OGJ Newsletter

General Interest — Quick Takes

IHS Herold: Hofmeister wants independent agency

John Hofmeister, former president of Shell Oil Co., wants the US to come up with a comprehensive approach to energy and the environment rather than using one that's politically driven.

Speaking on Sept. 22 at the IHS Herold Pacesetters Energy Conference in Greenwich, Conn., Hofmeister called for the implementation of an independent regulatory agency for energy policy. He envisions something similar to what the Federal Reserve has been for banking.

He suggests a federal energy resources board that would have its own rules, its own funding, and an appointment process independent of election cycles.

"If we fail to take the politics out of energy, we are going to zig-zag our way into the future," Hofmeister said. "Energy is too important to leave to everyday politics."

He noted that eight presidents and 18 Congresses have promoted US energy independence while oil imports have continued to grow in the last 35 years.

"We have yet to get a grip on what it means to be a modern country regarding energy and environment," he said.

Currently, Hofmeister is founder and chief executive officer of Citizens for Affordable Energy, a grassroots organization seeking to educate the public about energy.

IHS Herold: Markets to have 'moderate' recovery

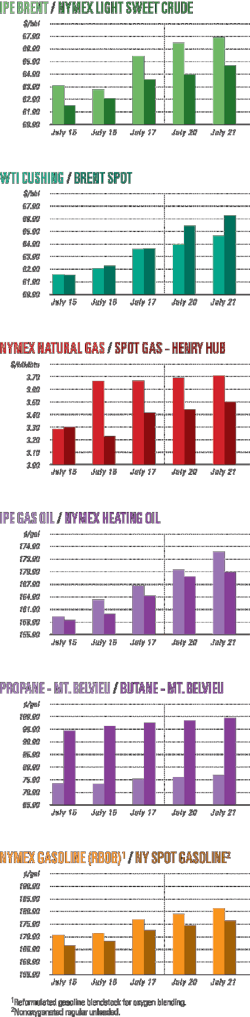

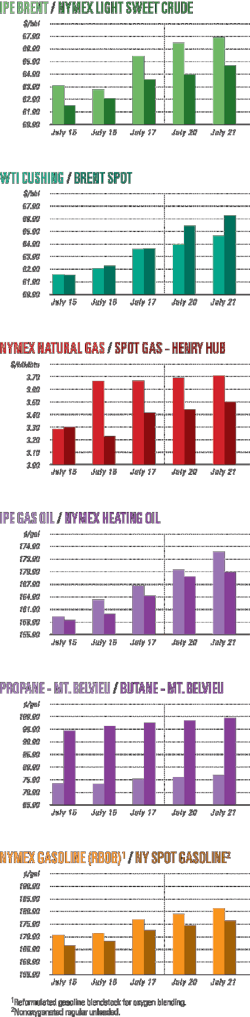

Prices for light, sweet crude are expected to average $67/bbl during 2010, a spokesman said Sept. 22 at the Pacesetters Energy Conference.

Oil prices dropped to about $35/bbl during February and have since rebounded with reports of improving global economic growth. Jim Burkhard, managing director of the IHS CERA's (Cambridge Energy Research Associates) Global Oil Group, believes that oil demand in the Organization for Economic Cooperation and Development nations likely peaked in 2005.

"We're not going to get back to that (oil) demand level again," Burkhard said, which means potentially less upward pressure on oil prices, primarily because oil demand in OECD nations continues to shrink.

The reasons behind lower oil demand include rising fuel economy standards in many countries and the penetration of alternative fuels, Burkhard said.

Sara Johnson, IHS Global Insight managing director of global macroeconomics, said the US real gross domestic product is beginning to recover, but she expects unemployment rates will continue to rise going into next year.

"Beware of early 2010," Johnson said, adding that she expects to see the start of job creation toward the end of the first quarter and beginning of the second quarter. "Don't expect a strong 'V-shape' recovery in the US."

The US dollar will depreciate and demonstrate more weakness through 2012, she said.

IHS Herold: Global reserves fall in 2008

Oil and gas companies' 2008 global investment for exploration and development projects totaled $492 billion—a 21% increase from 2007—yet oil and gas reserves fell, according to a report from IHS Herold Inc. and Harrison Lovegrove & Co. Ltd.

In the latest annual upstream performance review, the two companies reported that high oil prices during most of 2008 helped industry to generate record cash flow of $590 billion, up 36% from 2007. Report highlights were discussed Sept. 23 during the Pacesetters Energy Conference.

Industry's 2008 cash flow exceeded capital spending by $100 billion. Cash flow per boe increased 35% from 2007 to $29.66/boe. Last year marked the second consecutive year cash flow exceeded investment, the report said.

The 2009 Global Upstream Performance Review is an annual analysis of 232 oil and gas companies based on reports filed with the US Securities and Exchange Commission and other similar agencies worldwide.

"It is a very capital-intensive job to maintain reserves," said Nicholas Cacchione, IHS Herold senior vice-president and codirector of equity research. He expects reserves probably will drop in 2009 unless finding and development costs see a dramatic decline.

In 2008, world oil reserves declined nearly 3%, primarily due to a 5.2 billion bbl decline in revisions that stemmed from reduced commodity prices. Natural gas reserves grew by 3%, the same as the past 5 years. Gas production accelerated nearly 5% to 44.2 tcf.

Reserve replacement costs surged to $23.44/boe, up 70%, while finding and development costs rose 66% to $25.50/boe, due to a sharp drop in positive reserve revisions. Reserve additions, both from all sources and via the drillbit, were down over 20%.

During 2008, worldwide oil and gas revenues were $1.2 trillion, but net income was constrained by rapidly rising depreciation charges. Net income for 2008 was just under $310 billion.

Spending for proved reserves dropped 30% to $44 billion as merger and acquisition activity collapsed during the last 5 months of 2008, particularly in the US and Canada. Competition for unconventional resources was up sharply, led by US gas shale plays. Global spending for unproved reserves more than doubled from 2007 to $62 billion.

Industry Scoreboard

Exploration & Development — Quick Takes

McMoRan drilling ultradeep gulf shelf prospect

McMoRan Exploration Co., New Orleans, is setting intermediate casing at 23,500 ft, below a salt weld, at a proposed 28,000-ft ultradeep shelf prospect as part of its Gulf of Mexico exploration program.

McMoRan reentered a wellbore on South Marsh Island Block 230 in 20 ft of water south of Vermilion Bay. The Davy Jones prospect involves a large ultradeep structure on four blocks. The company will deepen the well to test Eocene Wilcox, Paleocene, and possibly Cretaceous Tuscaloosa.

Working interests in the prospect are expected to be McMoRan 25.7%, Plains Exploration & Production Co. 27.7%, Energy XXI 15.8%, Nippon Oil Exploration USA Ltd. 12%, W.A. "Tex" Moncrief Jr. 8.8%, and a private investor 3%.

Meanwhile, McMoRan plans to kick off a second sidetrack shortly at its Blueberry Hill deep gas prospect in 10 ft of water on Louisiana State Lease 340. The initial well and a first sidetrack established a 190-ft vertical hydrocarbon column, and the second sidetrack is to identify an optimum production take point.

McMoRan plans an updip sidetrack of the Hurricane Deep well on the southern flank of the Flatrock structure on South Marsh Island Block 217 in the fourth quarter of 2009.

Logs at the Hurricane Deep 226 well, drilled to 20,712 ft true vertical depth in early 2007, indicated an exceptionally thick upper Gyro sand totaling 900 gross ft, the top 40 ft of which were hydrocarbon-bearing. McMoRan believes the updip sidetrack could intersect a thicker hydrocarbon column.

McMoRan recompleted the Flatrock-5 well in September for production of 65 MMcfd of gas equivalent, bringing total output from five of the six Flatrock field wells to 265 MMcfed. Flatrock-4, shut-in in August due to a wellbore mechanical issue, is to return to production in the fourth quarter.

McMoRan plugged as noncommercial the Sherwood deep gas exploratory prospect on High Island Block 133. TD is 17,000 ft.

Talisman consolidates in Papua New Guniea

Talisman Energy Inc. has consolidated its foothold in Papua New Guinea by farming into Sydney-based New Guinea Energy Ltd.'s (NGE) onshore western province permits PPL 268 and PPL 269.

NGE announced in July 2008 that it had reached an agreement with a multinational oil company, but refrained from naming the company until the farm-in agreement had been finalized.

For permit PPL 269 NGE will assign an initial 50% interest and operatorship to Talisman. Talisman will then reimburse NGE for 75% of the direct costs of past expenditure—about $5 million—and fund an agreed seismic program up to a maximum of $6 million as well as comit to drilling, completing and testing a well up to a maximum of $15 million.

NGE will also have the option of progressively assigning up to an additional 20% interest in the permit based on the decisions over its funding share in the second and third option wells to a maximum of $15 million/well.

If NGE chooses to remain at 50% interest, Talisman will have the right to proceed with two additional wells by contributing 75% of the costs of the second and 65% of the costs of the third.

For PPL268, Talisman will assume an interest and operatorship of 15% by reimbursing NGE for 50% of past costs ($2.17 million) and funding an agreed seismic program up to a maximum of $5 million.

Talisman will be able to gain a further 35% by funding 80% of the costs of drilling, completing and testing a well. It can gain another 20% interest by funding 100% of two more wells.

NGE has decided not to farm out its third permit in the region (PPL267) and expects to drill a well on its Panakawa prospect before yearend.

Talisman's interests in PNG also include ownership of Rift Oil, which also has permits in the western province and a farm-in to nearby permits held by Horizon Oil.

Washington exploratory well disappoints Delta

Delta Petroleum Corp., Denver, said its plans for further drilling in the southern Columbia River basin in Washington state have been placed on hold until the company reviews completion and test information from the Gray 31-23 well, where tests have proved noncommercial thus far.

Delta perforated and tested the majority of the prospective zones in the Gray well at 11,580-12,280 ft.

"The six lowermost zones demonstrated high pressures as expected, but have flowed only fresh water to date. The zones located further uphole have flowed a combination of water and gas; however, the gas volumes have been minimal and substantially below precompletion expectations deeming these intervals uneconomic," the company said.

More tests are planned in the basalt section on intervals that had gas shows during drilling.

Delta and Husky Energy Ltd. hold 50-50 interests in 424,000 net undeveloped acres in the basin.

Aegean to start second phase at Epsilon field

Aegean Energy SA and Kavala Oil SA will use the Ensco85 (E85) jack up rig to start the second phase of its drilling program in Epsilon field off Greece with what would be the deepest and longest well ever drilled there.

The program, which calls for drilling in the Gulf of Kavala about 8 km west of Thassos Island and 18 km south from the main coast, was approved by the Greek Ministry of Development. The well will be spudded by the end of September. It is expected to reach a TVD of 5,500 m and vertical depth of 2,900 m within 90 days.

Aegan Energy secured $50 million from Standard Chartered Bank to underpin its program and hired Schlumberger to provide drilling management services.

The 2,000-hp E85 rig is capable of a maximum drilling depth of 7,600 m.

Last month Aegean Energy completed the PNA-H3 horizontal well on Prinos North field in Greece, which reached a TD of 4,370 m over 135 days because of the reservoir's complexity. It was drilled by the Energy Exeter jack up rig. The field lies in 50 m of water.

This and the Epsilon well are expected to increase production to 5,000 b/d from 1,300 b/d.

Drilling & Production — Quick Takes

World's first acoustic optical fiber installed

Composite Energy Ltd., Stirling, UK, installed the world's first downhole distributed acoustic optical-fiber monitoring system in a coalbed methane well in Scotland, according to Fotech Solutions Ltd., Hampshire, UK, the fiber's manufacturer.

The system is providing data such as downhole pump conditions, water level, flow profiles across production intervals, wellhead vibrations, and gas flow. Fotech notes that other potential uses include monitoring and locating sand production, determining tubing integrity, and detecting cross flow.

The system includes a low-cost telecoms-grade optical fiber and Flotech's Helios interrogator that provides acoustic or vibration information for each meter along the fiber's length, Fotech says.

Composite Energy, established in 2004, is active in developing CBM and holds 21 licenses covering coal fields in Scotland, England, and Wales.

Camamu-Almada basin block to be relinquished

A group led by Petroleo Brasileiro SA (Petrobras) plans to relinquish the B-CAM-40 exploration block to Brazil's Agencia Nacional do Petroleo (ANP).

No further exploration is planned on the Camamu-Almada basin block, whose exploration license has expired, said Norse Energy Corp. ASA, Oslo, which holds 10% interest. Petrobras holds 35% interest, and Brazil's Queiroz Galvao Perfuracao holds 55%.

Production from Manati gas-condensate field on the block reached a record 7.13 million cu m/day on Sept. 17. Output had averaged 5.23 million cu m/day so far in the current quarter, and the record was made possible by the completion of maintenance at a fertilizer plant that takes the field's gas, Norse said.

Norse expects production to stabilize above 6 million cu m/day for the rest of 2009 and increase further in 2010 (OGJ Online, Jan. 22, 2007).

Meanwhile, the 2001 Camarao Norte discovery, 9 km south of Manati field, which extends into the BM-CAL-4 block held 100% by El Paso Corp., is to be unitized, and unitization discussions will occur within months.

Reservoirs at Camarao Norte, formerly BAS-131, are in Upper Jurassic Sergi sandstones, same as at Manati. Norse estimates its 10% share of recoverable oil and gas at 12.4 million boe. The field is a 17 sq km ring-fenced area in 40 m of water.

El Paso declared commerciality of the field in the BM-CAL-4 block and proposed the name of Camarao.

Processing — Quick Takes

Siberian gas plant expansion starts up

Russian petrochemicals giant Sibur LLC announced earlier this month start-up of the second stage of its expansion at the Yuzhno-Balyksky gas processing plant in the Tyumen region, roughly 600 miles west of Novosibirsk.

The plant handles a hydrocarbon feed associated with crude oil production (called "associated petroleum gas") which it separates into natural gas, NGLs, and napthas. Its expansion doubles inlet capacity to 3 billion cu m/year (nearly 3 bcfd) and pushes Sibur's company-wide gas processing capacity to 19 billion cu m/year, said its announcement.

Sibur told OGJ that its current facilities under the Sibur Group include six gas processing plants—Nyagan, Muravlenkovsky, Gubkinsky, Yuzhno-Balyksky, Nizhnevartovsk, and Belozerny—and three compressor stations—Vyngopurovskaya, Varyeganskaya, and Vyngayakhinskaya. All are in western Siberia.

The new complex at Yuzhno-Balyksky consists of a booster compression station, drying and low-temperature condensation sections, a propane refrigeration plant, and other facilities.

Modernization of Yuzhno-Balyksky gas plant began in 2007 with the first stage increasing associated-gas processing capacity to 1.5 billion cu m/year from 900 million cu m/year.

The just-completed second stage of the expansion was designed by NIPIgazpererabotka JSC, Sibur's engineering center for gas-processing technologies, said the company. The control system was fully automated by Yokogawa Co., Japan. The new complex can handle both high and low-pressure associated gas.

When the entire new complex attains design capacity, the plant will produce 2.8 billion cu m/year of dry gas and 900,000 tonnes/year (about 28,000 b/d) of light hydrocarbons.

The capacity increase is aimed at receiving additional volumes of associated natural gas, mainly from the Priobskoye oil field that is being developed by Rosneft JSC. Sibur said modernization and expansion at the Yuzhno-Balysky plant have improved utilization of raw stream produced gas to 95%.

Partners break ground on Devil Creek gas plant

Joint venture partners Apache Energy Ltd. and Santos Ltd. broke ground at the Devil Creek domestic natural gas processing plant site in the Pilbara region of Western Australia about 50 km south of Karratha.

The plant will be fed raw gas through a 105-km subsea pipeline from the joint venture's offshore Reindeer field development in the WA-209-P permit.

The plant will supply as much as 220 TJ/day of gas into the Dampier-Bunbury trunk line. It will also produce as much as 500 b/d of condensate.

Santos has already signed up CITIC Pacific Ltd., Hong Kong, as the project's foundation gas buyer.

Under the $812 million (Aus.) contract, Santos will supply CITIC's Sino Iron magnetite mining project at Cape Preston, 100 km south of Dampier with 75 PJ of gas over 7 years from the latter half of 2011. The gas will be used as generation fuel for Sino's 450-Mw electric power station now under construction.

Reindeer field was discovered in 1997 and has a recoverable resource range of 390-610 bcf of gas.

Perth-based engineering and construction company Clough Australia is engaged as engineering, procurement and module fabrication contract for the Devil Creek project.

The $54 million (Aus.) contract is for engineering, design work, and procurement of all permanent materials and equipment plus fabrication and assembly of all modules for the facility.

Apache Energy in West Perth, a subsidiary of Houston-based Apache Corp., has 55% of the project with Santos holding 45%.

