeability of the formation as well as its response to hydraulic stimulation. Areas with lower and relatively equal horizontal stresses will have higher reservoir flow capacities and will achieve more effective multibranched hydraulic stimulations.

Assessing mineralogy

The mineral composition of the shale becomes important when one evaluates gas shale reservoir properties for quality. While ordinary shales consist predominately of various clays, the deep reservoir-quality shales are dominated by brittle minerals such as quartz, carbonates, and feldspars and are relatively low in clay (<50%). Such silicic shales are brittle and shatter when stressed, providing multiple dendritic fracture swarms.

In contrast, shales with a high clay content are plastic and absorb energy, providing single-planar fracs.

As shown in Fig. 4, the quartz-rich Barnett shale is brittle and shatters under hydraulic stimulation, creating an extensive area of reservoir permeability. The clay-rich Cretaceous-age shales promote long, single-plane hydraulic fractures that do not.

Technological capability

Efficiently pursuing gas shales is a high-tech undertaking, involving production of hydrocarbons that the industry traditionally has viewed as an essentially impermeable source or cap rock. The technological leap that cracked the technological code was the introduction of horizontal drilling supplemented by intensive hydraulic stimulation.

The permeability of the gas shale matrix is low, about a few hundred nanodarcies. Achieving economically attractive flow rates requires drilling long horizontal wells in extensively fractured rock by hydraulics or by nature. As such, the operator is either creating permeability by shattering the shale or linking up native permeability in the rock from small-scale natural fractures.

Considerable discussion has centered on the importance of natural fractures for providing economically viable flow paths in gas shales. Our view is that small-scale natural fractures, essentially microscale, grain-to-grain planes of weakness in the shale matrix, provide enhanced permeability and help create multibranched, orthogonal hydraulic fractures.

In contrast, large-scale natural fractures and faults are, in general, detrimental because they can limit effective horizontal lateral lengths, absorb hydraulic fracture energy and, at times, serve as conduits for water.

Gas shale formations such as the Fayetteville that have been deeply buried and then uplifted, tend to have more microscale planes of weakness due to relaxation of stress and formation cooling during the uplifting phase.

Well productivity

Today's best practices for effective hydraulic stimulation of gas shale formations involve a dozen or more frac stages, closely spaced perforation clusters, and massive injection of energy using large volumes of water and ideally no gels or other formation damaging chemicals.

A longer effective horizontal lateral, properly completed and stimulated, will create a larger volume of permeable reservoir (shattered matrix) connected to a wellbore.

As the accompanying table shows, the experience from the Fayetteville shale is that a 100% longer lateral combined with other key design modifications such as closer perforation clusters, higher volumes of injected energy, and the elimination of crosslinked gels provides a well with nearly three times greater early time productivity. The most recent wells have a 3.61 MMcfd initial potential (IP) and an average 4,120-ft horizontal length compared with a 1.26 MMcfd IP for earlier (first-quarter 2007) wells with a 2,100-ft horizontal lengths.

Importantly, the longer lateral well maintains its gas rate through at least the first 60 days of production and, based on type curve matching, throughout its full productive life.

In the Woodford shale, operators are testing horizontal wells with up to 10,000 ft of lateral to bring down the unit costs and attempt to make this challenging shale play more economic.

3D seismic

Today, operators are using 3D seismic extensively in the Barnett, Fayetteville, and numerous other shale plays to identify faults and other structural features of importance for designing and locating wells. Seismic also can help orient the azimuth of the horizontal leg to take advantage of stress and permeability anisotropy.

Even at costs of $200,000/sq mile, 3D seismic adds only $25,000 to costs/well (less than 1% of a well's capital expenditure), assuming 8 wells/sq mile.

A challenging technical topic still under development is how might seismic attributes help identify areas of lower stress and higher permeability, the economically attractive sweet spots.

Petrophysics, cores

With shale formations many hundreds of feet thick, choosing where stratigraphically to position the lateral leg becomes key. Detailed analysis of rock mineralogy, TOC, gas shows, and natural fracturing provides initial guidance, later fine tuned by drilling results.

In gas shale plays where the organically rich shale interval is interrupted by a significant zone of nonproductive shale or a frac barrier, dual laterals may need to be drilled from the vertical wellbore, such as being tested for jointly producing the Upper and Lower Montney shale in British Columbia.

Performance assessments

Several successful gas shale operators have established teams with high-level crosscutting technical capabilities. These teams generally located outside the shale business unit provide independent evaluations of how effectively each business unit is adapting and applying best technology and operations practices.

This organizational strategy is similar to the designation of consulting engineers, often the top technical position within the company, that report directly to the vice-president for exploration and production to provide independent reviews and help promote the use of best practices.

Multidisciplinary team

Cost-effective gas shale development requires a multitude of technical skills, including sophisticated reservoir modeling, geomechanics, geochemistry, and petrophysics, along with strong well testing and fracture diagnostics capability.

Our experience is that incorporating geologic, engineering, and operations talents into each business unit and then supplementing these talents with organizationally crosscutting experts, as discussed previously, can accelerate the process for cracking the technical code in each gas shale basin and making progressively better wells.

Continuous learning

Next to capturing the core areas of the better gas shale basins and plays and developing these areas with best practices technology, no single other factor is more important than relentless pursuit of efficiencies and cost reductions.

The fact that the larger shale plays require thousands of shale wells drilled over decades provides opportunity for continuous improvement, unlike conventional offshore development that must get it right the first time.

While the large acreage underlain by gas shale play leads itself to manufacturing style efficiencies, it is important to establish first the most efficient manufacturing design before putting it into large-scale use.

Early attention to best practices, appropriate to the specific shale play, and emphasis on continuous learning are key.

Rigs, multiwell pads

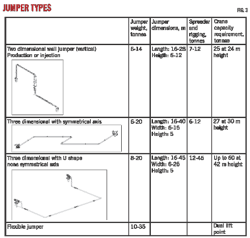

Fit-for-purpose rigs, with automation and mobility, can reduce the time to drill shale wells. The new generation of gas shale rigs needs:

• Sufficient horsepower (typically 1,000-2,000 hp) to drill long horizontal laterals.

• A compact design for easy mobilization and demobilization, particularly in areas with narrow roads and challenging terrain such as the Marcellus shale.

• Increasingly, a skid-mounting capability.

We have seen instances in which the use of fit-for-purpose rigs, an increasingly experienced crew, and the introduction of performance incentives have cut in half the drilling time of a shale well. Some operators, who have established in-house drilling and other service capabilities, report closer alignment of goals and better control over the quality of operations.

Multiwell pads also can save demobilization-remobilization time and greatly reduce land disturbance. As operators drill gas shale wells on closer spacings, it becomes increasingly efficient to drill multiple wells from a single well pad. This also will reduce land disturbance and access issues in rugged, environmentally sensitive terrain.

Learning-based improvements

Continuous learning, including learning from the successful and less successful experiences of other gas shale operators, can and has led to steadily improving results, such as fewer mechanical well failures, more effective well stimulations, and more optimum well spacing. Some of the better performing gas shale companies have set quantitative expectations, in considerable detail, for learning-based performance improvements.

One example of the benefits of rigorously pursuing learning was gained from the insight that restimulating older hydraulically fraced wells to contact and shatter more of the shale matrix would result in higher well performance. Much of the foundation for pursuing higher gas shale flow rates and enhanced reservoir permeability with intensively stimulated horizontal wells derived from this important insight.

The Denton Creek Trading No. 1 well in the Barnett shale illustrated how an operator converted an initial 1-bcf estimated ultimate recovery well to a 2.9 bcf EUR well with restimulation (Fig. 5). Importantly, this vertical well, as of mid-2009, already has produced 2.2 bcf.

One key aspect of gas shale well performance remains a puzzle, namely the significant variability in well performance, even when the underlying, readily measureable geological reservoir properties appear to be the same or similar.

One example of this is the repeated anomalous presence of side-by-side high and low performing wells. The core area (Wise, Denton, and Tarrant counties) of the Barnett shale provides a larger example of this phenomenon.

This area had more than 1,000 horizontal wells drilled between 2001 and 2006. The best 10% of the wells average about 8 bcf/well while the lowest 30% of the wells average about 1 bcf/well (Fig. 6).

A detailed plot of these wells vs. reservoir properties such as net pay, thermal maturity, and depth provides no clear trends, even for wells drilled and stimulated in a similar manner and at a similar time.

A possible explanation is the complex 3D distribution of small-scale natural fractures and in situ stress, a puzzle that remains tantalizingly below the resolution ability of current seismic and logging tools to unravel.

Entry strategies

Several successful strategies exist for entering a high quality gas shale play, ranging from aggressive leasing of emerging basins to entering into a joint venture with early-mover operators already holding core area acreage.

Gas shale plays with good market access and low transportation tariffs command a premium over gas shale plays and basins with less favorable access to markets. For example, a close-to-market gas shale play such as the Marcellus can have a transportation and market advantage of nearly $2/Mcf compared to a far-from-market Rockies gas shale play.

Sometimes, to counter high transportation cost disadvantages offered by traditional markets, the operator needs to step outside the box. For example, the operators of the northern British Columbia gas shale plays, notably in the Horn River basin, have begun to pursue alternative, higher value markets.

One of these is for shipping the produced gas to nearby Fort McMurray, Alta., to use in production and upgrading of oil sands. The other is for providing the shale gas to the planned LNG export plant at Kitimat, BC, for delivery to higher value Asia-Pacific markets.

In general, the well-prepared early-entry gas shale operator will be able to capture substantial acreage in the core area and gain leases with considerably lower lease bonuses and royalties. This strategy will provide lower breakeven cost opportunities, enabling the company to be one of the low-cost operators, as shown for an early entry operator in the Barnett shale gas play (Fig. 7).

When early-leasing entry is no longer available, the next favorable strategy is to form a joint venture with or acquire one of the early-entry competitors with high resource quality core area acreage.

This is the strategy followed by Shell Canada Ltd. and its acquisition of Duvernay Oil Corp. in the Montney resource play in Canada (OGJ, Sept. 8, 2008, p. 31) and by the BG Group in its joint venture with EXCO Resources Inc. for the Haynesville gas shale play (OGJ, Online, July 2, 2009).

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles