Low-btu gas in the US Midcontinent: A challenge for geologists and engineers

Considerable unexploited resources of natural gas in the US have been largely bypassed due to unacceptable levels of associated nitrogen (N2), which lowers heat content.

Natural gas that is laden with other common impurities such carbon dioxide, hydrogen sulfide, and heavier hydrocarbons typically has less of a problem accessing local markets because of the relative ease in which these components can be removed.

Nitrogen separates from natural gas with more difficulty, but as a result many domestic production opportunities have been shunned by generations of producers.

One such fairway of bypassed low-btu gas (nominally, gas with heat content <950 btu/standard cu ft) is in central and southern Kansas. The authors' premise is that small-scale and mobile nitrogen-removal systems, when coupled with good resource evaluation, can reap considerable reward with only small investment.

Substantial geologic and well-test data from wells in this region indicate possible, probable, and proved reserves of heretofore unsellable low-btu gas that can be explored and produced with varying degrees of risk.

Low-btu gas can be an unrecognized resource. Some of it can be utilized at the wellsite for powering pumps that tap oil zones or for onsite or sales-to-grid electrical generation by microturbines, but much of it is left behind pipe if its relative flow rate prohibits it from being blended with a higher-btu gas.

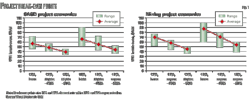

A successful exploitation endeavor will require judicious adherence to "fiscal proportionality," whereby early-stage nitrogen removal will succeed only when project costs are in line with project revenues. Pressures and rates of production must be diligently quantified in order to select the type and size of upgrading asset.

Recent advances in small-scale nitrogen removal are now providing a means for upgrading low-btu gas in these areas of Kansas that have frustrated gas producers since the early days.

Trends in gas quality

Low-btu gas in Kansas is found in a variety of reservoirs of varying age and in fields ranging in size up to giant Hugoton gas field.

Kansas produces 36 million bbl/year of oil and 370 bcf/year of gas, mostly from Mesozoic and Paleozoic strata. Giant Hugoton gas field in southwestern Kansas accounts for 53% of the current gas production in the state. Significant gas production elsewhere in the state is also associated with strata immediately overlying and subcropping beneath the basal Pennsylvanian angular unconformity.

Low-btu gas in this part of the Midcontinent is primarily caused by high percentages of nitrogen and subsidiary helium. Argon and CO2 can also be present, but they commonly compose less than 0.5% of the total gas.

Gas chemistry data are available from a variety of sources, including analyses published by the erstwhile US Bureau of Mines, scientific articles, and information occasionally reported on scout cards. A compilation of gas chemical analyses in Kansas from various sources shows that about one third of those record heating values of less than 950 btu/scf (Fig. 1).

The 950 btu/scf cutoff for low-btu gas is somewhat artificial, but this is a commonly specified minimum heat content necessary for sale of gas to large interstate pipelines. More often specific maximum percentages of individual nonhydrocarbon gases (nitrogen, CO2, water vapor, etc.) are also specified.

Histograms that depict the heating values of gases in a given geological province are typically skewed distributions, with a tail extending into the lower-btu values. Heating values for giant Hugoton field show an asymmetric distribution similar to that for Kansas at large (Fig. 1). Low-btu gases are thus a flank to a larger distribution in gas quality in this part of the Midcontinent, rather than a separate population of gases.

Differentiation of gas-chemistry data by stratigraphic interval shows gas compositions change with age of the strata. A comparison is facilitated by dividing the stratigraphic column of the state into six broad interval (Fig. 2) roughly corresponding to age of the pay zone.

The interval that corresponds to the Mississippian/basal Pennsylvanian unconformity can include reservoirs as old as Precambrian, for several different ages of pay zone can subcrop beneath this angular unconformity. Its stratigraphic position is considered below younger Pennsylvanian pays, and above older pay zones that have not been breached by it or older unconformities.

Comparison of the btu distributions (Fig. 3) according to stratigraphy shows that lower-btu gases are more common in younger pay zones in Permian and Upper Pennsylvanian rocks. Other chemical characteristics, such as the hydrocarbon wetness (a measure the ratio of higher-molecular-weight hydrocarbon gases to methane) decreases upward with younger strata.

Percentage of noncombustible gases and the nitrogen-to-helium ratio of gases increases overall (Fig. 4) with decreasing age of the producing formation.

Mapping of the chemical characteristics in a specific stratigraphic interval highlights areas where low-btu gas is commonly found and reveals trends in its quality. For example, low-btu gas is found along the perimeter of Hugoton gas field in southwestern Kansas (Fig. 5), and its distribution is relatively wide on the downdip eastern flank of the field. Hugoton field has produced 25.2 tcf since its discovery in 1922, and currently has 7,600 active wells. Its main pay zones are several porous carbonate beds in the Permian Chase Group.

Pay zones in the Permian Council Grove Group (underlying the Chase Group in Hugoton gas field) compose the giant Panoma gas field (3 tcf cumulative production since 1956, 2,400 active wells). Hugoton and Panoma gases are nearly similar in quality at any given locality. Low-btu gas is estimated to compose 15% of Hugoton field and 7% of Panoma field (M. Dubois, personal communication).

Quantity is its own quality in Hugoton field, thus most of its gas is upgraded in large cryogenic gas plants that also capture the helium. The nitrogen-to-helium ratio for Hugoton field is 40:1.1

Small Permian gas fields in central Kansas east of Hugoton field also produce low-btu gas from carbonates in the Chase Group (Fig. 5). Btu content of gas in these fields generally increases eastward. Their smaller reserves and geographic separation likely will require a different upgrading solution from Hugoton field.

The optimal type of upgrade processing will be determined by the rates, pressures, consistency of gas chemistry, and longevity of the individual wells. Pipeline logistics and the type of processing also need to be considered for either centralized or decentralized wellsite upgrading.

Smaller, isolated low-btu gas fields militate for on site processing. Skid-mounted upgrading units are an amenable solution, for these plants can be moved to other nearby localities when their gas source (a single or a few wells) is depleted.

Farther east in central Kansas, low-btu gas is present on the southern end of the Central Kansas uplift, particularly along a NW-SE trending faulted basement uplift called the Rush Rib, which straddles the Rush and Barton County lines (Fig. 6). Much of this low-btu gas is in reservoirs that subcrop and are directly above the basal Pennsylvanian unconformity. The quality of the gas degrades updip and northward onto the Central Kansas uplift (Fig. 6) due to an increasing percentage of noncombustible gas (mostly nitrogen).

As associated nitrogen is principally a value inhibitor to a natural gas, few studies focus on its source and migration. However, since nitrogen in natural gas is usually present in a nearly fixed ratio to helium,1 a new set of economics comes in to play for producers willing to consider extraction and purification the helium in low-btu gas.

Ancillary income is possible from the capture and sale of helium. In general, helium-to-nitrogen ratios increase with increasing age of the reservoir in the Midcontinent (Fig. 3), and gas fields with the greatest percentage of helium are those that are dominated by low-btu gas (Fig. 5).

Helium is linked to nitrogen in an almost constant ratio of 8:1 for Mississippian and other reservoirs subjacent to the basal Pennsylvanian angular unconformity. Helium content increases northward and updip and exceeds 3% in reservoirs at the north end of the Rush Rib (Fig. 6).

The geological reasons for this are not completely understood, but the relatively low nitrogen-to-helium ratio of the many gas fields along the Rush Rib, in combination with the high percentage of nitrogen and helium, makes this region a potential target for gas upgrading through various engineering processes.

The spatial distribution of low-btu gas can be complex, with each stratigraphic horizon showing different trends (Fig. 7). In general, shallower and younger strata are exploration targets for low-btu gas. Once it is found, an economic success then depends on the engineering solution to the low-btu problem.

Engineering solutions

From an engineering standpoint, nitrogen is by far the most difficult and expensive of all natural gas separation endeavors.

Other problematic gases such as CO2 and H2S that are sometimes associated with natural gas can be removed in systems that utilize relatively simple chemical reactions. Other constituents, such as heavy hydrocarbons (propane, butane, etc.) can also be removed relatively simply with refrigeration units and at a reasonably low cost.

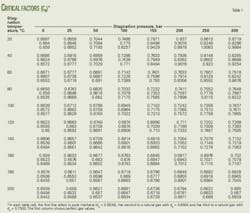

The shape and size of the nitrogen molecule is very similar to that of methane. For years upgrading of nitrogen-rich natural gases has focused on the respective boiling points of methane (–161° C.) and nitrogen (–196° C.), cryogenically liquefying the methane and venting the nitrogen through a system composed of compressors, heat exchangers, and pressure towers.

A similar procedure at even colder temperature can condense nitrogen and separate it from helium. Well-designed cryogenic systems work quite well, presuming these criteria: 1) high-pressure inlet gas (>600 psig), 2) large inlet volumes (>10 MMcfd), and 3) stable inlet volumes and gas composition.

In the early days, large cryogenic nitrogen-rejection plants were placed in geologic basins where nitrogen levels were most problematic. However, subsequent growth and integration of natural gas transmission systems across the country made it increasingly possible for lower-btu streams from one basin to be blended with higher-btu gas from another, mitigating the need for nitrogen removal.

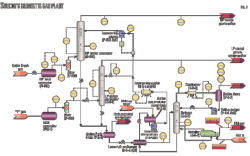

| Nitrogen rejection alternatives in the Midcontinent range from the IACX Energy mobile unit at Otis, Kan., (top left) that uses nitrogen sponge technology to the smaller American Energies Corp. plant at Elmdale, Kan., developed with aid of a grant from the Stripper Well Consortium,2 that uses the pressure swing adsorption method (top right) to BP American Production Co.'s cryogenic gas processing plant at Ulysses, Kan. (below). BP photo by John Charlton (Fig. 8). |

One by one, large cryogenic plants fell off the map. The remaining plants in the US were relegated only to those basins where blending capacity was limited or unavailable, such as Hugoton field (Fig. 8).

From the mid-1980s forward, many have tried and (mostly) failed to design compact systems for noncryogenic nitrogen removal. Large and expensive nitrogen-rejection projects quickly become wildcat endeavors when they are placed on projects with even the smallest degree of reservoir risk.

Lower or uncertain volumes of natural gas cannot be economically accommodated by large, capital-intensive plants because process turndowns can yield enormous inefficiencies.

A handful of companies focus primarily on nitrogen rejection. BCCK Energy, Midland, Tex., utilizes proprietary cryogenic processes to extract nitrogen from higher-volume, higher-pressure gas streams, whereas IACX Energy of Dallas utilizes a proprietary process based on pressure swing adsorption (PSA), which allows smaller volumes of gas to be processed.

The PSA process involves exposing the raw natural gas to a specialized carbon material that traps (adsorbs) hydrocarbons, allowing for the undesired nitrogen to pass through the carbon unaffected. Once a carbon bed is fully loaded with adsorbed hydrocarbons, it is depressurized and pulled down with a vacuum causing the release of the hydrocarbon from the carbon adsorbent.

Molecular sieve technology can also separate nitrogen from methane. A membrane allows passage of one gas species through it, and the residual gas becomes richer is the retained species.

The economics for all processes vary drastically with differing operating conditions and gas composition.

If a producer has demonstrably higher and sustainable volumes of nitrogen-laden gas, then a larger-scale cryogenic plant will probably yield substantially lower processing cost per thousand cubic feet. If, on the other hand, a producer has gas reserves that are more questionable or that produce at lower volumes and pressures, then a modular or skid-mounted system is probably a better fit.

IACX Energy currently has 16 mobile nitrogen rejection units operating, five of which are in Kansas. Its process, "Nitrogen Sponge," utilizes PSA to remove nitrogen from natural gas streams at or near the wellhead. IACX Energy guarantees its systems have 95% methane recoveries, >99% C3+ recoveries, and 92% on stream time.

Throughout its existing fleet, inlet volumes range from 100 to 700 Mcfd with nitrogen levels ranging from 12% to 41%. Lower throughput volumes are possible, with commodity prices being the only significant limiting factor. IACX's fees represent an "all in" number, from dehydration, nitrogen removal, liquids removal (if needed), and compression into the sales line.

The company does not sell its units, but rather it owns and operates them on a lease/toll basis using a percentage of proceeds, or with joint-venture agreements. IACX Energy also captures and purifies associated helium gas, where feasible.

An even smaller nitrogen-rejection PSA system was developed in joint effort by the Kansas Geological Survey and American Energies Corp., Wichita, with aid of a grant from The Stripper Well Consortium at Penn State University. This experimental plant utilizes nonpatented technology and an adsorbent composed of porous activated charcoal made from coconut husks.

During the 6-month test of this prototype plant, inlet volumes averaged 150 Mcfd with nitrogen levels ranging from 32% to 40% (615 to 715 btu/scf). Feed-gas compositions, plumbing, valve timings, and vessel pressures were subject to experimentation, and problems with dead space in pressure vessels and blowout of carbon dust were addressed.

With fine-tuning, approximately 75% of the nitrogen was eliminated from the low-btu feedstock gas, 98% of the C2+ hydrocarbons were recovered, but methane recoveries were only 55% to 65%, depending on feed-gas composition. The lesser efficiency of methane recovery indicates that processing low-btu dry gas (i.e., hydrocarbon component dominated by methane) will have lesser economic feasibility with this system than low-btu wet gas (i.e., natural gas with substantial ethane and heavier hydrocarbon component gases).

On stream efficiency is difficult to determine with only one prototype, but AEC maintains this plant, once it was fine-tuned, profitably upgraded low-btu input feeds to a simple requisite minimum pipeline heat content of 950 btu/scf. This PSA unit, like those of IACX Energy, is mobile and can be moved to other wellsites at relatively low cost once the low-btu resource is locally depleted.

Summary

Several low-btu gas plays can be defined by mapping gas quality by geological horizon in the Midcontinent.

Some of the more inviting plays include Permian strata west of the Central Kansas uplift and on the eastern flank of Hugoton field and Mississippi chat and other pays that subcrop beneath (and directly overlie) the basal Pennsylvanian angular unconformity at the southern end of the Central Kansas uplift.

Successful development of these plays will require the cooperation of reservoir geologists and process engineers so that the gas can be economically upgraded and sold at a nominal pipeline quality of 950 btu/scf or greater.

Nitrogen is the major noncombustible contaminant in these gas fields, and various processes can be utilized to separate it from the hydrocarbon gases. Helium, which is usually found in percentages corresponding to nitrogen, is a possible ancillary sales product in this region. Its separation from the nitrogen, of course, requires additional processing.

The engineering solution for low-btu gas depends on the rates, volumes, and chemistry of the gas needing upgrading. Cryogenic methods of nitrogen removal are classically used for larger feed volumes, but smaller feed volumes characteristic of isolated, low-pressure gas fields can now be handled by available small-scale PSA technologies.

Operations of these PSA plants are now downscaled for upgrading stripper well gas production. Any nitrogen separation process should be sized, within reason, to match the anticipated flow rate. If the reservoir rock surprises to the upside, the modularity of the upgrading units is critical, for they can be stacked to meet higher volumes. If a reservoir disappoints (and some will), modularity allows the asset to be moved to another site without breaking the bank.

References

- Jenden, P.D., Newell, K.D., Kaplan, I.R., and Watney, W.L., "Composition and stable isotope geochemistry of natural gases from Kansas, Midcontinent, U.S.A.," Chemical Geology, Vol. 71, No. 1-3, 1988, pp. 117–147.

- Bhattacharya, S., Watney, W.L., Newell, K.D., Ghijsen, R., and Magnuson, L.M., "A low-cost micro-scale N2 rejection plant to upgrade low-btu gas from marginal fields," in "Marginal Wells, Fuel for Economic Growth," 2008 Report, Interstate Oil & Gas Compact Commission, Oklahoma City, pp. 41-43.

The authors

Brunei

Tap Oil Ltd.'s Borneo subsidiary said it identified a contingent resource of 8 to 64 million boe in Brunei's undeveloped Belait oil and gas field onshore 65 km southwest of Bandar Seri Begawan.

Tap Energy (Borneo) Pty. Ltd. shot 118 sq km of 3D seismic and 60 line-km of 2D seismic over the field and adjacent areas on Block M, which covers 3,011 sq km in the Baram Delta. The balance of Brunei's largest onshore permit is underexplored.

The 3D seismic program, first in the Belait trend, is "designed to address the structural complexity of the field and identify deeper, higher impact targets," Tap Oil said. At least two wells are to be drilled starting in mid-2010.

Interests in Block M are Tap Energy (Borneo) 39%, Triton Borneo Ltd. 36%, China Sino Oil Co. Ltd. 21%, and Jana Corp. Sdn. Bhd. 4%.

Triton notes that Belait was discovered in 1913, and one well produced oil in 1924-31. A total of 18 wells have been drilled in the 122 sq km area.

India

Reliance Industries Ltd., Mumbai, has spud the first well on the D9 license in the Krishna-Godavari basin off eastern India.

The KG-D9-A1 well is to go to TD 4,820 m in 2,754 m of water using the Transocean Deepwater Expedition. Targets are early and middle Miocene slope fan sands. The well is the first in a four-well minimum work program on the 11,605-sq km block.

Reliance Industries is operator of the block, and Hardy Oil & Gas PLC holds 10% interest.

Russia

Crown Oil & Gas Inc., Bellingham, Wash., shot 779 line-km of high resolution 2D seismic on the 1,100 sq km Kikinsko-Gusikhinsky license in Russia's Saratov area.

Saratovneftegeophyzika interpreted the data and recommended drilling the Prirazlomny and Chernobulaksky prospects. Projected drilling depths are 2,230 m, with targeted pay zones starting with Upper Cretaceous at 700 m.

Drilling is likely in 2010, when more seismic is planned on five other leads.