Tullow will sell stake to fund Uganda refinery

Tullow Oil Ltd. plans to sell part of its Ugandan assets to finance an oil pipeline project and other production infrastructure, according to state media.

Uganda's state-owned New Vision newspaper said Tullow confirmed it would sell part of its wholly owned Block-2, to finance developments in the Lake Albertine basin.

"Uganda's oil basin development plan is an integrated project that requires building of a refinery that is linked with pipelines to supply local, regional and international markets," said Tim O'Hanlon, Tullow's vice-president for African business.

O'Hanlon said a joint venture undertaking is crucial because "we are an exploration and production company, but not in the pipeline or refinery business. …We need a partner with expertise in this area."

He said Tullow has "received many interested firms, but we are still screening them with the government to get the right partner."

Uganda's President Yoweri Museveni has said he will not allow international oil companies to refine the oil outside the country, saying it must be refined domestically to ensure that more profits are retained in the country.

Meanwhile, the discovery of oil in Uganda and plans to build a refinery could be delaying construction of the planned 320-km Eldoret to Kampala oil pipeline, according to a senior Kenyan ministry official.

Work has yet to begin on the pipeline, which was awarded to the Libyan-backed Tamoil East Africa in 2006, due to concerns that a refinery in Uganda will reduce profitability of their business and require more time to recoup their investment.

"The Libyans are asking for certain guarantees that should Uganda construct a refinery, it will in no way affect the pipeline usage," said Peter Nyoike, Permanent Secretary in Kenya's Ministry of Energy.

In June, Tamoil announced groundwork on the pipeline was expected to begin in July, with completion scheduled for 2011—4 years later than planned. Tamoil will hold a 51% stake in the pipeline, while Uganda and Kenya will jointly hold the remaining 49%.

Transportation — Quick Takes

FERC issues final EIS for FGT expansion project

The US Federal Energy Regulatory Commission's staff issued a final environmental impact statement on Florida Gas Transmission Co.'s Phase VIII expansion project just 5 months after it issued a draft EIS on the proposed $2.46 billion project.

The proposed line expansion in Alabama and Florida would add 820 MMcfd of capacity to FGT's system, FERC said. The project would include laying 483.2 miles of multidiameter pipeline, adding 198,000 hp of compression to eight existing stations, building a 15,600-hp compression station, constructing three meter and regulator stations, and upgrading two existing meter stations and building a regulator station, FERC said Sept. 18 in the final EIS.

The proposed expansion, expected to cost $2.455 billion, would start service in Spring 2011, assuming that it receives the necessary permits and approvals, according to FGT. The system is owned by Citrus Co., a joint venture of Southern Union Co., the pipeline's operator, and El Paso Corp.

FERC's final EIS said the proposed project would have limited environmental impacts, with appropriate mitigation measures, for reasons similar to those it listed in the draft EIS on Apr. 17. Commissioners will consider public comments and the final EIS before making a final decision, FERC said.

Golar LNG sign Fisherman's Landing deal

Golar LNG has signed a heads of agreement to sell LNG from the Fisherman's Landing coalseam methane-LNG project near Gladstone to Toyota Tsucho Corp. of Japan.

Toyota has agreed to buy 1.5 million tonnes/year of LNG for 12 years beginning in 2014.

Negotiations are now under way for the Toyota Group trading company to also buy a minority equity interest in the Fisherman's Landing project.

It is the smallest of the five CSM-supplied LNG plants proposed for Gladstone. The $500-million plant, scheduled to come on stream in 2012, is being developed by Golar and Perth Co. LNG Ltd. and will be supplied by CSM from Brisbane-based Arrow Energy Ltd.'s fields in the Surat basin in central Queensland.

Arrow says it has more than enough gas to supply the first LNG train. Site preparation has already commenced and documentation for front-end engineering and design has been submitted. In addition shipping agreements are in place and Toyota has become the foundation buyer.

At the moment LNG Ltd. and Golar each have a 40% interest in the Fisherman's Landing plant while Arrow has the option to take the remaining 20% stake.

Correction Japan's refiners facing hard choices, must seek alliances to ease closings" (OGJ, Aug. 3, 2009, p. 44) by Tomoko Hosoe, the vertical axis (Million b/d) was inadvertently reversed. The increments should ascend the axis 0 to 6. |

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles